Author: X10 CEO and founder Ruslan Fakhrutdinov, CoinTelegraph; Compiled by: Whitewater, Golden Finance

The current bull market for cryptocurrency has begun. One of the most significant differences compared to past cycles is the type of new investors entering the market. Bitcoin exchange-traded funds (ETFs) have effectively opened the door to wider participation by making it easier to participate, and an Ethereum ETF is widely expected to arrive soon.

New entrants may have some difficulty understanding cryptocurrencies, but given their first investment, there is a framework worth considering.

Easy to get started, little to gain

Beginners usually start by investing in big-name cryptos like Bitcoin and Ethereum Currency begins. In most cases, you can invest in Bitcoin and wait at least six months before checking its price to see if it has grown enough to sell. But for those who only have a few thousand dollars to invest, investing in Bitcoin won't make you a millionaire. The growth potential of BTC in the near to medium term is 2-3 times its current value.

Experienced players know they need to check out the latest trends. Investing in a dozen small projects can really pay off if done right. Assets that proved popular during the last bull market, such as new layer 1 protocols and lending platforms, may offer the opportunity to grow your investment 5 to 10 times.

However, risk and reward are two sides of the same coin. How much one is willing to gain or lose in cryptocurrency really depends on the time, resources, and energy one is prepared to invest in studying the market. This is the beauty of cryptocurrency.

Three narratives worth paying attention to

The average new user without any impressive experience can Three narratives are understood and should be believed. The key is to figure out the story behind each product. Innovation is at the forefront of this space as people in the cryptocurrency space are innovative and constantly looking for something new. I see three such trends emerging.

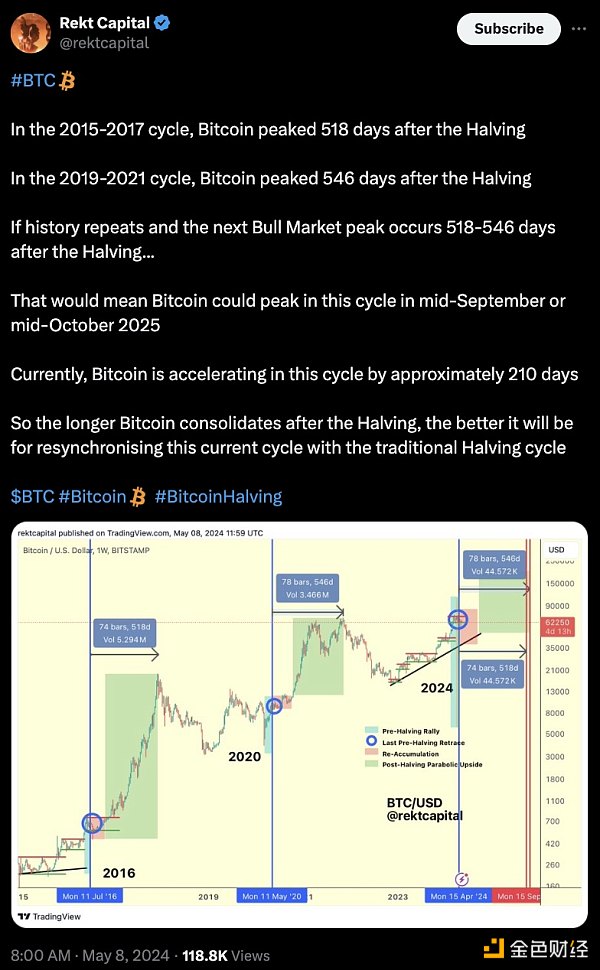

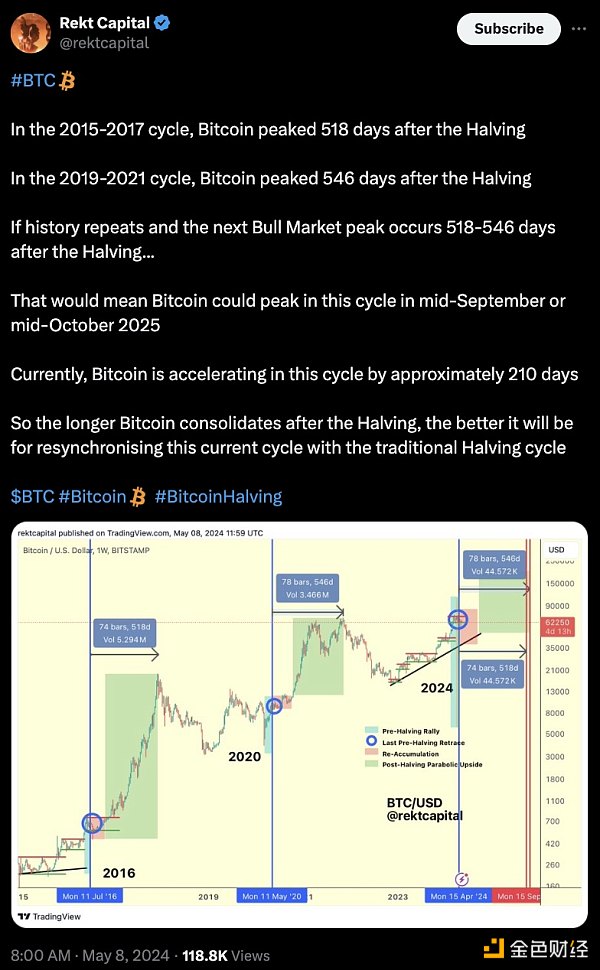

Will Bitcoin really peak at the end of 2025? Source: X

The first is the combination of artificial intelligence and blockchain technology. A large number of projects are now trying to innovate at the intersection of blockchain and artificial intelligence. While there's no guarantee that these efforts will be fruitful, the narrative itself is powerful. This trend, riding the wave of blockchain potential and cutting-edge advances in artificial intelligence, is likely to capture the imagination of investors and enthusiasts alike. I'm looking at RitualNet and Morpheus.

The second trend is to delve into more fundamental issues related to the tokenization of real assets or the tokenization of debt. aspect. In traditional markets, debt markets are larger than equity markets. However, in the cryptocurrency space, there is currently no debt market. Stablecoins can be seen as its starting point, as companies issue stablecoins in exchange for real dollars and then purchase short-term U.S. bonds themselves. However, the concept of corporate debt remains untouched in the cryptocurrency space. Therefore, everything related to debt tokenization has huge potential. PV01 and Ondo Finance are two projects in this field.

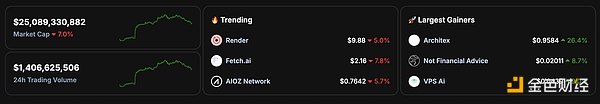

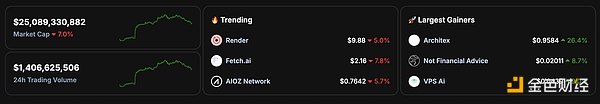

AI token trends as of May 8, 2024. Source: CoinGecko

The third trend focuses on enhancing blockchain technology itself – improving its efficiency, increase throughput and reduce operating costs. It uses new technologies such as the parallel Ethereum Virtual Machine (EVM) to process many things at the same time, thus speeding up transactions. Likewise, zero-knowledge (ZK) proofs keep things private but simple, making the entire system work smoother and cheaper. Sei and Monad are projects worth watching in this space.

But how do we use these narratives to delve deeper into a product? Imagine an investor researching a product. He is interested in a project and may even be excited about it. Every time he encountered something in the document that was difficult to understand, he highlighted it in red. Then he looked at the entire description and saw that there was too much red in the document: there were too many things in the product description that he didn't understand. And he doesn’t invest. Here's a simple strategy: If an investment is too complex to understand, it's probably not the right investment. This approach emphasizes the need for investment clarity.

So when you consider investment trends, keep in mind that large funds may have already made a move. If there's some kind of compelling narrative, chances are they're already invested in it. This is a good reminder to stay informed - and understand that In the world of investing, it’s often the giants who run the game.

Alex

Alex