In the wild stage of any industry, there are always pioneers who use the early primitive stage to stir up the situation and become new billionaires. When they become new dignitaries, their lifestyles often become mysterious and luxurious, and luxury houses are the symbol of their wealth and status.

Over the years, the explosive growth of the cryptocurrency market has created a group of new wealthy people, and the bigwigs in the currency circle have accumulated huge wealth by stirring up the situation. Their wealth is not only reflected in digital wallets, but also transformed into top luxury houses in the real world. Unlike traditional financial bigwigs, the new rich in the currency circle are often younger and more daring to show their wealth, and luxury houses have become the best stage for them to show their success. From 2020 to 2025, the global luxury housing market continued to heat up due to the post-epidemic privacy needs and low inventory, and the bigwigs in the currency circle took advantage of the situation and purchased many sky-high properties. These luxury homes are not only located in prime locations and luxuriously designed, but also often have high-tech facilities, which perfectly meet the extremely high requirements of privacy and security for people in the cryptocurrency circle.

Below, we will focus on the luxury home transactions of several well-known figures in the cryptocurrency circle, sort out their prices, locations and unique features, and take you to a glimpse of their luxurious homes.

EOS founder BB: 172.8 million Italian luxury home

Brendan Blumer is the CEO of EOS parent company Block.one and chairman of Bullish. At the age of 14, he founded Gamecliff, an automated trading platform for online game virtual props. In 2010, he launched Okay.com to create a collaborative data sharing ecosystem for the Asia-Pacific real estate market, and later developed into the largest digital real estate agency in Hong Kong. In 2017, he co-founded Block.one with Dan Larimer (BM), dedicated to the research and development of blockchain technology. Since the departure of founder BM, the core team of Block.one is almost entirely composed of BB's people.

In March 2025, Italian media L'Union Sarda reported that he bought the Romazzino villa for a record 160 million euros (about 172.8 million US dollars). Excluding Villa Certosa, this transaction is the highest transaction in the history of real estate in Sardinia and even Italy. This villa in Romazzino is one of the most luxurious mansions on the Costa Smeralda. It was formerly the home of Ahmed Zaki Yamani, the former Saudi oil minister.

The mansion has 350 meters of coastline and covers an area of 2.3 hectares. It has 28 bedrooms, 35 bathrooms, spacious terraces, two private beach entrances, two exclusive docks, three swimming pools, and about 23,000 square meters of gardens and supporting facilities.

Maji Da Ge: $25 million Los Angeles mansion

Huang Licheng, also known as "Maji Da Ge", is a former rapper and technology entrepreneur. Huang Licheng became famous in 1991 as a founding member of the pop/rap trio LA Boyz. LA Boyz was active in the early to late 90s, released 13 albums and became popular in Asia, and finally disbanded in 1997. After the success of LA Boyz, Huang Licheng founded the hip-hop group "Machi" in 2003 and achieved success again. In 2017, Huang Licheng and Mithril began to get involved in the cryptocurrency field. "Machi Brother" is one of the earliest NFT players with a certain trading scale and is also a big BAYC user. Their trading frequency, NFT holdings, and selling prices will have a certain impact on the NFT trading market and the floor price of blue-chip NFTs such as BAYC.

In June 2023, Huang Licheng purchased a mansion in the famous Bird Streets community in Los Angeles for US$25 million. This luxury villa has a spacious space of 14,000 square feet and has facilities such as a wine room, a marble bar and a large gym. It has 5 bedrooms and 8 bathrooms.

This mansion in Bird Streets was originally listed for sale at a price of US$34 million and was just completed in early 2022. But according to the photos, Maji bought it a year later at a price about 75% lower than the asking price. He became neighbors with other celebrities such as Hon Hai Group founder Terry Gou, the Winklevoss brothers, and LVMH Group CEO Bernard Arnault. Coinbase CEO: 133 million Los Angeles mansion Brian Armstrong is the co-founder and CEO of Coinbase in the United States. He worked at IBM, Deloitte and Airbnb in his early years and accumulated experience in software development and payment systems. After being exposed to the Bitcoin white paper in 2010, he became interested in cryptocurrencies and co-founded Coinbase with former Goldman Sachs trader Fred Ehrsam in 2012. Armstrong led Coinbase to become the largest crypto exchange in the United States. In April 2021, it went public directly, and its market value once reached 100 billion US dollars. In 2024, Forbes estimated his net worth at $11.2 billion, ranking second on the Crypto Rich List.

The villa cost $133 million. The mansion located at 10671 Chalon Road, Los Angeles, CA 90077 not only covers nearly five acres, but also includes a 19,000-square-foot main house and a 6,600-square-foot guest house with at least 10 bedrooms and 13 bathrooms. The estate is fully equipped with facilities, including tennis courts, two swimming pools, a motor court, a home theater, and a spa and gym.

The villa was designed by the highly respected British architect John Pawson, known for his signature minimalist aesthetic. The villa is designed with a "stacked cube" structure, large glass walls and simple interior decoration with spacious oak furniture, creating a modern and comfortable living environment. The villa originally belonged to Hideki Tomita, the founder of the Japanese job search agency Dip Corporation, who purchased the property in 2018 for $85 million and later sold it to Armstrong for $133 million. The transaction is considered one of the most expensive single-family home transactions in Los Angeles history.

SBF: Spent more than $240 million to buy more than 30 luxury homes

FTX founder Sam Bankman-Fried (SBF) quickly created FTX with his deep insight into the crypto market, and once developed it into the world's top cryptocurrency trading platform. However, at the end of 2022, FTX suddenly collapsed, attracting global attention. SBF was arrested on charges of misappropriation of customer funds and fraud, becoming one of the most controversial figures in the crypto industry. After the collapse of FTX in 2022, SBF's mansion was listed as a bankruptcy liquidation asset and sold at a significant discount in 2023.

In June 2023, FTX creditors issued a report stating that SBF abused customer deposits and spent more than $240 million in two years to purchase more than 30 multi-million dollar mansions in the Bahamas for employees, friends and family, including spending $30 million to purchase a property called "Albany Orchid Penthouse" and "Old Fort Bay Lot A" worth $16 million.

Orchid Penthouse is an 11,500-square-foot penthouse with 6 bedrooms, more than 6 bathrooms, and a value of $30 million. SBF lived here with former FTX engineering chief Nishad Singh, co-founder Gary Wang, Ellison and other FTX Group colleagues before FTX collapsed. The most outstanding feature of this penthouse, one of only nine ultra-luxury residences, is the arched filigree screen that runs the entire length of the penthouse's wraparound terrace. The mansion features Venetian plaster walls, Italian marble accents and German engineered doors and windows, and high-tech aspects include a comprehensive home automation system and a security-coded private elevator.

In addition, there are curved glass walls and a marble bar, and the interior also has a combined living room, dining room, family room, library, office. In addition to the master suite, there are four en-suite guest bedrooms. The master suite has dual bathrooms, dual walk-in closets and a private balcony with a private spa. Off the living and dining room, on a large terrace, there is a mosaic-tiled spa.

Curve CEO: $59.25 million for two luxury homes in Australia

Michael Egorov is the co-founder and CEO of Curve Finance, the leading decentralized stablecoin trading platform on Ethereum, known for its efficient, low-slippage automated market maker mechanism (AMM). Born in Russia, Egorov has a PhD in physics and worked on quantum computing and encryption technology in his early years. He worked as a technical lead on the NuCypher project before moving to the DeFi space, working to solve the problem of efficient exchange between stablecoins. Since Curve was launched in 2020, the platform has quickly become an important part of DeFi infrastructure. Although Egorov himself is extremely low-key, his influence in the DeFi community is far-reaching and he has repeatedly caused controversy due to his centralized control over protocol governance.

In May 2023, when Anna Egorova was revealed as the buyer of Avon Court, a luxury home worth A$41 million in Melbourne, she set a record for the highest real estate transaction in Victoria so far this year. But this is not the first time that the CEO of decentralized crypto protocol Curve Finance and the partner of crypto mogul Michael Egorov has made a big move in the Melbourne luxury home market. Property records around Shakespeare Grove in the high-end area of Hawthorn show that the Russian-born couple already owns the house next door to Avon Court. Avon Court was built in 1890 on 4251 square meters of land. This landmark four-story Victorian mansion is equipped with an elevator connection and has a total of nine bedrooms, seven bathrooms, a gym, a steam room, two swimming pools, a playground, a mini football field, a basement garage that can accommodate ten cars, and six kitchens.

Records show that they bought this Italian-style two-story five-bedroom mansion-Verona with a land area of 1412 square meters for A$18.25 million in March 2022. The couple’s total land holdings in the area have grown to a staggering 5,663 square metres. This isn’t the first time a crypto generalist has scouted out a chunk of land in Melbourne’s top postcodes. Prior to this, crypto casino founder Ed Craven paid $80 million for a run-down mansion on 7,187 square metres of land on St Georges Road in Toorak.

Li Lin, founder of Huobi: Hong Kong luxury house worth over HK$1 billion

Li Lin is one of the founders of Huobi.com and one of the earliest entrepreneurs in China to enter the field of cryptocurrency. He holds a bachelor's degree in automation from Tsinghua University and a master's degree from the Institute of Automation of the Chinese Academy of Sciences. In 2013, Li Lin founded Huobi.com and built it into one of the world's leading crypto asset trading platforms. Later, he sold Huobi to Justin Sun and got out of it unscathed.

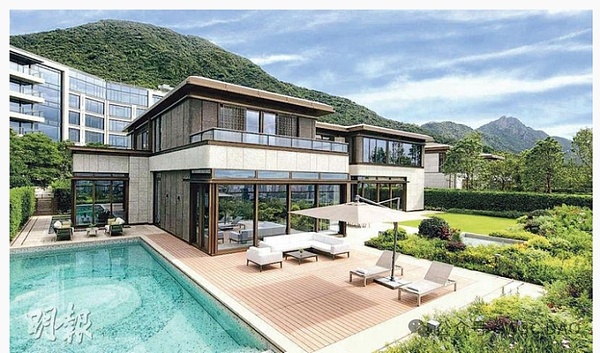

In August 2023, according to Wu Shuo, the largest first-hand housing estate in Kowloon, Hong Kong, Courtyard Villa C at Lung Kui Road Tiwai in Mid-Levels, has been purchased by Huobi founder Li Lin. Ming Pao reported that the property is sold in a rent-to-own format and can be leased for 90 months, or about 7 and a half years, starting from the 1st of this month. After completing the 7 and a half years of lease, there is a 3-month renewal right, after which the unit can be purchased, with a subscription price of HK$1 billion, based on a usable area of 11,692 square feet, at a discounted price of HK$85,529 per square foot. If the final buyer exercises the 1 billion yuan subscription right, the transaction price may become a new record for first-hand housing estate-style houses in Kowloon.

Summary

The mansion craze of the bigwigs in the cryptocurrency circle is not only a reflection of personal wealth, but also reflects the changes in the cryptocurrency industry. The crypto bull market from 2020 to 2022 made many people rich overnight, and luxury home transactions surged. However, the collapse of platforms such as FTX in 2022 also turned the mansions of some bigwigs into liquidation assets. The craze for buying luxury homes in the cryptocurrency circle may cool down, but the appeal of top luxury homes will not disappear. In 2023, global luxury home prices will rise twice as fast as non-luxury homes, and scarcity and low inventory will continue to push up prices. For the new rich in the cryptocurrency circle, luxury homes are not only a symbol of wealth, but also a way for them to establish their status in the traditional world.

Miyuki

Miyuki

Miyuki

Miyuki Alex

Alex Miyuki

Miyuki Weiliang

Weiliang Alex

Alex Miyuki

Miyuki Weiliang

Weiliang Alex

Alex Miyuki

Miyuki Weiliang

Weiliang