Author: GMF Research; Source: Tantu Macro

Editor's Note: On May 21, 2025, the Senate passed the procedural motion of the GENIUS Stablecoin Act by 69:31, entering the stage of plenary debate and amendment. This is the first comprehensive federal regulatory bill for stablecoins in U.S. history, marking a key step in stablecoin legislation. Interestingly, the launch of this stablecoin bill coincided with the poor demand for U.S. Treasuries and the continued rise in long-term interest rates. Some bond investors have high hopes for the bill, believing that the growth of the scale of stablecoins will bring new demand for U.S. Treasuries, thereby easing U.S. debt pressure. What is a stablecoin? What is its relationship with U.S. Treasuries? Can stablecoins (bills) save U.S. Treasuries? In this article, we try to answer these questions.

1. What is a stablecoin?

In simple terms, a stablecoin is a cryptocurrency. The most obvious difference between it and Bitcoin and Ethereum is that it maintains the relative stability of its value by anchoring to legal tender (mainly the US dollar).

Stablecoins are not "natives" of the blockchain. Each blockchain (such as the Bitcoin chain and the Ethereum chain) usually has only one "native token", such as Bitcoin (BTC) or Ethereum (ETH). Stablecoins are "derivative tokens" added to the blockchain by developers by writing code (usually smart contracts, such as Ethereum's ERC-20 standard). They are like a new plug-in for the blockchain to achieve the function of anchoring legal tender. At present, about 50% of stablecoins are deployed on the Ethereum public chain, but more and more stablecoins are migrating to other smart public chains such as Solana and Tron. As of May 2025, the total size of stablecoins is about US$240 billion, accounting for 7% of the entire crypto asset market, of which about 80-85% are denominated in US dollars.

Why do cryptocurrency investors need stablecoins? The answer is to facilitate transactions and value storage on the blockchain. The fiat price fluctuations of Bitcoin and Ethereum are comparable to roller coasters, with an annualized volatility of up to 100%. In comparison, the S&P 500 index is only 20%, gold is 18%, and crude oil is around 40%. This sharp fluctuation makes them more like risky assets for speculation rather than stable currencies for storing value, trading or pricing. The emergence of stablecoins is to solve this problem: it is pegged 1:1 to the US dollar and is on the blockchain, so it is easier to quickly convert between crypto assets than bank deposits, connecting the on-chain and off-chain markets. If the US dollar is the "vehicle currency" in the traditional financial field, then stablecoins are the "vehicle currency" in the world of crypto assets.

Stablecoins are not always stable, and they are highly dependent on the stabilization mechanism of the stablecoin. Sorted from high to low by currency value stability and market size, stablecoins are roughly divided into three types: Off-Chain Collateralized (about 90%) with traditional financial assets as collateral, On-Chain Collateralized (about 6%) with on-chain cryptocurrencies as collateral, and Algorithmic (about 2%) that almost entirely rely on algorithms to maintain currency value stability. Of these three types of stablecoins, the one that is most closely linked to the traditional financial market and is also the main target of the US Stablecoin Act this time is the off-chain collateralized stablecoin.

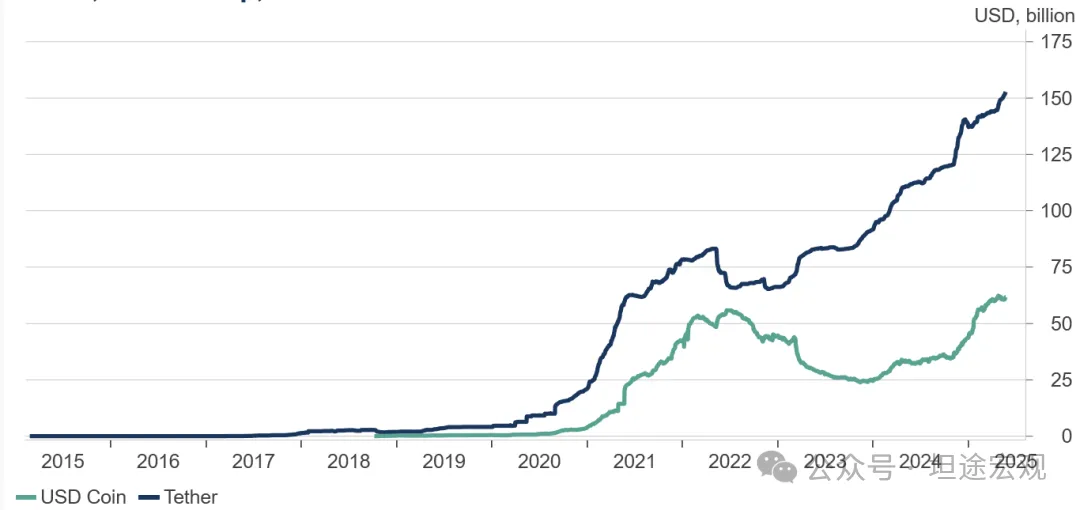

In simple terms, off-chain collateralized stablecoins are stablecoins backed by the "real money" of the traditional financial market, and their essence is a money market fund on the blockchain. The asset side of its issuer mainly holds highly secure and liquid traditional financial assets (such as bank deposits, short-term government bonds, and commercial bills) to ensure the stability of the fiat currency value. From the perspective of the stabilization mechanism, since stablecoin holders can always redeem the corresponding amount of fiat currency from the issuer on demand, the price of stablecoins in the secondary market will not deviate significantly from $1, otherwise arbitrage will occur. Of course, in reality, these stablecoins have certain redemption thresholds, so it is not a perfect arbitrage. The most famous representative of off-chain collateral stablecoins is USDT issued by Tether, which was born in 2014 and has a total market value of up to 150 billion US dollars by May 2025 (that is, 150 billion USDT in circulation). In addition to USDT, other large-scale off-chain collateral stablecoins include USDC issued by Circle, which currently has a market value of approximately 60 billion US dollars (Figure 1).

Figure 1: USDT and USDC scale

Source: Macrobond, GMF Research

2. What is the US Stablecoin Act?

Stablecoins are very similar to currencies or even a type of currency, but they are outside of regulation, and their rapid development implies several layers of financial stability risks.

The first is the risk of bank runs and asset fire-sales. Roughly speaking, stablecoins are the "shadow banks" of the current cryptocurrency system - they perform the functions of liquidity transform, maturity transform, and credit transform, but they do not have a deposit insurance mechanism, nor can they obtain liquidity support from the central bank like banks, and there is an obvious risk of bank runs. Gorton and Zhang (2021) compared the current stablecoins to the free banking era of the 19th century, arguing that stablecoins, like private banknotes, do not meet the information-insensitive characteristics of "no questions asked". Once a stablecoin encounters a large-scale run, it will inevitably sell its traditional world financial assets such as corporate bonds and commercial paper, and panic may even trigger a run on the traditional money market fund market. For example, after Lehman went bankrupt on September 15, 2008, Reserve Primary Fund, one of the largest money market funds in the United States, broke the buck due to its holdings of commercial paper issued by Lehman, which subsequently triggered a full run on U.S. money market funds. Similarly, USDC was briefly decoupled to $0.95 in 2023 due to the Silicon Valley Bank crisis, but fortunately the U.S. Treasury and the Federal Reserve took timely action to ensure that all deposits of Silicon Valley Bank were fully redeemed. Second, it may lead to deposit relocation and financial disintermediation. The interest on stablecoin deposits (pledges) on some blockchain platforms is much higher than the interest on bank deposits or money market funds in the real economy. The reason is that on the one hand, a large number of trading speculation activities on the blockchain have given rise to the demand for "borrowing and leverage", pushing up the borrowing rate of stablecoins; on the other hand, new DeFi projects are emerging in an endless stream, just like newly established banks, often choosing to offer high interest rates to "attract deposits". In the 1970s, the birth of money market funds and high interest rates in the United States triggered deposit migration and exacerbated the savings and loan crisis. The current rapid growth of stablecoins may trigger a new round of bank deposit or money market fund share losses. If decentralized finance represented by stablecoins and smart contracts develops further, it may even exacerbate the loss of business of traditional financial institutions and trigger financial disintermediation. Third, stablecoins themselves face criticism for lack of compliance and transparency. A few years ago, USDT issuance was opaque, Tether "manipulated the market", and "issued stablecoins out of thin air" were questioned (Griffin and Shams, 2020). In March 2021, Tether agreed to disclose the composition of its reserve assets every quarter after paying a fine of US$40 million. As the Bank for International Settlements (BIS) said: "Stablecoins are creating a new parallel monetary system, but their risk management mechanisms are still in the steam age."

Against this backdrop, the Senate and the House of Representatives each pushed for corresponding stablecoin bills in 2025. Among them, the Senate's GENIUS Act (Guiding and Establishing National Innovation for U.S. Stablecoins Act) is the first comprehensive federal stablecoin regulatory framework in the United States. It was proposed by Senator Bill Hagerty (Republican-Tennessee) on February 4, 2025, and was voted through on May 21 and entered the plenary debate and amendment stage. The bill requires stablecoin issuers to obtain federal or state licenses, and all stablecoins must be 100% reserved in U.S. dollars, short-term U.S. Treasury bonds or equivalent highly liquid assets to ensure 1:1 redemption. Issuers are required to disclose the composition of their reserves on a regular basis, publish monthly reports and undergo annual audits, especially issuers with a market value of more than $10 billion are subject to federal supervision. The bill also prohibits stablecoins from paying interest or income, restricts large technology companies and foreign companies from issuing stablecoins, emphasizes compliance requirements such as anti-money laundering (AML) and know your customer (KYC), and requires issuers to have the technical ability to freeze or destroy tokens to cooperate with law enforcement and national security needs. Since 1:1 reserve redemption is required, the GENIUS Act is equivalent to directly banning algorithmic stablecoins. The House of Representatives' STABLE Act (Stablecoin Transparency and Accountability for a Better Ledger Economy Act) is similar to the Senate, but focuses more on consumer protection and US dollar sovereignty.

The House of Representatives is reportedly coordinating with the Senate with the goal of passing a unified stablecoin bill before the August congressional recess.

3. What is the relationship between stablecoins and US debt?

In short, off-chain collateralized stablecoins usually hold a large amount of short-term US debt in order to maintain currency stability and cope with redemption pressure.

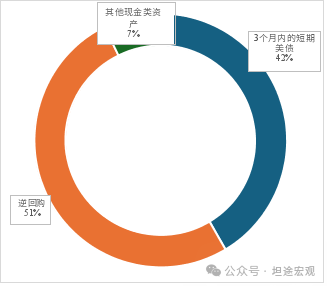

Currently, USDT and USDC hold a total of about $120 billion in short-term debt. Like money market funds, off-chain collateralized stablecoins also need to frequently respond to large inflows and redemption requests, and ensure that they can achieve "rigid redemption", which means that ultra-short-term US bonds with extremely high liquidity, security and almost no market value fluctuations are their most important holdings. According to USDT's audit report for the first quarter of 2025, about 2/3 of its total assets are short-term Treasury bonds (T-bills), with a total of about US$100 billion; 15% are cash and equivalents (repurchase, money market funds), precious metals and Bitcoin each account for 5%, and other investments account for about 10% (Figure 2). In terms of maturity, USDT clearly stated in the audit report that the remaining maturity of its US debt holdings is within 3 months. Looking at USDC, as of the end of March, about 40% of USDC's total assets were short-term U.S. Treasuries (T-bills), with a total of about US$20 billion, 50% were reverse repurchases, and the remaining 7% were cash assets (Figure 3). Similar to USDT, the U.S. Treasuries held by USDC are also short-term, and the remaining term is shorter, only 12 days. Although the reverse repurchases they issue may provide financing for other investors holding long-term U.S. Treasuries, the stablecoin itself does not directly hold any U.S. Treasuries with a term of more than one year. Figure 2: USDT asset ratio in the first quarter of 2025 Source: Tether, GMF Research Figure 3: USDC Asset ratio in the first quarter of 2025

Source: Circle, GMF Research However, due to the small size of stablecoins, the current demand for US debt in stablecoins is not worth mentioning in terms of stabilizing the selling pressure of US debts. The short-term US debt of about 120 billion accounts for only about 2% of the total size of US Tbills and 0.4% of the total size of tradable US debts. In addition, from the perspective of maturity, the US debts held by both USDT and USDC are Tbills with a duration of less than 3 months, which has no effect on alleviating the upward pressure on long-term interest rates.

Fourth, can stablecoins (bill) save US debts?

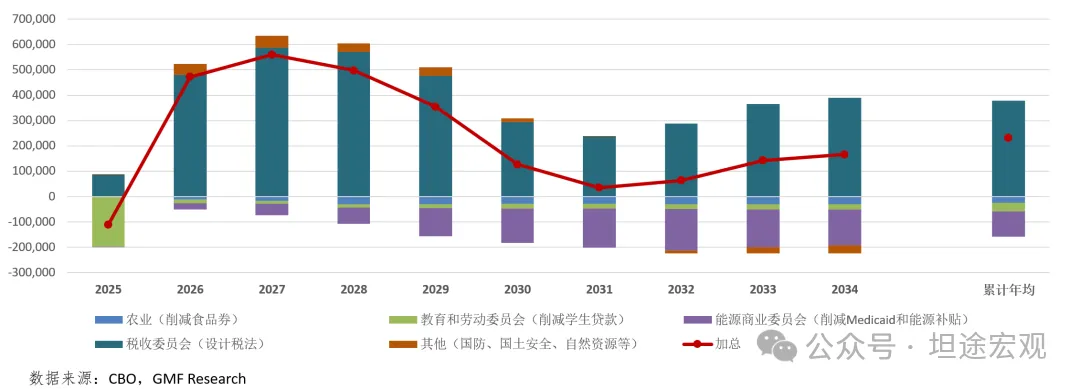

On May 22, Eastern Time, the House of Representatives officially passed the House version of Trump's tax cut bill, the Big Beautiful Bill (OBBB), with a slight advantage (215:214), and transferred it to the Senate for discussion. Although the total deficit increase in this draft over a 10-year period is not exaggerated (the cumulative deficit increase over 10 years without considering interest expenditures is 2.3 trillion US dollars), the rhythm shows the characteristics of "tax cuts in advance and spending cuts in the back" (Figure 4), that is, the main deficit growth will be in 2026-2028 (before Trump steps down). The result of this pre-emptive approach is that once the new president takes office in 2029, the budget reconciliation process may be restarted to modify the "original tightening clauses" in the following years, resulting in "the deficit has actually increased, while the tightening is only reflected in the CBO's forecast." It once again reflects the House Republicans' exploitation of loopholes in the rules and their political stance of "wanting to tighten but not daring to tighten." What's more, the fiscal stance of Senate Republicans may be more relaxed than that of the House of Representatives, and the OBBB will need to be adjusted by the Senate in the future, which poses a risk of further expanding the deficit.

Figure 4: The extent and source of the deficit increase over the years in the current House version of OBBB (CBO estimate)

In fact, since the beginning of the year, the Republicans' spending cuts and deficit reductions have always been in a state of "much ado about nothing". Neither Musk's government efficiency department, nor the aforementioned budget reconciliation bill (aimed at amending taxes and necessary spending for the next 10 years), nor the fiscal year 2025 appropriations bill (which dominates non-essential spending) have fulfilled their austerity promises, and market concerns about the sustainability of U.S. fiscal policy and the supply of U.S. debt continue to rise. At present, the only income item that can really significantly offset tax cuts still comes from tariffs. Coupled with the fading of the U.S. exceptionalism narrative, investors are actively seeking non-U.S. investment opportunities, causing long-term U.S. interest rates to fluctuate and rise since April driven by term premiums (Figure 5). "Who will buy U.S. debt" has become a topic of market concern. Against this backdrop, bond bulls have placed high hopes on this stablecoin bill, hoping to increase market demand for U.S. debt and resolve U.S. debt pressure.

Figure 5: 10-year term premium and interest rate expectations based on ACM model statistics

Source: Macrobond, GMF Research

The new bill cannot effectively increase the proportion of US Treasuries in the assets held by stablecoin issuers. Neither the GENIUS nor the STABLE Act requires stablecoins to hold only US Treasuries, but only requires them to be allocated in high-security and high-liquidity assets (similar to banks' high-quality and liquid assets, HQLA). This means that the current mainstream stablecoins USDT and USDC are likely to have basically met the asset allocation requirements of the bill - they have already allocated almost all their assets to US Treasuries, reverse repurchases and other cash and cash equivalents, and the motivation to further increase the proportion of US Treasuries is unclear.

The new bill may stimulate the growth of the stablecoin scale. From the perspective of total scale, the passage of the Stablecoin Act will mean that traditional enterprises such as banks can legally launch their own stablecoins to promote business, which may indeed lead to a steady growth in the total scale of stablecoins, but the magnitude is not easy to say. In early May, the U.S. Treasury Borrowing Advisory Committee (TBAC) made an estimate that the total scale of stablecoins will increase eightfold to 2 trillion in the next three years. Assuming that 50% of them are short-term U.S. Treasuries, it can bring about an incremental demand for U.S. Treasuries of about 1 trillion. However, TBAC estimates may overestimate the future demand for new U.S. Treasuries in stablecoins. First, stablecoins do not grow out of thin air, but are likely to come from the outflow of funds from traditional banks and money market funds. This means that the increase in demand for U.S. Treasuries by stablecoins will affect the demand for U.S. Treasuries by banks and money market funds. Second, an eight-fold increase in three years (an average annual doubling) is relatively optimistic. In the past three years, the scale of stablecoins has only increased by 70%. From mid-2020 to mid-2023, the cumulative growth of stablecoins has been about 8 times, but the background coincides with the massive easing of the Federal Reserve in 2020-2021 and the "Summer of DeFi" (explosive growth of decentralized finance). These conditions are not easy to appear in the current high inflation and high interest rate environment. Ultimately, the scale of stablecoins depends on investors' demand for DeFi activities and crypto asset transactions, rather than the introduction of regulatory policies. Third, strict regulation of the bill may lead to regulatory arbitrage. The bill requires issuers to conduct monthly audits and AML/KYC compliance, and requires them to cooperate with law enforcement at any time, which increases the cost of issuance and use, conflicts with the concept of decentralization, and may drive funds to stablecoins with loose regulation, such as on-chain collateralized stablecoins or stablecoins issued by non-US issuers, which will further weaken the demand for stablecoins for US Treasuries. The more important issue is that the demand for US Treasuries by stablecoins is concentrated on the ultra-short end, and it cannot directly alleviate the upward trend in long-term interest rates caused by the poor duration demand in the US Treasury market. In fact, from August to October 2023, the long-term US Treasury bond interest rate rose sharply due to the Treasury Department's continued issuance of medium- and long-term US Treasury bonds (coupons) with a term of more than one year. The 10-year interest rate rose from 3.8% to over 5%, highlighting the poor market duration demand. In view of this incident, the US Treasury stopped issuing coupons to the private sector after 2024 (the issuance volume remained unchanged), and all additional financing gaps were filled by Tbills. What's funny is that before taking office, US Treasury Secretary Scott Bessent publicly criticized the former Treasury Secretary Janet Yellen's continued issuance of Tbills, believing that over-reliance on short-term debt increased the Treasury's refinancing risk and suggested issuing 10-year and 30-year long-term bonds. But after he took office, he chose the same strategy and even further conveyed the message that the pace of coupon issuance will remain unchanged in the quarterly refinancing meeting (refer to the refinancing meeting in May this year). The problem of poor duration demand for US Treasury bonds can really be described as "you stomp and you'll be numb."

However, if the Ministry of Finance is willing to cooperate with the growth of the stablecoin scale and further reduce the proportion of future medium- and long-term US debt issuance, the duration problem may still have a chance to turn around. A simple estimate is that if stablecoins bring an additional 1 trillion Tbills of demand in the next three years, the Fed's balance sheet reduction ends and returns to slow expansion (mainly increasing Tbills) to bring a cumulative demand of 1 trillion Tbills (estimated based on the speed of restarting the expansion from October 2019 to the eve of the epidemic), and the incremental demand for Tbills brought by the natural growth of the money market fund scale is added, the market may be able to digest an additional 2-3 trillion Tbills, accounting for 7-10% of the total stock of tradable US debt. If Bessent is willing to make full use of these factors, then the proportion of Tbills can theoretically increase from the current 21% to more than 30%, which is significantly higher than the current TBAC recommended 15-20% range, but it does reduce the market duration supply. Of course, there is no free lunch in the world. The cost of doing so is that the amount of U.S. debt that the Treasury rolls over and matures every month will further increase significantly, and the short-term interest rate risk it bears will also increase further.

It should be noted that whether it is relying on stablecoins, choosing to issue more T-bills, or revaluing the market price of the Treasury's gold reserves of hundreds of billions, it is a short-term trade-off rather than a fundamental solution. The Treasury's technical bureaucrats have done everything they can to make a trade-off between the interest rate level and the risk of interest rate fluctuations. The real problem of the U.S. debt - as Powell, Dalio or Druckenmiller said - is that the U.S. finances are on an unsustainable path, and neither Republicans nor Democrats have the courage and willingness to actively and significantly tighten the fiscal policy. In a political environment where fiscal discipline is absent, any seemingly smart practice of postponing the debt problem is to cover up one's own mistakes and dig one's own grave.

Anais

Anais