Author: WisdomTree Digital Asset Director Benjamin Dean, CoinDesk; Compiled by: Whitewater, Golden Finance

WisdomTree Digital Asset Benjamin Benjamin Dean says we need to start thinking of blockchain as an infrastructure for financial innovation, rather than focusing on the prices of a handful of digital assets like Bitcoin and Ethereum.

Amid strong price gains for many cryptocurrencies, a major recent development has been undervalued. The tokenization of “real world assets” is also booming.

To understand what this development means, and the potential benefits of tokenizing these assets, we need to reframe how we think about the digital asset ecosystem.

We often ask questions like: "What is the price of Ethereum?", "How correlated is the digital asset with other asset classes?", "Should I include this in a diversified portfolio?" What allocation to asset classes?”. While such questions are interesting, they all relate to digital assets as an asset class themselves.

Another perspective is to think of various networks (such as Bitcoin, Ethereum or the Solana network) as digital infrastructure. Similar to how TCP/IP or POP3/SMTP are protocols used to build and commercialize services, digital asset networks are the base layer upon which financial services (and other services) can be deployed and delivered.

Asset tokenization is one such example. To quickly define the term, asset tokenization means using distributed networks and the databases that make up the components of these networks to register interactions between parties.

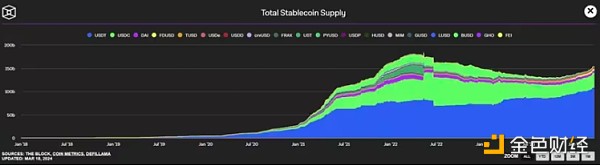

The most obvious example in recent years is the emergence of stablecoins, most of which are tokenized U.S. dollars. There are many ways to build these stablecoins. One popular model is to accept USD deposits, typically investing in US Treasury bonds, and then issue USD tokens (e.g. USDC, USDT) against these assets. The outstanding supply of these tokens is currently around $150 billion, up from almost zero five years ago.

Source: https://www.theblock.co/data/stablecoins/usd-pegged/total-stablecoin-supply

This product-market fit is now established, the question now is: If USD tokens can be issued , why can’t other currencies or assets be issued on the chain? This is the core of what the tokenization trend seeks to provide.

Another example is the U.S. Treasury bond. The current size of tokenized assets in the United States is approximately $750 million. U.S. Treasuries are up from almost zero two years ago. These tokenized Treasuries have one advantage over traditional stablecoins: they generate and provide yield. More generally, tokenized assets offer the potential for 24/7 trading, faster settlement times (T+0), and greater accessibility to anyone with a mobile phone All can be used.

These and other examples, including tokenized gold, demonstrate how digital asset networks can be used as the underlying digital infrastructure for distributing financial services. From this perspective, rather than measuring the success of these networks by the price of their native cryptocurrency, we can consider what other value-added services are provided through digital asset infrastructure. "The ideal outcome of using this technology is to create a faster, cheaper, more transparent and accessible financial system for everyone."

JinseFinance

JinseFinance

JinseFinance

JinseFinance Coindesk

Coindesk cryptopotato

cryptopotato Bitcoinist

Bitcoinist Beincrypto

Beincrypto Cointelegraph

Cointelegraph 链向资讯

链向资讯 链向资讯

链向资讯 链向资讯

链向资讯 Cointelegraph

Cointelegraph