Press: The WLD tokens allocated by Worldcoin to contributors Tools for Humanity were originally scheduled to be unlocked daily in a linear fashion starting on July 24, 2024. However, on July 16, Worldcoin announced that the unlocking schedule for 80% of WLD held by Tools for Humanity team members and investors will be extended from 3 years to 5 years. Affected by this "good" news, the price of WLD tokens surged by more than 50%.

WLD, which is known for its low circulation and high FDV, has long been criticized by the encryption community. This incident has once again aroused community attention. Cryptocurrency trader DeFi Squared once again issued an article to refute Worldcoin, saying that Worldcoin’s internal team controls the price through token circulation, extremely low circulation rate, high FDV, and releasing good news in order to maintain extremely high FDV when unlocked internally. It's a money grabbing scheme.

Compiled by Golden Finance 0xxz, take a look at the historical trend of WLD price before reading:

The following is the original text of DeFi Squared:

Worldcoin is expected to begin internal unlocking in 7 days, which is the lowest circulation ever in the industry One of the volumes, the circulation is only 2.7%. With this in mind, it makes sense to delve deeper into how the project reached this status.

This research article reveals how the Worldcoin team controlled the price in order to maintain $30 billion in FDV when the internal unlock began, while lying about not being involved. All content is up to date with the latest vesting schedule changes.

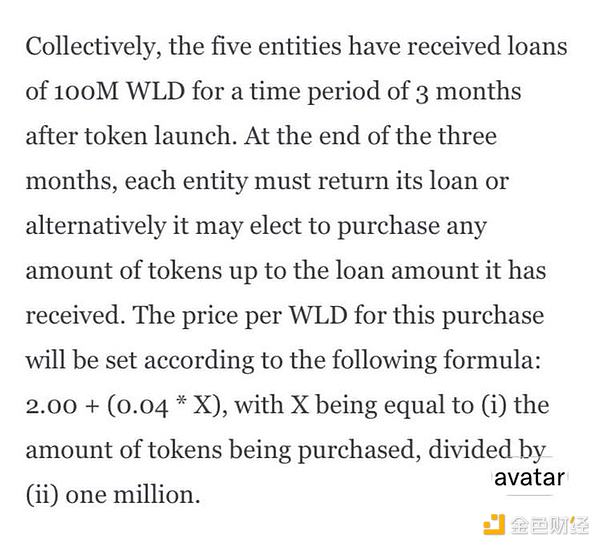

First, some background. When Worldcoin was first launched, the Foundation’s circulating supply was 1.4% or 140 million WLD. Although there were concerns that this liquidity would lead to its launch at an extremely high FDV, the team has allocated 100 million of these tokens to market makers and provided them with call options, allowing them to end the contract at slightly higher FDV. Buying back large amounts of tokens at prices above $2 is intended to prevent prices from surging too high. Allocating supply to market makers to create favorable price conditions is not uncommon in the industry.

2023 old The Worldcoin white paper describes the price suppression formula provided to market makers

As one would expect, WLD is unable to significantly exceed the call price during the life of this contract because the market makers It will only "depress" prices. Worldcoin CEO Alex Blania discusses here how this contract is specifically needed to prevent prices from squeezing their low float:

Worldcoin CEO Introducing their techniques to suppress prices to avoid WLD from skyrocketing to $10, later that year they refused to renew this contract and WLD prices surged to $10 (Source: Scoop Podcast)

Note that he noted that the aim is to avoid a "surge to $10" and went on to say that such a scenario would be "terrible."

Nevertheless, on December 16, with only 1.2% of the circulation, Worldcoin decided not to renew the existing market maker contract, canceled the call option that suppressed the price, and even further removed it from circulation. Another 25 million WLD were removed. Now, with minimal market maker participation, its market cap is just $98 million, and the price predictably surged 100% in a matter of hours — exactly what Blania claims they were trying to avoid. Within a month, Worldcoin price had short squeezed to nearly $12, with an FDV of $120 billion.

Apparently, the team later realized that it would be unwise for the US team to publicly describe how they control the price, so when asked at Token2049 Dubai if they paid attention to the price, Worldcoin’s CEO claimed that they could not Control the price, it's just driven by the market:

< /p>

< /p>

Worldcoin CEO claims they have nothing to do with price, despite their changing policies and token economics having clear impact on price Impact

That is not the case. The fact is that the 11-digit valuation was only possible due to the team’s tokenomics design, and the daily price movement of the token was influenced by the team on many occasions as they actively changed the issuance, did Market contract and make timely announcements before unlocking. This raises the question of why they don't want the public to believe this is true.

So, let’s go back to where we started – we go back to when insiders unlocked it, when the circulating supply was only 2.7%, which was probably the first time in cryptocurrency history that a major VC-backed project had the most Lowest ratio ever seen when unlocked. As a reminder, this may be the only thing keeping WLD afloat at a staggering $30 billion FDV, and insiders could soon sell it at that price. But why is the circulation rate so low? According to Blania in 2023, they must keep the circulation rate low because in order to achieve UBI, "it would be completely unfair to release 10% of the supply at once":

Worldcoin CEO Defending low circulation as necessary to achieve Universal Basic Income (UBI). Confusingly, however, the tokenomics arrangement devised by the team will result in the majority of token issuance next year going to insiders rather than UBI subsidies. (Source: The Scoop Podcast)

But that’s exactly what the team plans to do with the unlocked tokens, except those tokens end up in the pockets of insiders rather than UBI recipients. Even with the new unlocking plan, in a little over a year, teams/VCs will have issued nearly 1 billion tokens, and extrapolating the current UBI grant rate, only 600 million tokens will be issued by the same time Will be distributed to UBI recipients. This means that within a year, WLD issued by insiders is expected to account for over 60% of Worldcoin’s entire circulating supply. 60% is a huge percentage - it basically means that the majority of the ecosystem is purely for VC dumps. This seems to directly contradict the current rationale for keeping circulation rates low to benefit UBI recipients.

There are multiple other sources that add to the circulating supply, but these do not flow directly to UBI recipients. My previous research article discussed situations where large supplies of "community funds" are sold to trading desks at a discount; additionally, it's worth looking at Orb operators like this one (verified from the public Orb operator emissions wallet) , they sometimes earn a mind-boggling 20,000+ WLD per week by collecting biometric data from vulnerable populations and sending it directly to Binance:

< /p>

< /p>

When WLD prices soared to $12 in March, the Orb operator posted reports every 3 days Binance Sends WLD Close to $150,000

But the question remains – even with the circulation rate so low, who is currently holding nearly $30 billion in FDV and remains overvalued at the time of unlocking Unlucky victim worth it? It turns out that a large portion are actually Korean retail investors, many of whom probably can't even read English to understand the situation. At the time of writing, nearly 25% of circulating WLD is held on Bithumb, which continues to rise despite the impending unlock release:

< p style="text-align: center;">

As the insider unlock approaches, Korean retail investors’ WLD positions on Bithumb continue to grow. In recent months, these positions have lost 70- 80% because the Worldcoin Foundation actively sells tokens to trading platforms

(balance Historical data from Arkham Intelligence)

With this in mind, it may not be a coincidence that Worldcoin waited until a week before the unlock to release positive news. Although this was only a small change to release selling pressure, the news has proven to be very effective so far, forcing retail investors to unknowingly provide higher prices and more liquidity, allowing insiders to exit within a week. Worse yet, it seems possible (but unconfirmed) that someone on the team or at the VCs used inside information to pre-empt the news before it was even announced publicly:

Chart showing the unlock extension period There was a coincidental price spike in the 24 hours leading up to the news

Unfortunately, while such project behavior is not new to cryptocurrencies, it is surprising , many market participants remain unaware of the downsides to the investments they make. This article aims to shed light on a project that seems intent on supporting an otherwise low token price, and many of the reasons listed are why I intend to short WLD in the months after the unlock begins.

JinseFinance

JinseFinance

JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance Bitcoinist

Bitcoinist Catherine

Catherine TheBlock

TheBlock Tristan

Tristan Coinlive

Coinlive  Cointelegraph

Cointelegraph