Author: Ryan Yoon, Research Analyst, Tiger Research; Translation: Jinse Finance xiaozou

Despite the lucrative returns of the private equity market, retail investors remain elusive, remaining the exclusive domain of institutional investors and high-net-worth individuals.

Tokenization technology holds the potential to address the inherent limitations of the traditional financial system—particularly illiquidity, high barriers to entry, and cumbersome operations—but significant legal and technical hurdles remain.

Projects such as Ventuals, Zoshi, and FreeStock are exploring different approaches to private equity tokenization. While still in their early stages, these efforts have demonstrated the potential to break down structural market barriers.

1. The Allure of Private Equity—But It Has Nothing to Do with You

How can ordinary people invest in SpaceX or OpenAI? As private companies, they're off-limits to most investors. Retail investors have virtually no access—investment opportunities typically only emerge after an IPO. The core problem is that you're excluded from the outsized returns generated by the private market. Over the past 25 years, the private market has generated roughly three times as much value as the public market. Two structural factors underlie this. First, fundraising is a highly sensitive process for private companies. Deals tend to go only to established institutional investors, regardless of the investor's qualifications. Second, the growth of the private capital market has broadened financing channels. Today, many companies can raise billions of dollars without going public. OpenAI exemplifies both of these trends. In October 2024, it raised $6.6 billion from major investors including Thrive Capital, Microsoft, Nvidia, and SoftBank. By March 2025, it had secured another $40 billion in funding, led by SoftBank and with participation from Microsoft, Coatue, and Altimeter, setting a record for the largest private equity financing round in history. This is a system limited to select institutional investors, while a mature private capital infrastructure provides companies with alternatives to going public. As a result, today's investment landscape exhibits increasing exclusion—exacerbating inequality in access to high-growth opportunities. 2. Equal Participation—Can Tokenization Break Down Structural Barriers? Can tokenization technology truly address the structural inequalities in the private equity market? On the surface, this model is quite attractive: converting real-world assets into digital tokens, enabling fragmented ownership, and supporting 24/7 trading in global markets. But at its core, tokenization simply repackages existing assets, such as pre-IPO equity, into new forms—solutions for improving participation already exist within the traditional financial system. For example, platforms like Ustockplus, a subsidiary of South Korea's Dunamu, and Forge and EquityZen in the United States allow retail investors to participate in unlisted stock trading within existing regulatory frameworks. So, what exactly is the differentiated value of tokenization? The key difference lies in market structure. Traditional platforms use a peer-to-peer (P2P) matching model—buyers must respond to sellers' orders. Without a counterparty, trades cannot be completed. This model suffers from insufficient liquidity, limited price discovery, and uncertain execution times. Tokenization technology has the potential to overcome these structural limitations. If tokenized assets are listed on centralized exchanges (CEXs) or decentralized exchanges (DEXs), liquidity pools or market makers can provide a consistent counterparty, improving trade execution and pricing efficiency. In addition to reducing friction, this approach will reshape market architecture. Tokenization also enables innovative features that are unsupported by the traditional financial system. Smart contracts can automate dividend distribution, execute conditional trades, or implement programmable governance rights. These features enable entirely new types of financial instruments—designed for flexibility and transparency.

3. Pre-IPO Equity Tokenization Project

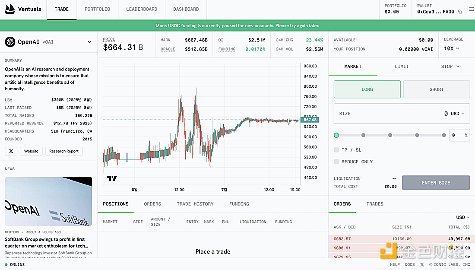

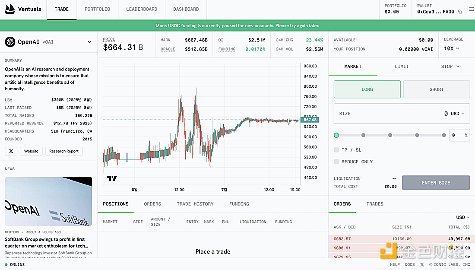

(1) Ventuals

However, this low barrier to entry comes with structural challenges, the most prominent of which is the oracle dependency problem.

The valuation data of non-listed companies is inherently opaque and updated with lags. Derivatives based on such incomplete information may exacerbate market information asymmetry.

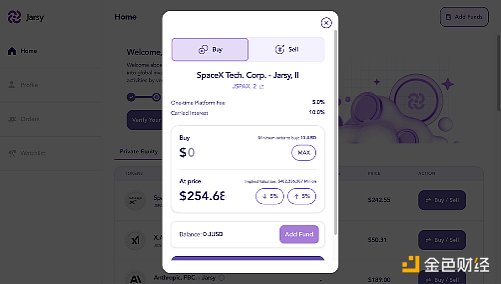

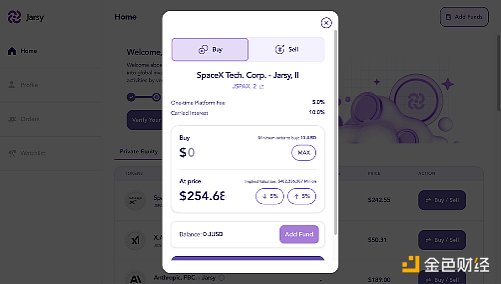

(2) Jarsy

Jarsy adopts a 1:1 asset-backed tokenization model. Its core mechanism is to directly acquire Pre-IPO shares and issue tokens based on a 1:1 shareholding ratio. For example, if Jarsy holds 1,000 SpaceX shares, 1,000 JSPAX tokens will be minted. While investors don't directly own the underlying shares, they enjoy all associated economic benefits—including dividends and price appreciation. This model relies on Jarsy acting as an asset management entity: the platform first measures market demand through a pre-sale of tokens, then pools funds to actually acquire shares. If the acquisition is successful, the pre-sale tokens are converted to the official tokens; if not, a refund is issued. All assets are held by a special purpose vehicle (SPV) and are verifiable in real time through a proof of reserves page. The platform also significantly lowers the investment threshold to just $10. There are no eligibility requirements for non-US investors, significantly enhancing global accessibility. All transaction records and asset holdings are stored on-chain, ensuring auditability and transparency. However, this model faces structural limitations. The most pressing issue is insufficient liquidity, which stems from the limited size of each company's holdings. For example, Jarsy currently holds approximately $350,000 in assets from X.AI, $490,000 from Circle, and $670,000 from SpaceX. In such shallow markets, even small sell orders from large holders can trigger significant price fluctuations. Given the opaque and illiquid nature of private equity, price discovery is already difficult, further amplifying volatility. Furthermore, while asset-backed tokenization offers stability, it sacrifices scalability. Each new token launch requires actual share acquisition—a process involving negotiation, regulatory coordination, and potential procurement delays, which limits the platform's ability to respond to rapidly evolving market trends. It's worth noting that Jarsy has only been online for a little over a year and is still in its early stages. As its user base and assets under management (AUM) grow, liquidity issues may gradually ease. As the platform scales, its broader reach and deeper tokenized equity pool will naturally foster a more stable and efficient market.

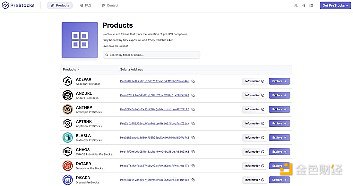

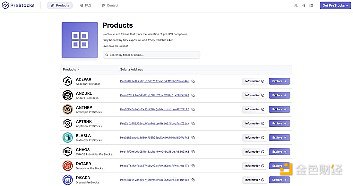

(3)PreStocks

PreStocks adopts a similar operating model to Jarsy, acquiring shares of non-listed companies and issuing tokens with a 1:1 endorsement ratio. The platform currently supports 22 Pre-IPO stocks and will soon open its products to the public. PreStocks, built on the Solana blockchain, integrates with Jupiter and Meteora for trading. It offers 24/7 trading and instant settlement, with no management fees or performance commissions. There's no minimum investment requirement; anyone with a Solana-compatible wallet can participate, significantly lowering the barrier to entry. However, there are certain restrictions: the platform is not available to users in the United States and other major jurisdictions. While the platform claims all tokens are fully collateralized by underlying stocks, detailed verification documentation is not publicly available. The team stated that it will regularly publish third-party audit reports and provide paid single-holding verification services upon demand.

Compared to Jarsy, PreStocks is more closely integrated with decentralized exchanges (DEX), which may give rise to a wider range of secondary application scenarios (such as token staking and lending). In the Solana ecosystem, tokenized public equity (such as xStock) has formed an active use case, and PreStocks may benefit from the synergy effect at the ecosystem level.

(4) Pre-IPO stock tokenization barriers to be broken

The tokenized equity market has taken shape. Although platforms such as Ventuals, Jarsy and PreStocks have shown early development momentum, major structural challenges remain.

The primary obstacle is regulatory uncertainty. Most jurisdictions still lack a clear legal framework for tokenized securities. Consequently, many platforms operate in a regulatory gray area, maintaining operations through jurisdictional arbitrage without requiring direct compliance. Furthermore, resistance from private companies remains a key barrier. In June 2025, Robinhood announced the launch of tokenized exposure services for companies like OpenAI and SpaceX for EU clients. OpenAI immediately issued a public statement opposing the move: "These tokens do not represent OpenAI equity, and we have no partnership with Robinhood." This response highlights the private sector's desire to control equity structures and investor governance—core functions they fiercely guard. Third, the technical and operational complexities cannot be ignored. Maintaining a reliable link between real-world assets and tokens, navigating cross-border compliance, addressing tax implications, and effectively enforcing shareholder rights are all challenging. These issues could severely hinder user experience and scalability. Despite these limitations, market participants are actively seeking solutions. For example, despite public criticism, Robinhood has announced plans to expand its tokenized assets to thousands by the end of the year. Platforms like Ventuals, Jarsy, and PreStocks are also continuously pursuing differentiated approaches to equity tokenization. In short, tokenization offers a viable path to improving access to private equity, but the field is still in its early stages. While current limitations exist, the history of crypto shows that technological breakthroughs and rapid market adaptation can—and often do—redefine the boundaries of what is possible.

Weatherly

Weatherly