Author: Mike Giampapa Source: Galaxy Ventures Translation: Shan Ouba, Golden Finance

While payments were the primary use case highlighted in the original Bitcoin whitepaper in 2008, recent developments over the past few years have made blockchain-based payments increasingly viable, not to mention preferable to traditional payment methods. Billions of dollars have been invested over the past decade to develop the underlying blockchain infrastructure, and we now have systems that can operate at "payments scale."

Blockchain is on a "Moore's Law"-like cost and performance curve, and the cost of storing data on a blockchain has dropped by several orders of magnitude over the past few years. Following Ethereum’s Dencun upgrade (EIP-4844), layer 2 environments such as Arbitrum & Optimism have a median per-transaction cost of ~$0.01, while modern alternative layer 1s are rapidly approaching fractions of a penny.

In addition to more performant, cost-effective infrastructure, the rise of stablecoins has been explosive and persistent, and is clearly a long-term trend in the otherwise volatile cryptocurrency industry. Visa’s recently launched public-facing stablecoin dashboard (Visa Onchain Analytics) provides a glimpse into this growth and shows how stablecoins and the underlying blockchain infrastructure can be used to facilitate global payments. Stablecoin transaction volume across the market has increased by ~3.5x year-over-year. When focusing on transaction volume that appears to be initiated directly by consumers and businesses (excluding automated transactions or smart contract operations), Visa estimates stablecoin transaction volume to be ~$265 billion over the past 30 days (~$3.2 trillion annualized run rate). To put this into perspective, this is about 2x PayPal’s 2023 payment volume (from the 2024 annual report) and roughly the same as the GDP of India or the UK. We’ve spent a lot of time digging into the underlying drivers of this growth and firmly believe that blockchain has great potential to be the future of payments. Payments Industry Context In order to grasp the fundamental drivers of growth in the crypto payments market, we must first understand some historical context. The payments infrastructure we use today in the United States and internationally (e.g., ACH, SWIFT) was established more than 50 years ago in the 1970s. The ability to send money around the world was a groundbreaking achievement and a milestone in the financial world.

However, the global payments infrastructure is now largely outdated, analog, and fragmented. It is an expensive and inefficient system that operates within limited banking hours and relies on many intermediaries. One of the notable problems with the current payments infrastructure is the lack of global standards. Fragmentation impedes seamless international transactions and introduces complexity to establishing consistent protocols.

The emergence of real-time settlement systems has been a major advancement in recent years. The international success of real-time payment schemes such as India's UPI and Brazil's PIX is well documented. In the United States, government and consortium-led efforts have introduced real-time settlement systems such as the Clearing House's Same Day ACH, RTP, and the Federal Reserve's FedNow. Adoption of these new payment methods has been slow, and the fragmentation between many competing interests has created significant challenges.

Fintechs attempt to offer user experience improvements on top of this legacy infrastructure. For example, players such as Wise, Nium, and Thunes enable clients to pool liquidity across accounts around the world so that transactions feel instantaneous to the user. However, they do not correct for the limitations of the underlying payment rails, nor are they capital-efficient solutions.

The Complexity of Today’s Payments

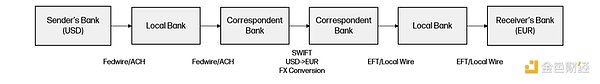

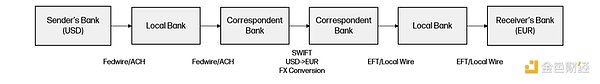

Given the fragmented nature of the existing financial system, payment transactions are becoming increasingly complex. This situation is perhaps best illustrated by the anatomy of a cross-border payment transaction, which contains many pain points:

Multiple intermediaries:Cross-border payments often involve multiple intermediaries, such as local and correspondent banks, clearing houses, foreign exchange brokers, and payment networks. Each intermediary adds complexity to the transaction process, leading to delays and increased costs.

Lack of standardization:The lack of standardized processes and formats can lead to inefficiencies. Different countries and financial institutions may have different regulatory requirements, payment systems, and messaging standards, making it challenging to streamline payments.

Manual processing:Legacy systems lack automation, real-time processing capabilities, and interoperability with other systems, leading to delays and manual intervention.

Lack of transparency:The opacity of the cross-border payments process can lead to inefficiencies. Limited visibility into transaction status, processing times, and associated fees can make it difficult for businesses to track and reconcile payments, leading to delays and administrative overhead.

High costs:Cross-border payments often incur high transaction fees, exchange rate markups, and intermediary fees.

It is not uncommon for cross-border payments to take up to 5 business days to settleandaverage fees of 6.25%. Despite these challenges, the market size for B2B cross-border payments remains huge and will only continue to grow. FXC Intelligence estimates the total market size for B2B cross-border payments to be $39T in 2023 and is expected to grow 43% to $53T by 2030.

It is clear that real-time settlement is urgently needed, and a global, unified payment standard does not yet exist. There is a solution that is available to everyone and can instantly and cheaply transfer value around the world - blockchain.

Crypto Payment Adoption

Stablecoin-enabled payments offer an ideal solution to current challenges in areas such as cross-border payments, and stablecoins are experiencing long-term growth around the world. As of May 2024, the total stablecoin supply is approximately $161B. USDT and USDC represent the third and sixth largest crypto assets by market cap, respectively. While they collectively account for approximately 6% of the total cryptocurrency market cap, they also represent approximately 60% of on-chain transaction value.

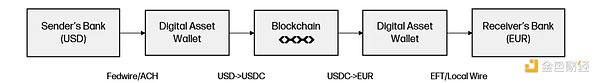

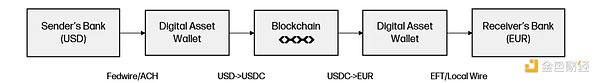

Recalling our cross-border payments example, the streamlined money flows provided by blockchain rails offer an elegant solution to the complexity that exists in the status quo:

Near-Instant Settlement: Compared to most traditional financial payment methods that take days to settle, blockchain rails can settle transactions nearly instantly around the world.

Reduced Costs: Due to the elimination of various intermediaries and superior technical infrastructure, crypto payments can significantly reduce costs compared to existing products.

Higher visibility:Blockchain provides a higher level of visibility as it relates to tracking the movement of funds and alleviating the administrative overhead of reconciliation.

Global standards:Blockchain provides a “high-speed rail” that is easily accessible to anyone with an internet connection.

By using stablecoin rails, payments can be greatly simplified in terms of the number of intermediaries involved. As a result, there is real-time visibility into the movement of funds, faster settlement times, and significantly lower costs compared to traditional payment methods.

Overview of the Crypto Payment Stack

When we look at the crypto payment market, there are four main layers of the stack:

Settlement Layer

The underlying blockchain infrastructure that settles transactions. Layer1 blockchains like Bitcoin, Ethereum, and Solana, as well as general-purpose Layer2 environments like Optimism and Arbitrum, are all selling block space to the market. They compete on multiple fronts, including speed, cost, scalability, security, distribution, etc. We expect the payments use case to become a heavy consumer of the blockchain space over time.

Asset Issuers

Asset issuers are entities responsible for the creation, maintenance, and redemption of stablecoins, which are crypto assets designed to maintain a stable value relative to a reference asset or basket of assets, most typically the U.S. dollar. Stablecoin issuers typically have a balance sheet driven business model, similar to banks, where they take customer deposits and invest them in higher yielding assets such as U.S. Treasuries, then issue stablecoins as liabilities, profiting from the interest spread or net interest margin.

On/Off Ramps

On/Off Ramps providers play a key role in increasing the usability and adoption of stablecoins as a primary mechanism for financial transactions. Fundamentally, they act as a technology layer that stitches together stablecoins on the blockchain with fiat rails and bank accounts. Their business models tend to be flow driven, and they take a small cut of the dollar amount that flows through their platform.

Interfaces/Applications

Front-end applications are ultimately the customer-facing software in the crypto payments stack that provides a user interface for crypto payments and leverages the rest of the stack to enable such transactions. Their business models vary, but are often a combination of platform fees plus some traffic-driven front-end transaction volume fees.

Emerging Trends in Crypto Payments

There are a number of trends we’re excited about at the intersection of cryptocurrencies and payments:

Cross-border payments are the first battleground

As mentioned above, cross-border transactions are often the most complex, inefficient, and costly, with a large number of intermediaries collecting rents along the way. It’s perhaps not surprising, then, that we’ve seen the most organic uptake of blockchain-based alternative payment solutions in the market. Providers supporting B2B payments (payments to suppliers and employees, corporate treasury management, etc.) and remittance use cases have gained strong traction in the market.

We see cross-border payments as being similar to logistics, where the “last mile” (on-ramp and off-ramp between fiat <> crypto) is particularly difficult to navigate. This is where businesses like Layer2 Financial* provide real value, as they do the heavy lifting of integrating with the various crypto and fiat partners on the backend (blockchains, custodians, exchanges/liquidity providers, banks, traditional payment rails, etc.) and provide a seamless and compliant experience for their customers. Layer2 also helps facilitate the highest speed/lowest cost transaction routes and is able to settle the entire lifecycle of a cross-border payment using crypto rails in as fast as ~90 minutes, 1-2 orders of magnitude faster than existing solutions.

Given the cost and efficiency gains, we are seeing adoption across all regions and end customers, crypto natives and traditional businesses. There is a particular need in regions where fiat currencies are less stable and USD is difficult to access. Africa and Latin America have been hotbeds of startup activity for these reasons. For example, Mural* has seen great success helping clients facilitate supplier and developer contractor payments between the US and Latin America.

Early Days of Supporting Payments-Grade Infrastructure

Most of the market infrastructure around the crypto ecosystem (e.g., custody platforms, key management systems, liquidity venues) was primarily built for retail trading as the primary use case. Over the years, this technology has matured to include more enterprise/institutional-grade software and services, but typically the infrastructure was not built to support real-time and scale for payments.

We see opportunities for new entrants and existing providers to launch/expand their offerings to capture this emerging use case. For example, new custody/key management systems such as Turnkey* improve transaction signing by ~2 orders of magnitude, achieving 50-100ms signing latency for millions of wallets. They also enable firms to design strategies around asset operations for increased automation and process scalability.

Liquidity partners are also restructuring their offerings to provide more frequent (ideally real-time) settlement capabilities for entry/exit providers. More automation is being adopted across the board, which will provide a more superior experience for end users.

On-chain yields will be a game changer

The issuance of digital fiat currencies on the blockchain is the first instantiation of a broader tokenization trend. As mentioned above, we have seen significant growth in stablecoin adoption, a fact that further underscores the inability of holders of these assets to earn a yield on their holdings (versus 4-5% on US Treasuries).

Tether and USDC dominate the stablecoin landscape today, accounting for over 90% of the ~160B USD stablecoin market. Recently, we have seen a flurry of new entrants offering on-chain yields in different forms. Stablecoin issuers such as Agora*, Mountain, and Midas are offering USD-pegged, yield-generating assets/programs that provide yields/rewards to holders. We have also seen companies such as BlackRock, Franklin Templeton, Hashnote, and Superstate create a number of tokenized US Treasury products that offer on-chain yields. Finally, we are seeing creative tokenized structures like Ethena* offering a synthetic asset pegged to the dollar that uses an ETH base transaction to provide on-chain yield.

Broadly speaking, we expect these new assets to be a huge catalyst for the expansion of on-chain finance. A market for yield assets is emerging, and we see a future where users can leverage specific instruments based on use case, risk/return preferences, and the region in which they operate. This could have a transformative impact on financial services around the world.

Early Signs of Increasing Utility of Stablecoins

While stablecoins have clear product-market fit across a variety of use cases, non-crypto natives (consumers and businesses) typically operate their daily lives in the fiat world. For example, businesses may be willing to leverage stablecoins and blockchain rails to execute cross-border payments, but most companies today prefer to hold and accept fiat currencies.

One of the barriers is the ability for businesses to accept stablecoin payments. Stripe’s recent announcement of support for its merchant clients to accept stablecoins is not only an important validation, but also a huge shift from the status quo. It can provide consumers with more payment options and make it easier for businesses to accept, hold, and trade digital assets.

Another hurdle is the ability to use stablecoins. The expansion of Visa’s stablecoin settlement capabilities supports tighter interoperability between blockchains and card networks. As an example, we’ve seen impressive organic demand in the market for stablecoin-backed card products that allow cardholders to use stablecoins anywhere Visa cards are accepted.

As stablecoins become more widely accepted and used in traditional payment methods, we increasingly expect these digital assets to become ubiquitous alongside non-digital assets.

Conclusion

Blockchain-based payments are one of the most important and exciting trends we’ve seen at the intersection of cryptocurrencies and financial services. We believe blockchain will be used to settle an increasing number of financial transactions, with payments set to become a key use case and primary consumer of blockchain in the future.

Catherine

Catherine