Author: Zoltan Vardai, CoinTelegraph; Compiler: Deng Tong, Golden Finance

The latest interest rate decision of the Bank of England may bring more upward momentum to the price of Bitcoin.

On August 1, the Bank of England announced that it would cut interest rates by 0.25% to the current 5%, ending one of the longest interest rate hike cycles in history.

The Bank of England cuts interest rates. Source: Bank of England

Bitcoin prices could benefit from the unexpected rate cut as economists are divided on whether the central bank will cut or keep rates unchanged.

Historically, easy monetary policy has boosted risk assets such as Bitcoin and gold, but Bitcoin prices have remained range-bound despite the rate cut.

Bitcoin Price Remains Below $65,000 Due to U.S. Monetary Policy

Despite the first interest rate cut in the United Kingdom in four years, Bitcoin prices remain below the $65,000 mark.

As of 11:20 a.m. UTC on Aug. 1, Bitcoin fell 2.4% in 24 hours to trade at $64,507, according to CoinMarketCap, while trading largely flat over the past week.

BTC/USD, one-month chart. Source: CoinMarketCap

The subdued price action can likely be attributed to the Federal Reserve’s decision to keep its key lending rate unchanged in August.

However, Bitfinex analysts noted that Bitcoin prices could see significant new liquidity and upward momentum following the September rate cut in the United States:

“The September rate cut will generate optimism and could generally increase market liquidity, which is positive for Bitcoin and other cryptocurrencies as investors seek higher returns outside of traditional assets. This could lead to upward pressure on Bitcoin prices and increased ETF inflows as investors look to take advantage of a more favorable environment for risk assets.”

Slowing Bitcoin ETF Inflows Put Pressure on BTC Prices

Slowing inflows into U.S. spot Bitcoin exchange-traded funds (ETFs) could also be behind Bitcoin’s lackluster price action.

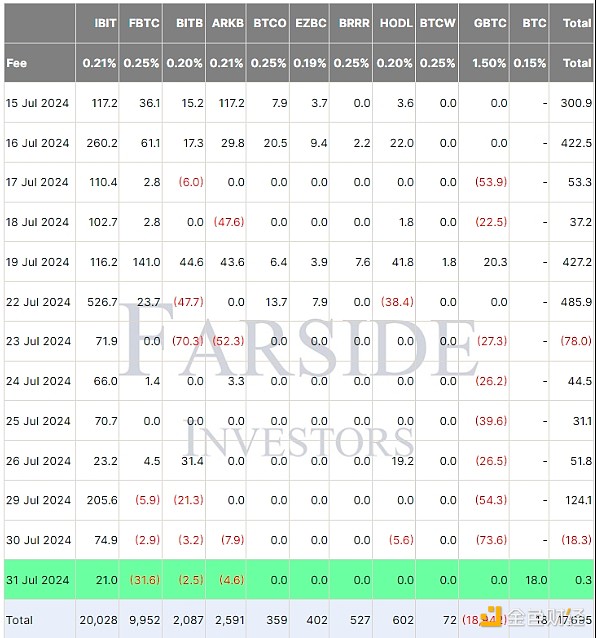

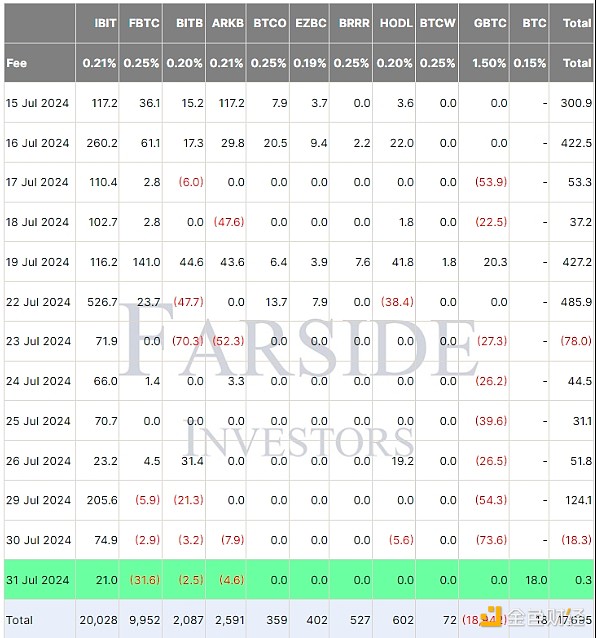

According to Farside Investors, U.S. ETFs accumulated only $300,000 worth of Bitcoin on July 31, while on July 30, they had a cumulative net outflow of more than $18.3 million.

Bitcoin ETF flow chart (million USD). Source: Farside Investors

ETF inflows can significantly contribute to the price appreciation of cryptocurrencies. In the case of Bitcoin, ETFs accounted for about 75% of new investment in the world's largest cryptocurrency as of Feb. 15, when the price of Bitcoin surpassed the $50,000 mark.

JinseFinance

JinseFinance