Lido CSM - Solo Staking is always improving, and decentralization is always there.

If the vision of blockchain is to build a decentralized, permissionless and trustless network, then we all know that we have not yet achieved this goal and there is still a long way to go.

Imagine a network composed of individuals, Validators are spread all over the world, guarding the security of the Ethereum network. This "individual" does not need to be a technical expert, and does not need to get up in the middle of the night to check the disconnected client. They may be verified through their private computer or mobile phone. Maybe they don't have 32 ETH, but they also provide security for this network.

This is an ideal state.

Currently, most of Ethereum's nodes are still run by centralized large node operators, but progress has not stopped.

On July 11, 2024, Lido's CSM (Community Staking Module) testnet was officially opened. Unlike the 37 professional node operators selected by Lido in the past, this time it is permissionless.

You, me, and him, everyone can help Lido run nodes.

OAO Features and Advantages Bond - Validator's Security Deposit

CSM (Community Staking Module) is Lido's first module on Ethereum. Through this module, anyone can "borrow" ETH allocated in the Lido pool from Lido by providing a small amount of ETH-based security collateral to help it run nodes and get rewards as NOs.

Before this, Lido's node operators (NOs) were 37 professional node operators selected based on Industry Reputation. In my opinion, rather than saying that they provide node operation services for Lido, it is better to say that these 37 node operators "borrowed" all the tokens in the Lido protocol with their reputation (although they cannot fully control these funds) to earn part of the annualized return of Ethereum.

In the real financial world, similar loans, whether companies or individuals, need to pay a margin, and the amount borrowed is usually a certain multiple of the margin.

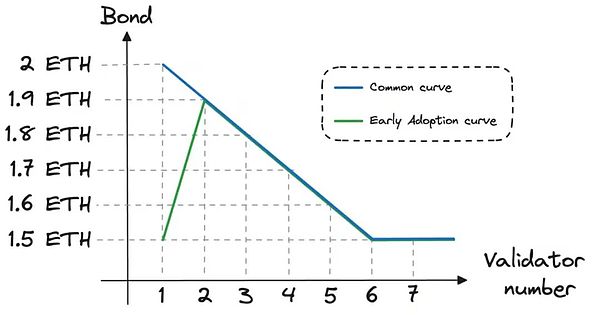

Lido's CSM innovation is that ordinary people who are capable of running nodes can also "borrow" a certain multiple of ETH from Lido's pool. The amount of the margin can cover the financial losses that may be incurred by running a node. The current margin required for the testnet is 2 to 1.5 Holesky ETH.

Note: If a NO verifies multiple validators, the required margin will also be reduced.

Lido DAO has currently decided to allocate up to 10% of the ETH in the total Lido pool to the CSM module. Independent node operators can queue up to receive Lido's allocated shares (stake allocation). In order to better identify high-quality node operators, CSM uses a dedicated oracle to monitor the performance of operators.

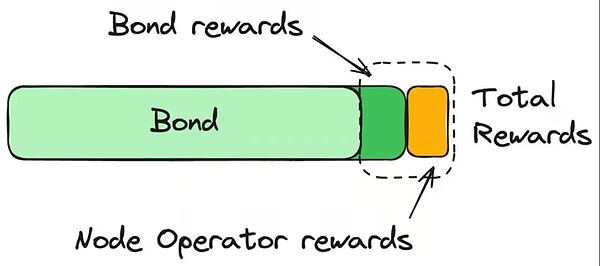

The rewards mainly come from:

The income generated by the margin pledge (capital gain) Example: 2ETH provided by an individual + the income share of the "borrowed" part of the running node (labour job) Example: 32ETH allocated by Lido

For individual NO, this is a good way to increase income. For example, 32 ETH can be split into multiple margin running nodes, thereby realizing the leverage effect in disguise.

However, any leverage behavior is inevitably accompanied by higher risks. In the single node operation (32 ETH), the possibility of confiscation of all 32 ETH is small. But if all 32 ETH are run in the form of margin, then there is a risk of confiscation of all of them when making mistakes.

The above are some views on Lido CSM. Although the market is sluggish and Ethereum seems centralized, innovation is always there.

JinseFinance

JinseFinance

JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance TheBlock

TheBlock cryptopotato

cryptopotato Coindesk

Coindesk Coindesk

Coindesk Cointelegraph

Cointelegraph Cointelegraph

Cointelegraph Cointelegraph

Cointelegraph