Currently, the scale of global stablecoins has exceeded US$268.3 billion, an increase of approximately 262% compared to 2019. At the same time, as a bridgehead for global digital asset centers, Hong Kong will take the lead in establishing a "same risk, same supervision" licensing system for fiat-referenced stablecoins after the Stablecoin Ordinance comes into effect on August 1, 2025. This system requires issuers to be locally registered, have paid-in capital of no less than HK$25 million, have their full reserve assets in 1:1 segregated custody and daily audits, enforce mandatory redemption on T+1 working day, and implement strict AML/KYC and financial disclosure. In the future, as RWAs become more deeply integrated with cross-border trade, Hong Kong will consolidate its position as a global hub for digital assets and stablecoins, leveraging a balanced approach to rule implementation and innovative pilot programs, combining strict regulation with an open ecosystem. This article, combining the latest regulatory documents with TokenPocket's frontline business observations, systematically examines the compliance process, industry chain, and future trends of Hong Kong's stablecoin market. It also focuses on the integration scenarios of stablecoins and the decentralized wallet ecosystem, providing readers with a comprehensive reference.

Hong Kong Stablecoin--Strategic Window

As one of the global financial centers, Hong Kong's advantages lie in:

1.

Financial hub and pioneering practice of offshore RMB:

Hong Kong connects the US dollar, RMB and global capital markets at the same time, and can naturally incubate multi-currency stablecoins. 2. "One Country, Two Systems" and Regulatory Initiatives: Hong Kong is the first testing ground for Asia's dedicated stablecoin law, enabling sandbox innovation within a compliant framework. 3. Solving Cross-Border Payment Pain Points: SWIFT cross-border remittances have an average cost of 6.35% and take 3–5 days to arrive. Stablecoins can achieve costs of <1% and settlement within seconds.

Hong Kong Stablecoin is the world's first "regulatory sandbox + license closed loop + scenario-first" framework

Compliance Timeline (2022-2025)

Hong Kong Stablecoin--Regulatory System Architecture

Impact and Trends

1. ... center">

2.

2.

2.

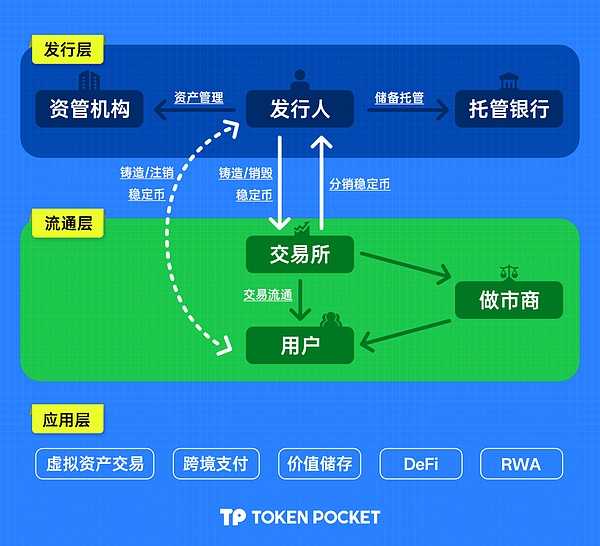

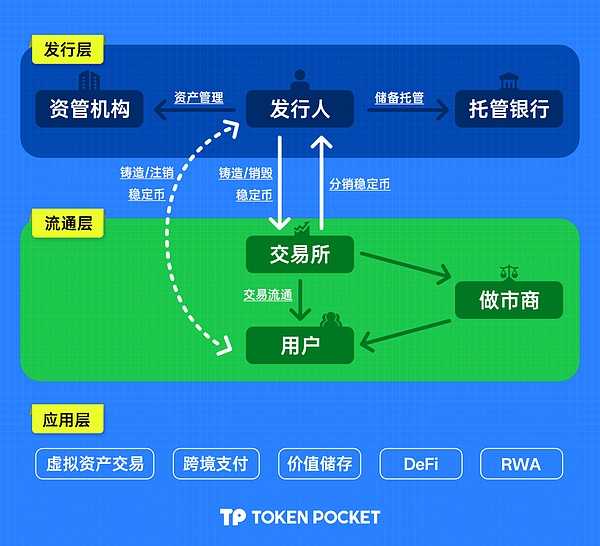

Hong Kong Stablecoin - Three-tier Ecological Architecture

The stablecoin ecosystem can be divided intothe issuance layer, the circulation layer and the application layerthree layers:

At the issuance layer

The core is composed of licensed issuers and their cooperating asset management institutions and custodian banks, which are responsible for the minting, asset reserve management and isolated custody of stablecoins;

At the circulation layer, exchanges and market makers jointly connect issuers and users: exchanges undertake users' subscription and redemption on the one hand, and provide trading and deposit and withdrawal services for stablecoins and other digital assets on the other hand, while market makers continuously provide buy and sell quotes to maintain market liquidity;

At the application layer, stablecoins can be accessed in diverse scenarios such as virtual asset investment, cross-border payments, and value storage. In addition, users can directly implement one-stop services such as asset management and cross-chain transfers through multi-chain self-custodial wallets such as TokenPocket, seamlessly introducing stablecoins from the secondary market into various on-chain applications.

Issuance layer: strict entry gives birth to "compliance dividends"

Issuer

The issuer is the entity responsible for creating, issuing and managing stablecoins to ensure their stable value and normal operation. In March 2024, the Hong Kong Monetary Authority (HKMA) and the Hong Kong Financial Secretary jointly launched the Stablecoin Issuer Sandbox. This aims to convey regulatory expectations and provide guidance to institutions planning to issue fiat stablecoins in Hong Kong. It also aims to conduct trials in a risk-controlled and small-scale environment to collect data and user feedback, and to develop a fit-for-purpose and risk-based regulatory regime. Core income: Interest income on reserve assets.

Sandbox and license progress

In July 2024, the Hong Kong Monetary Authority announced the list of participants in the Stablecoin Issuer Sandbox, including 5 companies and 3 groups of issuers, namely JD Coin Chain Technology (Hong Kong), Yuanbi Innovation Technology, and a joint venture established by Standard Chartered Bank (Hong Kong), Anmi Group and Hong Kong Telecom (HKT). These three companies have significant first-mover advantages. In addition, Hong Kong Financial Secretary Paul Chan Mo-po stated that stablecoins are not digital assets for speculation, but payment and stored-value tools with practical application scenarios. As long as there are practical application scenarios, they will be given priority when issuing licenses. Circulation layer: Dual license system activates the stablecoin market According to the Stablecoin Ordinance, Hong Kong virtual asset transactions require trading licenses, including VATP licenses and SFC licenses to upgrade virtual asset-related businesses.

VATP license:The Hong Kong Securities and Futures Commission will officially implement the virtual asset trading platform (VATP) licensing system on June 1, 2023. According to the "Circular on Transitional Arrangements for a New Licensing System Designed for Virtual Asset Trading Platforms", virtual asset trading platforms that provided virtual asset services in Hong Kong before June 1 and had substantive business can continue to provide virtual asset services in Hong Kong within 12 months. In all other cases, they need to apply for a VATP license.

SFC upgraded license: In addition to the virtual asset trading platform license, holders of the original SFC 1/4/7/9 license plates, which correspond to securities trading/securities consulting/automated trading services/asset management businesses respectively, can also carry out virtual asset corresponding businesses after the upgrade.

Application layer: the wallet becomes the ecological connector

TokenPocket is a one-stop multi-chain stablecoin wallet that supports 1,000+ networks, has over 30 million users worldwide, and over 5 million monthly active users, providing users with the "last mile" service of stablecoin applications.

Self-Hosted Wallet and Multi-Chain Support Management:TokenPocket supports the creation of mnemonic/private key wallets. Private keys and mnemonics are stored only on the user's device, locally encrypted and protected, and fully self-hosted. Covering over 1,000 blockchain networks including Ethereum, BSC, Tron, Solana, Arbitrum, etc., all mainstream stablecoins such as USDT, USDC, USD1 can be managed in a single interface, achieving a unified view of multi-chain assets and cross-chain transfers. In the future, TokenPocket will also support more stablecoins, allowing users to manage stablecoin assets in one stop. TokenPocket, as a stablecoin wallet, offers truly zero-fee stablecoin transfers. On the BSC network, users receive a daily fee-free USDT/USD1 quota. On the Tron network, TokenPocket offers a network fee payment service, providing not only a daily subsidy but also stablecoin network fee payment. This service is applicable to all interactions on the Tron network, significantly reducing the cost of on-chain stablecoin transfers and interactions.

Point-to-point payment and collection:TokenPocket supports QR code scanning payment, address book management and batch transfer functions, meeting the one-click payment and batch settlement needs of individuals and corporate B2B.

Enterprise-level asset security custody solution: Supports KeyPal hardware wallet, Passphrase function and multi-signature wallet function, etc., providing enterprise-level security design solutions to ensure the security of stablecoin asset custody and on-chain operations. Conclusion: Hong Kong's stablecoin legislation provides a new paradigm for global digital asset compliance exploration: a policy sandbox, license scarcity, and application-driven development. Issuers, custodians, trading platforms, and wallet applications are collaborating around two high-frequency scenarios: payment and RWA. As a multi-chain self-custodial stablecoin portal, TokenPocket plays a key role as a "terminal connector" in Hong Kong's stablecoin ecosystem through its zero-fee transfer, cross-chain transfer services, and asset security custody solutions, opening up new possibilities for stablecoin circulation and inclusive finance.

Xu Lin

Xu Lin