Author: Revc

AAVE in recovery

According to data compiled by Golden Finance, among the DeFi protocols with a circulating market value of more than 2 billion US dollars, AAVE has recorded an increase of nearly 30% in 7 days, performing well in the recent volatile market. The author summarizes the following reasons for recovery:

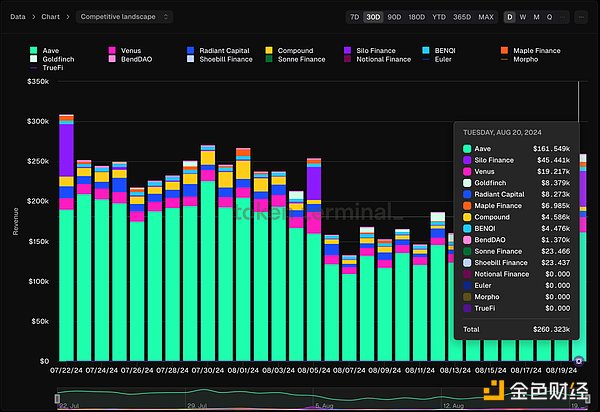

1. Market leadership: Aave is the largest lending agreement, with active loan amounts far exceeding those of its competitors. The market The share is solid. In7the volatile market at the end of the month, Aave not only withstood the impact of extreme market conditions strong>,The market share exceeded90% in a single day.

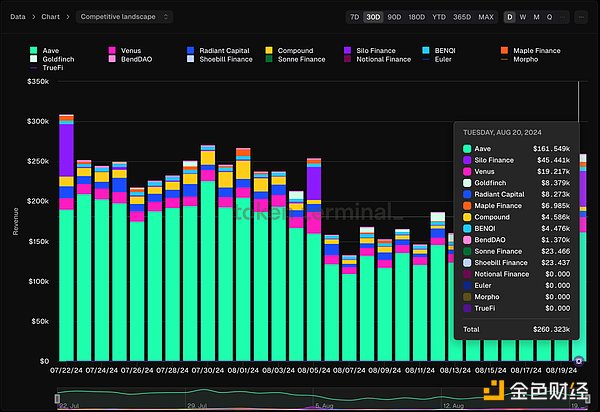

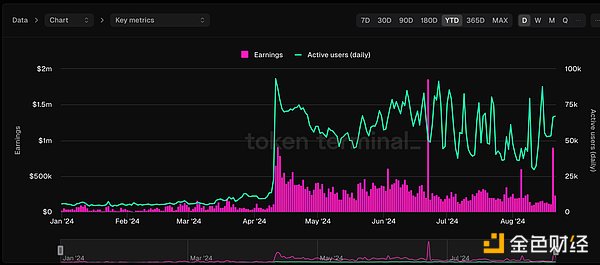

2. Strong growth data: Despite market fluctuations, Aave revenue and TVL still rebounded after the bear market, showing significant growth potential. Over the past30 days ,average income has accounted for the lending market’s income. strong>55%.

3. Security and governance advantages:Aave has excellent performance in security management, lending and borrowing bilateral network effects, and DAO governance.

4. Multi-chain deployment and token economics improvements: Aave has further improved its performance through multi-chain expansion and token economics upgrades. competitiveness in the market.

Aave Chan (the main representative of Aave DAO) has proposed a proposal to enhance the utility of AAVE’s token by overhauling its token economics sex. Key changes include eliminating the risk of AAVE being slashed when mobilizing security modules, replacing existing assets with the new Umbrella security module, optimizing the alignment of interests between pledgers and borrowers, and introducing anti-GHO tokens to enhance the revenue sharing mechanism . This move will increase demand for the AAVE token and further drive the protocol’s long-term growth and value accumulation.

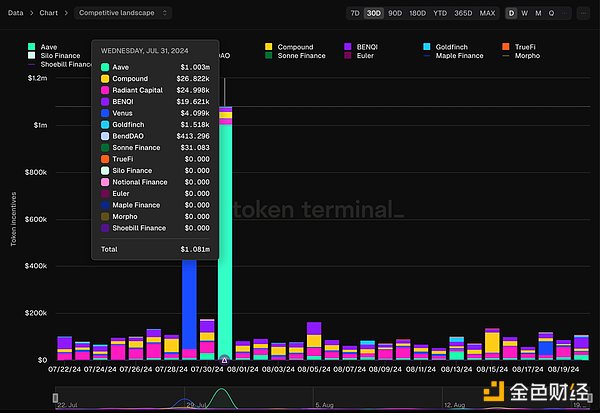

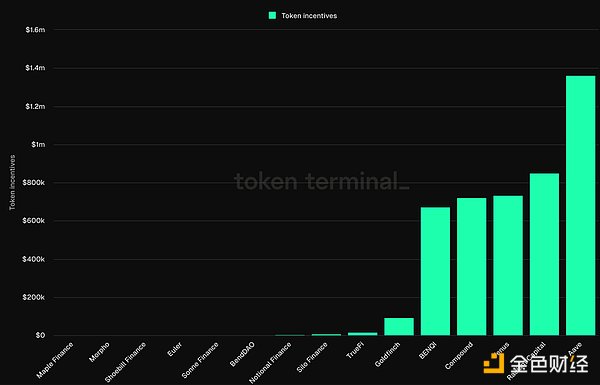

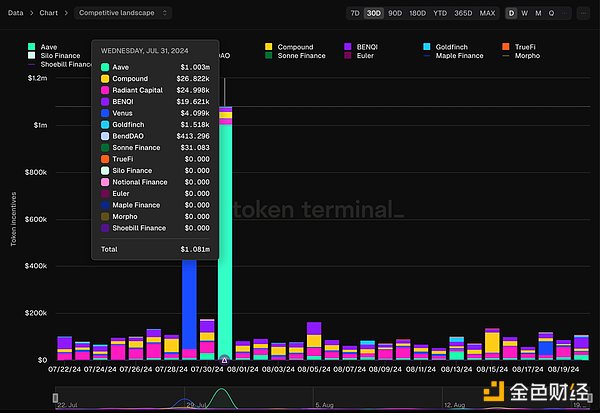

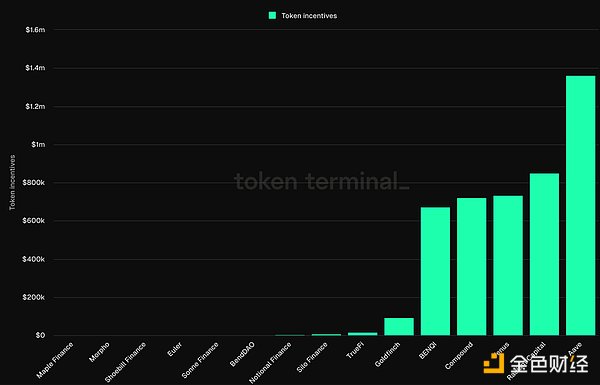

In additionAccording to data from Token Terminal, the Aave protocol also provides investors with a large number of incentives, solidifying its status as the number one Status of Lending Agreement.

Does the strong recovery of Aave indicate that the DeFi sector will explode

Recently, despite the poor price performance of the tokens of the DeFi protocol, But it has shown resilience amid market volatility. Token prices, total value locked (TVL), and loan volumes declined, reflecting the impact of weak demand, oversupply, and the wave of unblockings. However, leading projects such as AaveandEigenLayer have demonstrated strong profitability and market share, indicating that DeFi still has growth potential. As institutional investment increases and regulations become clearer, DeFi may become a major investment area in the future. And the current lock-up volume of the entire DeFi has recovered to 60% of the peak in 2021. Liquidity staking,re-pledge and lending, major DeFi protocols TVL, have experienced varying degrees in the past 7 days The recoverys.

By comparing Aave, we can sort out the conditions for the explosion of several DeFi protocols. First of all, there must be stable fundamentals, andlong-term possession Market leadership,Secondly requires stable revenue and token economics upgrades,to keep the protocol viable .

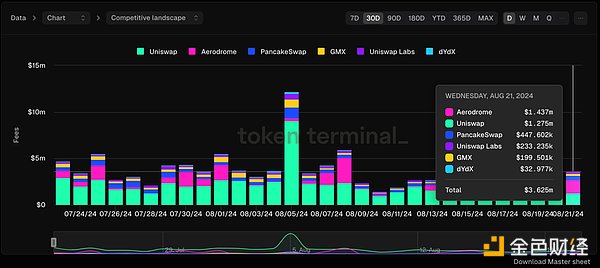

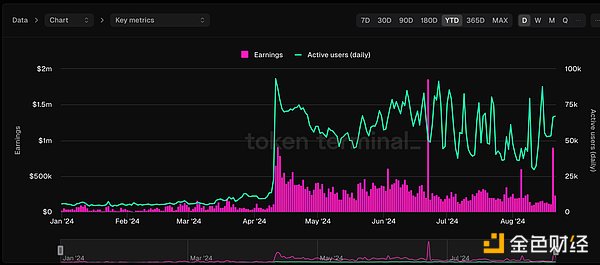

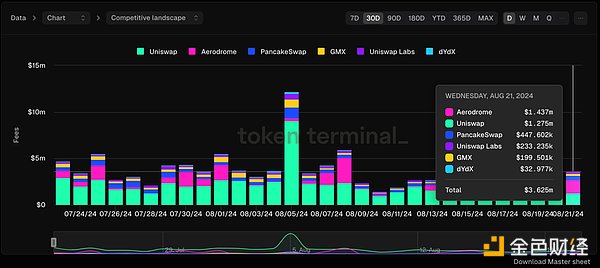

Take Uniswap as an example , its profits have been substantial since March Growth,And the number of daily active users is affected by changes in market popularity,in3 Fluctuating between 10,000 and 1010,000 ( Figure below strong>1),But Uniswap’s dominance is challenged by Aerodrome(Figure below2).

Uniswap has not been selling tokens recently A major economic update, but at the product level, it is planned to launch the V4 version update later this year. Uniswap V4 introduces the "hooks" and "singleton" architecture to make the liquidity pool more customized and efficient. Advantages include:

l hooks: Allow developers to insert custom logic at key points in the pool life cycle, supporting new features such as dynamic fees and limit orders.

l singleton: By merging all pools into one contract, gas fees are significantly reduced, and it is expected to reduce pool creation costs by 99%.

V4 will promote more flexible AMM innovation, improve the efficiency of on-chain transactions, and further consolidate Uniswap’s leading position in DeFi,However, UNI may not have the conditions to explode in the short term,It still relies on the development of the Ethereum ecosystem< strong>,Especially the performance of assets such as ETH,while ETH is affected by macro financial markets.

Let’s look at Lido, the leader in the liquidity staking track. Its performance is closely related to Ethereum. Lido allows users to pledge without locking assets. ETH, and receive stETH as a liquidity token. Its key features include ensuring network security and stability through a decentralized network of node operators, but its excessive market share has sparked controversy over centralization. Although Lido performs well in terms of technology and security, more node operators need to be introduced in the future to reduce centralization risks. Lido also faces competition from other staking services, especially the challenge of staking on centralized exchanges.

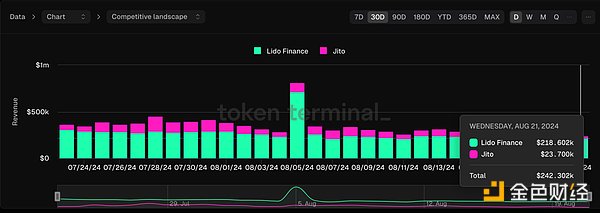

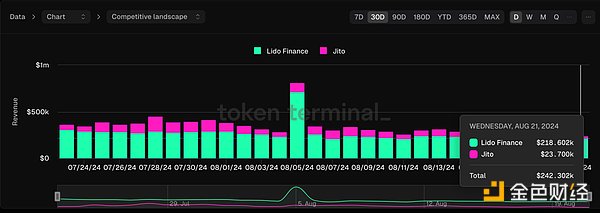

The latest data shows that Lido currently occupies nearly 70% of the liquidity staking market (Figure 1 below). In terms of revenue, Lido occupies nearly 80% of the market share. In terms of track revenue (Figure 2 below), Lido relies on its first-mover advantage to maintain its leading position. However, due to its high correlation with ETH, the currency price still fell back by 31.2% compared with the same period last year. The overall performance of DeFi is highly bound to ETH.

Lido protocol income< strong>(Figure 1 below)Affected by high degree of homogeneous competition,Remaining at a low level for a long time, Lido and the entire liquid staking track have not shown explosive potential in the short term.

Summary

In summary, DeFi from the beginning It can be seen from the agreement that the DEX and liquidity staking tracks are relatively mature and have no possibility of breaking out in the short term. However, similar to AAVE’s decentralized governance and token economics upgrade in the lending track,may be more favored and favored by investors.

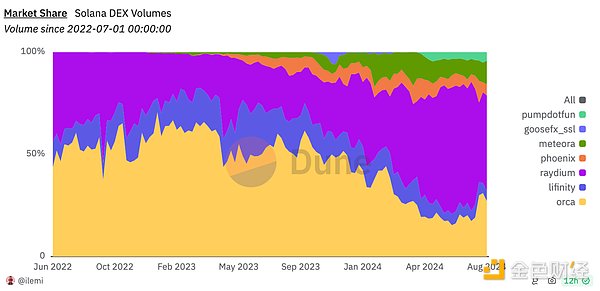

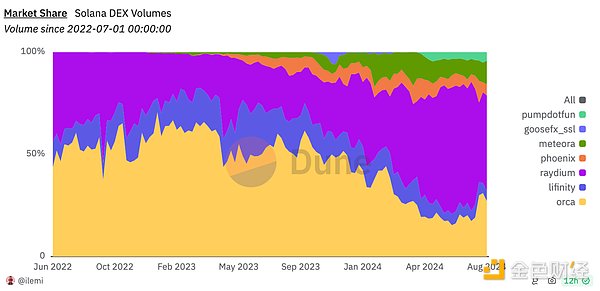

In addition to the innovation and upgrade of the protocol itself, the explosion of the DeFi track also requires a good macro-financial environment to give Ethereum room to perform well. More importantly, DeFi protocols must strengthen their integration with asset issuance such as MEME. Whether it is Solana or the recent rise of Tron, on-chain liquidity has become abundant due to the explosion of MEME users. The figure below shows that Raydium benefits from PumpFun. Consolidated and strengthened market share.

JinseFinance

JinseFinance