Author: Atis E, independent researcher Source: medium Translation: Shan Ouba, Golden Finance

In the coming months, Uniswap DAO appears to be preparing to allocate protocol fees to UNI stakersTake a vote. This article shares personal opinions and speculation on the future impact of this vote.

UNI Staking Proposal Summary

The Uniswap Governance Forum is currently discussing a Proposal to transform UNI into a fee-sharing token. The main idea is:

Upgrade Uniswap protocol governance to achieve permission-free, programmatic protocol fee collection< /p>

Allocate any protocol fees proportionally to UNI token holders who have pledged and delegated voting

Allow governance to continue to control core parameters: which mining pools charge fees, and the size of the fees

This initial proposal is the subject of another future proposal Basically, the proposal would actually introduce protocol fees on some Uniswap v3 pools:

Assuming on-chain voting Success, the community will have the option to charge a fee.

As a Uniswap representative, I generally support the proposal to allocate fees to UNI stakers from the Uniswap v3 pool. I think this would be an interesting experiment. The thorough preparation behind the proposal clearly demonstrates the foundation's capabilities and abilities.

There are still uncertainties, such as the specific pool of fees that will be implemented and the exact agreed tax rate. The fee switch must be customized for each pool, meaning fees are only activated for selected Uniswap v3 pool groups. Economically speaking, it doesn’t make sense to charge fees on pools with small capacity or short lifespans, especially when considering the DAO governance effort required for each fee conversion decision. The chosen mining pool is likely to be similar to the one Uniswap Labs already charges a 0.15% front-end fee. Based on previous votes, protocol rates are expected to be set between 10% and 20% of total swap fees.

Currently, there are no public plans to implement fees on v2, v4, or UniswapX. These versions can be addressed in future discussions, with the V3 fee conversion experiment serving as an important reference point.

The future of V3

Uniswap v3 is currently the most dominant iteration of the platform. In some respects, it is also the largest DEX in existence. However, I think Uniswap v3 is already in decline, and here’s why. This means that attempting a fee switch on v3 is a relatively low-risk move.

V4 is coming and will largely replace v3

Uniswap’s development strategy There are some similarities to Intel's previous tick-tock model, where architectural advancements ("tocks") were followed by optimizations ("ticks"). In this case, Uniswap v1 and v2 represent one tick cycle, with v3 and the upcoming v4 forming another cycle.

Uniswap v1 was a major improvement compared to the technical level at the time. V2 is architecturally similar, but features new features such as ERC20/ERC20 swaps and price oracles, as well as other enhancements to the overall design. Despite competition from v3, v2 remains strong, underscoring its enduring appeal.

V3 introduces another architectural leap, liquidity concentration. However, it does have some significant drawbacks, not only being more complex to use and increasing market risk for LPs, but also being more susceptible to MEV leakage by arbitrageurs, particularly in lower fee level pools of volatile assets.

I predict that Uniswap v3's design will not last in the long run, while the tried and trusted v2 model will likely outlast it. Once launched, v4 is expected to quickly surpass v3, thanks to several improvements:

Gas optimization: v4 introduces various optimizations, including a singleton design that reduces ERC20 transmission costs and a transient storage mechanism that significantly reduces Gas fees.

Innovation that benefits LPs: Features designed to recapture lost value in arbitrage (LVR) through auctions and dynamic fees, Provide a more favorable environment for limited partners.

Support v2 features: V4 will re-integrate a full range of liquidity positions, accommodate transfer fee tokens, and allow liquidity pools to LP donation, and other enhancements.

Essentially, v4 aims to address the shortcomings of v3 while incorporating the strengths of its predecessor.

Competition in the DEX landscape is intensifying

1. AMM competitors continue to rise

< p style="text-align: left;">Uniswap v3 initially dominated the industry with its innovative centralized liquidity model and restrictive licensing. However, these particular advantages no longer exist. The V3 core code has been under the GPL for nearly a year now. High-quality competitive AMMs continue to emerge. Uniswap v3 does still have the most resilient, tried and solid codebase, while some competitors have fallen prey to hackers. However, these benefits inevitably diminish over time.

2. Evolving transaction mechanism

On-chain transactions are moving towards intent-based system development. As a result, we expect the proportion of transactions conducted through AMMs to decline. While it is too early to declare the AMM model obsolete, the rise of platforms like UniswapX and Cowswap is likely to continue and increase their market share.

3. Emerging DEX-centric chains and rollups

About dedicated Uniswap applications There are compelling arguments on both sides of the debate over whether chains or rollups are the future of DEX.

Example: As Dan Elitzer emphasizes, in the current model, exchangers Paying Ethereum network fees is higher than the exchange fees they pay Uniswap’s limited partners. This is shockingly inefficient. Furthermore, trader losses due to imperfect execution due to slippage are also greater than swap fees – at least in 2021/2022. DEX trading user experience is improving significantly every year but if Ethereum’s focus remains on the settlement layer, these issues are unlikely to be fully resolved in the future. One can continually refine and complicate the design of a DEX, but it is impossible to fully replicate the CEX trading experience on a chain with 12-second block times—at least not without sacrificing decentralization or censorship resistance. impossible.

Reasons for objection: No one wants to connect their assets across chains to slightly improve their trading experience. Furthermore, we really don’t need further liquidity fragmentation.

However, the potential for shared ordering on the Ethereum mainnet could be a game changer. This innovation will enable synchronous composability between Rollups, allowing DEX contracts on Uniswap Rollups to seamlessly access the liquidity of all participating Rollups. Such a development would eliminate most concerns about liquidity fragmentation and user inconvenience.

All in all, these factors make it very unlikely that Uniswap v3 will continue to dominate the main network. There's not much to lose by carefully trying fee conversions.

Limited partner question: Taxation without representation?

Risk of fee conversion

If fee conversion results in many liquidity providers (LPs) Quitting Uniswap may be counterproductive. Losing limited partners would mean less liquidity in the pool, making the pool less attractive to traders. Reduced exchange activity will reduce income for remaining limited partners, causing more limited partners to leave. This could set off a chain reaction of declining liquidity, leading to a worst-case scenario - a death spiral.

Fortunately, DeFi traders do not seem to be overly sensitive to price changes so far. Even if some limited partners decide to leave after charging fees, overall deal volume may not drop significantly. This means that limited partners who remain will ultimately earn a higher annual interest rate (before agreement fees are taken into account). To some extent, these higher transaction returns will offset the cost of protocol fees, thereby achieving a stable balance.

In support of this view, Gauntlet's research (currently being updated) shows that as long as fees are not set too high, a death spiral is unlikely to occur. Their data-driven approach provides reassurance that fees, if collected carefully, will not lead to a mass exodus of limited partners.

The fair value of the agreed tax rate

The tax rate of 10% to 20% in the real economy Not uncommon. However, this does not translate directly to Uniswap's case for the following reasons:

Typically, taxes The goal is profit, not total revenue. For limited partners on Uniswap, swap fees represent their gross income, not net income. Studies that measure LP returns using the impermanent loss model or the loss and rebalancing (LVR) model (for unprotected and hedged LPs, respectively) have concluded that Uniswap v3 LPs have a net profit margin of almost zero. Therefore, in this case, a tax system designed to accurately collect earnings will generate minimal revenue, highlighting the mismatch between traditional tax logic and limited partner earnings dynamics.

Taxes are used to fund public services in the traditional economy, such as infrastructure and health care. Reallocating tax revenue to UNI token holders does not inherently ensure the benefit of contributors (i.e. limited partners) in a manner consistent with typical taxpayer expectations.

Despite these challenges, there are compelling reasons to consider protocol fees:

The agreement fee is more like value added tax (VAT) than income tax or capital gains tax. A key feature of VAT is that it is paid by the customer, not the provider. Limited partners can, to some extent, force exchangers to pay more fees and offset protocol fees by migrating their assets to pools with higher fee tiers. However, without concerted action, this shift is unlikely to occur widely, resulting in continued undervaluation of LP liquidity in Uniswap v3.

The fee distribution model incentivizes UNI token holders to actively participate in governance by requiring token delegation for revenue sharing. Research shows that active delegation can increase the degree of decentralization of a DAO. This is also a big step towards making the Uniswap ecosystem (especially the Foundation and DAO) self-sustainable rather than relying on the Treasury.

LP and DAO

Combined with the above situation, it is very Obviously, the purpose of fee conversion is:

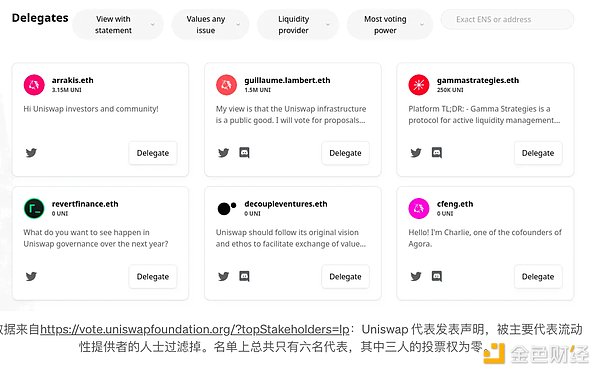

However, it was not the limited partners—or at least not primarily the limited partners—who were asked to do the deal. The current situation is one oftaxation without representation . At least, not enough representation. Delegates with a clear preference for the LP only have a few million UNI votes.

p>

In addition, there are some well-known trading companies among representatives of large DAOs. There are clear potential conflicts of interest between them and Uniswap LPs (particularly retail LPs).

My position is that limited partners are the lifeblood of any decentralized exchange and their voting rights should reflect this. Hopefully, the upcoming UNI staking and re-delegation will provide Uniswap LP with the opportunity to gain more votes.

One technical step to increase the voting power of LPs is to allow delegation of UNI tokens in their liquidity positions. This requires some technical changes, but is certainly doable.

Compensate for LP?

There are some ideas on how to tie LP support to fee conversion programs, such as:

Liquidity mining plan

Airdrop for "loyal" LP

Gas rebate

Even assuming the limited partners have enough voting power to pass these ideas (which is uncertain), I find none of these ideas entirely convincing:

Targeted liquidity incentives may be effective as a means of tax redistribution. However, they could disrupt the free market and damage Uniswap’s credibility as a neutral platform. Accurate targeting is challenging and requires significant monitoring, research, and management expenses, while poorly targeted incentives can harm the ecosystem by attracting primarily profit-seeking limited partners.

If public DAO voting is involved, the criteria for airdrops can easily be manipulated by large token holders. Future airdrops are more likely to cause a governance crisis, undermine Uniswap’s neutrality, and encourage airdrop mining as an LP speculative strategy. Additionally, airdrops without KYC requirements would disproportionately benefit large holders or sybils, while requiring KYC would be a worse option and contradict the permissionless ethos of Uniswap.

Natural gas rebates will unfairly favor active limited partners over those that bear lower risk or Retail Limited Partners. Their long-term impact will be to prompt limited partners to adopt strategies that are actually worse.

The Uniswap Foundation’s strategy of focusing on growing the ecosystem appears to be more viable than any of these options (targeted liquidity With the possible exception of mining). Ideally, the limited partners get a relatively small share, but the pie is much larger.

Conclusion

Encouraging UNI token holders to delegate their tokens is expected to improve the decentralization of the DAO and the sustainability of the ecosystem.

Currently, the implementation of fee conversion on V3 will provide critical data for decision-making on future versions of Uniswap and other protocols within the ecosystem. provide information.

Limited partners are the obvious short-term losers from the expected fee switch, and it is uncertain whether the long-term expected benefits of the ecosystem will be enough to compensate their loss.

LP should strive to achieve better coordination and a stronger voice in DAO decision-making. This includes building support for a more conservative approach to fee switching: for example, imposing fees of no more than 10% on only a small subset of mining pools.

JinseFinance

JinseFinance

JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance Edmund

Edmund JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance Bernice

Bernice Zoey

Zoey Kikyo

Kikyo