Author: Qin Jin

On February 6, Bitcoin’s biggest advocate, Michael Saylor Microstrategy, a listed company led by ), released its fourth quarter financial report for 2023.

This financial report has two distinctive features. It's worth focusing on. First of all, in its fourth quarter financial report, MicroStrategy characterized itself as “the world’s first Bitcoin development company,” which is rare in history. Because in the history of Bitcoin, there has never been a company dedicated to developing Bitcoin. Bitcoin Core organizes individual developers in the form of DAO to develop and maintain the Bitcoin network, and there have never been corporate developers. Since Bitcoin will continue to advance on the road of future evolution, many unconventional historical events will appear or be created that may be difficult for us ordinary people to understand.

Looking now, micro-strategy is an unconventional existence. MicroStrategy stated that we are a publicly listed company committed to the continued development of the Bitcoin network through our activities in capital markets, advocacy capabilities and technological innovation. It is rare in history to develop the Bitcoin network in the form of a company.

In addition, MicroStrategy also stated that we also develop and provide industry-leading artificial intelligence-driven enterprise business intelligence software to promote our vision of realizing intelligence everywhere, and are leveraging our intelligent software development capabilities to develop Bitcoin applications . We believe the combination of our operating structure, Bitcoin strategy and focus on technological innovation provides a unique opportunity to create value.

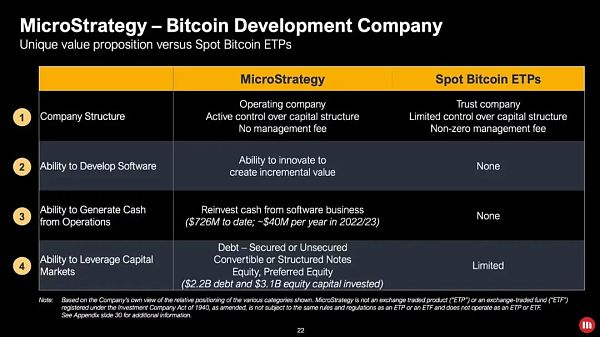

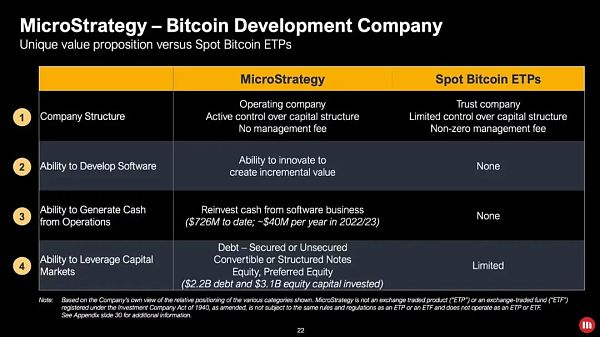

Secondly, in the fourth quarter financial report, MicroStrategy also compared itself with Bitcoin ETF to reflect its "unique value" claim”. You must know that Bitcoin spot ETF is a securities product approved by the US SEC and publicly traded in the capital market in a compliant manner. And what does the micro strategy compare with the 11 Bitcoin spot ETFs including BlackRock? The answer is, their stock MSTR. The relationship between MSTR and the BTC held by MicroStrategy is somewhat similar to the relationship between IBIT and the BTC held by BlackRock. At first, Wall Street was fascinated by the story. Put it this way, I don’t know if you understand it or not.

In response to the question of whether investors who want to allocate Bitcoin should choose ETF or MSTR, MicroStrategy also tried to prove that it is better in its fourth quarter financial report. choose.

Micro-strategy gives three benefits of configuring MSTR. The first is that investors who purchase MSTR can actively control the capital structure. The second is that the company has the ability to innovate value, while the ETF just holds crypto assets. The third is the difference in management fees. Fourth, micro-strategy companies’ ability to generate cash and tap capital markets for attractive debt transactions.

Some analysts said that relative to Bitcoin spot ETFs, micro-strategy stock MSTR continues to provide many important benefits to investors who want exposure to Bitcoin.

We know that MicroStrategy is the first listed company in the world to begin to reserve Bitcoin in a compliant manner in the capital market. It has been 4 years now, and in terms of seniority in the history of Wall Street institutions buying Bitcoin, MicroStrategy may be ranked ahead of BlackRock and Fidelity. What is reflected behind this decision is the courage and strategic vision of the company's founder. As can be seen from their fourth quarter financial report this year, this courage and strategy will continue to be implemented.

For example, MicroStrategy stated in the financial report that as a listed company, we are able to use cash flow and proceeds from equity and debt financing to accumulate Bitcoin. It is our main financial reserve asset. Since the end of the third quarter, the company purchased 31,755 Bitcoins for $1.25 billion, or $39,411 per Bitcoin. On February 6, Michael Saylor, founder and chairman of MicroStrategy, posted that he purchased 850 Bitcoins in January 2024 for $37.2 million.

MicroStrategy was founded in 1989 and has a history of 35 years. Before 2020, I had been engaged in software consulting business. In July 2020, it began to explore the purchase of alternative assets such as Bitcoin. As of February 6, 2024, the company already held 190,000 Bitcoins, worth more than $8 billion.

In 2023, the price of Bitcoin surged, benefiting from the close relationship between company stocks and the company's reserves of Bitcoin. The company's stock MSTR soared 337%. It became one of the biggest gains among U.S. companies valued at $5 billion or more, outpacing Nvidia's 234% gain and Meta's 194% surge at the time.

Before the U.S. SEC approved the Bitcoin spot ETF, to a certain extent, MicroStrategy’s stock MSTR was another compliant Bitcoin. Mapping securities products. However, after the U.S. SEC approved 11 Bitcoin spot ETFs, the company's stock price was somewhat affected. Even when the price of Bitcoin was basically flat, it has fallen 22% so far in 2024. Bitcoin is up 4% this year. This is also an important reason why MicroStrategy’s financial report performance in the fourth quarter of 2023 was lower than expected.

According to MicroStrategy’s fourth quarter 2023 financial report, the company’s total revenue in the fourth quarter of 2023 was US$124.5 million, which was the same as in the fourth quarter of 2022. The year-on-year decrease was 6.1%, or 7.8% at non-GAAP constant exchange rates. Gross profit in the fourth quarter of 2023 was US$96.3 million, with a gross profit margin of 77.3%, compared with US$105.8 million in the fourth quarter of 2022, with a gross profit margin of 79.8%.

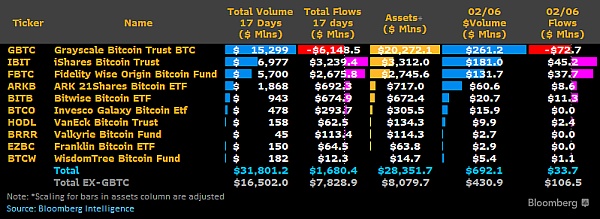

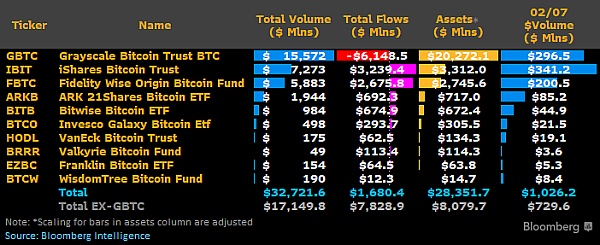

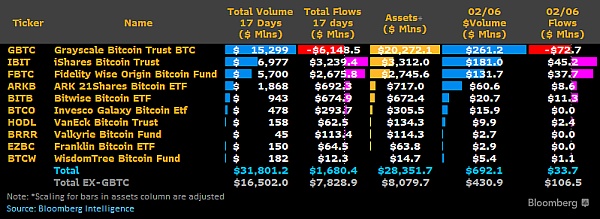

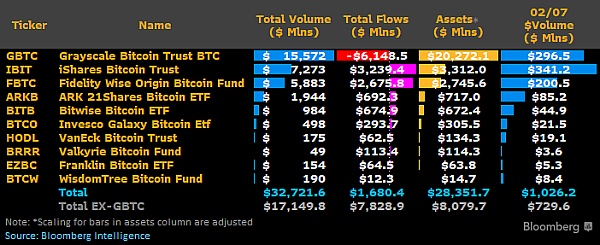

Financial report performance is lower than market expectations, which is usually a concrete manifestation of some problems in the company. I think the performance of various amazing investors after the adoption of the Bitcoin spot ETF is one of the important reasons. According to the latest data provided by Bloomberg analysts, within 17 trading days since the launch of the Bitcoin ETF, its trading volume has reached $31.8 billion. Today’s Bitcoin spot ETF trading volume has exceeded US$1 billion.

So micro-strategy Bitcoin strategy in Bitcoin ETF Under the influence, can it continue to help the company's stock MTSR continue to create new stories?

However, while MicroStrategy has proven that its stock MTSR has advantages over Bitcoin ETFs, they are also beginning to implement new strategic initiatives. That is, transforming the company into a Bitcoin development company. This move will position the company to differentiate itself from Bitcoin ETFs, create cash flow, and allow MicroStrategy to more actively develop and invest in Bitcoin products and companies.

As for whether this strategic move is effective, we will leave it to time to answer.

JinseFinance

JinseFinance