By Olga Kharif and Muyao Shen, Bloomberg; Translated by Deng Tong, Golden Finance

When it comes to complying with the law, “it’s better to ask for leniency than to get permission,” the billionaire founder of the Binance cryptocurrency exchange once told his team, according to the U.S. government.

It’s time for Zhao Changpeng to ask for leniency, but prosecutors are in no mood to grant it. In a court filing ahead of Tuesday’s sentencing hearing, they cited the flippant attitude he displayed in that and other remarks as one of the reasons they recommended the court sentence him to three years in prison, longer than guidelines provide, if he is found guilty. He pleaded guilty in November to violating anti-money laundering laws.

If a Seattle judge agrees with prosecutors and orders him jailed, Zhao Changpeng will go down in history as the richest person ever to serve time in a U.S. federal prison, as his ownership of Binance and the estimated $43 billion in personal wealth associated with it remain intact. His wealth could become even more as Binance’s business accelerates amid cryptocurrency’s latest bull run. Although Zhao Changpeng gave up his CEO title as part of his agreement with the government, his lingering influence on the company cannot be ignored: The new board is dominated by his loyal friends, while the mother of his three children plays a major role in its operations.

Needless to say, the arrangement with the Justice Department did not satisfy some critics of the cryptocurrency market.

Zhao Changpeng leaves the Seattle federal court on Nov. 21 after pleading guilty in a deal with the U.S. government. Photograph: Chloe Collyer/Bloomberg

“The Justice Department should prosecute dozens of people associated with Binance and not only prosecute and punish them, but also ban them from the financial industry forever,” said Dennis Kelleher, president and CEO of advocacy group Better Markets Inc. He won’t punish others, and he deserves the strongest sanctions possible.”

Changpeng Zhao also agreed to pay a $50 million personal fine. Binance itself agreed to a $4.3 billion fine to settle a case involving a stunning array of allegations related to violations of anti-money laundering and sanctions laws, including the U.S. Treasury Department’s claim that the exchange failed to prevent and report suspicious transactions from Hamas, al-Qaeda and other groups designated by the United States as terrorist organizations. In asking for a three-year prison sentence, U.S. Attorney Tessa M. Gorman and her fellow prosecutors cited the “enormous” consequences of Zhao’s misconduct and what she called “significant harm to U.S. national security.”

Yet despite the severity of the charges and the guilty pleas by Binance and its former leader, the company built by Zhao Changpeng is thriving and its status as the foremost cryptocurrency exchange has withstood the test. The business, which earns fees from customer trades, is often a money-printing machine during cryptocurrency booms like this one, with Bitcoin hitting a record high last month as investors flocked back into the market following the launch of the U.S. exchange.

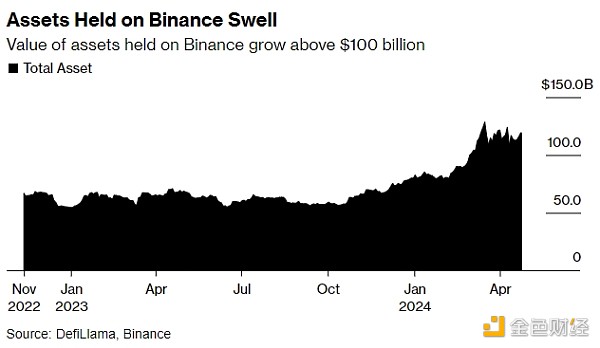

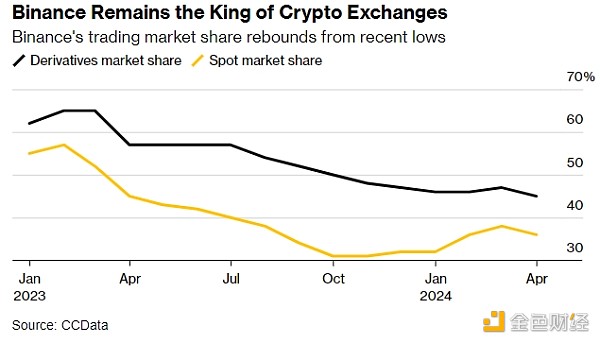

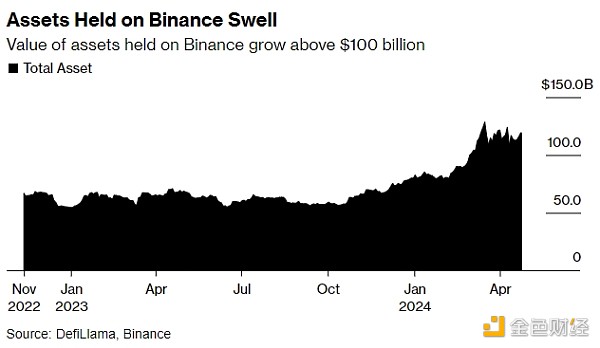

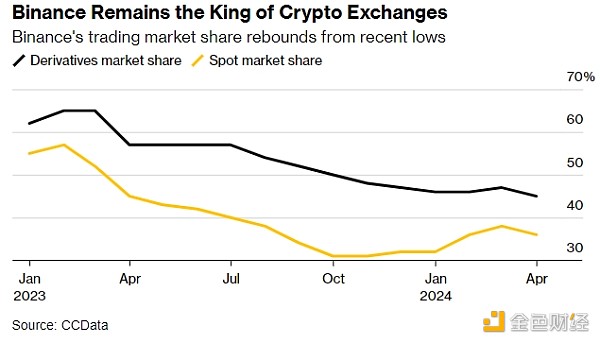

Despite its decline in dominance, Binance retains its market share lead in spot and derivatives cryptocurrency markets. The company said it added more than 40 million new users in 2023, up 30% from the previous year. Customers’ holdings on the exchange have grown to more than $100 billion. The company’s annualized revenue could reach $9.8 billion in the 12 months ending in March, according to Bloomberg estimates.

“It’s actually things like ETFs that are helping drive the activity,” Andy Goldin, Binance’s global head of data and analytics, said in a March interview. “It’s really more institutional trading activity that’s driving the trend right now.”

Binance has held out in large part because traders view the company and Zhao very differently than its one-time nemesis FTX, which went bankrupt after founder Sam Bankman-Fried illegally misappropriated billions of dollars worth of user cryptocurrency. Following his conviction, SBF was sentenced to 25 years in prison, and his net worth is currently estimated at $0. Of the crimes the DOJ has accused Binance of, deceiving customers about the use of their funds was not one of them.

The different outcomes for SBF and CZ reflect the two men’s very different operating styles. After his crypto empire collapsed, SBF embarked on a tumultuous effort to talk and tweet his way out of trouble, and even failed attempts to testify in his own defense at trial. CZ, on the other hand, pleaded guilty, cooperated with the government, and remained tight-lipped. Even their signature hairstyles offer a symbolic contrast: SBF is known for his long, unruly curls, while CZ sports a shoulder-length bob that looks like it would be at home in boot camp.

Most importantly, Unlike FTX, Binance is well-positioned to handle the impulses of hot-money crypto traders who tend to pull funds from exchanges at any sign of trouble, such as the Terra UST stablecoin collapse and the bankruptcy of Three Arrows 2022 Capital hedge fund, not to mention Binance’s own legal entanglements last year.

“Binance is the largest exchange that has survived the failures of FTX, 3AC, Terraform Labs and others,” said Austin Campbell, an adjunct professor at Columbia Business School and an advisor to blockchain companies. “The U.S. government action was seen as a huge overhang, and because they were able to survive, it gives people confidence in them.”

How much has changed inside Binance since the plea deal to expel Zhao Changpeng is the topic of much conversation in the crypto world.

The most obvious change is that Zhao has given up his role as the company’s public face. While he’s never been one to mingle with celebrities or invite journalists into his home, as FTX’s SBF did at his luxurious Bahamas penthouse, Zhao has become so low-profile since his guilty plea that he’s almost invisible. Gone are the days when he would push his ideas in interviews on financial news TV, podcasts and conference panels, or confuse foes and fans on social media.

Filling in much of the blanks is He Yi, a mother of three and one of the co-founders of Binance.

Binance co-founder He Yi in Dubai last May. Photographer: Natalie Naccache/Bloomberg

“People are worried that once CZ is no longer at the helm, there will be chaos,” said Annabelle Huang, managing partner of Amber Group, a cryptocurrency investment firm that trades on Binance.

While Richard Teng, formerly chief regulator of Abu Dhabi Global Market, is post-CZ CEO and public face of Binance, Zhao’s partners remain a significant force at the company.

He Yi said on social media that Binance’s efforts to tackle the notorious “Wild West” crypto culture remain a work in progress. She decried so-called “rat trading,” or buying and selling designed to manipulate the market or for corrupt motives, such as giving advance notice of a new token listed on an exchange that could change its price. She threatened to blacklist any employees involved in shady dealings: “If we prove that a Binance team member is corrupt, we will keep your identity confidential and reward you with a security bug bounty of $10,000 to $5 million.”

Binance CEO Richard Teng at the Gulf Binance Digital Asset Forum in Bangkok on March 19. Photo by Sirachai Arunrugstichai/Bloomberg

He Yi and Teng shared a conversation during a nearly two-hour “Ask Me Anything” session at X in December. She described the two’s division of labor at the company: She focuses on the needs of users, while Teng acts as the public face interacting with global regulators. “The best place for me is to serve customers,” and “Teng is more suited to the CEO role.” So what about Zhao Changpeng himself? “CZ just stepped down, he’s not going to hell,” He Yi said with a smile during the X discussion. Spiritually, he’s “still with us, don’t worry,” she said, as she spoke. Here’s a look at some of the things Zhao Changpeng has been doing while awaiting sentencing: Going skiing. While awaiting sentencing, Zhao’s base camp has been in Los Angeles, with his sister, but he’s been allowed to roam the U.S., where his two college-age children live, according to a court filing. The court banned him from leaving the country, even after he requested to visit an unidentified relative who was undergoing surgery in Abu Dhabi, where his partner He Yi and their three children also live.

Changpeng Zhao also has some friendly faces on Binance’s board, including trusted lieutenants who worked for the company for years while it violated U.S. law.

Heina Chen, a co-founder and board member, was one of more than 160 people who wrote glowing letters of recommendation to the court on Zhao’s behalf, trying to persuade it to give him a lighter sentence. She said, "CZ is the spiritual leader of Binance. He is also, without a doubt, my cautious leader and guide." Board member Rock He, who has been with Binance since its founding in 2017, gushed that Changpeng Zhao is like a brother to him: "This connection is what I am most proud of in my life and it is a gift from heaven." Wang Xin, a former White & Case attorney listed by Binance as an independent board member, told the court that Changpeng Zhao helped take care of her after she lost her mother, as part of what she called "a tradition of quiet friendship that has lasted for decades." Representatives for Binance did not respond to requests for comment on whether Zhao continues to discuss the company with current employees and board members.

It’s time for Zhao’s friends to take care of the company he created, a large company with thousands of employees scattered around the world but still without a physical headquarters. U.S. regulators (likely large law firms or consultants) will be assigned to closely monitor Binance’s compliance with the U.S. plea agreement for five years to ensure that it takes appropriate measures to comply with anti-money laundering and sanctions laws. Ultimately, the monitors’ report will answer the question of how much Binance has been able to change its ways.

The legal entanglements don’t end there, however. Last June, the U.S. Securities and Exchange Commission (SEC) filed a lawsuit against Binance and its sister company Binance.US, accusing them of operating an unregistered exchange, broker-dealer and clearing house, among other charges. Many believe the case will drag on for years as Binance fights the charges. Meanwhile, in Nigeria, a Binance executive has been in jail since late February for tax evasion and fraud; But he pleaded not guilty.

Many traders who use Binance haven’t seen much change at the exchange — and for many, that’s a good thing. They say they’re still talking to the same mid-level to junior staff and that their trading experience hasn’t changed.

“It makes no difference to us,” said investor Alistair Milne. “If anything, there’s more certainty now because of the settlement, so that’s good news.”

Some are more cautious, especially in the post-FTX environment.

“I’m not losing sleep over the idea that Binance is going away, but I need to make sure I’m not taking on all the risk,” said Tim Grant, CEO of Deus X Capital. Deus X Capital manages more than $1 billion.

When it comes to Zhao Changpeng’s own risks, it will be up to federal judge Richard Jones to decide whether and for how long he goes to jail.

Zhao Changpeng leaves federal court in Seattle on November 21. Photo: Chloe Collyer/Bloomberg

Sam Mangel, a prison consultant who served his sentence himself, saidIf the billionaire does serve time, it will likely be in a lower-security prison, where he might even see some friendly faces among his fellow inmates.

“He won’t be blackmailed, and he won’t be threatened,” Mangel predicted. “People who are very successful in low-security prisons tend to be respected.”

As for his next steps after being sentenced, Zhao told the court in a February letter that he has been discussing ambitious plans to use blockchain technology with biotech startups “with the goal of curing diseases once and for all and providing healthcare to billions of people in the world.” Another insight into Zhao’s recent thinking comes from a concept paper for Giggle Academy, his global online elementary school project.

“I could try to help fight corruption, world hunger, climate change, etc.,” the concept paper reads. “But I have no expertise in that area.”

JinseFinance

JinseFinance