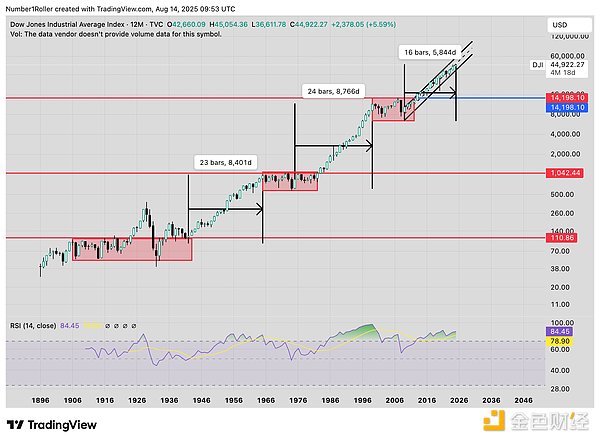

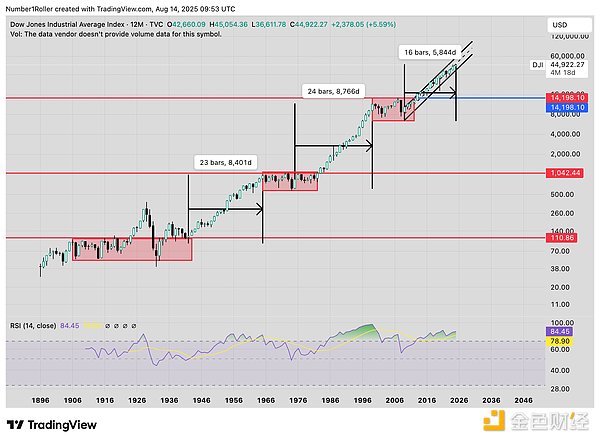

Source: Digital Asset Research, Compiled by Shaw Jinse Finance. Honestly, I've seen enough of the four-year cycle theory. Today, I'm going to rant about why those who follow it ultimately fail miserably. These people have never studied time or cycles in their lives, yet they're so certain the four-year cycle will complete. They have no idea what they're dealing with and will ultimately be forced to buy at a higher price. This is a purely data-based argument, not some random guess. I'm simply fed up with the overwhelming pessimism and excessive caution in the market, and it's made me incredibly optimistic. I'm not trying to exaggerate what's going on in this market, but this sentiment alone is enough for me to declare that I've had enough of this nonsense. We're going to keep rising, and we're going to keep rising for longer than these people can remain sane. A bull market doesn't peak when everyone is ready to take profits and walk away. It peaks when people rush to leverage up and mortgage their homes to buy more stocks. It peaks when your simple-minded friend/neighbor/cousin/uncle makes a killing, far beyond their means, quits their job, and becomes an investment professional. It peaks when no one, and I mean no one, is bearish anymore. Today is a stark contrast to the situation back then, when every time the S&P 500 drops 3%, investors flee the market, or when the entire cryptocurrency world plans to sell off within the next three months because of some invented cycle with no hard data to back it up. What these new cycle experts fail to realize is that a cycle is only as good as the underlying conditions that created it. The saying "the map is not the territory" comes to mind. This means that while you can stare at a map forever, it only gives you a rough idea of where you are. A map won't tell you there's a huge pit 300 feet to your left. It won't tell you there's a giant oak tree in the middle of a field. It won't tell you there's an abandoned shack a mile ahead. And it certainly won't tell you that it's 110 degrees Fahrenheit with 50% humidity outside, or whether you're in a jungle or a deciduous forest. A map shows you the coordinates and direction of your location, but it doesn't give you a sense of the actual objects, surroundings, and terrain you might encounter while navigating. A cycle is a map; it provides us with time frames and historical data that give us a rough idea of what we might typically see, but the real reality lies in the underlying market conditions. These conditions determine whether a cycle grows or shrinks, becomes more volatile or less volatile, and so on. The conditions in the cycle we're in today are fundamentally different from those of the past three, and we'll examine why and how this is reflected in the charts. A key distinction here is between saying "this time is different" and "it's the same old thing, but different." Price Structure and Behavior From the outset of this cycle, it's clear that the market's structure and behavior differ from those of previous cycles. This is because new assets and markets go through different stages of growth and adoption. This reminds me of Peter Lynch's point about how company styles change over time. Companies don't always remain high-growth businesses. Over time, they transition to lower-growth businesses that become mainstream players within their industries. This is a typical adoption cycle, where the first stage is hype, the second stage is growing pains and uncertainty, and the final stage is when mass adoption begins and the early majority of users begin to dominate. Let's look at the case of Amazon, including its life cycle and market structure, and compare it to Bitcoin and Ethereum. This is a thesis we made during the market’s Q1 plunge a few months ago. We demonstrate a close correlation between Amazon (AMZN)'s current structure and behavior and what we're currently witnessing in major cryptocurrencies. Clearly, the early 2017 cycle was driven by significant hype, similar to Amazon's in 1999. The 2021 bull run, however, was structurally more like sideways trading than a significant expansion. This will be a key test of whether the asset can survive the 2020 crash and 2022 bear market to prove its worth. Similarly, Amazon (AMZN) didn't reach a new all-time high until after 2008. It had a long struggle to prove that it could survive the dot-com crash and build a viable long-term business. Finally, we reach the mass adoption phase, where the early majority begins to join. This is the final hurdle facing Bitcoin and cryptocurrencies as an asset class. The final argument that was once raised—"What if the government bans it?"—no longer holds true. Far from banning it, the government is doing everything it can to embrace it. This is a classic example of an adoption curve. Okay, that's great, we know we're in the mass adoption phase, but what does this have to do with the four-year cycle? Let's take a step back and look at the Dow Jones. The Dow Jones is undoubtedly any serious analyst's favorite chart, as its price history on TradingView goes back to 1896. With over 100 years of data, it's the best dataset we can rely on. Looking at the one-year chart of the Dow Jones, we can see that there have been three periods of consolidation in its history that lasted more than a decade. Following the first two periods of consolidation, expansions lasted approximately 17 to 23 years. The most recent consolidation occurred from 2000 to 2013. Currently, this rally has only lasted 16 years, which would be the shortest in history if this were the top.

If we look closely at the 16-year bull market that began at the 2008 low, we can see that it retested the previous high four times.

The 2015 bottom was a retest of the 2008 top. The 2020 bottom was a retest of the 2015 top. The 2022 bottom was a retest of the 2020 top. And the recent April bottom was a retest of the 2022 top. The market, like clockwork, has repeatedly turned previous tops into support levels while continuing to advance along this bull channel. However, the key is the duration of the market's rally after each pullback. As shown in the chart above, the shortest rally cycle is 22 months. Currently, we've only been up for five months since the April low. Using the shortest possible 22-month upcycle, the market would reach its peak in early 2027.

This is another great data point that shows you why I believe the entire market is bullish for at least the next 12 months. In this environment, it's hard for me to believe cryptocurrencies will crash while stocks continue to rise.

From Bull to Bear and Back to Bull

Another reason why I believe this bull market has only just begun is the April crash.

I don't think people fully appreciate the level of panic that crash caused in both the stock and cryptocurrency markets. We're talking about market sentiment, timing, and prices at severe bear market levels.

The readings we're seeing are comparable to the oversold levels and levels of panic seen in 2020, 2008, and 2000. The market was completely shattered. This effectively gave this market the momentum it needed to kick off a new bull run that will last longer and be stronger than anyone expected. Just look at what happened with Ethereum (ETH). Ethereum's plunge lasted longer than the FTX crash, and the price drop was almost identical. In my view, this is the end of the bear market that began at the market top in 2024. We formed a triple top during the last rally in November, and the subsequent 50-plus-week bear market ended with that crash. Supporting this view is the fact that Ethereum (ETH) has already experienced a complete bull market. Typical bull markets last between 90 and 120 weeks. Subscribers are well aware of the importance of these timeframes. Interestingly, the period from the 2022 low to the early 2024 high was exactly 90 weeks. In other words, I believe it was a complete cycle that quietly completed, followed by a bear market cycle that began at that high, lasted a full year (similar to other bear markets), and ended with a crash in April. Just look at the Relative Strength Index (RSI) reading in the chart above. The weekly RSI has only reached these levels three times, and all three times were bear market bottoms. The April low is equivalent to a bear market bottom, which gives us ample room to move higher.

Copper/Gold Ratio

Here's a great market correlation chart provided to me by Bravos Research.

This is the Copper/Gold Ratio chart, which has consistently predicted Bitcoin's parabolic moves and cycle tops since 2013.

Every time this chart bottoms out, Bitcoin begins its most aggressive expansion. Subsequently, when it tops out, Bitcoin also continues to trade at higher levels. I find this chart interesting for two reasons. Besides the correlation (which is the clearest I've ever seen), the timing is also interesting. This chart is currently at a low, and assuming it's bottoming, the typical bull market cycle is 17 months. 17 months from today, that's early 2027, which matches what I just showed you for the Dow Jones.

Not only would it have continued rising for 17 months, but it would have coincided with the largest phase of Bitcoin's bull run, which supposedly hasn't even begun yet.

By the way, I want to show you some data from Stansberry Research that highlights the short positions in Bitcoin that traders are committing to.

We are currently at the highest level of bearishness we've seen since 2021. Stansberry’s data continues to show that every time the COT reaches a new extreme 1-year bearish level, subsequent price action follows. This is only six years of data, but extrapolating this suggests Bitcoin could surge to $230,000 by this time next year, again suggesting a longer cycle based on this extreme reading. Next up are altcoins. I don't have much to say about altcoins, except that I think the outlook for a major altcoin market rally is very bright. However, large market moves take time, and as you can see, if these moves take time to play out, then a four-year cycle becomes meaningless.

Look at the "Other" chart below, and if you think this looks bearish in any way, you can't call yourself an analyst. Just based on this structure alone, you can develop an extremely bullish outlook for altcoins.

Additionally, we know that the longer a market takes to break out of old highs, the larger its swings tend to be.

Once this breaks out, it's hard to say how far this will go, but I highly doubt it will last just eight weeks after nearly five years in the making. Looking at TOTAL3 versus BTC below gives us some idea of the timeline. Not only is it just getting started and hasn't broken out yet, but the typical cycle is 12 to 13 months, meaning we won't see a clear outcome until the second half of next year. Then, a quick look at the overall "Other" chart shows the same story, but over a longer timeframe. What's different about this recent bear market is that it's lasted longer than any other. So when it breaks out, we should expect a significant surge, and more importantly, one that lasts for a long time. You can't analyze any of these charts and conclude that the breakout will end in eight weeks. Based on these charts, we'd expect the rally to last 12 to 18 months.

The Halving Theory

Finally, let's talk about the halving theory, which, as I understand it, is the root cause of the four-year cycle, right? If the halving theory is correct, then why are we hitting a new ATH before the 2024 halving? According to the theory, we should be hitting a new ATH after the halving. And why are we crashing in the first quarter of the fourth year of a four-year cycle? This has never happened before. But it's still the same, isn't it? It seems to me that there are a lot of cracks, but these people, like bears in a bull market, refuse to give up and accept the facts. Here's a novel idea proposed by Adam Back, a well-known BTC OG who is even quoted in the white paper. He points out that the cycle top is actually in April 2024 because technically that is the apex of the halving cycle, and the next halving cycle will end in mid-2028. An interesting point of view, and a reasonable one in my opinion. This does not mean that Bitcoin will not see a pullback before 2028, or that 2028 is what I consider the cycle top target, it simply shows that the halving has no real impact on the Bitcoin price. Below is a view of the Bitcoin halving and cycle top. While this statement is admittedly a bit hyperbolic, I strongly believe there's ample data to suggest this four-year cryptocurrency cycle isn't over. In my view, the contrarian view is clear: both stocks and cryptocurrencies are poised for significant and prolonged gains. While everyone is concerned about the four-year cycle and overvaluations, I recommend taking a closer look at the actual data and facts to support these concerns. Any market veteran can tell you that current sentiment simply isn't strong enough to warrant a market top. Too many people are ready to sell before Ethereum reaches new highs and altcoins are poised to break out of their four-year consolidation range, while the Dow Jones and the copper-to-gold ratio suggest there's far more upside than people realize. As I said on X a few days ago, long cycles are harder, not easier. And because we're still in the early stages, people think they won't last long because they'll make a killing. That's simply not the case. The longer the cycle, the more likely people are to lose money. Not many people consider the fact that Ethereum did experience a complete bull run from its June 22nd low to its April 24th high, followed by a year-long bear market. Timing, price, and market sentiment all point to this being accurate, yet most people overlook this fact. This wall of worry, fear, and doubt will continue to fuel this bull run far longer than anyone expected. The fact that most people are stuck in a four-year cycle is just adding fuel to the fire.

Remember, the market will do whatever it takes to fool as many people as possible.

Although we are entering a long bull market, that doesn't mean the journey will be smooth sailing. There will be dips, pullbacks, and corrections along the way that can confuse even the most experienced traders. Having a framework for understanding market conditions is crucial to helping you find the right position that so many investors are trying to find.

Catherine

Catherine