Author: Haotian

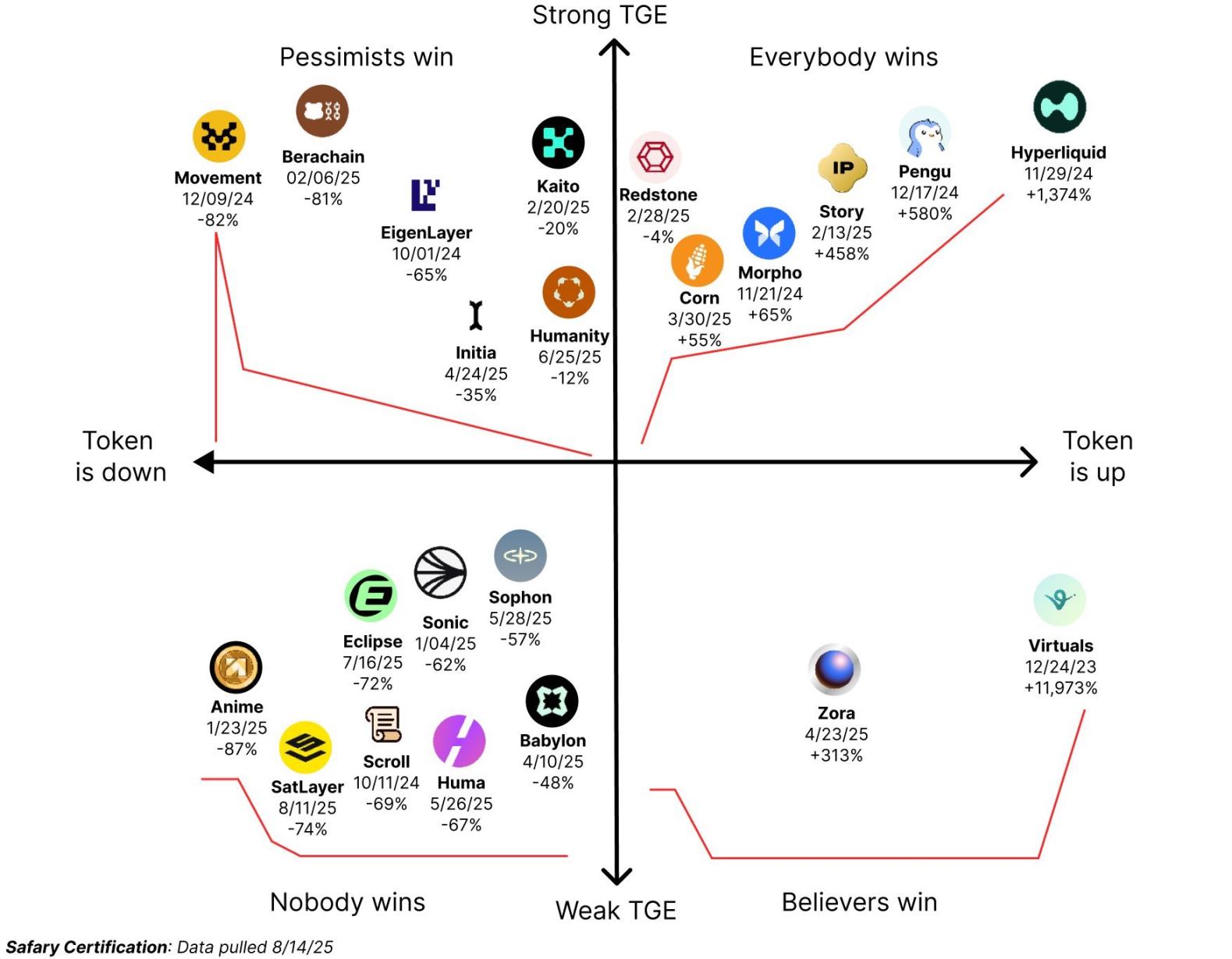

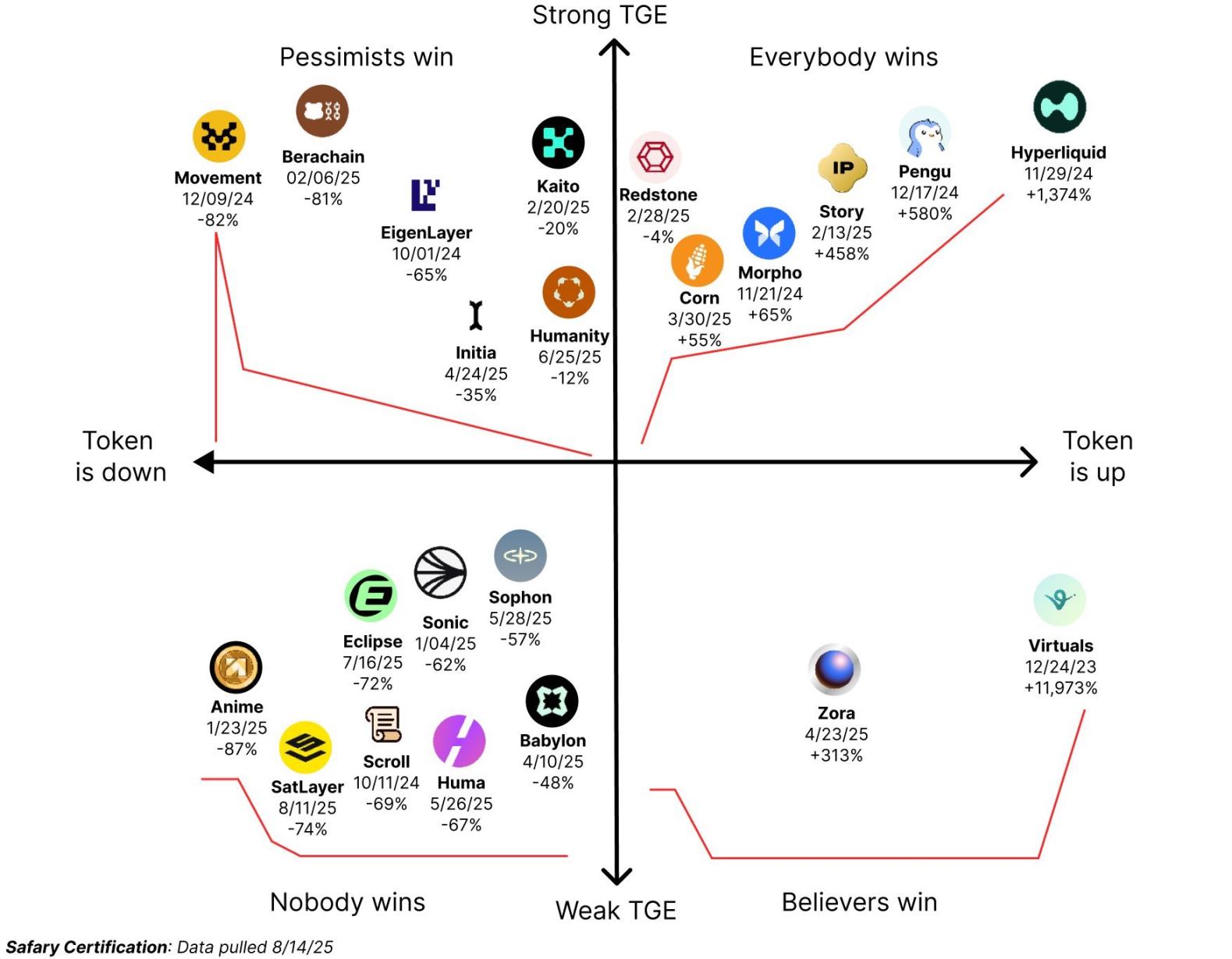

I saw a picture on Twitter this morning and had some thoughts, so I’d like to share it with you:

1) It is very important to choose a TGE in a time window with abundant liquidity, so important that it can ignore the fundamentals of the project. For example, $Pengu, an NFT community MEME token, launched on December 17th of last year, during a period of abundant liquidity, yet it performed better than most projects. Meanwhile, $BABY and $HUMA, projects with technical narratives and VC backing, launched in April and May of this year, when liquidity was relatively dry, and performed very poorly. 2) Projects tend to launch in large groups, but market liquidity needs to be considered. For example, in November and December of last year, projects like Hyperliquid, Movement, Pengu, and Morpho emerged. While performance varied widely, fortunately, most of them ultimately withdrew. Meanwhile, in April and May of this year, Babylon, Initia, Zora, Huma, and Sophon emerged in droves, but liquidity was insufficient and their performance was disappointing. 3) During the TGE window, some projects may peak immediately upon opening. Some projects may launch TGEs during periods of abundant market liquidity and retail investor Fomo, ignoring their own weak fundamentals. For example, Dongxiang and Berachain saw exuberant Fomo sentiment upon their opening, but ultimately experienced an inexorable decline. This simply demonstrates that market liquidity dividends, without fundamental support, can accelerate the decline of some projects. 4) During the wrong TGE window, projects with a panicked fundamentals but a strong foundation can actually present golden opportunities for value discovery. $ZORA is a prime example, launching during the market's quietest and most illiquid period, becoming the sole winner among its group of projects. An earlier example, $Virtual, launched during the darkest of times, yet consistently delivered exceptional fundamental performance, leading waves of Solana AI agent enthusiasm and ensuring the collective faith prevailed. 5) Regardless of the strong or weakest exit window, there will always be projects with excellent fundamentals that emerge. For example, Hyperliquid was able to build a massive community of supporters, leading to a wave of hype surrounding the Perp Dex platform, and the price of $HYPE has seen a gradual, step-by-step increase. Also, despite launching at the height of last year's Trump liquidity surge, with $FLOCK's minimum circulating market capitalization plummeting to an exaggerated 3 million, its outstanding fundamentals enabled it to achieve a near-exchange listing grand slam, ensuring its believers prevailed in the end. For most retail investors, understanding the importance of the TGE window and adopting differentiated strategies: chasing highs and entering and exiting quickly during strong TGEs, or focusing on investment research during weaker TGEs, identifying undervalued, high-quality indices and holding them for the long term, all have the potential to emerge as the ultimate winner, albeit with some difficulty.

Anais

Anais