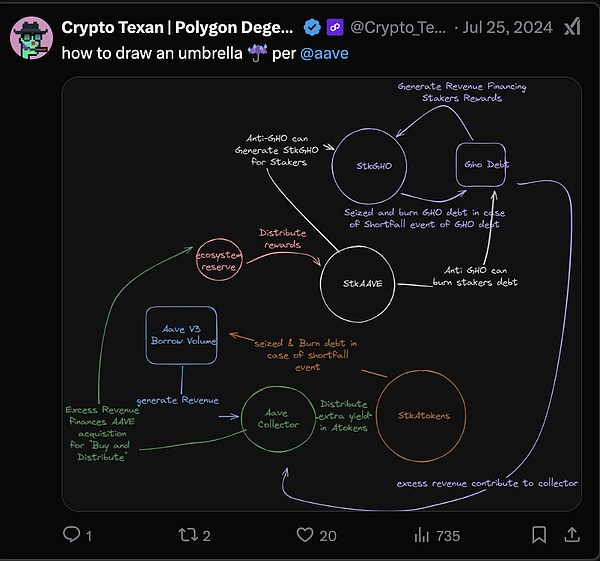

By Asset Umbrella adopts a more targeted protection mechanism Allows stakers to stake their aTokens (certificates of deposits in Aave) into different security modules, each corresponding to a specific asset and Blockchain. This setup enables the protocol to address bad debts at the individual asset level, rather than relying on a single “one-size-fits-all” solution.

One of Umbrella’s key innovations is Introduced an automated mechanism, often referred to as the “Aave Robot”, "">The pledged aTokens can be automatically slashed and destroyed to cover bad debts. This automated mechanism eliminates the need to rely on governance proposals to decide whether to execute cuts in the event of a funding shortage, improving response speed and reducing governance-related conflicts of interest .

2.3 How does Umbrella improve the overall protocol stability?

>By dispersing risks across independent asset pools, Umbrella significantly reduces systemic risk. If a particular asset generates bad debt, the stakers in the security module corresponding to that asset will be slashed to cover the loss and prevent the risk from spreading to other asset pools. This design not only enhances overall stability, but also allows for more granular control over risk parameters and ensures that incentives are always aligned with market conditions for each asset. 3. New Aavenomics: Fee Switch 3.1 Transition from stkAAVE to Umbrella Staking With the introduction of Umbrella, the traditional model of staking $AAVE on a single security module is changing. While $AAVE staking still exists, its primary function is no longer to bear all the risks of the protocol, but to become a

Auxiliary components, focused on governance and benefit from a distribution of the net proceeds of the Agreement. At the same time,the pledge module divided by assetsOne of the major changes to Aavenomics is how the protocol’s net revenue is redistributed. The agreement is based on the interest rate differential between the lending and borrowing rates. Generates net income and adopts a "Buy & Distribute" mechanism, where a portion of the net income will be used to repurchase $AAVE on the open market and distributed to stakers to enhance the value of $AAVE Claim. In addition, stakers of the Umbrella module can also receive aTokens and other rewards linked to the performance of each reserve asset.

3.3 Introducing $anti-GHO: A new mechanism for GHO borrowers

Under the new Aavenomics system, the $GHO borrowing discount mechanism enjoyed by $AAVE stakers has been replaced It is an “anti-GHO” mechanism. Borrowers who pledge $AAVE will accumulate non-transferable “anti-GHO” over time. ” tokens, which can be used to offset or “burn” part of the $GHO debt. This system provides real economic benefits to AAVE stakers while avoiding distorting effects on the broader market.

3.4 Governance and decision-making mechanism under the new model

While governance remains critical,. Aave DAO Still in ControlParameter Adjustment (such as reserve factors, incentive ratios) and strategic decisions (such as protocol expansion, new asset launches, etc.) . This approach strikes a balance between automation and decentralized governance, improving the efficiency of protocol operation. /span>Efficiency and transparency.

The following two articles from @0xboca,about Umbrella upgrades and the new Aavenomics are also worth reading and referring to.

https://x.com/0xboka/status/1878813433036169289

< p style="text-align: left;">https://x.com/0xboka/status/1882568334908268893 Weatherly

Weatherly