Original: Liu Jiaolian

Today, BTC tried to hit 64k, once stood on it, and was shot down again. Mt.Gox's compensation is about to start. The market is still uneasy about the potential selling pressure. Jiaolian has written many internal references about Mt.Gox in the past six months, and has also made some quantitative calculations. The estimated selling volume at that time was about 50,000, which is actually similar to the amount that the German government cleared not long ago.

Yesterday, it was mentioned that the selling of long-term holders seems to be ending, which is definitely a very favorable factor for the market to rise.

There is a foreign person named Justin Bons who posted a long series of posts a few days ago. His views were sensational and caused a lot of commotion and concern. People from all walks of life came on stage and took the opportunity to criticize BTC. In fact, if you look at Bons' long post, you will know that he is promoting the not-so-new argument that BTC will soon become unsafe, in order to include his last few "private opinions":

First, he believes that BTC cannot ultimately maintain the 21 million upper limit, but should introduce eternal inflation to ensure that BTC is continuously over-issued to pay miners. (Similar to the economic model of PoS?)

Second, he advocates that BTC should adopt large block expansion like BCH to increase throughput and return to the original intention of BTC as a payment tool (Hey, why is this such a familiar tune? BSV, and package more transactions to pay miners.

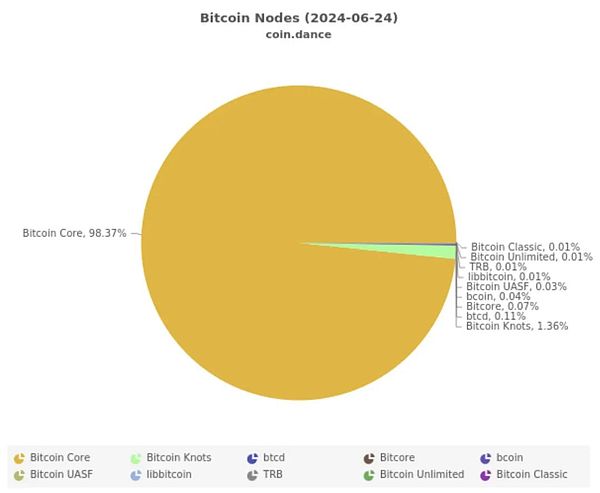

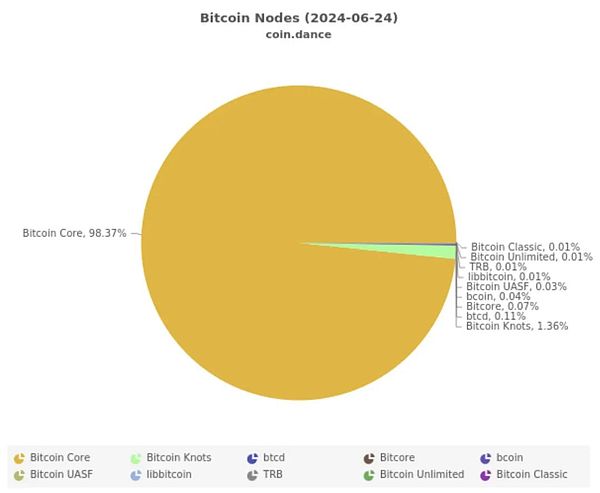

Third, he criticized the current BTC client market share of more than 98%, which is a monopoly position. More diverse clients should be developed and popularized to avoid the power to modify core rules being monopolized by the Bitcoin Core development team.

Even if you can’t tell whether his argument about the imminent failure and collapse of the BTC security model is correct, when you see that he is using the “doomsday prophecy” of BTC’s failure to return to zero to “carry private goods” and promote his three “world salvation ideas” mentioned above, you should be able to smell some ill intentions.

His high-sounding theory is essentially in line with the “death spiral theory” and is essentially nothing new: BTC production is halved, causing a sharp drop in miners’ income; miners’ income decreases, forcing them to shut down mining machines; mining machines shut down, computing power decreases; computing power decreases, security decreases; security decreases, BTC value decreases; value decreases, prices collapse; price collapses, miners’ income further decreases… So miners further shut down more mining machines and computing power… This is a death spiral that slides all the way to zero.

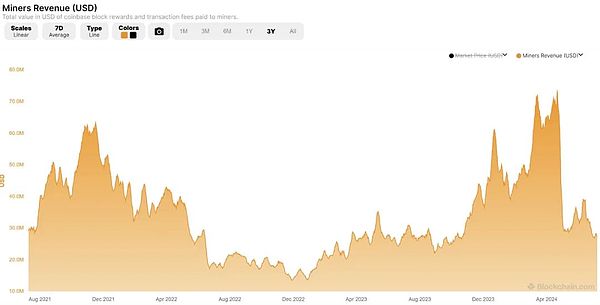

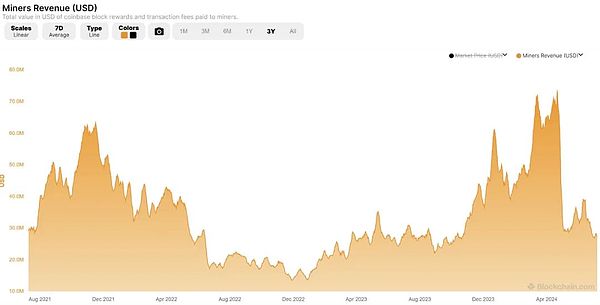

Of course, compared to the classic death spiral theory, Bons's "security collapse theory" has made a little "innovation": he denied the role of hash power in the death spiral, but instead said that the level of hash power is not important, what is important is the income of miners, and he is talking about the miners' US dollar income. —— We know this because he quoted this chart:

He used this chart to illustrate that miners' dollar income has decreased, so BTC has become no longer safe. He further predicted that in the next 4-12 years, BTC's security will completely collapse and BTC will return to zero.

But why did he make the above "innovation"? He himself said that the cost of attacking BTC is the determining factor of BTC's security, not the hash power. He said that with the advancement of technology, hash power can be increased without increasing costs, but BTC's security has not increased synchronously.

However, think about it carefully, isn't it because BTC's computing power continues to hit historical highs that the classical death spiral theory has been unable to fulfill its predictions, so that this argument is about to go bankrupt in people's minds?

In this case, Bons stepped forward and proposed a revised theory of the death spiral theory—— The security collapse theory attempts to prove that BTC has or will soon fall into a security death spiral by avoiding the fact that BTC computing power continues to grow, and will eventually return to zero in full view of the public because it is difficult to implement the three salvation suggestions he gave.

However, although he used the strategy of criticizing Michael Saylor, the boss of MicroStrategy, a large coin hoarder, for not understanding the security of PoW to try to consolidate his theory that BTC security is not linked to hash computing power but to miners' income, he is still making circular arguments.

The logical loophole is too obvious: even if miners only spend extremely low costs to run a huge amount of hash computing power, as long as it is difficult for other systems outside the BTC system to get a hash computing power that matches it, it is difficult to attack the BTC system. This is the iron wall forged by the relative advantage of hash computing power.

The absolute value of hash computing power, or the absolute value of the cost of producing hash computing power as he said, is actually not important. What is important is the comparative advantage between the efficiency of the BTC system in producing hash computing power and the efficiency of other systems in producing hash computing power outside the BTC system. What is important is the production relationship, not the productivity.

In this comparative advantage of production relations, what is compared is of course hash power (hash rate), not production cost, let alone miner income.

It is better rather than worse to use lower production costs to produce products with greater competitive advantages, namely hash power. It is like saying that it costs 50,000 yuan for others to make a car, and you only need 10,000 yuan to make a car of the same level. This is obviously an advantage rather than a disadvantage. This is an extremely simple economic common sense, but he mystified it and then turned it upside down.

If miners can produce the same or even higher hash power at a lower cost due to the improvement of production process (technology), then miners can demand lower income for this. Just like the analogy above, if others make a car at a cost of 50,000 yuan and sell it for 200,000 yuan, you only need to sell it for 50,000 yuan if you make it at 10,000 yuan. Obviously, you will gain a greater market competitiveness advantage.

Therefore, BTC miners require lower income and provide higher hash power, which is essentially similar to the example of cars, selling the same or even better goods at a lower price. This of course greatly improves BTC's market competitiveness, rather than making BTC worse.

If technology continues to advance and productivity continues to increase, miners can ask the market to pay lower security fees, and they can provide higher security, just like better bodyguards cost less, which will only make BTC better, and only require fewer blocks and less transaction fees to meet the income requirements of miners.

In essence, block issuance is a fee shared by all BTC investors, and transaction fees are the total fees paid by all BTC users. These two items together constitute the total income of BTC miners. The total income of miners determines the upper limit of the cost that miners can continue to operate in the long term.

Less fees and higher security. This is the bright future of BTC.

XingChi

XingChi