Author: Marcel Pechman, Cointelegraph; Compiled by: Deng Tong, Golden Finance

ETH price has failed to close above $2,350 in the past 15 days, but some traders are still hoping for a rebound on February 6 Can bring more complete changes to trends.

Traders are watching to see whether Solana's network outage and the exchange's massive Ethereum outflows last week have an impact on prices. Traders also question whether Ethereum can rally another 10% to reclaim the $2,650 level last observed on January 12.

Ethereum remains the leader in DApp deposits

On February 6, the Solana Network emerged The five-hour outage disrupted block production and prompted multiple exchanges to suspend user deposits and withdrawals of SOL and Solana-based tokens. Analysts highlighted the ongoing challenges Ethereum rivals face in maintaining uptime during peak demand periods, reinforcing Ethereum’s dominance among decentralized applications (DApps).

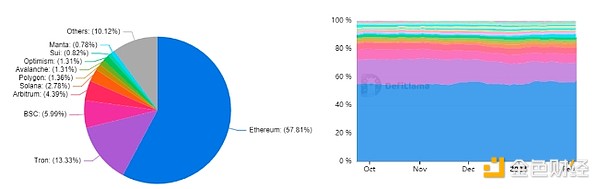

User @tytaninc shared his paper on the X social network refuting criticism of Ethereum’s congestion and high fees. In terms of DApp deposits, or total value locked (TVL), Ethereum holds 57.8% of the market share at $34.8 billion. According to data from DefiLlama, Ethereum’s dominance would expand to 67.4% if Layer 2 solutions such as Polygon, Optimism, and Arbitrum were included.

Blockchain ranking by TVL market share. Source: DefiLlama

One might argue that the average DApp user on Ethereum might not be willing to bear the network’s hefty transaction fees, which average $5.85. However, data shows that in the past week alone, Ethereum had 382,490 active addresses interacting with its DApps, led by Uniswap, 0x Protocol, Metamask Swap, OpenSea, and 1inch Network. Notably, when aggregating the ecosystem’s Layer 2 scalability alternatives, active addresses surged to over 2 million, according to DappRadar data.

Ethereum’s transaction and staking volume favors bullish momentum

Regardless of DApp metrics, asset flows remain is the final determinant of price. For example, the recent Solana outage had no discernible impact on network deposits or SOL token prices. This emphasizes the importance of monitoring exchange deposit and staking metrics. The fewer tokens available immediately, the greater the impact on price when demand surges.

Recent net Ethereum transaction flows show reserves plummeting to their lowest levels in more than a year. Since April, net withdrawals have reached 7 million ETH, indicating lower demand from holders to sell their tokens. To further understand how ETH holders reacted to the sale, we should analyze Ethereum’s staking process.

Staking is a fundamental process in the Ethereum network where participants lock tokens to validate transactions using proof-of-stake consensus. Simply put, an increase in total deposits pledged is considered beneficial to the price of ETH. Data from StakeRewards shows that the amount of ETH locked is currently at a record high of 29.6 million, up from 28.9 million a month ago.

ETH derivatives show long and short demand balance

To know whether Ethereum investors To turn bullish, BTC futures contango, also known as the basis, should be analyzed. In a neutral market, fixed-month contracts should trade at a premium of 5% to 10% to account for their longer settlement periods.

Ethereum futures 1-month premium. Source: Laevitas

Data shows that on February 6, the ETH futures premium stabilized at 7%, still below the neutral threshold , but slightly improved from the previous two days. Essentially, leveraged long (buy) and short (sell) demand has been balanced over the past week.

In order to rule out external factors that may only affect Ethereum futures, we should analyze the Ethereum options market. The 25% Delta Skewness indicator compares similar call (buy) and put (sell) options and will turn positive when fear prevails.

Ethereum 30-day options 25% delta bias. Source: Laevitas

As shown above, delta skewness has remained neutral since February 2, falling within the neutral range of -7% to +7%. On one hand, bulls celebrated a 3.9% rally above $2,350 on February 6, but demand for protective puts failed to increase. However, there are no signs of optimismaccording to Ethereum futures and options indicators, suggesting there is moderate distrust in current price levels. Ultimately, if Ethereum’s bullish momentum continues, professional traders will be in for a surprise.

JinseFinance

JinseFinance

JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance Xu Lin

Xu Lin JinseFinance

JinseFinance Xu Lin

Xu Lin Others

Others Bitcoinist

Bitcoinist Cointelegraph

Cointelegraph Cointelegraph

Cointelegraph