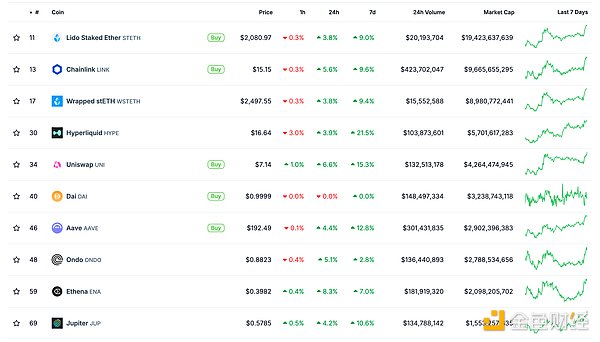

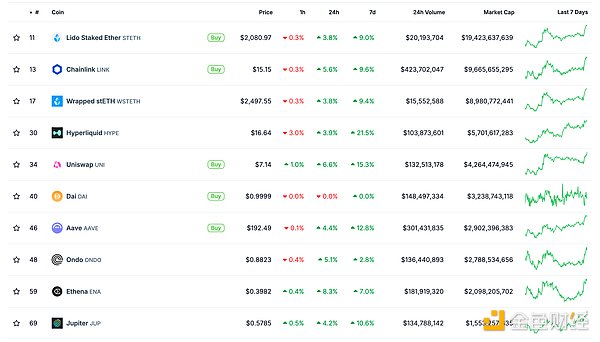

DeFi data

1. Total market value of DeFi tokens: 96.125 billion US dollars

DeFi total market value data source: coingecko

2. The trading volume of decentralized exchanges in the past 24 hours was 6.394 billion US dollars

Top ten rankings of DeFi projects with locked assets and locked-in amounts Data source: defillama

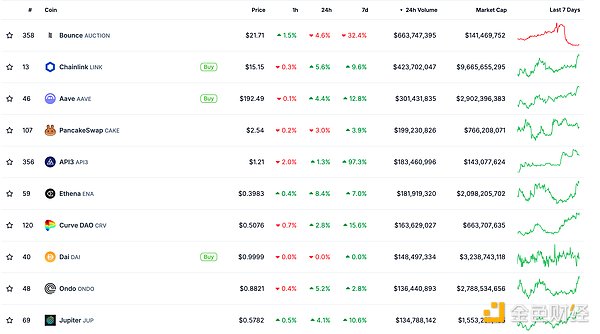

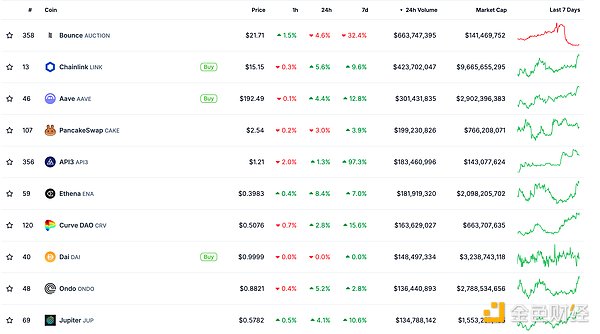

NFT data

1. Total market value of NFT: US$19.493 billion

NFT total market value, market value ranking of the top ten projects Data source: Coinmarketcap

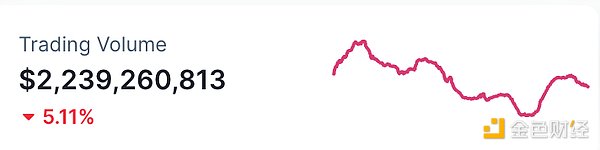

2.24-hour NFT trading volume: 2.239 billionUS dollars

NFT total market value, market value ranking of the top ten projects Data source: Coinmarketcap

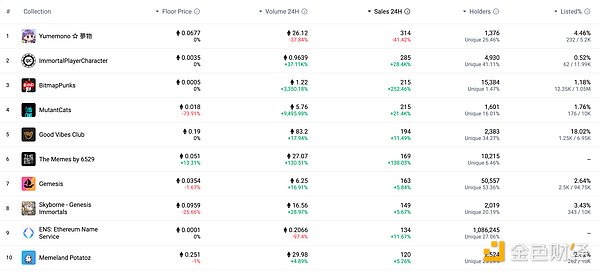

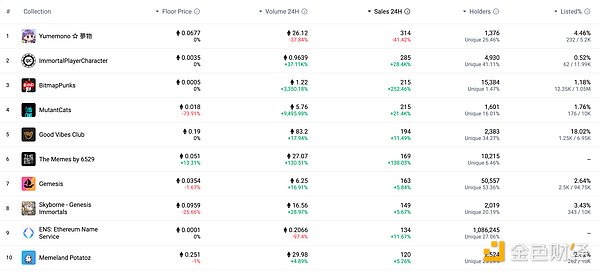

3. Top NFTs in 24 hours

Top ten NFTs with the highest sales growth in 24 hours Data source: NFTGO

Headline

Ethereum's worst performance in Q1 2025, negative returns for three consecutive months

On March 24, according to Coinglass data, Ethereum experienced the worst start in recent years in the first quarter of 2025, with negative returns for three consecutive months:

January: -1.28% (historical average return: +20.63%, median: +31.92%);

February: -31.95% (historical average return: +11.68%, median: +8.78%);

March: -10.16% (historical average return: +19.55%, median: +9.96%);

This is the first time that Ethereum has had three consecutive months of negative returns in the first quarter since complete data records were available in 2017. Comparing the performance of the first quarter of previous years:

2024: two increases and one decrease (-0.13%, +46.28%, +9.33%);

2023: positive returns for the whole quarter (+32.44%, +1.26%, +13.46%);

2022: two increases and one decrease (-26.89%, +8.78%, +12.2%);

2021: positive returns for the whole quarter (+78.51%, +8.41%, +34.74%).

MEME hot spots

1.mubarak, BUBB and $BANANA ranked top three in the BSC ecological Meme coin transaction volume ranking in the past 24 hours

On March 24, according to GMGN data, mubarak, BUBB and $BANANA ranked top three in the BSC ecological Meme coin transaction volume ranking in the past 24 hours, among which: mubarak’s 24-hour trading volume reached 35.8 million US dollars, and its market value was temporarily reported at 159 million US dollars, with a 24-hour increase of 21%; BUBB’s 24-hour trading volume reached 14.1 million US dollars, and its market value was temporarily reported at 15.4 million US dollars, with a 24-hour decrease of 33%; $BANANA’s 24-hour trading volume reached 10 million US dollars, and its market value was temporarily reported at 55.6 million US dollars, with a 24-hour decrease of 0.43%.

2. Embr.fun, a Meme application chain built on Initia, is about to launch a public beta version

On March 21, Embr.fun, a Meme application chain built on Initia, is about to launch a public beta version. Join the waiting list to get early access and exclusive rewards. Embr.fun is built by Embr Labs and supported by Initia Interwoven Stack. The project is built for the next generation of Meme economy, aiming to bring more innovative and interesting gameplay to Meme and become the first platform to promote the development of the next generation of Meme.

DeFi hotspots

1. Aptos ecological liquidity pledge agreement Amnis Finance launches governance token AMI

On March 24, Aptos ecological liquidity pledge agreement Amnis Finance launched its governance token AMI, with a total of 1 billion. The token distribution plan includes: 20% community rewards, 20% team, 15% marketing, 16% ecological development, 16% investors, 5% liquidity and 8% airdrop.

2.dYdX: Will use 25% of the net protocol fee to buy back market tokens

Golden Finance reported that according to dYdX official news, the decentralized exchange dYdX announced the launch of its first $DYDX token buyback plan. From now on, the platform will use 25% of the net protocol fee every month to buy back DYDX tokens from the open market.

3.Berachain launches "proof of liquidity" system to start governance phase

Golden Finance reported that Berachain, a Layer 1 blockchain based on EVM, will launch its Proof-of-Liquidity (PoL) system today, marking the official launch of the first phase of its on-chain governance. The PoL system aims to disperse the supply of Berachain's governance token BGT to achieve on-chain governance. The first implementations will be carried out in specific DeFi liquidity pools, and Berachain developers said they plan to add new reward vaults outside the initial DEX pool.

Berachain's PoL approach encourages users to provide liquidity to the network while allowing these assets to remain available. Unlike traditional proof-of-stake (PoS) blockchains that lock tokens, Berachain encourages users to stake assets in DeFi liquidity pools to earn governance tokens BGT. Validators then rely on the BGT delegated to them to increase their influence in the consensus, which means that network security (through validators) is closely linked to the liquidity of the ecosystem.

4. Binance will support Celo network upgrade on March 26

On March 24, Binance announced that it will support the Celo (CELO) network upgrade and hard fork. To this end, the platform will suspend the top-up and withdrawal operations of Celo network-related tokens from 09:00 on March 26, 2025, Beijing time. The network upgrade and hard fork is expected to be carried out at 11:00 on March 26, 2025, Beijing time, at block height 31,056,500.

5. Solana chain AI concept coins rebounded, BUZZ rose more than 36% in 24 hours

On March 24, according to GMGN market data, Solana chain AI concept coins rebounded, among which: Fartcoin market value is now 575 million US dollars, 24 hours increase of 26.92%; ALCH market value is now 58.2 million US dollars, 24 hours increase of 12.57%; GRIFFAIN market value is now 50.1 million US dollars, 24 hours increase of 16.51%; BUZZ market value is now 13.6 million US dollars, 24 hours increase of 36.12%.

Disclaimer: As a blockchain information platform, Golden Finance publishes articles for information reference only and is not intended as actual investment advice. Please establish the correct investment concept and be sure to improve risk awareness.

Kikyo

Kikyo