Author: Prashant Jha Source: cointelegraph Translation: Shan Oppa, Golden Finance

< p style="text-align: left;">The approval of a Bitcoin ETF has many optimistic about the possibility of an Ethereum spot ETF launching soon, but experts warn it could be a lengthy process.

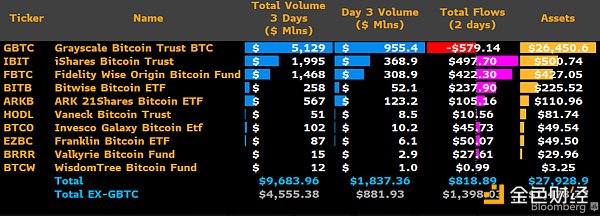

The U.S. Securities and Exchange Commission (SEC) approved 10 spot Bitcoin exchange-traded funds (ETFs) on January 10, allowing U.S. investors to invest in Bitcoin-backed securities. The spot Bitcoin ETF began trading on public exchanges on January 11 and has attracted billions of dollars in inflows so far.

The approval of a spot Bitcoin ETF has marked an important moment in Bitcoin’s history over the years. However, with the spot Bitcoin ETF approved, all eyes turn to the spot Ethereum ETF application, which has a final deadline of May.

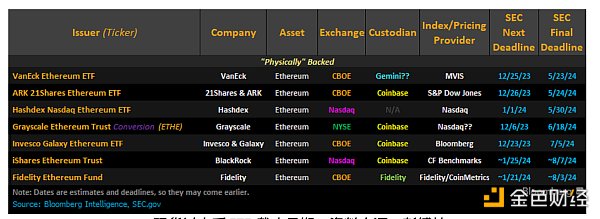

Similar to the 2023 spot Bitcoin ETF application, major financial institutions including BlackRock, ARK Invest, Fidelity, Invesco Galaxy and other major financial institutions are applying for spot Ethereum ETF. Ark was the first to file for a spot Ethereum ETF in September 2023, followed by BlackRock and others.

The SEC’s decision on a spot Ethereum ETF has been delayed multiple times, similar to the numerous delays in approving a spot Bitcoin ETF.

While the seven Ethereum ETF applicants have different deadlines, the SEC may also make decisions on all applications at the same time, as it did with the spot Bitcoin ETF.

p>

Spot Ethereum ETF expiration date. Source: Bloomberg

As the deadline looms, ETF experts and the cryptocurrency community are unsure whether the U.S. Securities and Exchange Commission (SEC) will Opinions on approving spot Ethereum ETF are divided.

On the one hand, Bloomberg ETF analyst James Seyffart believes that U.S. securities regulators have regarded Ether as a commodity when approving the Ethereum futures ETF. Therefore, it is only a matter of time before the SEC finally approves the Ether ETF. Eric Balchunas, a senior analyst at Bloomberg, said that the chance of spot Ether ETF being approved before May is as high as 70%.

On the other hand, Mark Yusko, CEO of Morgan Creek Capital, believes that the possibility of spot Ether ETF receiving US approval in 2024 is less than 50%. Yusko believes that the SEC remains generally hostile to cryptocurrencies, as the agency’s chairman, Gary Gensler, hinted in a message released on the day of the product’s approval. He added that the SEC may still consider Ether a security, unlike Bitcoin which is considered a commodity. Gensler has often argued that all cryptocurrencies except Bitcoin are securities. However, Bloomberg analyst James Seyffart believes that “the SEC has effectively tacitly regarded Ethereum as a commodity.” Rika Khurdayan, chief legal officer of Bitstamp US, told Cointelegraph, She believes the U.S. Securities and Exchange Commission (SEC) will approve a spot Ethereum ETF, but the approval process may be longer than Bitcoin:

"However, since the SEC requires Considering the unique characteristics of Ethereum compared to Bitcoin, including its underlying technology, functionality, and its complex creation history and environment, the approval process may be lengthy. I think the SEC may also want to observe the Bitcoin ETF market before approving Another cryptocurrency ETF."

Ethereum spot ETF seems feasible, but problems remain

Ethereum has maintained the second place in the cryptocurrency market capitalization ranking for many years, and the US market has allowed Ethereum futures trading.

However, experts point out that the Ethereum blockchain and its functionality are significantly different from Bitcoin, which could complicate the regulatory approval process.

Unlike Bitcoin, Ethereum does not have a fixed total amount and supports a mining mechanism. Coin holders can pledge Ethereum to earn income.

Cathy Yoon, general counsel of Web3 development company Wormhole Foundation, told Cointelegraph that she believes the U.S. Securities and Exchange Commission (SEC) will eventually approve an ETH ETF, but staking issues remain Up in the air:

"Whether traditional players will be willing to adopt staking, especially if using staking-as-a-service providers, many of which have been stepped up by the SEC Censorship, or for those who self-custody, whether they will do the staking themselves is an open question."

Launch of Spot Bitcoin ETF Indicating that traditional financial markets have strong interest in cryptocurrency securities, as these products quickly gained billions of dollars in daily trading volume, 11 spot Bitcoin ETFs created more on January 16 than they have launched in all of 2023. The combined total of 500 ETFs has three times more daily trading volume. But it remains to be seen whether the Ethereum ETF will replicate the same trend.

p>

Despite the current challenges from the U.S. Securities and Exchange Commission (SEC), the following factors lead people to believe that the spot Ethereum ETF is expected to be approved in 2024:

Parallel listing and regulation of Bitcoin and Ethereum futures: Over the past year, both futures products have Attracting a large number of large traders to participate, making them comparable assets in the eyes of the SEC.

Expectations of continued market strength and growing demand from institutional investors have put additional pressure on regulatory approvals.

BlackRock’s ETF record compared to Garry Gensler

< p style="text-align: left;">BlackRock played a key role in getting the spot Bitcoin ETF approved. The U.S. Securities and Exchange Commission (SEC) has rejected multiple spot Bitcoin ETF proposals ahead of 2023. However, the crypto community has gained confidence in potential approval after BlackRock entered the Bitcoin ETF market with a record of 575 successful approvals and only 1 rejection.

As the deadline for a final decision on the spot Ethereum ETF approaches (in May), many are wondering whether BlackRock can maintain its record.

Bitfinex head of derivatives Jag Kooner told Cointelegraph that the entry of a large financial firm like BlackRock into the Bitcoin ETF market is seen as a positive sign of crypto ETFs gaining general acceptance signal, but he also warned of possible early resistance from regulators:

"Institutional interest tends to lead regulators to have a positive view of the market; however, Grayscale Both its application to convert its Ethereum Trust into an ETF, as well as BlackRock's application, have faced resistance from the SEC. The main factor may be the classification of Ethereum as a security or a commodity."

One of the potential obstacles to Ethereum getting a spot ETF could be Gensler’s view on the cryptocurrency market. Gensler has reiterated multiple times that he considers all cryptocurrencies except Bitcoin to be securities.

Bakkt’s general counsel Marc D’Annunzio told Cointelegraph that Gensler’s regulatory stance on cryptocurrencies could be a roadblock for other crypto ETFs to be approved.

He said: "Gensler is careful to note that the recently approved spot Bitcoin ETF is limited to 'a non-security commodity' (i.e. Bitcoin). In addition, Gensler has also stated multiple times that he believes most cryptocurrency tokens are securities, and it seems unlikely that a spot ETF will be approved until the committee's view on Ethereum is clear."

D'Annunzio added that if an Ethereum spot ETF is approved, it "will require clear guidance from regulators and could benefit from the actual operating results of a spot Bitcoin ETF."

JinseFinance

JinseFinance

JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance Brian

Brian Huang Bo

Huang Bo JinseFinance

JinseFinance Huang Bo

Huang Bo Beincrypto

Beincrypto Bitcoinist

Bitcoinist Cointelegraph

Cointelegraph