Written by: Zeke Source: YBB Capital Translation: Shan Ouba, Golden Finance

Foreword

The halving rule has begun to fail, and many altcoins are in trouble. Speculators are withdrawing, and believers are beginning to doubt themselves. The despair of the industry comes not only from the low prices in the secondary market, but also from confusion about the future direction. Criticism has begun to become the main theme in the circle, from the lack of applications to the details in the financial reports of major public chains. Now, the spearhead has begun to point to Ethereum, the former hot land of encryption. So, what is the internal dilemma of the king of altcoins?

1. Horizontal expansion and vertical stratification of the main chain

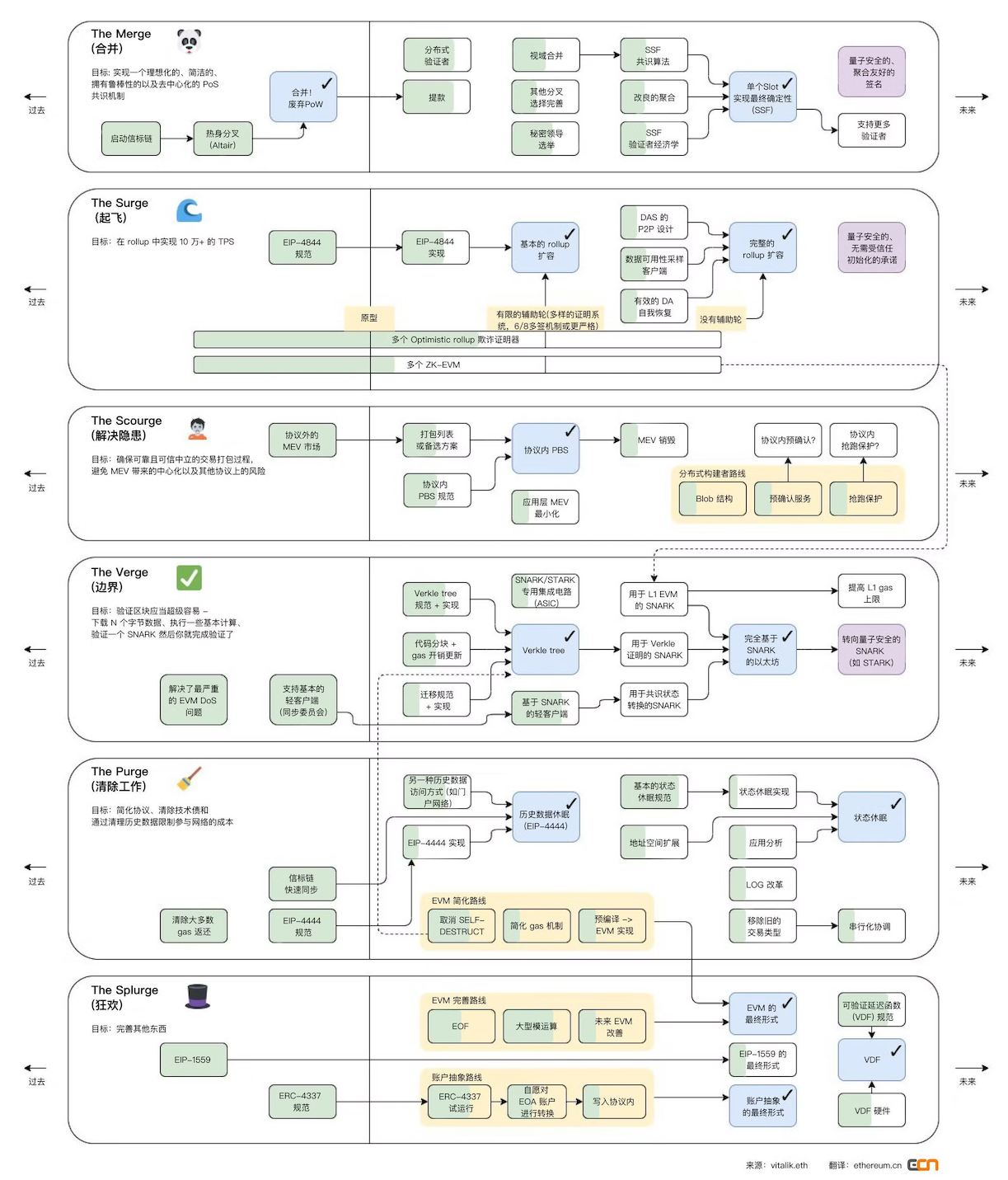

Towards fully modularized sub-type expansion is Vitalik’s A vision of the end of Ethereum in 2018 and 2019. That is, the bottom layer is optimized around Data Availability, and the upper layer is infinitely expanded, so as to escape the public chain triangle paradox, and Ethereum becomes the settlement layer of ten thousand chains, and finally realizes the End Game of the blockchain expansion game.

After determining the feasibility of the concept, the roadmap of Ethereum at both ends began to advance rapidly. In 2023, with the successful merger of the main chain and Beacon Chain in the Shanghai upgrade, the main theme of modularization began to cover the Ethereum ecosystem. Now, after the Cancun upgrade, the first step towards EIP4844, the main chain itself has been infinitely close to Vitalik's idea in his early years. Its upper layer is also flourishing, and Gas, TPS, and diversity are gradually crushing former opponents. It can be said that except for the disadvantage of the sense of separation, all heterogeneous chains' narratives about Ethereum Killer should be declared over. But the cruel reality is that TON and Solana are constantly rising, and many Infra projects that plagiarize modular narratives are even better than the "modular originals" supported by ETFs in the secondary market. What is the reason for this situation?

From the transformation of POS to the development of Layer2 is the main focus of recent criticism of Ethereum's "crimes", but in my opinion, Ethereum developers and Vitalik are not at fault in promoting modularization. If there is any, it may be that the process is pushed too fast and too idealistic. I wrote a paragraph in an article at the beginning of the year, which roughly means: If blockchain has a lot of application value outside the financial field, Mass Adoption will eventually come, then Ethereum's shift to modularization will make sense. Obviously, Ethereum is too idealistic in this regard, and there is no evidence to prove that these two points are real. The same is true for the pricing curve of DA. With the current status of Layer2, the imagined application layer outbreak has not arrived. Secondly, among a large number of general chains, only ARB, OP, and Base remain active. It is impossible to satisfy the positive cycle of Ethereum with DA income alone. There are still many remaining problems. For example, Gas consumption has been reduced by dozens or even hundreds of times. Things that once required the purchase of 0.1ETH can now be done with only 0.001ETH, and user activities have not increased by dozens to hundreds of times, making the market supply far greater than demand. However, it seems right to promote the development of public chains towards large-scale adoption while maintaining decentralization and security to the maximum extent. Ethereum has been able to gradually turn the "pie" it has drawn for eight years into reality, which is already precious in the crypto world. Unfortunately, reality is utilitarianism first, and the market will not pay for ideals. In the current situation of lack of applications and liquidity, the contradiction between technical idealists and investors will continue to deepen.

2. Human nature

The idealization of Ethereum is not only reflected in the judgment of the future of the application layer, but also in the judgment of human nature. There are two most hotly debated issues about Layer2: 1. Centralized Sequencer; 2. Token. From a technical perspective, Layer2 can be decentralized. But from a human perspective, it is impossible for the top Layer2 projects to hand over the huge profits brought by the sequencer. Unless the three words of decentralization can activate the token and achieve greater benefits. For example, the top Layer2s just mentioned are certainly fully capable of decentralizing the sequencer, but they will not do so. Because they are all top-down projects that have been burned through huge financing, their birth method is very Web2, and so is their operating logic. The relationship between community members and Layer2 is more like the relationship between consumers and cloud server operators. For example, those who often use Amazon's AWS servers may receive some coupons and cash back, and the same is true for Layer2 (airdrop). But the sequencer income is the lifeblood of Layer2, from the perspective of the project. Design, financing, development, operation, hardware purchase, each link does not need community support. In their logic, users do not contribute much (this is why many Layer2 project parties always have a bad attitude towards users), not to mention that the community wants to decentralize the sorter. Layer2 cannot be bound by morality alone. If you want to decentralize the sorter as much as possible, you have to design a new sorter solution from the perspective of the interests of the Layer2 project party, but obviously this solution will be very controversial. A better approach is to erase the decentralized sequencer part of the roadmap or put it in an invisible place on the roadmap. Today's Layer2 is completely contrary to Ethereum's original intention of embracing modularity. Most Layer2s are just stealing concepts and dividing up everything valuable in Ethereum.

Let's talk about Tokens. The public chain in the form of Layer2 is still a new product in encryption. From the three different perspectives of Ethereum, Layer2 project parties, and the community, the existence of Tokens is very contradictory. Let's talk about it in order. From the perspective of Ethereum, Layer2 should not have Tokens. Layer2 is just a "high-performance expansion server" for Ethereum that needs to be used across chains. It only charges user service fees, which is healthy for both parties. Only by maintaining the value and status of ETH to the maximum extent can the business be carried out for a long time. To put it in a more concrete way, if the entire second-layer ecosystem is compared to the European Union, then maintaining the stability of the euro is necessary. If a large number of member states are issuing their own currencies to weaken the euro, then the European Union and the euro will eventually cease to exist. What is more interesting is that Ethereum does not restrict Layer2 from issuing coins, nor does it restrict whether Layer2 should use ETH as a gas fee. This open attitude in rules is indeed very "Crypto". However, with the continued weakening of ETH, "EU members" have been ready to move. In the chain-issuing tools of the top Layer2, it is basically clearly marked that projects can use any token as Gas, and projects can choose any integrated DA solution. In addition, one-click chain issuance will also lead to the birth of a small alliance on the second layer.

On the other hand, from the perspective of Layer2 and the community, even if ETH rebounds strongly in the future, Tokne's situation is still very embarrassing. As for issuing coins, the top Layer was actually very hesitant in the early days. In addition to the above-mentioned problems of being in opposition to ETH, there are also the following points: regulatory risks, no need to maintain development through Tokens if there is no shortage of money, the scale of Token empowerment is not easy to make, and direct use of ETH can promote TVL and ecological growth the fastest. Issuing Tokens by yourself may conflict with this matter, and liquidity cannot be stronger than ETH.

It is still a problem of human nature. No one can refuse to print billions of banknotes out of thin air. Furthermore, from the perspective of community members and ecological development, Tokens seem to exist. In this way, in addition to charging a fixed service fee, there is also a treasury that can be cashed out at any time. Why not? However, the design of Tokens must be combined with the above issues to minimize empowerment. As a result, a bunch of air tokens that do not need to be mined through POS staking and POW were born. Their functions are only voting, and each linear release will also divide a large amount of liquidity from the market. As time goes on, these unmotivated tokens will continue to fall after a one-time airdrop, and neither the community nor the investors can give a good explanation. So should they be empowered? Any valuable empowerment will conflict with the above problems and eventually fall into a dilemma. The status of the tokens of the four kings can also well illustrate the above problem.

Base, which does not issue tokens, is now much more prosperous than Zks and Starknet, and its sorter income has even exceeded that of OP, the creator of Superchain. This has been mentioned in previous articles about the attention economy. Borrowing social media influence, operation, and pull to create the wealth effect of MEME and multiple projects in the ecosystem is actually an indirect multiple small airdrops, which is much healthier than directly issuing coins and then airdropping them at one time. In addition to creating continuous attraction, it can also avoid a lot of problems. By allocating a portion of the sorter income every month, it can continue to be active and build a healthy ecosystem. In addition, the current Web3 point gameplay is just the superficial knowledge of PDD. Coinbase is far better than upstarts like Tieshun in the way of steady operation.

Third, vicious competition

The first layer and the second layer are homogenized, and the second layer and the second layer are also homogenized. This situation stems from a very critical problem. In this round, there are not many independent applications that can support an application chain, and the few that can stand up have "run away" (DYDX). From the current situation, it can be said that the target users of all Layer2 are the same, even the same as the main chain. An extremely bad phenomenon has also arisen from this. The second layer is constantly eroding Ethereum, and the second layer and the second layer are also competing viciously for TVL. No one understands the difference between these chains. Users can only rely on point activities to judge where to store money today and where to swipe transactions. Homogeneity, fragmentation, and lack of liquidity. Ethereum is currently the only one in the Web3 public chain ecosystem that can simultaneously possess the above three points. These problems also stem from the drawbacks brought about by Ethereum's own open spirit. We may soon see a large number of Layer2s being naturally eliminated, and the centralization problem will also cause various chaos.

Fourth, leaders do not understand Web3

Whether it is the former Vitalik Buterin or the current KOL Vitalik is known as "Little V". His contribution to infrastructure has indeed promoted the prosperity of the entire circle since the Satoshi era, which is obvious to all. However, the reason why Vitalik is now called "Little V" is not only because of his private life, but also because of a very interesting argument that the leader of Ethereum does not understand DApp, let alone DeFi. I agree with this statement to some extent, but before continuing to discuss this issue, I would like to make one thing clear. Vitalik is Vitalik, and only Vitalik. He is not an omnipotent god, nor is he a dictator who is useless. In my eyes, Vitalik is actually a relatively humble and active public chain leader in work and study. If you have read his blog, it should not be difficult to find that he updates one to three discussions on philosophy, politics, Infra, and DApp every month, and is also happy to share on Twitter. Compared with some public chain leaders who like to criticize Ethereum from time to time, Vitalik is much more pragmatic.

After saying good things, let's talk about the negative side. In my eyes, Vitalik has three problems:

1. He has too much influence on this circle, from retail investors to VCs. Everyone is influenced by his words and deeds. To Vitalik's entrepreneurship is also a pathological trend for Web3 project parties;

2. He is more persistent in the technical direction he is optimistic about, and sometimes even goes to the platform;

3. He may really not understand what crypto users need.

Let's start with Ethereum's expansion. The argument that Ethereum urgently needs to expand is often supported by the ultra-high on-chain access brought about by the overflow of external liquidity in 21 to 22 years. But every time Vitalik talks about this, he seems to really not understand that this is obviously a short-term phenomenon, and why users come to the chain. Another point is that he has repeatedly emphasized the technical superiority of ZK on Layer2, but ZK is obviously not so friendly in terms of user experience and ecological development. Today, a large number of ZK Rollups started by To Vitalik, not to mention the T2 and T3 echelons, even the top two kings are on the verge of death, and the performance of the three giants of Optimistic Rollup is better than the sum of dozens of ZK Rollups. There are some other problems like this. For example, in the middle of last year, the criticism of the MPC wallet was biased and directly supported the AA wallet. Earlier, SBT was proposed, but it was so useless in application that no one mentioned it later. It can be said that the technical solutions supported by Vitalik in recent years have not performed well in the market. Finally, his recent remarks on DeFi are also confusing. Comprehensively speaking, Vitalik is not perfect. He is an excellent and idealistic developer, but at the same time he lacks understanding of the user group and occasionally expresses subjective opinions on things that he does not understand deeply enough. The industry needs to disenchant him and distinguish right from wrong in the controversy about him.

V. From virtual to reality

From the ICO boom in 2016 to the P2E bubble in 2022. In the history of infrastructure being limited by performance and constantly developing, each era will have a matching Ponzi scheme and emerging narrative, thus pushing the industry towards a bigger bubble. And now we are experiencing an era of bubble bursting, with huge financing projects self-destructing, high-sounding narratives failing again and again, and Bitcoin and copycat value faults. How to do valuable things is the main point that I will continue to output in many articles this year. From virtual to real is also the current main trend. When Ethereum embraces modularization, many people say that the narrative of the Ethereum killer should be turned over. But now the hottest ecosystems are TON and Solana. Do they have any innovations that change Crypto? More decentralized or secure than Ethereum? None, not even in terms of narrative. They just made those mysterious things more like applications, and integrated the advantages of the chain into a level closer to Web2, that's all.

With the internal volume growing exponentially and the external liquidity lacking. Efforts to find new narratives are also insufficient to fill the block space of Ethereum's second layer. As the industry leader, Ethereum should first solve the fragmentation and internal corruption of the second layer. In particular, why did the Ethereum Foundation (EF), which was not mentioned above, not play a matching role despite the massive squandering of funds? In the case of an extreme oversupply of second-layer infrastructure, why is infrastructure funding still given the highest priority? Even the leader of Cex is lowering its profile and seeking change. EF, as a key organization to accelerate the growth of the ecosystem, is going the other way.

Xu Lin

Xu Lin