Source: Bankless; Compiled by: Songxue, Golden Finance

The core feature of the Ordinal system is the ability to write arbitrary data to Satoshi. This is why the word “inscription” has recently become synonymous with “Bitcoin NFT” or “Ordinal NFT”.

The inscription is accomplished by including the data in the Bitcoin transaction. Specifically, the data is placed in transaction witnesses, which are parts of a Bitcoin transaction that typically contain signatures and other proof of authorization.

The data recorded here can vary from simple text to images, SVG, and even HTML. Once satoshis are imprinted on data and transactions are mined, the imprints become permanent. It is as secure, immutable and decentralized as any other data on the Bitcoin blockchain. This means that once written, a satoshi carries its data forever and is always distinguishable from other satoshis.

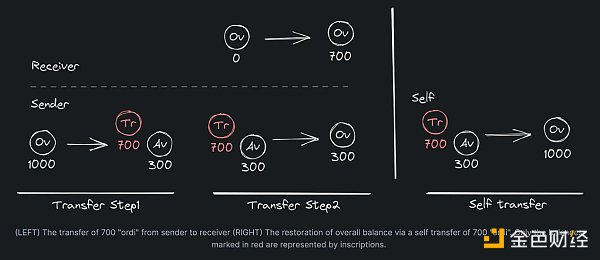

Additionally, with the Ordinals theory, the movement and ownership of credited satoshis can be tracked across transactions and over time. This makes it possible to trade, give away or sell these engraved satoshis like any other Bitcoin transaction. However, special care (sat control) must be taken in transactions to ensure that specific token satoshis are transferred correctly, as Bitcoin transactions generally do not distinguish between individual satoshis.

On-Chain Ordinals

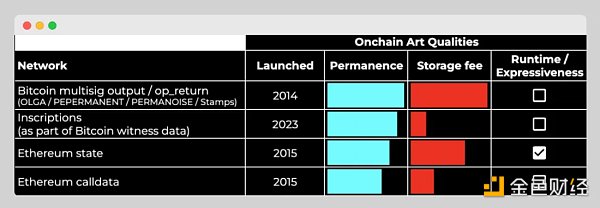

For flexibility and practicality, many NFTs on Ethereum make their art and metadata are stored off-chain, such as on a storage network such as IPFS, rather than directly on Ethereum. This is because, in addition to limited data limitations, on-chain storage on Ethereum also faces high storage costs.

In contrast, due to the way the underlying data is stored in transactions, each Ordinals is entirely on the Bitcoin blockchain, and storage costs are significantly cheaper compared to on-chain Ethereum NFTs. many. What they lack in advanced smart contract capabilities, they make up for with the best persistence-to-cost ratio in the NFT space today.

BRC-20 Explanation

The Ordinals approach has popularized the creation of 1/1 NFTs and Bitcoin-based NFT collections. However, on top of Ordinals also emerged BRC-20, an experimental unofficial fungible token standard built through inscriptions.

BRC-20 is not a smart contract-based token like Ethereum’s ERC-20, and they are not fully fungible. They are created by writing JavaScript Object Notation (JSON) text fragments into Bitcoin NFTs. This JSON contains basic information about the token, such as maximum supply and token code. For transfers or purchases, additional NFTs are burned and can be used to track balance adjustments in batches, such as 100 tokens, 500 tokens, 1,000 tokens, etc.

In recent months Come, BRC-20 tokens surge in popularity.

Rare Sats Explained

The Rare Sats emerging from the Ordinals protocol introduce a new dimension to the perception of Satoshi.

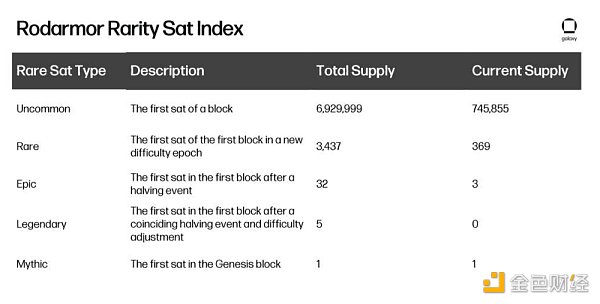

The centerpiece of understanding rare Sats is the Rodarmor Rarity Index, named after Ordinals creator Casey Rodarmor. The index divides satoshis into different categories based on their uniqueness and rarity. These categories range from the most common, which make up the majority of Bitcoin's supply, to the mysterious, which includes the first Satoshi mined in the Bitcoin genesis block.

The index also recognizes Other important categories such as Uncommon, Rare, Epic, and Legendary, each with its defining characteristics and maximum supply, are often associated with key moments in the Bitcoin timeline, such as mining difficulty adjustments and halving events.

In addition to these categories, other unique types of Sats are also of historical significance, such as Pizza Sats, Palindrome Sats, Block 9 Sats, and more, each commemorating a special moment or pattern in Bitcoin’s history. For example, Pizza Sats commemorate the first known Bitcoin transaction for a tangible commodity, while the digital symmetry of Palindrome Sats makes it interesting.

Growing interest in rare Satoshis has given rise to the practice of “Sat Hunting,” turning ordinary Satoshis into sought-after collectibles and creating one of the newest niches in the NFT ecosystem. one.

Top Ordinals Market and Wallet

To make and transfer Ordinals and BRC-20, you need a wallet that can recognize and manage Satoshis. Some popular wallets in this regard include:

Xverse – “Bitcoin wallet for everyone”;

Leather – “Enter the Bitcoin economy”;

OKX — "Your Web3 Portal".

Once you have your wallet ready, you can start browsing the popular Ordinals marketplace to see if any NFT listings or BRC-20s catch your eye. Some of the largest markets include OKX’s Ordinals Market, Magic Eden, and Gamma.

Ordinals adoption

In 2023, after Casey Rodarmor launched the Ordinals protocol , the Bitcoin community began to respond to the surge in Bitcoin NFT minting. The Ordinals protocol popularized a method of converting individual satoshis (the smallest Bitcoin denomination) into NFTs.

It’s worth noting that Ordinals has been derided by some “conservative” hardline Bitcoin supporters, in line with 2014 when some of these same people objected that Bitcoin-based counterparty NFTs were spam way is no different. What is their argument? Bitcoin should always only be used for payments.

By contrast, both Counterparty veterans and new creative experimenters have praised Ordinals’ approach as potentially revolutionary for Bitcoin’s future NFT scene. Most importantly, these new NFTs are driving up transaction fee revenue for Bitcoin miners, pointing the way for future NFT activity to help replace Bitcoin’s ever-dwindling block subsidy.

Controversy over Ordinals

The introduction of Ordinals not only diversified Bitcoin’s use cases; Debate over the fundamental nature of Bitcoin. While some traditionalists advocate retaining Bitcoin's original purpose as a payment system, a growing faction sees these developments as a natural evolution of the network's capabilities, providing new avenues for creativity and financial opportunity.

The Ordinals protocol has proven to be a legitimate game-changer in the NFT space by enabling on-chain storage of multiple data types at a relatively low cost compared to Ethereum. It challenges preconceived notions of what the Bitcoin blockchain can achieve, extending its utility beyond simple monetary transactions.

This innovation is not without its challenges, however. The surge in Bitcoin NFT minting, especially with the popularity of BRC-20 tokens and the practice of “Sat Hunting,” has led to increased network congestion. This phenomenon has raised concerns about Bitcoin L1’s scalability and efficiency as it forays into new areas of digital asset creation and management.

Looking ahead, ongoing discussions around network congestion, transaction fees, and the role of NFTs in the Bitcoin ecosystem may determine the future direction of the network. As such, progress in the Ordinals space and its impact on Bitcoin and the broader cryptoeconomy are worth keeping an eye on.

JinseFinance

JinseFinance

JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance Davin

Davin Beincrypto

Beincrypto Coindesk

Coindesk Bitcoinist

Bitcoinist