Written by Shlok Khemani Translated by Glendon, Techub News

Throughout the history of cryptocurrency, one topic that has continued to be hotly debated is where the ultimate value will flow in the blockchain technology stack. While the core debate in the past has focused on the battle between protocols and applications, there is a crucial third layer in the stack that is often overlooked by everyone - the wallet.

The "Fat Wallet" theory holds that as protocols and applications become increasingly "lean," more room for development is freed up for the two most valuable resources - distribution and order flow. As the final front end of contact with users, I believe that nothing is more capable than wallets to convert this value into actual benefits.

This article will explore this from three perspectives. First, we will outline three structural trends that will continue to commoditize the protocol and application layers. Secondly, we will explore how wallets can leverage their proximity to end users to monetize through a variety of avenues, including payment for order flow (PFOF) and distribution as a service (DaaS) for selling applications. Finally, we will explore why two alternative front-ends, Jupiter and Infinex, have the potential to beat wallets in the race for end users.

Towards Leaner Protocols and Applications

The question of how value will ultimately accrue in the blockchain technology stack can be reduced to a basic framework. For each corresponding layer of the crypto stack, you can ask yourself the following question: "If a product in this layer increases its take rate, will users switch to a cheaper alternative?"

In other words, if Arbitrum increases its take rate, will users switch to other protocols such as Base? Similarly, at the application layer, if dYdX increases its take rate, will users switch to the Nth undifferentiated perpetual contract decentralized exchange (Perps DEX).

Based on this logic, we can determine where switching costs are highest and therefore who has asymmetric pricing power. At the same time, we can also use this framework to determine where switching costs are lowest and which layer in the stack will become increasingly commoditized over time.

While historically, protocols have had disproportionate pricing power, I believe this is changing. Today, there are three structural trends that are increasingly "streamlining" the protocol layer:

1. Multi-chain applications and chain abstraction: As multi-chain becomes a basic condition for applications to remain competitive, the user experience across blockchains will become increasingly indistinguishable, and the switching costs of the protocol layer will only become lower and lower. In addition, chain abstraction will further reduce switching costs by eliminating the need for cross-chain bridging. As a result, applications will no longer be limited to the network effects of a single chain. Instead, chains will become increasingly dependent on the distribution of the front end.

2. Maturity of the MEV supply chain: While MEV (miner extractable value) can never be completely eliminated, there are many initiatives, both at the application layer and closer to the bottom layer, that will increasingly redistribute the amount of MEV extracted from end users. Importantly, as the MEV supply chain continues to mature, value will increasingly climb up the MEV supply chain and accumulate asymmetrically to the party that can obtain the most exclusive user order flow. This means that protocols will lose bargaining power and become "thinner", while front-ends and wallets will gain leverage and become "fatter".

3. Towards an agent paradigm: In a world where transactions are primarily executed by agents and "solvers" rather than humans, attracting this agent flow will become key to the survival of blockchains. Importantly, given that agents and "solvers" are programmed to primarily optimize for best execution, protocols will no longer compete on intangible assets such as "resonance" and "consistency". Instead, transaction fees and liquidity will become the most important factors - which will only further "lean" the protocol layer, as protocols will have to compress fees and incentivize liquidity to remain competitive.

So, revisiting our original question - if a protocol increases its fee rate, will users switch to cheaper alternatives? - while it may not be obvious now, I believe that as switching costs continue to decrease, the answer will increasingly lean towards "yes".

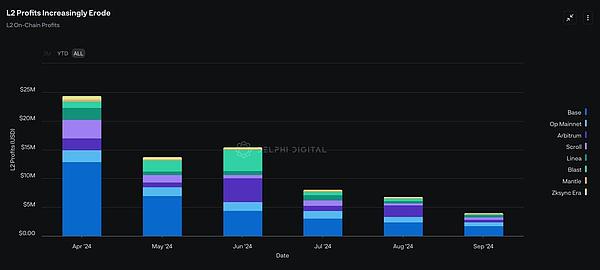

Data Source: Dune Analytics

Intuitively, one would think that if protocols become "thinner", then applications must become "fatter". While some of this value will indeed be recaptured by applications, the argument of simply discussing "fat applications" is limited. Value accumulates in different ways in different application verticals. Therefore, the question should not be “will apps get fatter?” but “which apps will get fatter?” As I outlined in A New Framework for Identifying Crypto Market Moats, the structural differences unique to crypto apps — forkability, composability, and token-based acquisition — have the net effect of lowering barriers to entry and acquisition costs (CAC) for emerging competitors. Therefore, while a few apps have features that cannot be easily forked, it is extremely difficult for crypto apps to cultivate moats and maintain market share. Back to our original framework again — if an app increases its fee rate, will users switch to cheaper alternatives? I think for 99% of apps, the answer is “yes.” As a result, I expect most applications to struggle to capture value, as once a fee model is enabled, users will inevitably move to the next undifferentiated application that offers a more lucrative incentive.

Finally, I believe the rise of artificial intelligence (AI) agents and solvers will have a similar impact on applications as it did on protocols. Given that agents and solvers will primarily optimize for execution quality, I believe applications will also be forced to compete fiercely in attracting proxy traffic. While liquidity network effects may be winner-take-all in the long term, in the short and medium term, applications will gradually become mired in a price war.

This raises the question: if both protocols and applications continue to “get thinner,” where will most of the value re-aggregate?

The “Fat Wallet” Theory

In short, the answer is who owns the “end user.” While in theory any front end, including an application, could become an owner, the “fat wallet” thesis asserts that nothing is closer to the user than the wallet. Here are five sub-arguments to support this logic:

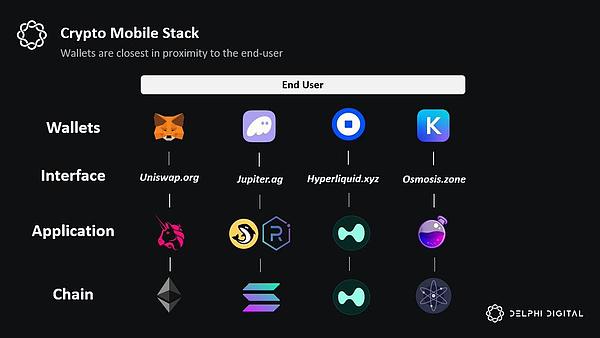

1. Wallets dominate cryptocurrency mobile user experience (UX): A good litmus test to understand who owns the end user in a mobile context is to ask the following question: Which Web2 application does the user ultimately interact with? While most users "interact" with Uniswap's front-end to trade, they still access this front-end through their own wallet application. This means that if mobile devices increasingly dominate the user experience of cryptocurrency, wallets, as the standard application entry, may continue to strengthen their relationship with end users.

2. Wallets meet user needs: Cryptocurrency applications are essentially financial applications. Unlike Web2, almost every on-chain transaction is some form of financial transaction. Therefore, the account layer is crucial for cryptocurrency users. In addition, there are some unique features that work in conjunction with the wallet layer: payments, principal returns on idle user deposits, automated portfolio management, and other consumer use cases such as cryptocurrency debit cards. Fuse seems to be leading the way in this regard, with features such as Fuse Earn and Fuse Pay allowing users to spend wallet balances in the real world using Visa debit cards.

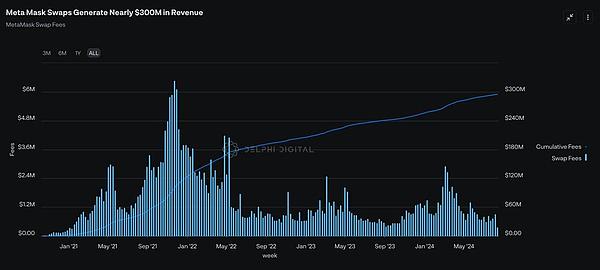

3. The switching cost of wallets is terrifyingly high: Although it is theoretically possible to change wallets by simply copying and pasting the seed phrase, this is still a psychological sticking point for most ordinary people. Given the high level of trust that users implicitly have in wallet providers, I believe that brand and "convenience" are strong sources of defensibility at the wallet layer. Revisiting our original question again - if this product in the stack increases its fee rate, will users switch to cheaper alternatives? - At the wallet layer, the answer seems to be "no"; MetaMask's fee rate for in-wallet exchange is 0.875% reflects this logic.

4. Chain abstraction: While chain abstraction is a technically thorny problem, one of the more compelling solutions is to solve it at the wallet layer. The idea that I can easily access any application on any chain through a single account balance seems particularly intuitive. Projects such as neBalance, Brahma, Polaris, Particle Network, Ctrl, and Coinbase's Smart Wallet are all moving toward this vision. Looking ahead, I speculate that more teams will meet user needs by solving chain abstraction at the wallet layer.

5. Unique synergy with artificial intelligence: While AI agents are expected to increasingly commoditize other parts of the blockchain stack, users still need to authorize the agents to ultimately execute transactions on their behalf. This means that the wallet layer is best suited to be the canonical front end for AI agents. Other outcomes of integrating AI at the account level may also include automated staking, yield farming strategies, and curated user experiences enhanced by large language models (LLMs).

Profit Opportunities

The first opportunity for wallets to become profitable is to own the user order flow. As mentioned earlier, while the MEV supply chain will continue to evolve, one thing will increasingly become true - the entities with the most exclusive access to order flow will reap a disproportionate increase in value.

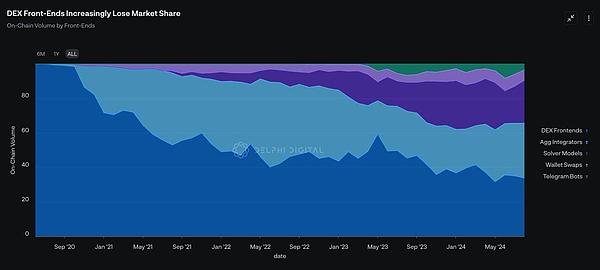

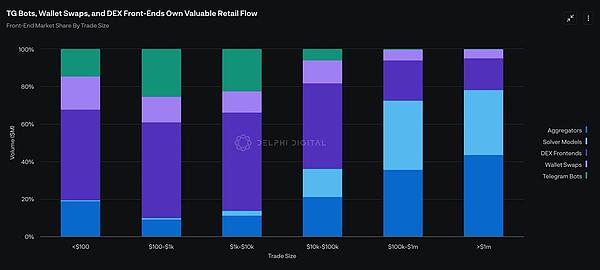

Currently, the frontends that dominate by total order flow are primarily solver models and decentralized exchanges (DEXs). However, looking at this chart alone lacks nuance. It is important to understand that not all order flow is created equal. There are two types of order flow: (1) fee-sensitive order flow and (2) fee-insensitive order flow.

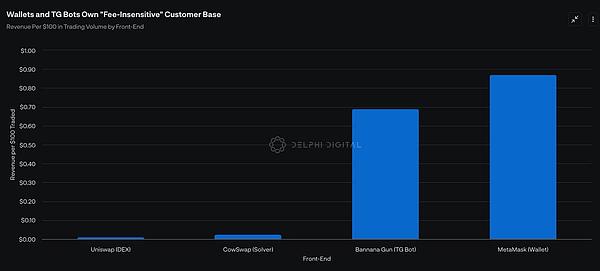

Typically, solver models and aggregators disproportionately dominate "fee-sensitive" order flows. Given that these users trade more than 100,000 orders, execution efficiency is critical to them. These traders will not even accept an additional fee of more than 10 basis points (bps). Therefore, "fee-sensitive" traders are the least valuable customer group - although they dominate the front-end market by volume, the value generated by these front-ends for every $1 traded is much lower than other types of front-ends.

In contrast, wallet exchanges and Telegram bots have a more valuable user base - "fee-insensitive" traders. These traders do not pay for execution, but for convenience. Therefore, paying 50 basis points for a trade is insignificant to them, especially when the outcome they expect is a binary outcome of "100x gain or zero gain". Therefore, Telegram bots and wallet exchanges generate much higher revenue than other frontends for every $1 of trading volume exchanged.

Looking forward, if wallets can capitalize on the trends above and continue to master end-user relationships, I expect in-wallet exchanges to continue to eat into the market share of other frontends. More importantly, even if they can only increase their market share by 5%, this growth will have a huge impact as wallet exchanges generate nearly 100 times more revenue per $100 traded than DEX frontends.

As such, this brings us to the second opportunity to monetize wallets - Distribution as a Service (DaaS).

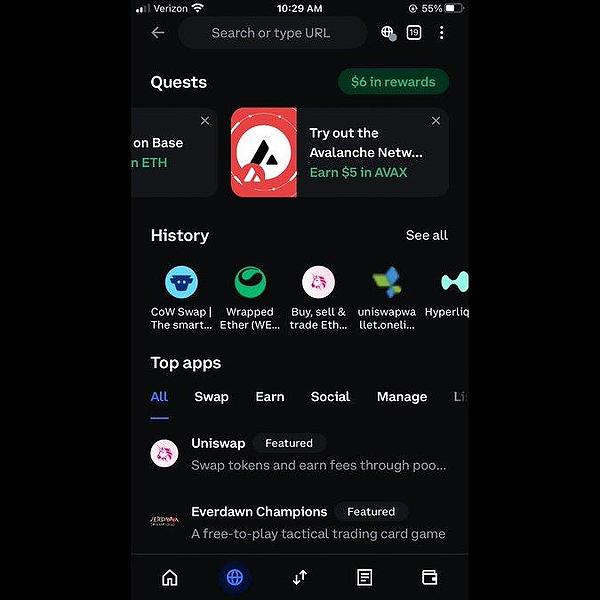

In addition to acting as the canonical frontend for users to interact on-chain, applications will ultimately be subject to distribution by wallet providers, especially in mobile environments. Therefore, similar to Apple's monetization through iOS, wallets seem to be well-positioned to strike exclusive deals with applications in exchange for distribution rights. For example, wallet providers could set up their own app stores and charge apps under some kind of revenue sharing agreement. MetaMask seems to be exploring an adjacent path with "Snaps".

Similarly, wallet providers can also steer users to specific applications in exchange for some sharing economy benefits. The advantage of this approach over traditional advertising is that users can seamlessly purchase items and interact with the app from the comfort of their wallet. Coinbase already seems to be exploring a similar path with its “Featured” apps and in-wallet “Quests.”

Wallets can also help grow emerging blockchains by sponsoring user transactions in exchange for some financial rewards. For example, assuming Bearachain just wants to attract users to their blockchain, it could pay MetaMask to sponsor the bridge costs and gas fees on Bearachain. Given that wallets will ultimately own the end users, I expect they can also negotiate some favorable terms.

As more users use wallets as their primary on-chain entry, we may see a shift in demand from “block space” to “wallet space” as attention becomes the most precious resource in the crypto economy.

Strong challengers to "fat wallets"

Finally, while wallets have a clear first-mover advantage in the race for end users, I am still excited about the prospects of two alternative front-ends:

1. Jupiter: By leveraging its decentralized exchange (DEX) aggregator as an initial entry point, Jupiter has been able to cultivate one of the strongest relationships with end users. This has earned them the best starting point to expand other adjacent products in the crypto space, including its perpetual contract DEX, launchpad, native LST, and the recently launched RFQ/Solver product. I am particularly looking forward to the release of the Jupiter mobile app, as it has the potential to enable Jupiter to surpass the wallet in a mobile environment and become the front-end closest to the end user.

2. Infinex: By acting as a front-end aggregator for applications on the Ethereum Virtual Machine (EVM) chain and Solana, Infinex aims to provide a centralized exchange (CEX)-like experience while retaining principles such as non-custodial and permissionless. Infinex will initially provide spot trading and staking services, and plans to integrate perpetual contracts, options, lending, margin trading, yield farming, and fiat on-chain functions. By abstracting the account layer and using familiar Web2 features such as Passkeys, I think Infinex also has the potential to replace wallets and become the canonical front-end in the crypto space.

While it is not clear to me who will ultimately win the competition to own the "end user", it is becoming increasingly clear that (1) user attention and (2) exclusive order flow will continue to be the scarcest and most monetizable resources in the crypto economy. Whether it is a wallet or an alternative front-end such as Jupiter or Infinex, I expect that the most valuable projects in the crypto space will belong to the entity that owns these two resources.

Alex

Alex

Alex

Alex Alex

Alex Hui Xin

Hui Xin YouQuan

YouQuan Joy

Joy Alex

Alex Aaron

Aaron Joy

Joy Aaron

Aaron Brian

Brian