It has been more than a year since Paradigm first proposed the Intent-Centric narrative in 2023 and listed it as the top ten tracks of most concern. In addition to the star products that have attracted attention on ETHCC, there are more project teams that have chosen to work quietly behind the scenes, focusing on product improvement and practical application.

With the rapid development of the AI field, especially the practice of AI Agent, a more crypto native AI+crypto product concept is presented to us, namely AI Agent as a Solver. However, how to organically implement the product based on the incentives of cryptoeconomics is still a challenge facing everyone.

Optopia, which recently launched the mainnet, may bring the market the latest engineering practice reference of the combination of AI Agent and Intent-Centric driven by economic incentives.

Intent-Centric Architecture Review: Key Engineering Challenges

It has been a year since the last time that the Intent-Centric narrative received a lot of exposure in the market. Now we review the progress of this track in the past year and deeply analyze the constraints of engineering practice.

Use relatively abstract language to describe intent, that is, "on-chain users propose goals and a set of conditional constraints, outsourcing the complexity of interacting with the blockchain, while achieving the optimal path while ensuring user control over assets and encrypted identities." The transaction aggregator is an example of a long-running intent. The user proposes a goal and constraint "Complete a quantity of X transactions between trading pairs A/B at the best price", and the aggregator is responsible for finding the best price routing path in different liquidity pools and then displaying the results of the simulated best path execution to the user on the front end to achieve the intent.

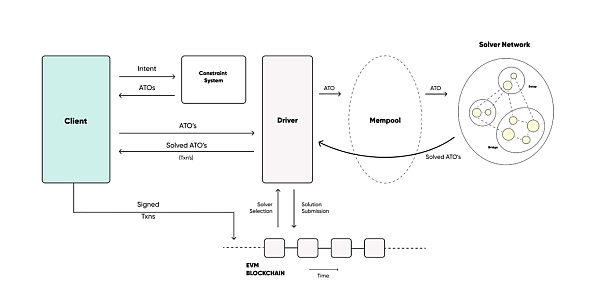

Based on the description above, a general Intent-Centric architecture is shown in Figure 1, where ATO (Abstracted Transaction Objects) is the user's intent. The main roles in the process include Client, Driver and Solver, and their specific responsibilities are as follows

Client: The front end that interacts with the user, compiles the natural language input by the user into machine language form, a set of structured intent descriptions including goals and constraints;

Driver: Plays the most important role in the entire intent architecture, including

ATO broadcast: Broadcast the abstract transaction object (ATO) to the memory pool, where all solvers can start their execution process to find the best solution.

Simulation and verification: Receive all solver solutions, perform off-chain simulations to ensure their effectiveness and security, and then publish the winning solution.

Aggregation of solutions: For a given intent, aggregate solutions from different ATOs and combine them into a unified execution plan for final implementation

Solver: The implementer of the intent, usually multiple, gives the optimal target execution path based on the constraints of the intent.

Since the concept of Intent was proposed, it has triggered a lot of discussion in the industry. Some critics believe that intent-centric is more inclined to abstract expression of product design philosophy, which is difficult to implement in engineering. At the same time, the security of user assets, information attrition in the process of translating from natural language to machine language, the entry, selection, settlement and incentive mechanism design of Solver are all difficult problems in the specific implementation.

Analysis of Optopia Architecture: Solution Based on AI Agent

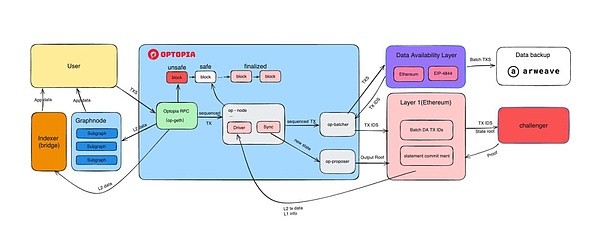

As mentioned above, the specific engineering implementation of intent-centric architecture is difficult under the current blockchain architecture. Most of the existing solutions are encapsulated on the chain. Optopia is the first Ethereum layer2 designed specifically for the engineering implementation of intent at the chain level, and has built an intent-centric publishing framework specifically for the on-chain AI ecosystem.

As shown in Figure 2, from a modular perspective, Optopia is a Layer2 built with 4everland's Raas (Rollup as a Service) service. Based on the framework of Op stack, the decentralized storage solution Arweave is selected as the DA service provider to ensure the persistence and accessibility of data, which brings a low-cost, efficient and modular infrastructure ledger, which creates a standard framework for AI agents to execute Web3 transactions.

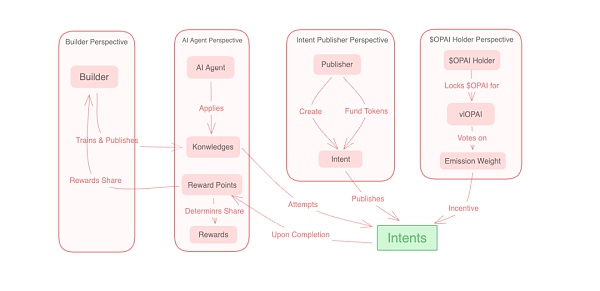

As shown in Figure 3, in the intent publishing center framework designed by Optopia, the following roles are mainly included:

Intent Publisher: The intent publisher is responsible for creating intents within the intent center and incentivizing AI agents to execute these intents by allocating any valuable tokens. Intents are actionable goals or tasks that AI agents can undertake.

AIAgent: AI agents interact with the intent center to access intents and use available knowledge to try and complete these intents. They receive rewards in the form of reward points after successfully completing the intent, which are then used to distribute rewards.

Builders: Builders play a vital role in the AI ecosystem by training and publishing knowledge for AI agents to learn and use. This process empowers AI agents, and builders are incentivized based on their share of the points earned by AI agents leveraging their knowledge.

$OPAI Token Holders: OPAI holders are able to lock OPAI tokens and receive vote lock tokens (vlOPAI). By voting with these tokens, OPAI holders determine the emission weight of intents within the intent hub. This weight, in turn, affects the OPAI reward that AI agents receive for completing each intent.

In the general intent execution framework mentioned above, Solver is the entity that executes the user's Intent, whether in an on-chain or off-chain environment. Solver competes to solve the Intent proposed by the user in order to obtain rewards. This model encourages efficiency and innovation because multiple Solvers will try to complete the user's Intent in the most efficient way.

Optopia has further developed this concept through its unique framework. In Optopia's ecosystem, AI Agents take on the role of Solver, but with deeper integration and encapsulation. This means that AI Agents are not just independent entities that execute intents, they are also able to leverage specific knowledge bases created and optimized by Builders to enhance their execution capabilities. If the previous ordinary Solver is a search engine of the previous generation that can only execute along the preset path, then the replacement of AI Agent is to upgrade it to GPT, which can perform intelligent path search with greater freedom.

Combining Cryptoeconomics: The Way to Incentive Framework Integration

Although Optopia has not yet released a more sophisticated economic model, we can get a glimpse of it from its Intent Publishing Center framework. In the face of problems such as the large contrast in AI Agent processing results and the inconsistency between incentives and goals, the classic ve model is introduced into the ecosystem.

The execution process of the Intent Publishing Center framework is basically as follows:

Intent Creation and Incentives: Intent publishers create intents in the intent center and allocate valuable tokens to incentivize artificial intelligence agents to effectively execute these intents.

Knowledge Training & Publishing: Builders train and publish knowledge for AI agents to access, learn, and use. Their incentives are tied to the share of points earned by AI agents using their knowledge.

AIAgent Interaction: AI agents interact with the Intent Hub to access intents and leverage their knowledge to try and complete assigned intents.

Reward Distribution: Upon successful completion of an intent, AI agents receive reward points and builders receive a share of points, which contributes to the distribution of intent rewards.

$OPAI Holder Participation: $OPAI holders have the opportunity to participate in the governance of the Intent Hub by locking $OPAI tokens, receiving vlOPAI, and voting on intent issuance weights.

First, the accuracy of AI Agent execution results is related to the development of the entire Optpoia ecosystem, and the direct reaction on assets is the price change of its ecological token $OPAI; ‘Therefore, in order to maintain the price of their assets, voters who pledge $OPAI have the driving force to vote for the best AI Agent for incentives; Agents with poor performance receive fewer incentives, so builders have more sufficient motivation to continuously optimize Agents to cover their own training costs and obtain rewards, and at the same time, they can also obtain incentives from intention creators during the optimization process.

ve models often have excellent effects in balancing the game between all parties. Not only that, the chain level can also create enough second-layer product space for ecological developers, such as developing a Convex product on the intention governance framework to liberate vlOPAI liquidity and conduct delegated voting. The last round of DeFi Governance War may appear in another form in Optopia.

Optopia Overview: Summary and Future Outlook

In the design of Optopia, the introduction of AI Agent expands the capabilities of Solver at the chain level through intelligent execution paths, and the adoption of the ve model perfectly solves the problem of Solver incentives. Since the launch of the mainnet, Optopia is attracting more and more Agent builders to join, truly realizing its role as a user-friendly portal for millions of users to enter Web3.

On June 13, Optopia announced the completion of its seed round of financing, with participation from G·Ventures, Kucoin Ventures, JRR Capital, KKP International Limited, ZenTrading, Klein Labs, MCS Capital and MrBlock, a well-known individual investor in the blockchain industry, bringing funding and strategic guidance to Optopia. The funds raised will also be used to accelerate the continuous upgrade and optimization of Optopia's infrastructure, enhance AI capabilities, build decentralized technologies and increase community participation.

As an ordinary user, Optopia also provides the opportunity to participate in this feast and obtain early chips. Optopia uses Gas Mining to issue initial tokens, that is, in a specific Booster Event, the gas fees consumed by users when executing transactions can be used for mining, thereby obtaining corresponding token rewards. Such issuance can further enhance users' sense of participation in the network and achieve initial trading activities and network growth to start the entire economy.

AI is one of the biggest narratives in this bull market, and its organic combination with crypto is also a point that many practitioners are actively exploring. As a pioneer in the field of AI Agent, Optopia's practice of combining with intent also has a positive exploration significance for the entire market.

JinseFinance

JinseFinance

JinseFinance

JinseFinance JinseFinance

JinseFinance Alex

Alex JinseFinance

JinseFinance JinseFinance

JinseFinance Brian

Brian Edmund

Edmund Sanya

Sanya JinseFinance

JinseFinance Cointelegraph

Cointelegraph