Author: Lou Kerner, Founder of CryptoOracle Source: medium Translation: Shan Ouba, Golden Finance

On June 29, 2017, during a conference call I hosted involving ICOs, I saw the light of cryptocurrency.

I began to believe that cryptocurrency would be the biggest event in human history, and since then, I have been following cryptocurrency 24/7. In the past seven years, I have traveled around the world, spent time with some of the greatest people on the planet, and written more than 400 cryptocurrency-related blog posts.

Here are the seven most relevant thoughts I had as I reflected on this seven-year crypto journey:

1. We are in a “damn war” for the soul of the metaverse

In January 2017, I wrote my first article about FAMGA (Facebook, Apple, Microsoft, Google, and Amazon), noting that their growing share of the tech market was good for their shareholders but a disaster for the rest of the planet. Since then, Nvidia has also emerged as the sixth dominant company.

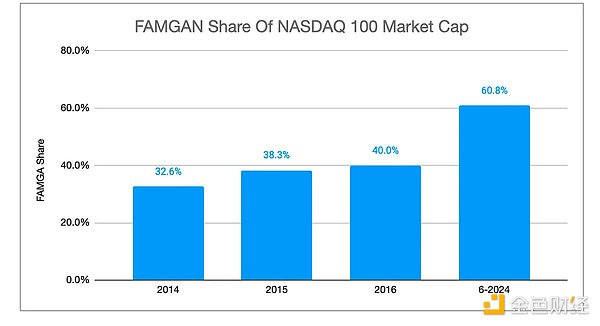

At the end of 2016, FAMGAN’s share of the Nasdaq 100’s market capitalization was 40%. Now, 7 and a half years later, the market cap share of these six dominant companies has soared to over 60%:

This means that FAMGAN has captured over 68% of all tech market cap created by the NASDAQ 1000 over the past 10 years. It turns out that the US is the land of monopolies, and things are getting worse by the day.

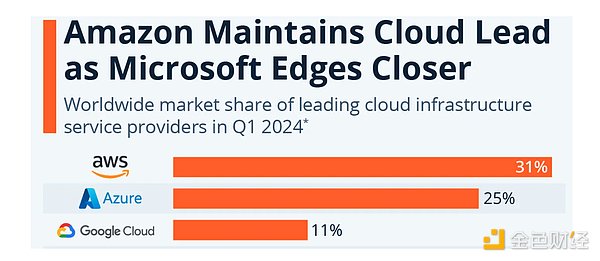

Monopoly stifles competition and dominates new markets:

I still think the macro thing that will drive tech forward is the Metaverse, and it will be powered by crypto. That’s why Facebook rebranded to Meta. And we’re in a damn war for the soul of the Metaverse, between the FAMGANs and the broader tech community (e.g. who will own our identity in the Metaverse?). It feels like Star Wars. The FAMGANs are the Death Star, and the broader open source crypto community is the Alliance. Aside from the fact that the Death Star usually wins, being part of the Alliance is awesome. But I’m ready for a good fight. IMHO, FAMGANs are a far greater threat to crypto than governments.

2. It’s all about community

I define community as an ecosystem that, when it works, everyone gets more out of it than they give.

I define crypto/Web3 as a family of technologies (blockchains, cryptocurrencies, smart contracts…) that together enable community-driven decentralization.

Web2 was all about how much money you can make from your customers. How much profit you can make from your customers. Web3 is all about how much utility you can provide to members of your community.

We still need better tools for token economics, governance, and consensus in order for decentralization to truly scale. But I’m still encouraged by the fact that many very smart people are working on it, and that the bar for centralization we’re competing against is so low.

3. It’s a Bitcoin World

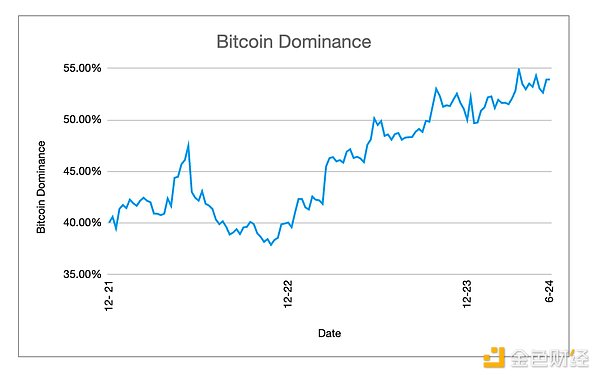

Apart from memecoins, the main driver of this year’s surge in crypto market interest has been Bitcoin, thanks to the launch of a BTC ETF in the U.S. Although the number of cryptocurrencies has increased fivefold to over 20,000 since 2021, Bitcoin’s dominance, or its share of the total cryptocurrency market cap, has risen by more than 11% during this period:

Today, accounting for 54% of the total cryptocurrency market cap, Bitcoin remains the dominant ecosystem in the cryptocurrency industry as it has proven to be the most secure digital system and the most reliable monetary system in human history. And Bitcoin is just getting started.

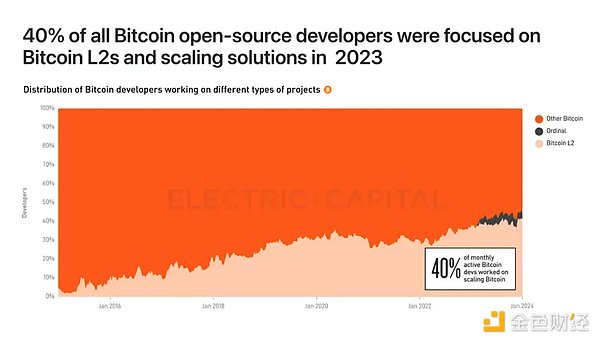

I think Bitcoin L2 is by far the biggest narrative in 2024. The idea of a vibrant L2 ecosystem built on top of Bitcoin is astounding to many, including me, and a growing number of Bitcoin developers as well:

I published my 10-year million dollar price target for Bitcoin in January 2021. So I’m all in.

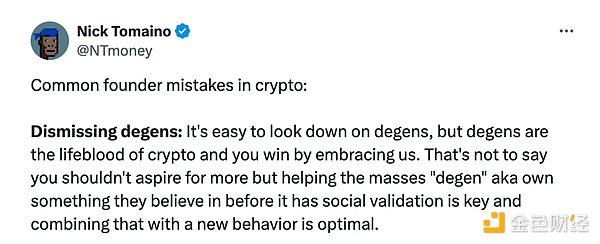

4. This is also a Degen world

I participated in Solana Breakpoint in 2021. But I didn’t really appreciate Solana until 2024 when I published “This is a Degen world, and Solana is the king of Degen”.

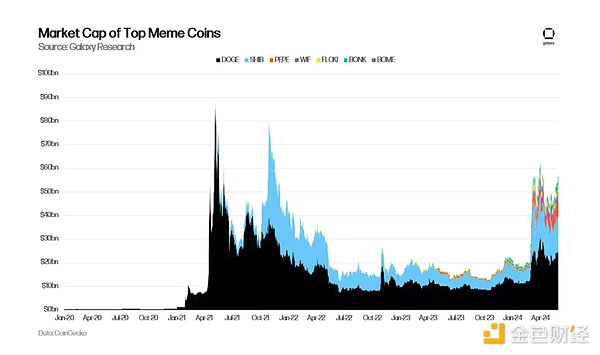

Nothing is more Degen than Memecoin, whose market value has increased 4 times in the past eight months:

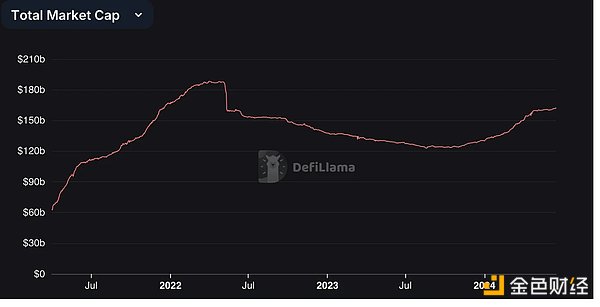

We are seeing a ton of innovation in the space, especially with interest-bearing stablecoins. Ethena’s interest-bearing (17%!) stablecoin has a market cap of over $1B, generating interest through staking ETH and hedging strategies that leverage funding and basis differences in perpetual and futures markets. Mountain Protocol recently raised an $8M Series A for its yield-bearing stablecoin.

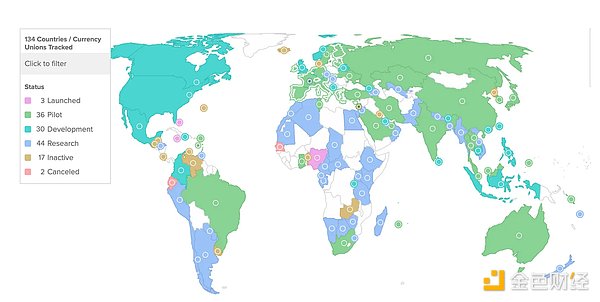

While the noise about CBDCs has died down, there are 36 pilot projects underway, including 11 of the G20 countries (Brazil, Japan, India, Australia, South Korea, South Africa, Russia, and Turkey), and three CBDCs that have been launched and are in actual use (Nigeria, Jamaica, and the Bahamas).

Unlike some who disparage CBDCs as dystopian risks, I think we are already in a dystopia to a large extent, and anything that has the potential to expose a billion people to cryptocurrency is worth the risk.

6. The intersection of cryptocurrency and AI is a big deal

In July 2020, I took my first deep dive into AI with the release of GPT-3. I wrote "OpenAI's GPT-3 is the future we've been waiting for."

Like everyone else, GPT-4 blew me away.

In April, I co-founded the Collective’s AI Web3 Accelerator with Eric Bravick (a 35-year AI veteran) to work with projects that are trying to solve the following seven problems:

Projects that solve any of the above problems will make a lot of money.

7. Cryptocurrency happens more outside the United States

The world is big, and many places are much more friendly to cryptocurrencies than the United States. In September, go to Singapore for Token2049, one of the “three best crypto conferences on the planet.” In October, go to Dubai for the Future Blockchain Summit, and then you’ll understand why “I’m moving to Dubai.” I can’t wait to attend Devcon in Thailand in November! Paris Blockchain Week was the highlight of April because of its amazing crypto community, as well as its thriving AI ecosystem. Tel Aviv, Lisbon, Zurich, Vilnius, and Saigon were other highlights of my crypto travels. Plans for this year also include Korea Blockchain Week in September, and time in Hong Kong, the new crypto capital of China.

ZeZheng

ZeZheng

ZeZheng

ZeZheng JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance Weiliang

Weiliang Brian

Brian Brian

Brian Xu Lin

Xu Lin Catherine

Catherine Cointelegraph

Cointelegraph