There has been a lot of discussion recently around EigenLayer's re-staking and LRT (Liquid Restaking Token). Users are betting on the potential airdrop expectations of each protocol, and then Staking has become the hottest narrative in the Ethereum ecosystem. This article will briefly discuss some of the author’s thoughts and opinions on LRT.

LRT is a new asset class derived from the multi-sided market around EigenLayer. The purpose of LRT and LST is to "liberate liquidity", but due to the different composition of LRT's underlying assets, LRT is more complex than LST, with diversity and dynamically changing nature.

When considering the ETH standard, if the Ethereum pledge under LST is regarded as a currency fund, then LRT as an asset manager can be regarded as the Fund of Fund for AVS. Comparing LST and LRT is a way to quickly understand the underlying logic of LRT.

1. Portfolio

LST’s investment portfolio only has one type of Ethereum pledge, but LRT’s investment portfolio is diverse, and funds can be invested in different AVS to provide them with economic security, and naturally have different risk levels. Different LRT protocols have different fund management methods and risk preferences. At the level of fund management, LST is passive management and LRT is active management. LRT may provide different management strategies corresponding to different levels of AVS (such as EigenDA vs. newly launched AVS) to adapt to users' return/risk preferences.

2. Yield, sources and composition

< p>LST and LRT have different yields, as well as the source and composition of the yield:LST's yield is currently stable at approximately 4.9% Left and right, the common income from the Ethereum consensus layer and execution layer is composed of ETH.

The rate of return of LRT is temporarily uncertain, but it basically comes from the fees paid by each AVS, and may be composed of AVS tokens, ETH, USDC Or a mixture of the three. According to information we have received from communicating with some AVS, most AVS will set aside a few percentage points of the total token supply as incentive and security budgets. If AVS is already online before the currency is issued, it may also pay ETH or USDC, depending on the specific situation. (In this way, Restaking can actually be understood as the process of replenishing ETH to mine third-party project tokens)

Since it is AVS token-based, the risk of token fluctuations will be higher than ETH is larger and APR will fluctuate accordingly. AVS may also have entry and exit rotations. Such factors will bring uncertainty to LRT's yield.

Ethereum There are two penalties for staking: Inactivity Leaking and Slashing, such as missing block proposals and double voting. The rules are very certain. If operated by a professional node service provider, Correctness can reach around 98.5%.

The LRT protocol needs to believe that the AVS software coding is correct and have no objection to the penalty rules to avoid triggering unexpected penalties. There is inherent uncertainty due to the diverse nature of AVS and the fact that most are early-stage projects. Moreover, AVS may have rule changes as its business develops, such as iterating more functions and so on. In addition, at the risk management level, it is also necessary to consider the upgradeability of the AVS Slasher contract, whether the slashing conditions are objective and verifiable, etc. Since LRT acts as an agent for managing user assets, LRT needs to comprehensively consider these aspects and choose partners carefully.

Of course, EigenLayer encourages AVS to conduct a complete audit, including AVS's code, slashing conditions, and logic that interacts with EigenLayer. EigenLayer also has a multi-signature veto committee to conduct final review and control of forfeiture events.

LRT’s rapid growth in the short term

Source: EigenLayer

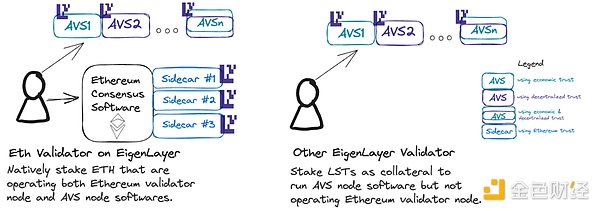

EigenLayer for LST Re-pledge adopts a phased opening model, and there is no restriction on Native Restaking. Restricting LST may be a means of hungry marketing, but in fact it is more important to promote the growth of Native Restaking. Because after restricting LST, if users want to re-stake, they can only turn to the third-party LRT protocol to provide Native Restaking, which also greatly promotes the development of the LRT protocol. The current ETH flowing into EigenLayer through LRT accounts for about 55% of EigenLayer’s total TVL.

In addition, the implicit point is that Native Restaking can provide Ethereum Inclusion Trust, which is also the third trust model provided and advocated by EigenLayer in addition to Economic Trust and Decentralization Trust. That is, in addition to committing to Ethereum through staking, Ethereum validators can also run AVS and make commitments to AVS. Most of these commitments are related to MEV. One of the use cases is "future block space auction". For example, the oracle may need to provide price feeding services within a specific time period; or L2 needs to publish data to Ethereum every few minutes, etc. They can pay the proposer to reserve future block space.

LRT’s competitive landscape

First of all, in order to make the liberated liquidity useful, the integration of DeFi is the main competition among LRT protocols. a little.

As mentioned above, although AVS theoretically need to calculate the economic security they require to reach a certain security threshold, the current approach of most AVS is to use a portion of the total supply of Tokens for incentives. Since different AVS rotate in and out, incentives depend on the price of AVS Token, so the uncertainty of LRT assets is much greater than that of LST (LST has a stable "Risk-free rate" and good expectations for ETH price), in mainstream DeFi In terms of protocol integration and compatibility, it is difficult to become a "hard currency" like stETH.

After all, as a pledge agreement, LRT’s liquidity and TVL will be the first criteria that DeFi protocols pay attention to, followed by brand, community, etc. Liquidity is mainly reflected in the time period of exit. Generally speaking, it takes seven days to exit from EigenPod, followed by a certain amount of time to exit from Ethereum staking. Protocols with larger TVL can build better liquidity, such as Liquidity Pool Reserve operated by Etherfi which provides fast withdrawals (i.e. eETH - ETH).

But it is too early to discuss the integration of mainstream DeFi before the EigenLayer mainnet is launched, because many things are still unknown.

In other aspects, Ether.fi recently launched the $ETHFIWIFHAT meme token tweet on the official website to build momentum for the token’s launch and make people think. Swell uses Polygon CDK, EigenDA and AltLayer to build zkEVM L2, with its LRT rswETH as the gas token. Renzo focuses on multi-chain integration on Arbitrum, Linea and Blast. I believe that each LRT protocol will launch its own differentiated playstyle in the future.

However, whether it is LST or LRT, the degree of homogeneity is relatively high. Although LRT has more room for development than LST, even if an LRT launches a new idea to the market, Competitors are also capable of following suit. The author believes that the moat still lies in consolidating and improving TVL and liquidity. Etherfi currently has the highest TVL and the best liquidity. Assuming that all LRT protocol airdrop expectations are fulfilled, Etherfi will have a greater advantage in attracting new funds. (The adoption of institutional users cannot be ignored. 30% of Etherfi’s TVL comes from institutional users)

After the airdrop event, it is entirely possible that the LRT landscape will be reshuffled. The competition for users and funds will become more intense (for example, after Etherfi's airdrop is distributed, some funds may immediately flow to other platforms). Until EigenLayer is fully launched on the mainnet and AVS starts to provide revenue, LRT will not be very sticky to users.

The sustainability of LRT

The sustainability of LRT can actually be seen as the sustainability of the EigenLayer system, because the income from Ethereum staking will has always existed, while AVS may not. A question that is often asked is: at the current TVL of 11b, how does EigenLayer provide a yield that matches it (e.g. 5% per year)? The author believes that there are the following points:

Although EigenLayer’s TVL reached 11b before the main network was fully launched, even surpassing AAVE, but in a series of related After the airdrop of the protocol ends, EigenLayer's TVL will definitely have a correction period of mean reversion. Overall, it doesn't take that much to consider yield in the short term.

Secondly, each AVS token provides different returns, durability, and volatility. Each staker’s risk preference and pursuit of returns are also different. In this There will also be spontaneous dynamic regulation by the market in the process (more ETH pledged to a certain AVS will reduce the yield, prompting pledgers to switch to other AVS or other protocols), so it is not possible to simply use the percentage of the entire TVL to directly calculate the need Benefits provided.

From a mid- to long-term perspective, the driving force for the sustainable development of the EigenLayer ecosystem still lies on the demand side, that is, there needs to be enough AVS to pay for economic security, and it must be sustainable , which is also related to the quality of AVS's own business. At present, in addition to the 12 early AVS partners such as AltLayer, there are also a series of AVS that have announced cooperation. The author understands that there are dozens of AVSs waiting in line for integration. Of course, this is also related to the project quality of AVS, the performance of Token and the design of the incentive mechanism. There is currently no way to give definite comments.

Summary

Finally, regarding the future pattern of LRT, the author has the following views:

1. Despite the fierce competition, LRT is still the preferred direction for investment layout in the primary market EigenLayer ecosystem. When investing in AVS in EigenLayer, the investment logic should consider the investment logic of this middleware. This is not different because EigenLayer is used to start the network, but the way to implement the product is different. There may be dozens or hundreds of AVS built on EigenLayer in the future, so the concept of AVS is not unusual. The direction of node service providers is already firmly occupied by some mature companies. LRT is obviously closer to users. As an abstraction layer between users and EigenLayer, it has the attributes of both Staking and DeFi. As an allocator of assets, it has a greater say in the ecosystem. Throughout EigenLayer's ecological layout, we also focus on areas such as developer tools, Anti-slashing key management, risk management, and public goods.

2. Currently, the proportion of EigenLayer re-staking through LRT and LST is approximately 55% and 45%. We expect that with the gradual development of EigenLayer, the advantages of LRT unlocking liquidity will become apparent, and this ratio may reach about 73% (assuming that some giant whales and institutions that conservatively hold stETH still choose to passively hold stETH). Of course, the risks of LRT cannot be ignored. Due to the nested asset structure, we also need to pay attention to systemic risks such as depeg under extreme market conditions. In the long run, we hope to see AVS in the EigenLayer ecosystem thrive and provide LRT with a relatively stable underlying structure and benefits.

JinseFinance

JinseFinance

JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance Max Ng

Max Ng Cryptohayes

Cryptohayes Cointelegraph

Cointelegraph Cointelegraph

Cointelegraph