Author: Christopher Bendiksen, Head of Bitcoin Research, CoinShares Translation: Shan Oppa, Golden Finance

Another halving is coming. At this point, most people know what happened — Bitcoin’s ongoing monetary inflation rate was cut in half. This ratio will remain at the new level of around 0.9% for approximately the next 4 years, when it will be halved again.

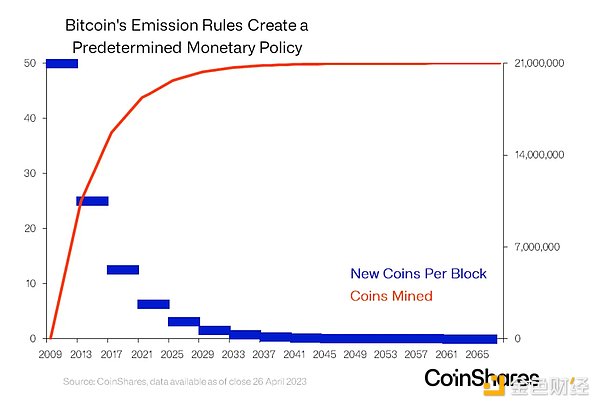

We have detailed the technical aspects of halving before, so we won’t go into it this time, but the final effect is shown below. Completely predictable monetary inflation, heading towards zero over time, results in a supply cap for Bitcoin of just under 21 million Bitcoins, to be reached sometime around the year 2140.

p>

We have also discussed the non-technical aspects of this topic extensively during and after the last halving and over the years, but as per tradition, for all newcomers, we will post the answers Making Habitual Updates Some of the most common issues we see:

Half pair price Is there any impact?

Is the halving factored into the price?

How will miners be affected?

There simply isn’t enough time to cover all of this in one article, so we’ll answer the last two very succinctly questions (suggest some sources for those who want to go deeper) and focus on the first one - which is the most interesting one anyway.

So has the halving been priced in? No, that's not possible either. For a thorough and necessary critique of the EMH, we direct interested readers to Chapter 2 of the erudite Bitcoin is Venice by Alan Farrington and Sasha Meyers. As for the miners, they'll be fine!

The halving does affect prices

But it may not be in the most obvious way way to have an impact - at least not immediately. Our view is that halving affects price in two ways, one slowly and continuously, the other immediately and temporarily:

-

This is the "obvious" way to go - it will cut the ongoing supply rate in half, thereby alleviating structural selling pressure on miners. It's just that this effect is not immediate, but will have an impact over time

But the more direct fact is that each halving is actually a huge marketing campaign. This brought an immediate renewed focus on Bitcoin (and wouldn't you know it, it wasn't dead this time either), injecting adrenaline into the market, but it faded quickly thereafter

Let's look at them in more detail.

The supply shock caused by the halving

The "obvious" impact of the halving is that Effects of supply shocks. Overnight, the supply was cut in half, reducing Bitcoin’s monetary inflation rate by 50%. However, this is not as impactful in the short term as one might think. Most of its magic works over time.

As a thought experiment, let’s consider the size of Bitcoin issuance relative to current ETF flows from the United States. At current prices, the ETF consumes approximately 9,000 Bitcoin per day. The mining network produces approximately 900 coins per day. This means that even if miners sell all the coins they mine every day, ETF traffic will still consume 10 times that amount.

After halving it will be 20 times. Well, that’s double, but that doesn’t change the fact that the only way for anETF to acquire so many tokens is through upward repricing, causing existing holders to add dormant tokens back to the market .

But this does not mean that there is no effect. Let's imagine the price is 10 times higher than here. At this level, the same ETF flow would only consume 900 tokens per day, fully balancing the ongoing supply (assuming no other buying and selling in the market). At this price level, the impact of the halving would be immediately greater.

In the long run, with constant traffic, halving can actually maintain price levels at higher and higher levels, or if traffic continues at a If the issuance falls at the same rate, the price level can be maintained at a similar level. This definitely is an important impact, but in the short term it's so completely swamped by speculation that it's pointless to look for any immediate impact.

Having as a marketing campaign

This is where the effects are felt immediately. Every time a halving approaches, the media reports it with undying fascination, giving Bitcoin a fresh look in traditional media. At this point, people who first heard about Bitcoin during the last bull market but thought it was dead will find out that it's actually pretty good and often performs much better than they thought. That’s certainly the case this time around, with prices approaching all-time highs, even before the halving.

p>

Even if the coverage isn’t always technically accurate (see screenshot above for an example), we think this new media attention is a sign of reigniting cyclicality One of the key triggers for the speculative mania that tends to hit Bitcoin about once a year. 4 years. At this point, momentum becomes the driving force and a classic bull market rally begins. The outcome seems to be the same every time: Prices go parabolic at some point, getting ahead of themselves, followed by a brutal correction.

We do not recommend trying to time these cycles. We believe that Bitcoin is about timing the market rather than timing the market. The basic investment case is clear, a little bit of Bitcoin goes a long way.

Weiliang

Weiliang

Weiliang

Weiliang Anais

Anais Weatherly

Weatherly Weatherly

Weatherly Alex

Alex Miyuki

Miyuki Alex

Alex Miyuki

Miyuki Catherine

Catherine Kikyo

Kikyo