Author: David C, Bankless; Translator: Deng Tong, Golden Finance

The cryptocurrency market has been worrisome over the past few days as the industry appears to be ahead of investors’ concerns about the state of the global economy.

Today’s market action has shown the virtue of patience, especially when unwinding firm bets on new technologies. Although crypto assets have shown resilience today and rebounded 20% from recent lows, there is still a lot of fear in the market.

While the road ahead is full of uncertainty, especially in the short term, several key indicators show that there is reason to remain optimistic. Today, we dive into 5 compelling reasons not to press the sell button.

1. The U.S. economy is basically stable

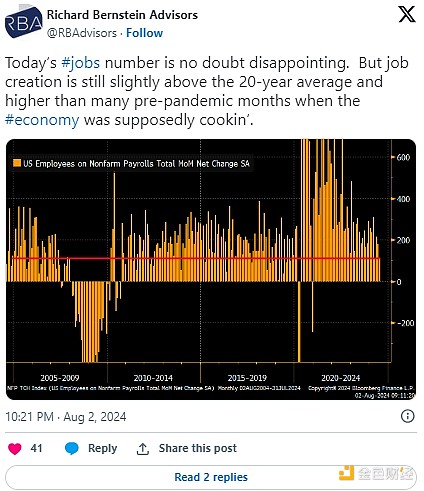

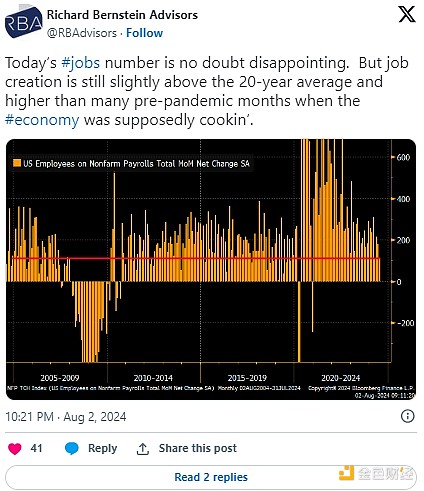

First, from a macro perspective, while the recent jobs report did scare the market,other economic data show that things may not be as bad as this data point suggests.

Specifically, the ISM Services PMI, which measures service sector activity, grew more than expected in July. The growth it shows is not just job creation, but also means that as people were laid off, service sector jobs were added, which indicates strong business activity. In addition, while unemployment rates did come in higher than expected, triggering the nasty Sam's Rule, they are still near a historic low of 4.3%, and U.S. GDP growth also continues to be strong.

Second, the number of bitcoins on exchanges is at a historic low

Another signal that can be used to gauge the health of the market is the number of bitcoins held on exchanges, which has reached a historic low relative to the price.

This data point may reflect some bullish sentiment from retail investors as well as an increase in institutional holdings. If holders are prepared to sell in a short period of time, we could see these numbers spike, but they are still trending downward.

3. Cryptocurrency becomes an election focus

As cryptocurrency becomes an increasingly hot topic in the U.S. election, there will definitely be positive developments in the market.

Whether or not Trump’s intention to make Bitcoin a strategic reserve asset is feasible, his support has prompted the Democratic Party to reconsider its position as Kamala begins to campaign against him. Although her camp has hardly signaled support for cryptocurrencies, she recently hired David Plouffe, a former consultant to Binance and Alchemy Pay, to hint that there may be positive developments in the future. Meanwhile, Trump continues to speak out about the industry, prompting powerful figures in Silicon Valley to endorse it, which are involved in many fields beyond cryptocurrencies.

Fourth, TradFi continues to emerge

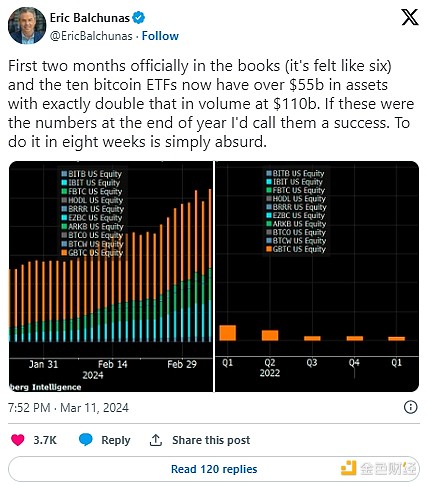

Diving deeper into cryptocurrencies, the level of adoption in traditional finance (TradFi) is another reason for optimism.

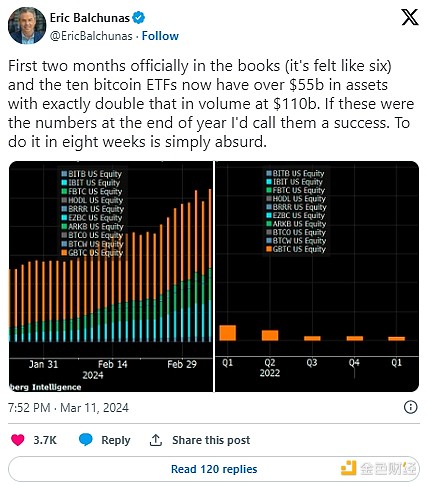

From Bitcoin ETFs to Ethereum ETFs to BUIDL, cryptocurrencies continue to make history in this cycle as institutional investors increasingly get involved in cryptocurrencies, even through on-chain tools. In addition, this history is not only about cryptocurrencies, but also about ETFs. BlackRock's IBIT ETF has reached $10 billion in assets under management faster than any other ETF in history. With more and more funds and services deployed on the chain, the tokenization of traditional assets is becoming a trend worth betting on.

Five. This industry has always been in great volatility

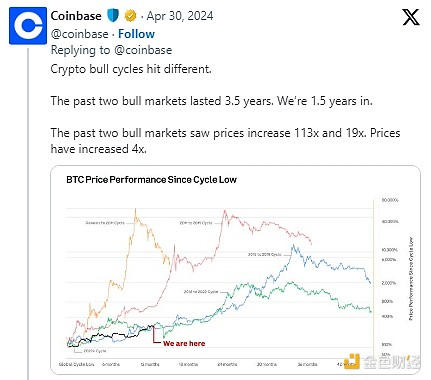

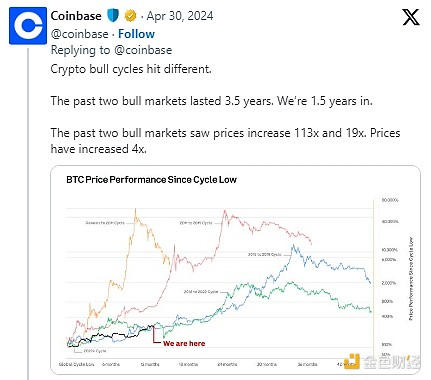

For experienced cryptocurrency investors, volatility and adjustments are the norm. It won’t make their pain any less severe, but for long-term investors, it’s easier to ride the wave than to time the right entries and exits.

During a bull market, multiple declines, ranging from 5-10% declines to large declines of 40-70% are normal. Furthermore, market cycles are built around the Bitcoin halving, with the bottom occurring approximately 1.3 years ago and the peak occurring approximately 1.3 years later. As we are less than four months away from the halving, history suggests that this cycle still has a long way to go, although the unprecedented macro equations certainly make one think that this time may be different.

Cheng Yuan

Cheng Yuan