Original: Liu Jiaolian

Overnight, BTC fell to 55k, then recovered and rose to around 58k.

With the approach of the Fed's September interest rate meeting and the expectation of interest rate cuts, the market began to panic inexplicably. This can be seen from the large amount of bearish sentiment and excessive short orders in the market.

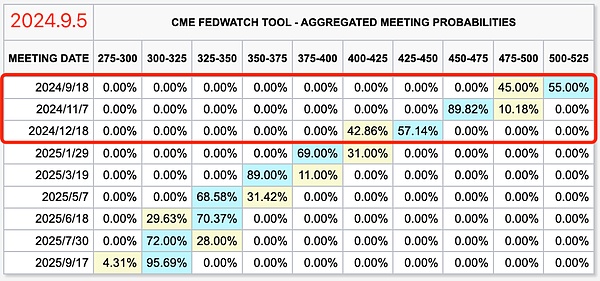

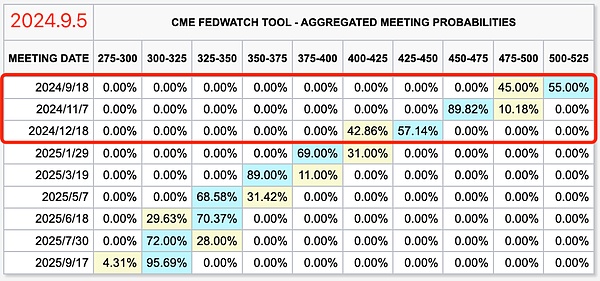

The Chicago futures market expects a 100% probability of a Fed rate cut in September. Among them, there is a 55% probability of a 25bp rate cut and a 45% probability of a 50bp rate cut. There will be three rate cuts this year, and the total rate cut will reach 100bp, or 1%.

The sahm rule has sounded the recession alarm. The US stock market seems to have a double top. Nvidia's flash crash exceeded 10%. ... The market is in crisis.

The theory of rate cuts leading to collapse began to spread. Similar remarks were not only in Chinese communities, but also on overseas English social platforms. To believe that the Fed will mess up at the operational level and that the US economy and even the dollar hegemony will collapse completely is obviously a tactical underestimation of the enemy. This kind of quick victory theory is absolutely unacceptable.

The teaching chain often talks about the predicament of the Fed, the end of the dollar hegemony, and that all countries that are ridden by the hegemony (including China) will eventually become equal to the United States through their own struggles, and even the "new Longzhong Strategy" of "three-way division of the world" in the global monetary system. All these are strategic judgments.

Strategically, do not fear the enemy. Tactically, do not underestimate the enemy.

On the one hand, we must recognize the power of the empire; on the other hand, we must realize that the imperial hegemony will eventually end. The two aspects are dialectical unity. The surrender theorists have only one and no two. The quick victory theorists have only two and no one. Don't kneel like the surrenderists, and don't fantasize like the quick victory theorists.

When you can't see the road ahead, you might as well look at the road you came from.

Jiaolian pulled out three charts of the Federal Reserve's interest rate regulation history, the S&P 500 index trend history, and the gold trend history over the past 40 years, and looked at them carefully.

These 40 years are 40 years in which China and the United States have jointly promoted the development of globalization, and it is also 40 years in which human society has entered the information age, the Internet age, and the mobile Internet age. 40 years of changes, 40 years of vicissitudes.

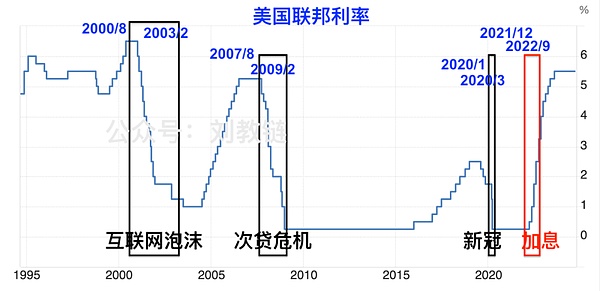

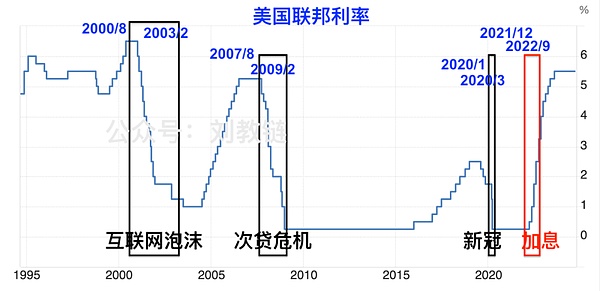

In the past 40 years, the Federal Reserve has had 4 typical monetary policy interventions. Among them, 3 were passive interest rate cuts and 1 was an active interest rate hike.

These four actions, without exception, were accompanied by a brief collapse of the U.S. stock market:

The first time, 2000/8-2003/2, the Internet bubble burst, and the U.S. stock market plummeted. The Federal Reserve responded by cutting interest rates, but the speed was slow (nearly 3 years), and the terminal interest rate did not drop to 0.

The second time, 2007/8-2009/2, the subprime mortgage crisis, the U.S. stock market really collapsed, and the low point was even lower than the low point of the Internet bubble burst. The Federal Reserve was still slow to cut interest rates. After it took a year and a half to finally reduce the terminal interest rate to 0, the U.S. stock market bottomed out and rebounded, starting a decade of long bull market.

The third time, 2020/1-2020/3, the COVID-19 pandemic, the U.S. stock market was circuit-breakered one after another. This time, the Fed started to cut interest rates ahead of schedule, and cut interest rates at the speed of light when the U.S. stock market hit the top and collapsed, and it dropped to 0 interest rate in 2 months.

The fourth time, 2021/12-2022/9, the Fed raised interest rates, and the U.S. stock market pulled back. This time, the Fed started to raise interest rates in the name of fighting inflation and took the initiative to puncture the bubble. In the past, the U.S. stock market rose against the interest rate hike, but this time it collapsed as soon as the interest rate was raised, which was somewhat unusual.

It seems like a mystery. The teaching chain hopes to find out why the U.S. stock market was able to rise against the interest rate hike in the past, and why it failed to withstand the low interest rate hike in the first half of the period, but withstood the high interest rate hike in the second half of the period.

So the teaching chain took the trend chart of gold over the past 40 years to look at together.

Think about a question first: Since Buffett criticized gold as a zero-interest asset with no interest or dividend income, why would anyone buy it? (Not considering industrial use, nor emotional factors, only considering rational investors)

The answer should be that zero-interest assets are a hedge against negative real interest rates. When the real interest rate is positive, zero-interest assets fall. When the real interest rate is negative, zero-interest assets rise.

So, if we regard the rise and fall of gold as an interest rate phenomenon:

The wave of interest rate hikes from 2005 to 2007 seemed to have increased the nominal interest rate quite sharply, but because gold was rising rapidly, we know that the market is pricing that the real interest rate is still not high, or even negative. Therefore, this wave of interest rate hikes did not destroy the rise of US stocks until the high interest rate pulled the subprime leverage to burst.

From 2011 to 2015, although the Federal Reserve has been maintaining a zero interest rate, gold peaked and fell in the second half of 2011, and bottomed out at the end of 2015, so the effect of raising interest rates has already been achieved. In this way, when the nominal interest rate began to increase from 2016 to 2020, gold began to bottom out and rebound, and the two offset each other, greatly easing the increase in real interest rates, thereby ensuring the smoothness of interest rate regulation and not interrupting the ten-year bull market recovery of the US stock market.

In 2021-2022, in the first half of the interest rate hike, gold fell synchronously, which actually caused the degree of real interest rate increase to be strengthened, greatly exceeding the increase in nominal interest rates. This directly collapsed the US stock market. In the second half, although the nominal interest rate was high and continued to rise, gold also began to rise rapidly, which is equivalent to saying that the real interest rate has actually eased, so the US stock market bottomed out and recovered, and even hit a new high.

After this analysis, the conclusion is obvious: it is precisely because of the rise of zero-interest assets that the hedge offsets the high interest rates of nominal interest rates, eases the pressure of high interest rates, and promotes the bull market of risky assets.

Next, the Federal Reserve will lower the nominal interest rate.

So, if gold continues to rise, it will be equivalent to strengthening the Fed's interest rate cut. On the contrary, if gold falls simultaneously, it will weaken the effectiveness of the Fed's interest rate cut.

Obviously, the former situation may be more conducive to achieving the soft landing that the Federal Reserve has been thinking about.

As for BTC, it is both a zero-interest asset and has the attributes of a risky asset.

Ironically, the rise of gold and BTC represents the decline of the US dollar.

It seems that the Fed's goal can only be a choice between "soft landing + depreciation of the US dollar" and "strong US dollar + hard landing".

ZeZheng

ZeZheng