Source: Vernacular Blockchain (ID: hellobtc)

The stablecoin track has always been regarded as one of the holy grails of the crypto world. Whether it is Tether's USDT or Terra's UST, they have played a pivotal role as heavyweight players in the industry.

In the past two months, a new project with a high yield label has emerged, and it has quickly risen to become the fifth largest stablecoin in the entire network:On February 19, USDe issuer Ethena Labs launched the public mainnet, aiming to create a synthetic dollar USDe based on Ethereum (ETH). As of the time of writing, the supply has exceeded 2.366 billion pieces, second only to USDT, USDC, DAI, and FDUSD.

Source: https://www.coingecko.com

So what kind of stablecoin project is USDe? How can it break through the siege in such a short time? What are the controversies behind it? At the same time, what new variables does the recent stablecoin track contain?

01 The rapid rise of the stablecoin USDe

The biggest impact of USDe on the stablecoin market is undoubtedly that it has been launched for only two months. With its high yield attribute, the total volume has quickly risen from 0 to over 2.3 billion US dollars.

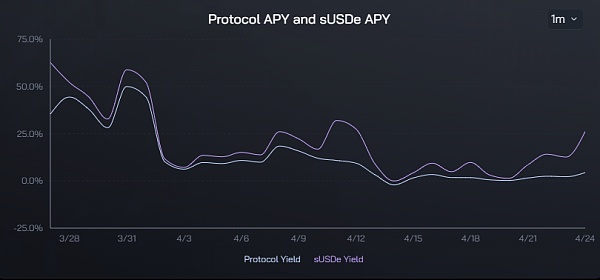

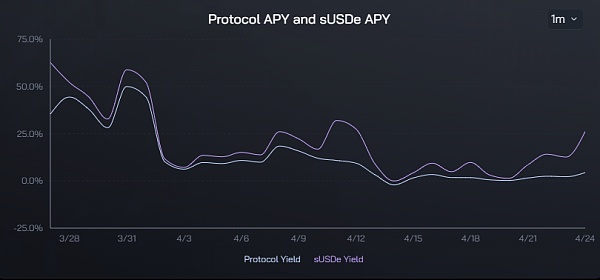

Data from the Ethena Labs official website shows that as of the time of posting, the annualized rate of return of USDe is still as high as 11.6%, and it has previously maintained above 30%, which reminds people of the UST in the Anchor Protocol with an annualized rate of return of up to 20%.

Annualized rate of return of Ethena protocol and annualized rate of return of USDe

Annualized rate of return of Ethena protocol and annualized rate of return of USDe

What kind of stable currency mechanism is USDe, and why does it have such a high annualized return? Behind this is actually the perfect version of the Satoshi dollar concept mentioned by the founder of BitMEX in the article "Dust on Crust".

In short, if the expected Airdrop income is excluded, the current high income sources of USDe are mainly two:

ETH's LSD staking income;

Delta hedging position (i.e., short position of perpetual futures) funding rate income;

The former is relatively stable, currently floating around 4%, while the latter depends entirely on market sentiment, so USDe's annualized income is also directly dependent on the funding rate (market sentiment) of the entire network to some extent.

The key to the operation of this mechanism lies in the "Delta neutral strategy" - If an investment portfolio consists of related financial products and its value is not affected by small price changes of the underlying assets, such an investment portfolio has the nature of "Delta neutrality".

That is to say, USDe will form a "Delta neutral strategy" through equal amounts of spot ETH/BTC long positions and futures ETH/BTC short positions: the Delta value of spot positions is 1, the Delta value of futures short positions is -1, and the Delta value after hedging is 0, which means "Delta neutrality" is achieved.

In simple terms, when the USDe stablecoin module receives user funds and buys ETH/BTC, it will simultaneously open an equal amount of short positions, thereby maintaining the value of each USDe total position through hedging, which ensures that there is no risk of liquidation loss in the collateral position.

For example, if the BTC price is assumed to be $80,000, for example, if a user deposits 1 UBTC, the USDe stablecoin module will simultaneously sell 1 futures BTC, forming USDe's "Delta neutral" investment portfolio.

For example:

If BTC is initially $80,000, then the total value of the portfolio is 8+0=80,000 US dollars, so the total position value is still $80,000;

If BTC falls to $40,000, then the total value of the portfolio is still 4+4=80,000 US dollars, so the total position value is still $80,000 (the same is true for increases);

At the same time, the corresponding futures short position in the USDe stablecoin module can obtain the funding rate income paid by the long position because it has opened a perpetual futures contract of 1 BTC (in retrospect, the funding rate in Bitcoin's history has been positive for most of the time, which also means that the overall return of short positions will be positive, and this situation is even more so in the context of strong bullish sentiment).

With the two combined, the annualized rate of return of USDe can reach 20% or even higher. From this, it can be seen that when the market is extremely bullish, the annualized high return of USDe is particularly guaranteed - because Ethena Labs took advantage of the opportunity to earn funding rates by shorting in the bull market.

02 Old Ponzi or New Solution?

Interestingly, the debate about ENA/USDe in the community has become louder and louder recently, and many people even compare it with the former Terra/Luna, calling it the new version of Terra/UST's Ponzi game of stepping on the left foot and the right foot.

In fact, objectively speaking, the first half of USDe's stablecoin generation/stabilization mechanism is significantly different from Terra's gameplay. It does not belong to the gameplay of Tiyunzong (Tiyunzong, a Wudang school light skill, means that you can ascend to heaven by stepping on your left foot with your right foot). On the contrary, since it is harvesting all traders who are long in the bull market and pay for it, the high yield is supported, which is also the biggest difference between it and Terra.

It is actually the second half of Ethena that is worth noting - once it encounters the test of depegging, it may really embark on a negative spiral suicide path similar to LUNA/USDe, resulting in the possibility of bank runs and accelerated collapse.

That is to say, there may be a nonlinear sentiment singularity - the funding rate continues to be negative and continues to widen, Fud discussions begin to appear in the market, USDe yields plummet + de-anchor discounts, and then the market value plummets (user redemptions):

For example, if it falls from 10 billion US dollars to 5 billion US dollars, Ethena must close its short positions and redeem the collateral (such as ETH or BTC). If any problems arise during the redemption process (wear and tear caused by liquidity problems under extreme market conditions, large market fluctuations, etc.), USDe's anchoring will be further affected.

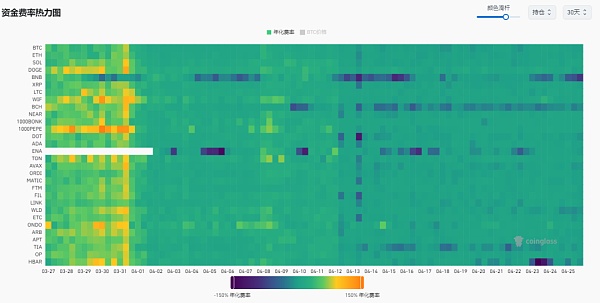

Source: coinglass

Source: coinglass

This negative feedback mechanism does not rule out malicious sniping, detonating this singularity, and thus facing a negative spiral dilemma similar to the collapse of UST. Therefore, for investors, whether this "collapse singularity" will appear, when it will appear, and whether it can be withdrawn in time are the key to whether the USDe bull market game can be fully withdrawn.

Then you need to keep a close eye on the proportion of Ethena's ETH and BTC holdings in the entire network, the negative funding rate of the entire network, and other factors.It is worth noting that with the recent sharp correction in the market, the funding rate of BTC and ETH has dropped significantly from an annualized rate of more than 20%, and even began to turn negative. The latest data shows that BTC is -1.68% and ETH is 0.32%.

According to the official website of Ethena Labs, the total value of USDe's Bitcoin collateral assets exceeds $800 million, and the Ethereum position exceeds $1 billion, accounting for nearly 80% of the total.

Because Ethena is actually harvesting all cryptocurrency traders who are long in the bull market and pay funding fees for it, the high yield rate is extremely dependent on the positive funding rate behind the market sentiment. From this perspective, if the funding rate of the entire network continues to turn negative, or even increases, USDe is likely to face the test of a sharp decline in yields.

03 The rise and fall of the stablecoin track

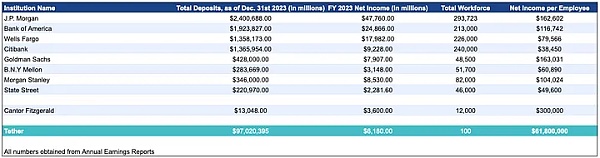

Pulling back the perspective to the macro level, the stablecoin track has actually always been a lucrative super big cake. In horizontal comparison, the money printing attributes of leading players such as Tether are even no less than CEX:

Tether generated approximately US$6.2 billion in net income in 2023, accounting for 78% of Goldman Sachs ($7.9 billion) and 72% of Morgan Stanley ($8.5 billion) in the same period. Tether has about 100 employees, while the latter has 49,000 and 82,000 employees respectively.

Net income, total number of employees, and employee income of major companies as of December 31, 2023, source: @teddyfuse

Net income, total number of employees, and employee income of major companies as of December 31, 2023, source: @teddyfuse

Tether is currently almost the most profitable crypto company other than trading platforms (CEX is probably only Binance can stabilize the pressure).

For Web3 projects and crypto companies that are generally still operating at a "loss" and selling token subsidies, it is even more out of reach, which is one of the main reasons why the stablecoin business is so popular.

According to CoinGecko data, among the top 5 stablecoin players, the total circulation of USDT has exceeded 109 billion US dollars, accounting for about 69% of the total stablecoin volume of the entire network, sitting firmly on the Diaoyutai.

In addition to the dominant USDT, since the US regulators closed Silicon Valley Bank on March 10, 2023, the net outflow of USDC has exceeded 112 billion US dollars, and the total circulation has dropped to about 33 billion US dollars, a decrease of about 30%, temporarily ranking second, and compared with the third place DAI (5 billion US dollars), it is a fault-like lead.

In addition, BUSD has been replaced by FUSD due to regulatory pressure, and with Binance accelerating the frequency of LaunchPoll, the total amount quickly exceeded 3.5 billion US dollars; followed by the emerging USDe, which brought a new variable worth looking forward to.

In general, under the background of decentralized stablecoins eliminating stability considerations and centralized stablecoins facing "reserve + supervision", decentralized stablecoins have become the biggest expectation of the current market for the "holy grail" of the stablecoin industry, so the high-yield USDe can rise rapidly.

And we are only in the early stages of the long-term stablecoin competition. The arrival of new players like FDUSD and USDe is likely to change the competitive landscape and bring new variables to the stablecoin market, which is worth looking forward to.

JinseFinance

JinseFinance