Author: Arjun Chand, Bankless Analyst; Compiler: 0xxz@黄金财经

VC’s interest in crypto x AI is unquestionable. Just last week, Sentient announced a massive $85 million seed round. This round of investment includes investments from heavyweights such as Peter Thiel’s Founders Fund, Pantera Capital, and Framework Ventures.

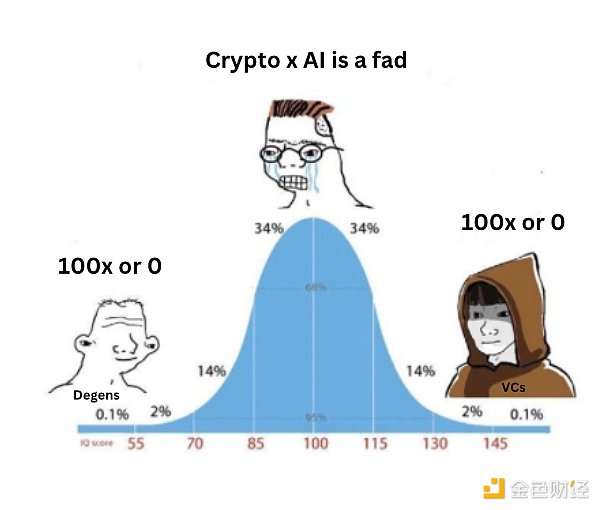

While both AI and cryptocurrencies have attracted widespread attention, some may think that the combination of the two is just a passing trend in the crypto Twitter echo chamber. But as more and more such projects attract the eyeballs of top investors, the likelihood that these projects will achieve certain results is increasing.

Let’s analyze why venture capital firms are betting big on crypto and AI.

First Principles Thinking

The intersection of Crypto x AI presents a unique opportunity: to build a new financial and AI ecosystem based on first principles, based on the value of crypto.

The world doesn’t need another Instagram or a Nasdaq with slightly lower latency. It requires entirely new ways of interacting, collaborating, and exchanging value. Crypto x AI has the potential to unlock this by building entirely new systems from the ground up.

This creates a ton of new opportunities for startups and investors. Venture capitalists are always looking for the next big thing, and the intersection of Crypto and AI is an exciting investment opportunity.

We all want success. Maybe you’re into memecoin, maybe you’re funding startups that want to succeed.

The Inevitable Rise

The impact of AI is undeniable. It’s rapidly permeating every aspect of our lives, from chatbots to advanced tools, becoming an integral part of our work and daily lives. People’s reliance on AI will only grow, creating a powerful network effect: the more we use it, the more valuable it becomes. Venture capitalists are realizing this, too. As Pantera’s Cosmo Jiang puts it, “In [10], 15, 20 years, everyone will be using AI,” so saying you’re investing in an AI company “will be as silly as saying, ‘I’m investing in a company with a website.’ ” This isn’t just speculation; it’s a clear trend. Like the internet, AI is moving toward mainstream adoption.

Broken: VCs turn to AI

Awakening: VCs wait for their crypto portfolios to turn to AI

Pantera Capital....is raising a new $1 billion fund. The fund says all crypto companies will be AI companies in the next 10 to 20 years. It has invested 15 to 20 percent of its capital in AI-related blockchain projects in its earlier funds, and the new fund will have a higher percentage.

Interesting: AI and crypto are becoming a powerful combination. Remember all that talk about attracting a billion new crypto users? Forget human users; the future superusers of cryptocurrency may be AI agents.

Experts believe that the combined power of cryptocurrency and AI could contribute trillions of dollars to the global economy by 2030. By getting in early and backing the right players, VCs hope to capture a large share of the massive value created in this emerging field.

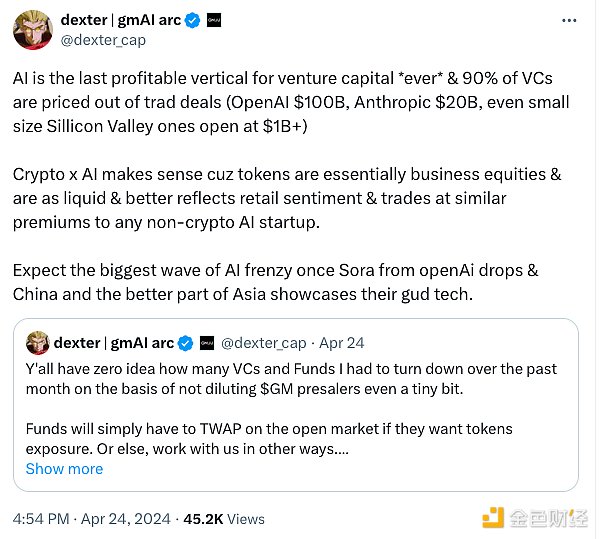

The harsh reality is that for most VCs, the AI train may have already left the station. Outrageous valuations for companies like OpenAI ($80 billion), xAI ($24 billion), and Anthropic (over $18 billion) have made big tech AI deals out of reach for all but a select few.

Cryptocurrencies offer a compelling alternative — a backdoor into the AI future without writing a billion-dollar check.

AI is the last profitable vertical in venture capital *ever*, with 90% of venture capital companies priced out of traditional trading range (OpenAI $100 billion, Anthropic $20 billion, and even small Silicon Valley companies opening at over $1 billion). Crypto x AI makes sense because the tokens are essentially commercial equity, highly liquid, better reflect retail sentiment, and trade at premiums similar to any non-crypto AI startup. Expect the biggest AI frenzy once openAi's Sora goes public and China and much of Asia showcase their superior technology.

In addition, VCs are also buying Crypto x AI tokens on the open market. For example, Polychain, Digital Currency Group, and DAO5 reportedly purchased hundreds of millions of dollars worth of $TAO (Bittensor).

Perhaps the best part is that in the case of Crypto x AI, retail investors also have a chance to participate.

Trust Gap

The current state of AI is like a high-stakes poker game with hidden cards. Companies like OpenAI have developed solutions worth billions of dollars based on closed-door research.

While this may work in their favor, it creates a huge trust gap for VCs and the public. How can you trust companies like OpenAI when their own boardroom has become a public farce?

I am still thinking about the fact that the OpenAI board fired Sam because he was not trustworthy and the entire Super Alignment team resigned due to security issues,

I have been wondering what happened for months, there is a lot of content for anyone to refer to

Crypto x AI, on the other hand, is all about open source development, driven by tokens to align incentives. This way, we can build AI that serves all participants, not companies or countries.

VCs believe that the open source approach will lead to faster innovation, a wider talent pool, and ultimately greater benefits for all participants.

FOMO?

The tech industry is no stranger to hype cycles, and the current discussion around crypto and AI is no exception. It’s an opportunity to realize big returns, which sometimes creates a sense of urgency, even a kind of FOMO.

Even if the specifics are still a little fuzzy, Crypto x AI is a narrative that’s hard to resist. However, it’s important to acknowledge the inherent uncertainty. Venture investing is still educated guesswork, and professionals are learning as they go.

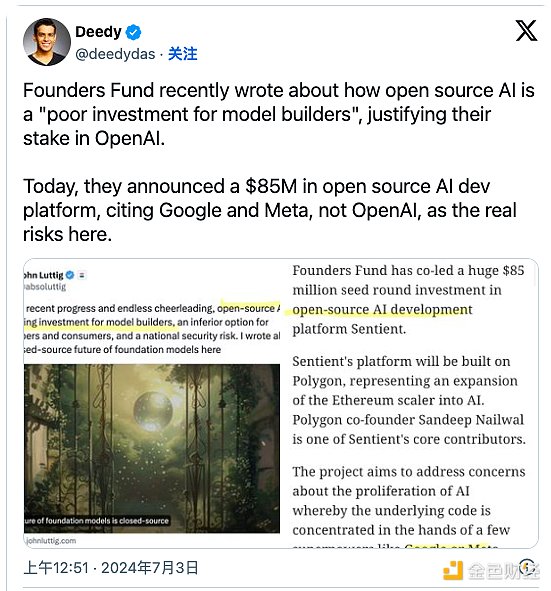

Founders Fund recently wrote that open source AI is a “bad investment for model builders,” justifying their investment in OpenAI. Today they announced an $85 million investment in an open source AI development platform, noting that the real risk lies with Google and Meta, not OpenAI.

Will Crypto x AI be the best narrative of this cycle? Or is it just another overhyped fad? Only time will tell.

For now, it’s clear that we’re still in the early stages of this exciting space, and venture capitalists are placing bets with a mix of optimism, caution, and a dash of speculative enthusiasm.

The question is, are you in the right position?

Anais

Anais