Author: Shigeru Satou

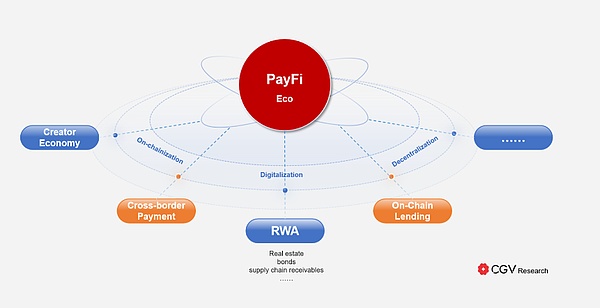

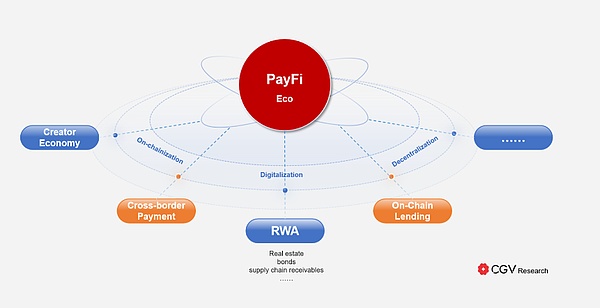

PayFi, or Payment Finance, refers to an innovative technology and application model that combines payment functions with financial services in the field of blockchain and cryptocurrency.

The core of PayFi is the sending, receiving and settlement process of cryptocurrency, rather than transaction behavior.This model not only covers the payment and trading of cryptocurrency, but also includes a variety of financial activities such as lending, financial management, and cross-border payments. Through decentralized technology, PayFi makes financial activities faster and safer, and reduces friction and costs in the traditional financial system, thereby promoting seamless value transfer and financial inclusion on a global scale.

PayFi was first proposed by Lily Liu, Chairman of the Solana Foundation, at the EthCC conference in July 2024 as a new concept. In her view, PayFi represents a new way to build financial markets, creating financial primitives and product experiences around the Time Value of Money (TVM). These are difficult or impossible to achieve in traditional or even Web2 finance.

PayFi's vision is to use blockchain technology to revolutionize the payment system, achieve more efficient and low-cost transactions, and provide a new financial experience, create more complex financial products and application scenarios, and create an integrated value chain to form a new financial cluster.

The CGV Research team believes that with the development of high-performance blockchain technology, the true value of PayFi will expand and scale rapidly in this environment. This expansion can accelerate the integration of payment and financial services, making cryptocurrencies more practical and efficient in daily transactions and more complex financial operations. In the future financial ecosystem, PayFi will become a key driving force.

PayFi: Inheriting and Expanding Bitcoin's Payment Vision

Bitcoin was born from the concept of "decentralized payment" proposed by Satoshi Nakamoto in his revolutionary white paper "Bitcoin: A Peer-to-Peer Electronic Cash System". This concept not only introduced a new form of currency - Bitcoin, but more importantly, it envisioned a global payment system without intermediaries, which could bypass the limitations of traditional financial institutions and achieve more efficient and transparent value transfer. Satoshi Nakamoto's vision aims to completely reform the existing payment system and eliminate high fees, lengthy settlement times and financial exclusivity.

However,while Bitcoin successfully led the cryptocurrency revolution, its original intention as an everyday payment medium has not been fully realized.Bitcoin is more regarded as a means of storing value than a currency for daily transactions.

Over time, stablecoins have emerged to fill this gap. Stablecoins build a bridge between cryptocurrencies and the real-world financial system by mapping the value of fiat currencies onto blockchains, driving the first practical application scenario of blockchain payments. Since 2014, the growth of stablecoins has expanded exponentially, proving the strong market demand for blockchain payments. Stablecoins enable users to enjoy the transparency and decentralization benefits of blockchain technology while avoiding the risks of cryptocurrency price fluctuations. To date, stablecoins have supported approximately $2 trillion in payments per year, close to Visa's annual payment processing volume.

However, while stablecoins have driven the development of blockchain payments, blockchain payments still face many challenges, such as poor user experience, transaction delays, high costs, and compliance issues. These challenges limit the widespread application of blockchain payments as a mainstream payment medium.

The further expansion of the payment ecosystem depends in particular on the promotion of financial instruments and financing mechanisms. In the traditional financial system, tools such as credit cards, trade financing, and cross-border payments have greatly promoted payment applications around the world by providing liquidity and financing options.

As an emerging industry, blockchain does not necessarily need to completely rebuild a market, but can provide more valuable products and solutions through blockchain technology on the basis of the existing market. It is in this context that PayFi came into being.

By leveraging the high performance and low-cost transaction characteristics of advanced public chains, PayFi not only allows blockchain payment systems to surpass traditional financial mechanisms, but also creates a more liquid and adaptable global financial market. This evolution is both a return to the original intention of Bitcoin and a major innovation based on Bitcoin. Through PayFi, the blockchain payment system will truly unleash its potential and drive the global financial system towards a more efficient and inclusive future.

PayFi Core Concept: Time Value of Money (TVM)

"Time is more valuable than money. You can get more money, but you can't get more time."

Time Value of Money (TVM) is a core concept in finance that emphasizes the difference in the value of money at different points in time. The basic principle of TVM is that a sum of money is usually worth more now than the same amount of money in the future. This is because the money currently held can be used immediately for investment, thereby generating returns, or for consumption, which brings immediate utility.

Simply put, the important concept behind the time value of money is "opportunity cost".If the person holding the money does not use the money immediately, he will lose potential investment opportunities and cannot obtain potential returns. Therefore, the current value of the money must reflect these forgone opportunities. For example: - Loans and mortgages: In bank loans, interest rates are calculated based on TVM, and the interest paid by the borrower is actually compensation for the right to use the funds provided by the bank; - Investment evaluation: When evaluating investments such as stocks, bonds or real estate, investors consider the present value of future returns to determine the attractiveness of the investment; - Capital budgeting: When companies conduct capital budgeting, they evaluate the future cash flows of different projects and calculate their present values by discounting to help management make the most favorable investment decisions, etc. PayFi uses blockchain technology to allow users to realize the time value of funds on the chain at a very low cost and in an efficient manner; by leveraging smart contracts and decentralized platforms, PayFi enables users to manage and invest funds without intermediaries, thereby maximizing the efficiency of fund utilization. This new model not only significantly reduces transaction costs, but also shortens transaction time, allowing funds to quickly enter the market for reinvestment or other uses.

In addition, PayFi's infrastructure provides the possibility for the development of more complex on-chain financial products, such as on-chain credit markets, installment payment systems, and automated investment strategies based on smart contracts, which will be expanded to more complex financial products and application scenarios, creating an integrated value chain, thus forming a new "financial cluster".

Bond RWA + DeFi: Building a new financial cluster with PayFi at the core

In the financial system, real-world assets (RWA) and decentralized finance (DeFi) each have unique advantages, but also face their own challenges: RWA has a huge market size and stable value, but relatively low liquidity, and insufficient transparency and transaction efficiency; DeFi has an efficient trading mechanism and global liquidity, but mainly relies on encrypted assets and lacks direct connection with the real economy.

Different from some industry opinions such as "PayFi is a subdivision of the RWA track", CGV research believes that RWA is part of the PayFi ecosystem. In addition to RWA, PayFi also involves a wider range of crypto assets, smart contract-driven financial services, and decentralized payment and settlement systems. The introduction and application of RWA with the help of DeFi is an important part of PayFi's realization of its core functions.

RWA needs DeFi to improve liquidity and transaction efficiency, achieve fast and low-cost global financing through the digitization of blockchain and smart contracts, and enhance transaction transparency and security. At the same time, DeFi enriches asset categories, reduces volatility risks, provides a stable source of income, and connects the real economy by introducing RWA, promoting its practical application and development on a global scale.

Through PayFi, RWA and DeFi are no longer independent financial systems, but interdependent and complementary organic wholes, realizing the integration and innovation of real assets and on-chain financial services.

——Digitalization and on-chain:Introducing RWA to the blockchain. The PayFi platform first digitizes RWA through smart contracts, enabling it to be represented and traded on the blockchain. This process ensures the transparency and security of the value and ownership of RWA on the chain. In this way, traditional RWA assets can be divided into small units, making it easier to trade and invest globally.

——Smart contracts and payment systems:Enable efficient transactions and settlements. Once RWA is digitized, the PayFi platform uses smart contracts to automate the transaction and settlement processes. This not only speeds up transactions and reduces costs, but also ensures the transparency and security of transactions. In addition, PayFi's on-chain payment system makes the transfer and payment of these assets simpler and more efficient, solving the settlement delays and high fees common in traditional finance.

——Liquidity Pool and Financing Channel:Provide financial support for RWA. PayFi's liquidity pool provides sufficient financial support for RWA, enabling these assets to obtain financing from global investors. By using RWA as collateral, PayFi allows investors to participate in financing activities on the DeFi platform while providing a stable source of funds for RWA. This model not only increases the liquidity of RWA, but also brings diversified investment opportunities to DeFi investors.

——Risk Management and Transparency:Enhance market trust. Through blockchain technology, PayFi ensures the transparency and verifiability of all RWA transactions, reducing information asymmetry and operational risks. The automatic execution of smart contracts reduces the risk of human intervention, while the immutability of blockchain ensures the security of transaction records. All of this enhances market trust and promotes the further integration of RWA and DeFi.

In the future, PayFi will play an increasingly important role in promoting global asset liquidity, reducing transaction costs and enhancing market transparency. In Lily Liu's view, PayFi introduces RWA and institutional finance into the on-chain liquidity pool, creates an integrated value chain, and constitutes a "new financial cluster", which may be the biggest theme in this cycle of the crypto market.

Why does PayFi happen on Solana?

Why does PayFi happen on Solana instead of other L1 public chains or L2 solutions? Lily Liu's answer is: "Solana has three advantages: high-performance public chains, capital liquidity, and talent liquidity." These advantages constitute a threshold that other competitors are difficult to cross at this stage.

First, high-performance public chain. Solana's core technical advantage lies in its unique Proof of History (PoH) consensus mechanism, which enables it to process more than 65,000 transactions per second (TPS), and transaction confirmation time is usually around 400 milliseconds. This performance far exceeds Ethereum's 10-15 TPS and long confirmation time. Even L2 solutions on Ethereum, such as Optimistic Rollups, find it difficult to match Solana in terms of latency and throughput. Although Visa claims that its servers can handle up to 56,000 TPS, in actual use, Visa only processes an average of 1,700 transactions per second. In contrast, Solana is fully capable of meeting actual payment needs.

Second, capital liquidity. As of August 30, 2024, the Solana ecosystem has a total locked value (TVL) of more than $10 billion and has attracted significant investments from top venture capital funds including Andreessen Horowitz (a16z), Polychain Capital, Alameda Research, etc. This capital liquidity provides strong financial support for the expansion of PayFi.

Finally, talent liquidity. The Solana Foundation actively promotes the construction of the developer community, organizing more than 500 hackathons and developer education programs around the world. As of 2024, there are more than 5,000 active developers in the Solana ecosystem, making it one of the fastest growing blockchain developer communities in the world. The strong talent pool supports the development of various innovative projects and continues to attract new technical and financial talents to join the ecosystem, laying a solid foundation for the development of PayFi.

PayFi uses programmable payments to connect the traditional world with the blockchain world, and through smart contracts, it makes it possible to expand the scale of credit finance on the chain. Solana's advantages not only support the development of PayFi, but also make it highly competitive in the future global payment and financial markets.

Take PYUSD as an example. PayPal chose Solana as the new public chain for PYUSD payments, mainly focusing on Solana's fast settlement capabilities, low transaction fees, and strong developer ecosystem. Solana's token extension features, including confidential transfers, transfer pegs, and memo fields, provide PYUSD with the necessary flexibility and commercial practicality.

As PayPal said: "These features are not optional. If you want PYUSD to play a role in the broader business field, you must provide it to merchants." Today, Solana has become the main platform for PYUSD, accounting for 64% of the market share, while Ethereum only accounts for 36%. In addition, as early as September 2023, Visa has expanded the settlement function of USDC from Ethereum to Solana.

PayFi's application scenarios and typical projects

The essence of PayFi is to reshape and upgrade the traditional financial system using advanced encryption technology. Therefore, all financial scenarios can and need to be redone with PayFi

1. Cross-border payments and trade

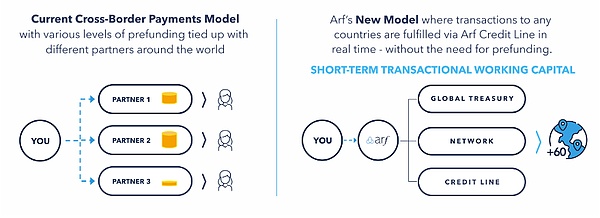

The traditional cross-border payment problem mainly lies in the isolation problem in the centralized sovereign currency system. Due to the influence of national monetary policies such as foreign exchange controls and capital circulation, cross-border payments always have cumbersome processes, long time consumption and high costs. At first, everyone believed that cryptocurrency payments to replace traditional cross-border payments was an excellent solution, but the enterprise-oriented solution still had many shortcomings.

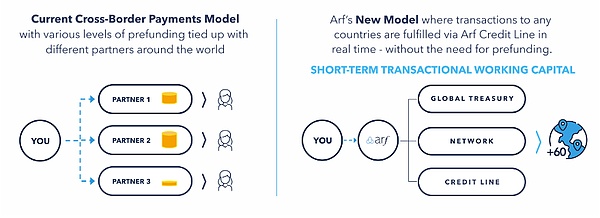

Today, the cross-border payment industry still relies heavily on prepaid funds to achieve same-day settlement. Currently, more than $4 trillion is locked up in prepaid funding accounts, which is a huge and hidden cost for financial institutions and the global payment industry. PayFi can optimize this and leverage crypto services with traditional credit finance.

Comparison between the current cross-border payment model and the Arf improved model

(from: Arf)

Arf (@arf_one):The world's first regulated, transparent short-term liquidity solution designed to support cross-border payments. Headquartered in Switzerland. By providing licensed money service businesses and financial institutions with digital asset-based working capital and settlement services, as well as local entry and exit capabilities, Arf eliminates the capital-intensive business model institutions in the cross-border payment industry. Arf provides a unified liquidity network for cross-border payments and trade, eliminates prefunding requirements, and provides 24x7 transparent and compliant services. As of now, Arf's on-chain transaction volume has recently exceeded $1.6 billion without any defaults, becoming one of the fastest growing stablecoin use cases.

2. Supply Chain Finance

Supply Chain Finance combines financial services with supply chain management, based on trade relationships and transactions in the supply chain, and provides systematic financial products and services to upstream and downstream enterprises in the supply chain through the control and management of supply chain information flow, logistics, and capital flow. Traditional supply chain finance is subject to cumbersome contract and legal work, and it is difficult to automate evaluation, and the financing process is slow, which seriously affects the financing turnover of small and medium-sized enterprises. PayFi has greatly simplified the process of accounts receivable acquisition and other businesses, alleviating the problem of corporate financing difficulties.

Global companies are denied $2.5 trillion in trade financing each year due to the limitations of traditional financial institutions

(from: Isle Finance)

Isle Finance(@isle_finance):The first project to provide the RWA PayFi network for supply chain payments, introducing instant Web3 liquidity into supply chain finance and providing competitive returns with Grade A quality to liquidity providers. Through Isle, supply chain payments are combined with real-time settlement and liquidity management of blockchain technology, enabling supply chain participants to process payments and settlements more quickly and improve capital utilization efficiency; at the same time, on-chain liquidity providers can anchor the payment stability of high-credit buyers and share with buyers the early payment discounts provided by suppliers. Isle's main customers include high net worth individuals (HNWIs), crypto native users, DAO inventory, asset managers and family offices, and allow ordinary users to pledge ISLE tokens to obtain liquidity mining rewards.

3. Consumer Finance

PayFi for C-end users may be more interesting to users, mainly in the field of consumer finance, which is also the part that Lily Liu emphasized in her PayFi sharing, "Buy Now, Pay Never". Users can cover current expenses by promising future income, and the mandatory part will be implemented by smart contracts on the chain. In consumer finance, the key to PayFi is that the service provider who connects the merchant network plays the role of acceptance in the middle, so that consumers can obtain sufficiently diverse consumption scenarios.

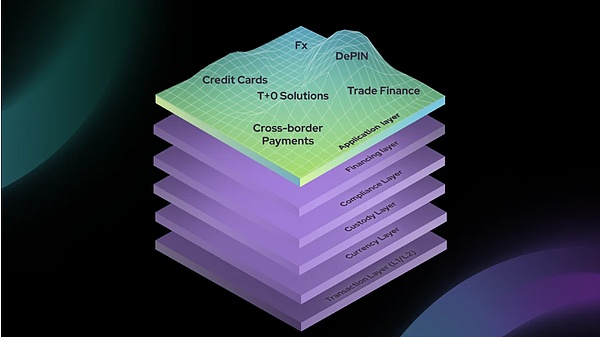

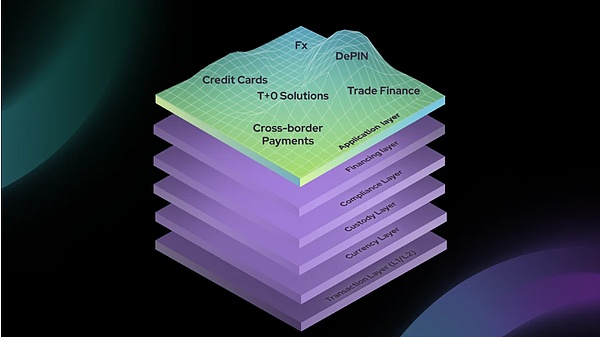

PayFi Stack's open stack of compliant payment financing solutions

(from: Huma Finance)

Huma Finance (@humafinance):The industry pioneered PayFi Stack, an open stack designed to build compliant payment financing solutions, and advocated industry leaders to optimize solutions to meet the unique needs of PayFi. The initial stack contains the following layers: transactions, currencies, custody, financing, compliance, and applications. Taking the financing layer as an example, it includes: from credit ratings, underwriting to RWA oracles, etc. As a representative project of the financing layer, Huma focuses on short-term financing commonly seen in the payment field. As of August 26, 2024, Huma (single-caliber statistics) has a total financing payment amount of more than 280M and a default rate of 0.

CrediPay (@Credix_finance):Helping businesses increase sales and improve cash flow efficiency through seamless and risk-free credit services. Sellers offer buyers flexible payment terms at attractive prices and receive advance payments. We manage and protect customers from any credit and fraud risks, allowing them to focus only on what matters most: increasing sales and profitability. Currently, Credix's services are mainly concentrated in Latin America, such as accounts receivable factoring.

Opportunities and Challenges of PayFi

1. Market Growth Space

The core goal of PayFi is to introduce the time value of money onto the chain and reconstruct the financial system in a more programmable, sub-custodial, and decentralized way. With the rapid increase in the number of stablecoins worldwide and the continuous improvement of cryptocurrency infrastructure, PayFi is expected to become an important force in transforming traditional finance.

According to Statista, the total global digital payment transaction volume is expected to reach approximately $9.46 trillion in 2023, and this figure is expected to continue to grow, possibly reaching $14 trillion by 2027. At the same time, data from mordorintelligence shows that the DeFi market size is estimated to be $46.61 billion in 2024 and is expected to reach $78.47 billion by 2029, with a predicted compound annual growth rate of 10.98%.

Calculations by the CGV Research team show that, assuming that PayFi can account for 10% of the total global digital payment transaction volume (conservative estimate), by 2030, the PayFi market size (estimated to be $1.8 trillion) will be 20 times the size of the DeFi market (US$87 billion). This means that PayFi has huge market potential and is expected to occupy an important position in the global digital payment field.

2. Regulatory and compliance challenges

With the continuous increase in the issuance of stablecoins around the world, the attitudes of central banks towards stablecoins have gradually eased. In a broad sense, stablecoins anchored to the fiat currency standard can be regarded as a digital extension of the fiat currency. The payment business mainly involved in PayFi uses stablecoins as a medium, which is actually still subject to the supervision of the sovereign monetary system.

On the one hand, the current PayFi projects focus on compliance, and usually only licensed institutions are allowed to participate, while individual users need to go through strict KYC processes and reviews. On the other hand, a large number of PayFi projects tend to expand their business in third world countries. Since local regulations are usually not sound enough and regulatory barriers are low, the compliance risks are relatively small.

3. Technical and security risks

After years of DeFi development, although security issues have not been completely eliminated, a large number of security vulnerabilities have been identified, and after strict audits, the security of PayFi on the chain is basically equivalent to that of traditional DeFi.

However, technical challenges mainly exist in the off-chain part. Since PayFi requires a large amount of access to real-world assets, ensuring the enforcement of off-chain logic remains an unresolved issue. The current solution is usually to handle the alignment of on-chain and off-chain through an intermediary entity, but this solution still needs to be further improved.

Conclusion

PayFi, as a new wave of payment finance, is reshaping the global financial ecology with its unique charm. It not only inherits Bitcoin's payment vision, but also raises the efficiency and inclusiveness of financial services to a new level through the innovation of blockchain technology. With the support of high-performance public chains such as Solana, the market size of PayFi is expected to grow exponentially and become the main driving force of the future financial market.

As Lily Liu foresaw, PayFi closely combines RWA and DeFi to build an integrated value chain and form a new financial cluster. This revolutionary innovation will drive the global financial system towards a more efficient and inclusive direction.

JinseFinance

JinseFinance