Ben Strack, Blockworks; Translated by Deng Tong, Golden Finance

The app you use to bet on the Super Bowl won’t offer odds on which cryptocurrency ETFs will be available in 2025.

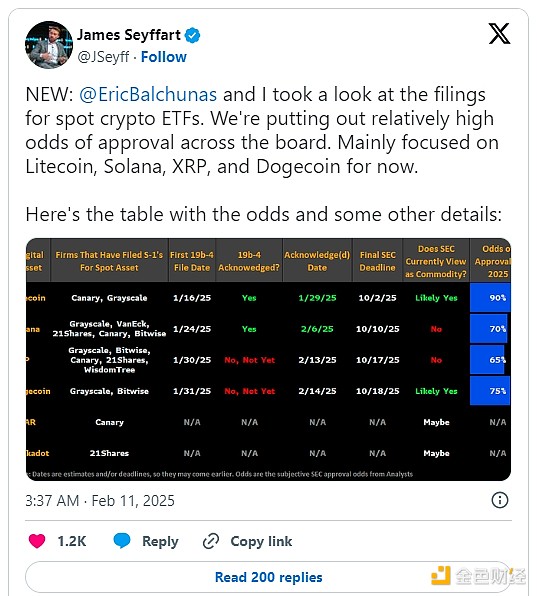

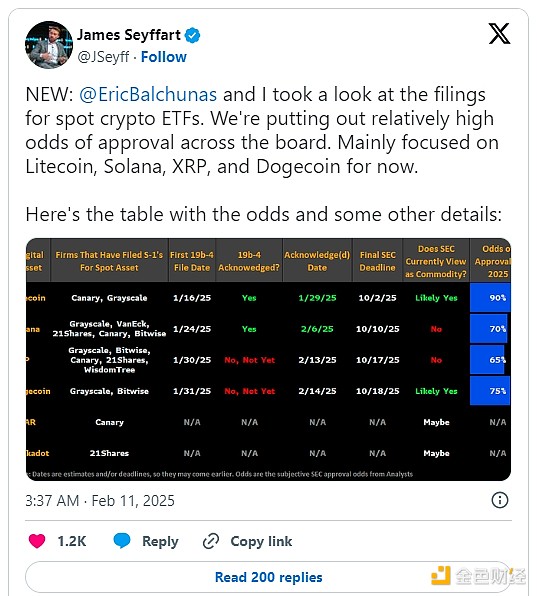

For that, many have looked to Bloomberg Intelligence analysts James Seyffart and Eric Balchunas — the duo that provided a credible voice for X users before the approval of Bitcoin and Ethereum ETFs last year.

A Litecoin ETF is the frontrunner to launch this year — with a 90% chance, they say.

In addition to the LTC product, Seyffart and Balchunas give a 75% chance of a Dogecoin ETF being approved in 2025.

Then the Solana and XRP ETF probabilities drop slightly to 70% and 65%, respectively.

Anyway, some of the Bloomberg folks are also in line with what we’re hearing.

I’ve written about these filings on and off, but let me remind you of the idea here.

The SEC didn’t previously label LTC and DOGE as securities — a good thing if they want to eventually be classified as such an ETF. The agency also admitted Litecoin’s application. That’s another good sign, as we’ve seen (before then) fund managers pull back on products that the SEC wasn’t ready to consider.

Seyffart expects further confirmation this week.

As for the assets that Balchunas and Seyffart see as slightly less likely to enter a U.S. ETF this year, SOL has been deemed a security in several SEC lawsuits. The regulator appealed against Ripple last month.

Ripple Chief Legal Officer Stuart Alderoty said in a January X post that he expects “revisiting arguments that have already failed” will likely be “thrown away by the next administration.”

Even so, Bitwise General Counsel Katherine Dowling warned that the SEC will be in “purgatory” until agency chairman nominee Paul Atkins is confirmed. Court cases don’t disappear overnight — and “nor should they,” she noted.

SEC Commissioner Hester Peirce confirmed last week: “Determining how best to unravel all of these issues, including ongoing litigation, will take time.”

Dowling added that DOGE is not a “dolphin in the net” — an allusion to assets whose securities status is unclear (due to the SEC’s claims).

So why aren’t the odds 100% for LTC and DOGE ETFs? Almost nothing is certain (you know the mantra about death and taxes).

ETF.com’s Sumit Roy told me last month that “the SEC remains cautious about market manipulation and custody risks, which apply to all cryptocurrency ETFs.”

The SEC’s 240-day deadline to rule on the Litecoin proposal expires in early October.

Weatherly

Weatherly