Major changes announced and expected to be announced by the U.S. government on trade, immigration and fiscal spending mean that expectations for interest rates could change later this year.

The Federal Reserve on Wednesday (March 19) left interest rates unchanged, while the Summary of Economic Projections showed that two rate cuts this year are possible, the same as the Fed's forecast at its December meeting.

The Fed's wait-and-see stance was enough to provide a boost to Wall Street. The Dow Jones Industrial Average rose 384 points, or 0.9%, on Wednesday, the S&P 500 rose 1.1% and the Nasdaq Composite rose 1.4%.

However, investors should not be complacent about the prediction of two rate cuts, because major changes announced and expected to be announced by the U.S. government on trade, immigration and fiscal spending mean that expectations for interest rates could change later this year.

In other words, the Fed may cut interest rates twice, more than twice, less than twice, or no interest rate cuts.

Federal Reserve Chairman Powell said at a press conference on Wednesday: "Uncertainty is unusually high right now, and we must first see how the situation will develop. As far as I know, no one has much confidence in their forecasts."

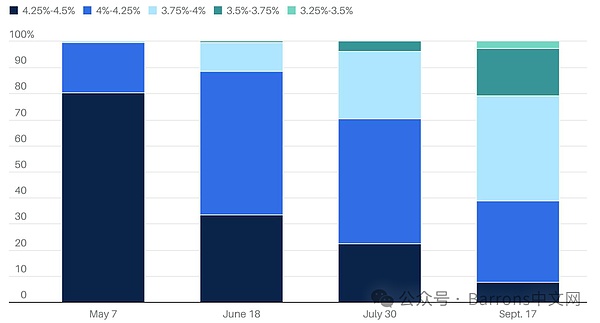

Interest rate futures market forecasts the probability of rate cuts in the next four interest rate meetings

Note: The current federal funds rate target range is 4.25%-4.5%. Data as of 3:25 p.m. EST on March 19.

Source: CME Fed Watch

The Fed expects that US economic growth will slow this year and inflation will rise, that is, the Fed expects the US economy to fall into stagflation this year. The "Summary of Economic Projections" shows that the Fed lowered its initial forecast for US real GDP growth in 2025 to 1.7% from 2.1% in December last year, and expects the unemployment rate to be 4.4% this year, higher than the previous forecast of 4.3%.

The upward revision of inflation expectations for 2025 and 2026 is particularly noteworthy. The Fed currently expects that the PCE price index will increase by 2.7% by the end of this year, higher than the 2.5% expected in December last year. In addition, the Fed expects inflation to fall to the Fed's 2% target only in 2027.

With inflation expectations rising, the Fed may continue to wait and see without cutting interest rates this year, but despite the current stability of the labor market, Powell pointed out that if the number of layoffs increases significantly, it may quickly push up the unemployment rate, prompting the Fed to cut interest rates several times during the rest of the year.

In the press conference that lasted about 60 minutes, Powell mentioned the word "uncertainty" 18 times. Fed officials also pointed out in their official statement after the meeting that "uncertainty about the economic outlook has risen."

One of the reasons for the rising uncertainty in the economic outlook is the possible impact of Trump's tariffs. Powell said: "The Summary of Economic Projections does not show that inflation will fall further, and tariffs are the main reason."

Powell pointed out that tariffs leading to price increases are the Fed's "baseline expectation scenario", but the price increases caused by tariffs will be "temporary phenomena."

Powell said: "If the inflation caused by tariffs disappears quickly without us taking action, then we can not worry too much about inflation. This will depend on whether the inflation caused by tariffs rises very quickly and whether inflation expectations are effectively controlled."

Powell said that even without considering the impact of tariffs, the inflation path of the United States this year is likely to be bumpy. He noted that a sharp rise in goods inflation in the first two months of the year outweighed any material impact from tariffs.

But Powell reiterated his confidence that the Fed’s interest rate policy is well-positioned to respond to changing economic dynamics. He said officials are focused on “hard data” rather than “soft data” such as sentiment and confidence indicators that have fallen sharply in recent months.

“Hard data such as employment and consumer spending remain healthy,” Powell said.

Powell said the Fed was not ignoring the decline in consumer confidence, but the correlation between such data and economic activity has not been strong recently.

Powell also downplayed the significance of a sharp rise in longer-term inflation expectations in the University of Michigan’s consumer sentiment survey, calling it an “outlier.” He noted that inflation expectations measured by other surveys, including one conducted by the Federal Reserve Bank of New York, remain stable.

The Fed's wait-and-see approach to economic activity and inflation means it may take months for Fed officials to get the "clarity" they seek.

Fitch Chief Economist Brian Coulton commented: "The FOMC's sharp downward revision of its economic growth forecast and upward revision of its forecast for core inflation highlight the adverse impact of the sharp increase in US tariffs. Coupled with the recent survey showing that US households' expectations for inflation over the next five years have risen sharply, the Fed's job will become more difficult, which also means that officials will remain on hold for quite some time and postpone the timing of further rate cuts."

RSM Chief Economist Joe Brusuelas pointed out that the Fed's inaction may accelerate the impact of US trade policy. He said: "The Fed's wait-and-see stance will be challenged due to the high uncertainty of the magnitude and scope of the trade shock. The biggest revelation of this interest rate decision for businesses, policymakers and investors is to avoid risks until the magnitude of the trade shock can be determined and the new scale of trade and financial rules are formulated."

Alex

Alex

Alex

Alex Jasper

Jasper YouQuan

YouQuan Jixu

Jixu Kikyo

Kikyo Hui Xin

Hui Xin Alex

Alex Catherine

Catherine Clement

Clement Jasper

Jasper