Robinhood chooses Arbitrum:

Arbitrum is Ethereum's Layer 2 expansion solution, and the logic behind its choice is "standing on the shoulders of giants." By adopting Arbitrum, Robinhood not only achieved higher performance and lower fees than the Ethereum mainnet, but more importantly, inherited Ethereum's unparalleled security, a large developer community, and mature infrastructure. In addition, Robinhood also announced plans to migrate to its own Layer 2 network based on Arbitrum technology in the future, which is specially optimized for RWA, which shows its ambition for long-term layout. Comparative analysis: This is not a simple question of "who is better", but a manifestation of a strategic path. Solana is a single chain that pursues "integrated high performance", while Arbitrum represents the path of "modularization" and inheriting Ethereum security. The former is more radical, and the latter is more robust.

2. Analysis of core technical components

In addition to the underlying public chain, several key technical components together constitute the core functions of stock tokenization products.

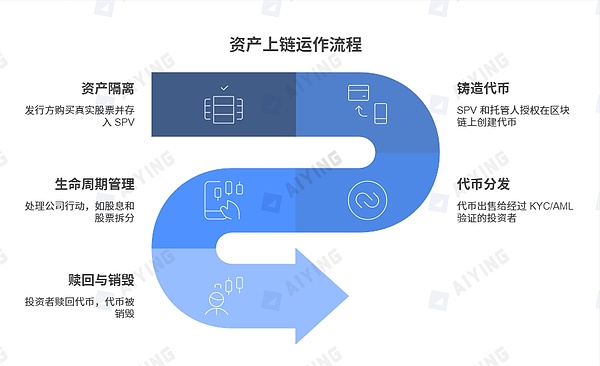

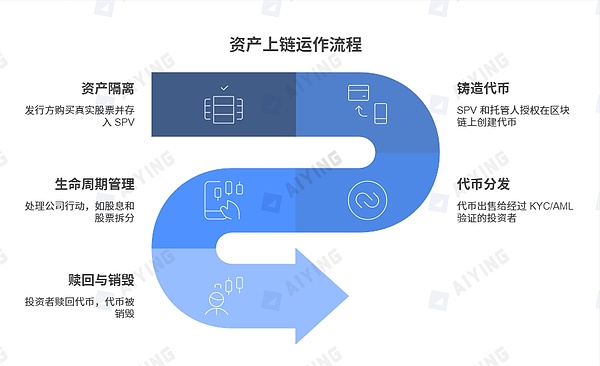

3. Detailed explanation of asset on-chain and SPV operation

For asset-backed tokens, SPV is the key hub connecting real-world assets and the blockchain world. Its rigorous and interlocking operating procedures ensure the security and compliance of assets.

Asset Isolation:

The issuer (such as Backed Finance) first purchases real stocks in a compliant financial market (such as the New York Stock Exchange). These stocks will not be placed on the issuer's own balance sheet, but will be deposited in an independent, regulated special purpose vehicle (SPV) and kept by a third-party licensed custodian (such as a bank).

Token Minting:

After the SPV and the custodian confirm that the real assets are in the warehouse, they will send a verified instruction to the smart contract on the chain, authorizing the minting of an equal amount of tokens on the target blockchain (such as Solana) (for example, if 100 shares of TSLA are deposited, 100 TSLAX tokens will be minted).

Token Distribution:

The minted tokens are sold through compliant exchanges (such as Kraken) or directly to qualified investors who have passed KYC/AML audits.

Lifecycle Management:

During the life of the token, the issuer needs to handle corporate actions through smart contracts and oracles. For example, when Tesla pays dividends, the SPV receives the dividends and triggers the smart contract to distribute the equivalent stablecoins or tokens to the on-chain holders. In the case of a stock split, the smart contract automatically adjusts the number of tokens for all holders.

Redemption & Burning:

When qualified investors wish to redeem, they send the on-chain tokens to the designated burn address. After verification by the smart contract, the SPV is notified. The SPV then sells the corresponding number of real shares in the traditional market and returns the cash received to the investors. At the same time, the on-chain tokens are permanently destroyed to ensure that the on-chain circulation and off-chain reserves always maintain a 1:1 balance.

III. Core Analysis (III): Business Model and Risk Assessment - The "Reef" Behind Opportunities

Behind the complex compliance and technical architecture is a clear business logic. The stock tokenization platform has not only created unprecedented value for users, but also opened up new profit channels for itself. However, opportunities and risks always go hand in hand.

1. Business model and profit source

Although all platforms provide stock token transactions, the profit models of different platforms have different focuses.

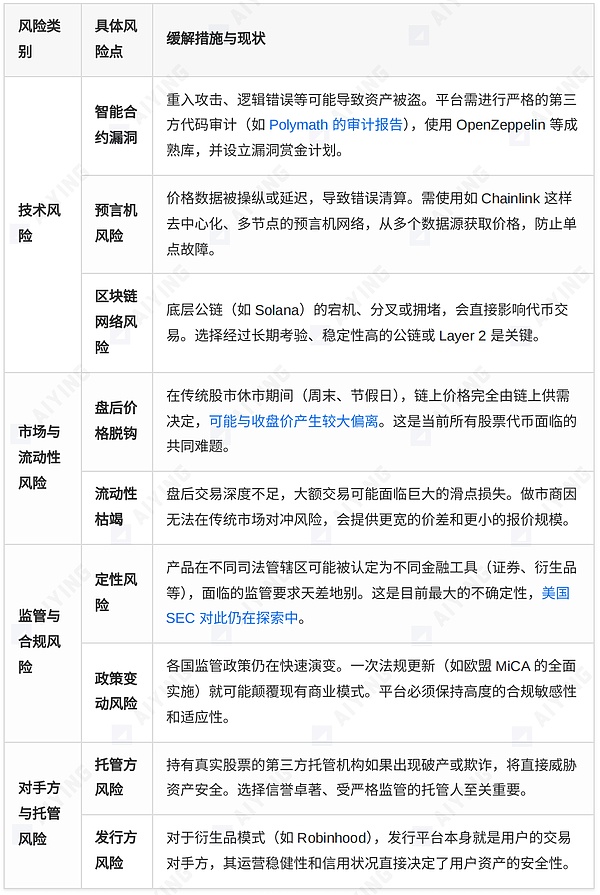

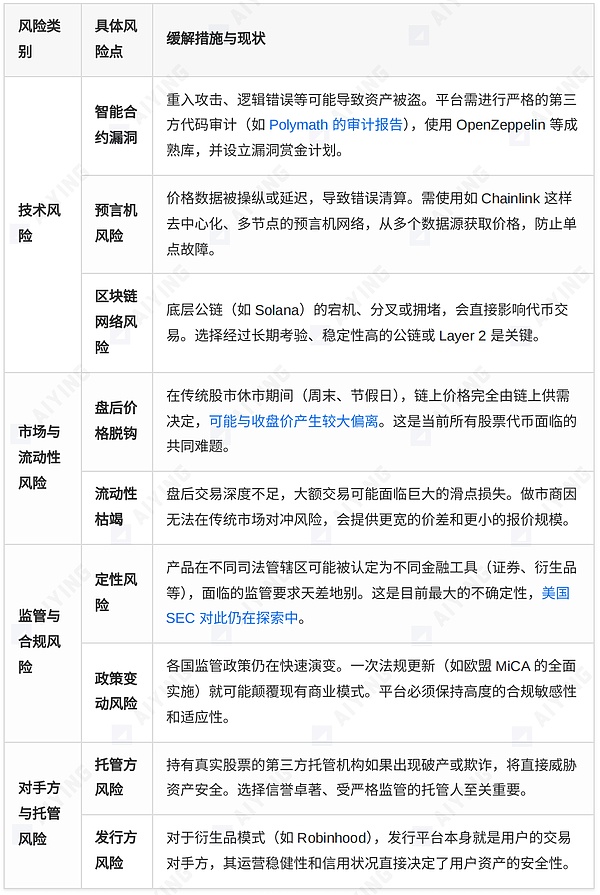

2. Comprehensive risk assessment matrix

While enjoying the convenience brought by stock tokenization, investors must be aware of the various risks hidden behind it.

3. Market structure and future prospects: Who will dominate the next generation of financial markets?

Major platforms in the asset tokenization track are competing for the market with different strategic positioning. Understanding their differences will help us gain insight into the future direction of the industry.

1. Comparison of the main player matrix

The RWA tokenization track has emerged in large numbers, and they have formed a distinctive competitive landscape based on different strategic considerations. We divide the main players into three camps for in-depth comparison.

2. Market trends and evolution paths

Looking to the future, stock tokenization and even the entire RWA track are showing several clear trends:

2. Market trends and evolution paths

Looking to the future, stock tokenization and even the entire RWA track are showing several clear trends:

list-paddingleft-2">From isolation to integration:

Early tokenization projects were mostly isolated attempts within a single platform. Today, the trend is turning to deep integration with mainstream financial institutions (such as BlackRock, Franklin Templeton) and the vast DeFi ecosystem. Tokenized assets are becoming a bridge connecting TradFi and DeFi.

Regulation-driven innovation:

Regulatory clarification is the strongest catalyst for market development. The EU's MiCA Act, Switzerland's DLT Act, and the Monetary Authority of Singapore's "Guardian Plan" are all providing the market with clearer rules, which in turn encourages more compliance innovation. Compliance capabilities are becoming the core competitiveness of the platform.

Institutional entry and product diversification:

As BlackRock brings the trillion-dollar money market to the blockchain through its BUIDL fund, institutional participation will inject unprecedented liquidity and trust into the market. Product types will also expand from single stocks and bonds to more complex structured products, private equity and alternative assets.

Private equity tokenization has become a new blue ocean:

Platforms represented by Robinhood have begun to explore the tokenization of non-listed company stocks, which has opened a window for the private equity market that is usually limited to institutions and high-net-worth individuals. Although it faces huge challenges in valuation, information disclosure and law, it is undoubtedly a new direction with great potential.

Future Outlook and Thinking

The wave of stock tokenization is unstoppable, but the road ahead is not smooth. Several core issues will determine its final form:

Open vs. Closed Battle:

Will the future market be dominated by an open, composable model like xStocks, or will it be won by a compliant, but closed "walled garden" model like Robinhood? More likely, the two will coexist for a long time, serving user groups with different risk preferences and needs. Crypto Native users will embrace the open world of DeFi, while traditional investors may prefer to try it in a familiar, regulated "garden".

The race between technology and law:

Cross-chain technology (such as CCIP), Layer 2 solutions, and privacy computing (such as ZK-proofs) will continue to evolve to solve the current technical bottlenecks in scalability, interoperability, and privacy protection. At the same time, whether the global legal framework can keep up with the pace of technological innovation and provide certainty for these innovations will determine the development speed and ceiling of the entire industry.

Stock tokenization is far more than a simple "on-chain" of financial assets. It is fundamentally reshaping the issuance, trading, settlement, and ownership paradigms of assets. It promises a more efficient, transparent, and inclusive global financial market. Although this road is full of technical, market and regulatory "reefs", the future direction it points to is undoubtedly irreversible. For all market participants, whether investors, builders or regulators, the top priority is to actively and prudently embrace this coming financial revolution based on a deep understanding of its underlying logic and potential risks.

Anais

Anais