IOSG| Early Exploration of the BTC-LST Ecosystem

Custody risk, slashing risk, and liquidity risk are the main concerns in the BTC LST landscape.

JinseFinance

JinseFinance

Author: Bai Ding & Jomosis, Geekweb3

Introduction:Restaking and Layer2 are important narratives of the Ethereum ecosystem in this cycle. Both aim to solve existing problems in Ethereum, but the specific paths are different. Compared with extremely complex technical means such as ZK and fraud proofs, Restaking is more about empowering downstream projects in terms of economic security. It seems to just ask people to pledge assets and get rewards, but its principle is by no means as simple as imagined.

It can be said that Restaking is like a double-edged sword. While empowering the Ethereum ecosystem, it also brings huge hidden dangers. At present, people have different opinions on Restaking. Some say that it has brought innovation and liquidity to Ethereum, while others say that it is too utilitarian and is accelerating the collapse of the crypto market.

There is no doubt that to determine whether Restaking is a panacea or a poison to quench thirst, only by figuring out what it is doing, why it is doing it, and how it is doing it can we draw an objective and clear conclusion, which is also of great reference significance for determining the value of its token.

When it comes to Restaking, Eigenlayer is bound to be an unavoidable case. If you understand what Eigenlayer is doing, you will understand what Restaking is doing. This article will take Eigenlayer as an example, introduce Eigenlayer's business logic and technical implementation in the clearest and most understandable language, and analyze the impact of Restaking on the Ethereum ecosystem in terms of technology and economy, as well as its significance to the entire Web3.

As we all know, Restaking means "re-staking". It was first rooted in the Ethereum ecosystem and became popular after Ethereum transformed into POS in 2022. What is "re-staking"? Let's first introduce the background of Restaking, namely PoS, LSD, and Restaking, so that we can have a clearer positioning of Restaking.

1. POS (Proof of Stake)

Proof of Stake, also known as "proof of equity", is a mechanism for probabilistically allocating accounting rights according to the amount of assets pledged. Unlike POW, which distributes accounting rights according to the computing power of network participants, it is generally believed that POW is more decentralized and closer to Permissionless than POS. The Paris upgrade was launched on September 15, 2022, and Ethereum officially changed from POW to POS, completing the merger of the main network and the beacon chain. The Shanghai upgrade in April 2023 allowed POS pledgers to redeem their assets, confirming the maturity of the Staking model. 2. LSD (Liquidity Staking Derivatives Protocol) As we all know, the interest rate of Ethereum PoS staking mining is relatively attractive, but it is difficult for retail investors to obtain this part of the income. In addition to the requirements for hardware equipment, there are two reasons:

First, the amount of Validator's pledged assets must be 32 ETH or its multiples, and the huge amount of assets is beyond the reach of retail investors.

Second, before the Shanghai upgrade in April 2023, the assets pledged by users cannot be withdrawn, and the utilization efficiency of funds is too low.

In response to these two problems, Lido was born. The pledge model it adopts is joint pledge, that is, "group pledge, profit sharing", users deposit their ETH on the Lido platform, and the latter aggregates it as the pledged asset when running Ethereum Validator, which solves the pain point of insufficient funds for retail investors.

Secondly, users pledge their ETH on Lido, and will exchange ETH-anchored stETH tokens at a 1:1 ratio. stETH can not only be exchanged for ETH at any time, but also as a token equivalent to ETH, it can participate in various financial activities as a derivative token of ETH on mainstream DeFi platforms such as Uniswap and Compound, which solves the pain point of low capital utilization of POS Ethereum.

Since POS is to pledge highly liquid assets for mining, products led by Lido are called "Liquid Staking Derivatives", which is what we often call "LSD". Like the stETH mentioned above, it is called a liquid pledge token, which is "Liquid Stake Token" in English, which is "LST".

It is not difficult to find that the ETH pledged to the PoS protocol is the real native asset, which is real money, while LST such as stETH is generated out of thin air, which is equivalent to stETH borrowing the value of ETH to directly print one more copy of money, and one copy becomes two copies, which can be understood as the so-called "fiscal leverage" in economics. The role of fiscal leverage in the entire economic ecology is not simply good or bad, and it must be analyzed in combination with the cycle and environment. What needs to be remembered here is that LSD adds the first layer of leverage to the ETH ecology.

3. Restaking (Re-staking/Re-staking)

Restaking, as the name implies, is to use LST tokens as pledged assets to participate in more staking activities of POS networks/public chains to obtain returns, while helping more POS networks to improve security.

After staking LST assets, a 1:1 pledge certificate will be obtained for circulation, which is called LRT (Liquid Restaking Token). For example, if stETH is pledged, rstETH can be obtained, which can also be used to participate in DeFi and other on-chain activities.

That is to say, the LST tokens such as stETH generated out of thin air in LSD are pledged again, and a new asset is generated out of thin air, that is, the LRT asset that appears after Restaking, adding a second layer of leverage to the ETH ecosystem.

The above is the background of the Restaking track. After reading this, there will definitely be a question: the more leverage, the more unstable the economic system. The LSD layer is understandable, which solves the problem that retail investors cannot participate in POS and improves the efficiency of capital utilization. What is the necessity of the Restaking layer of leverage? Why should the LST that was generated out of thin air be pledged again?

This involves two levels: technology and economy. In response to this issue, the following will briefly sort out the technical structure of Eigenlayer, analyze the economic impact of the Restaking track, and finally conduct a comprehensive evaluation of it in terms of technology and economy.

(As of now, many English abbreviations have appeared in this article, among which LSD, LST, and LRT are core concepts, which will be mentioned many times later. We can strengthen our memory again: ETH staked by Ethereum POS is the native asset, stETH anchored to the staked ETH is LST, and rstETH obtained after staging stETH on the Restaking platform is LRT)

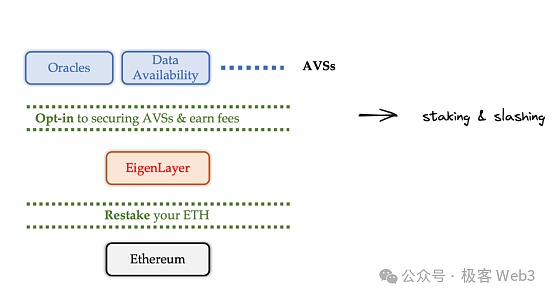

We must first clarify the core problem that EigenLayer wants to solve in terms of product functions: Provide economic security from Ethereum for some underlying security POS-based platforms.

Ethereum has extremely high security due to its considerable asset pledge amount. However, if some services are executed off-chain, such as the sorter of Rollup or the verification service of Rollup, the parts executed off-chain are not controlled by Ethereum and cannot directly obtain the security of Ethereum.

If they want to obtain sufficient security, they have to build their own AVS (Actively Validated Services). AVS is a "middleware" that provides data or verification services for terminal products such as Defi, games, and wallets. Typical examples include "oracles" that provide data quotation services and "data availability layers" that can provide users with the latest status of data.

However, it is quite difficult to build a new AVS because:

1. The cost of building a new AVS is very high and it takes a long time.

2. The pledge of the new AVS often uses the project's own native Token, and the consensus of this type of Token is far inferior to ETH.

3. Participating in the staking of the new network AVS will make the staker miss the stable income of staking on the Ethereum chain, which will consume opportunity costs.

4. The security of the new AVS is much lower than that of the Ethereum network, and the economic cost of attack is very low.

If there is a platform that allows start-up projects to directly rent economic security from Ethereum, the above problems can be solved.

Eigenlayer is such a platform. Eigenlayer's white paper is called "The Restaking Collective", which has two major features: "Pooled Security" and "free market".

In addition to ETH staking, EigenLayer collects Ethereum staking certificates to form a security leasing pool, attracting pledgers who want to earn extra income to re-stake, and then renting the economic security provided by these pledged funds to some POS network projects. This is "Pooled Security".

Compared with the unstable APY in the traditional DeFi system, which may change at any time, Eigenlayer uses smart contracts to clearly mark the staking income and penalty rules for pledgers to choose freely. The process of earning income is no longer an uncertain gamble, but an open and transparent market transaction, which is the "free market".

In this process, the project party can rent the security of Ethereum to avoid building AVS by themselves, and the pledger obtains a stable APY. In other words, while improving the security of the ecosystem, Eigenlayer also provides benefits to users in the ecosystem.

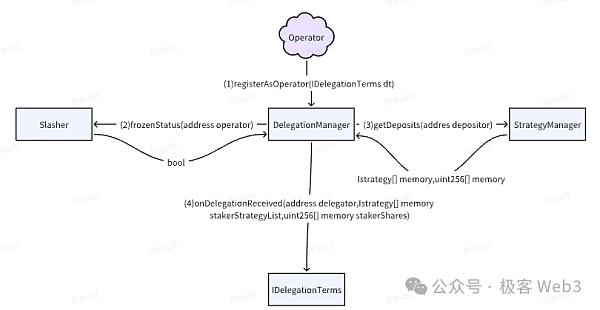

The security process provided by Eigenlayer is completed by three roles:

Safe lender - Staker (staker). Staker pledges funds to provide security

Safe intermediary - Operator (node operator). Responsible for helping Staker manage funds while helping AVS perform tasks.

Safe receiver - AVS of middleware such as oracles.

(Image source: Twitter @punk2898 )

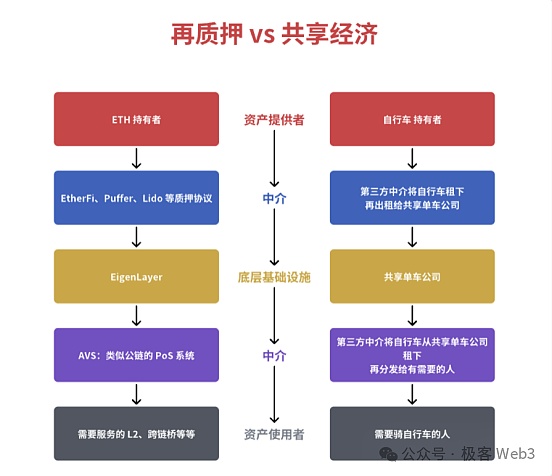

Someone has made a vivid metaphor for Eigenlayer: using shared bicycles to compare the upstream and downstream of Eigenlayer. Shared bicycle companies are equivalent to Eigenlayer, which provides market services for LSD and LRT assets, which is equivalent to shared bicycle companies managing bicycles. Bicycles are equivalent to LSD assets because they are all assets that can be rented. Riders are equivalent to middleware (AVS) that requires additional verification. Just like cyclists rent bicycles, AVS rents LSD and other assets to obtain network verification services to ensure its own safety.

In the shared bicycle model, users are required to pay deposits and breach of contract liability to prevent malicious damage to the vehicles, while Eigenlayer uses pledge and penalty mechanisms to prevent Operators participating in verification from doing evil.

Eigenlayer provides security with two core ideas: pledge and confiscation. Pledge provides basic security for AVS, and confiscation increases the cost of any subject to do evil.

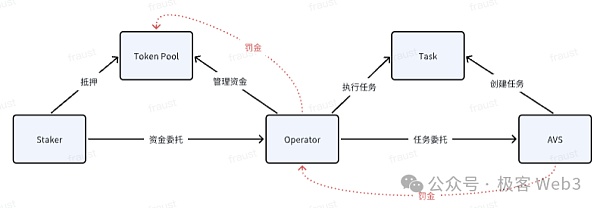

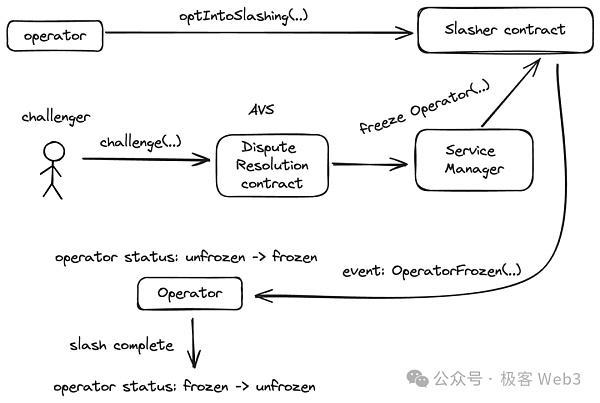

The interactive process of pledge is shown in the figure below.

In Eigenlayer, the main contract that interacts with the stakers is the TokenPool contract. There are two types of operations that the stakers can perform through TokenPool:

Pledge - Stakers can pledge assets to the TokenPool contract and specify that a specific Operator manage the pledged funds.

Redemption - Stakers can redeem assets from the TokenPool.

There are three steps for Stakers to redeem funds:

1) Stakers add redemption requests to the request queue and need to call the queueWithdrawal method.

2) Strategy Manager checks whether the Operator specified by the Staker is in a frozen state.

3) If the Operator is not frozen (described in detail later), the Staker can initiate the complete withdrawal process.

It should be noted here that EigenLayer gives Stakers full freedom. Stakers can cash out the staked funds and transfer them back to their own accounts, or convert them into staked shares and re-stake them.

According to whether Stakers can personally run node facilities to participate in the AVS network, Stakers can be divided into ordinary stakers and Operators.Ordinary stakers provide POS assets for each AVS network, while Operators are responsible for managing the staked assets in the TokenPool and participating in different AVS networks to ensure the security of each AVS. This is actually a bit like Lido's routine.

The relationship between Staker and AVS is like that between the security supply and demand sides. Stakers often do not understand the products of AVS project parties, cannot trust them, or do not have the energy to directly run equipment to participate in the AVS network; similarly, AVS project parties often cannot directly reach Stakers. Although the two parties are in a supply and demand relationship, they lack an intermediary to connect them. This is the role of Operator.

On the one hand, Operator helps pledgers manage funds, and pledgers often have trust assumptions about Operators. EigenLayer officially explains that this trust is similar to Staker staking on the LSD platform or Binance; on the other hand, Operator helps AVS project parties operate nodes. If Operator violates the restrictions, it will be slashed for doing evil, making its evil cost far exceed the evil benefits, and in this way AVS builds trust in Operator. In this way, Operator forms a trust intermediary between pledgers and AVS.

For the Operator to enter the Eigenlayer platform, it must first call the optIntoSlashing function of the Slasher contract to allow the Slasher contract to constrain/punish the Operator.

After that, the Operator must register through the Registery contract. The Registery contract will call the relevant functions of the Service Manager, record the Operator's initial registration behavior, and finally transmit the message back to the Slasher contract. At this point, the initial registration of the Operator is completed.

Next, let's take a look at the contract design related to slashing. In Restaker, Operator and AVS, only Operator will become the direct object of slashing. As mentioned above, if an Operator wants to join the Eigenlayer platform, it must register in the Slasher contract and authorize the Slasher to perform slashing operations on the Operator.

Of course, in addition to the Operator, the slashing process also involves several other roles:

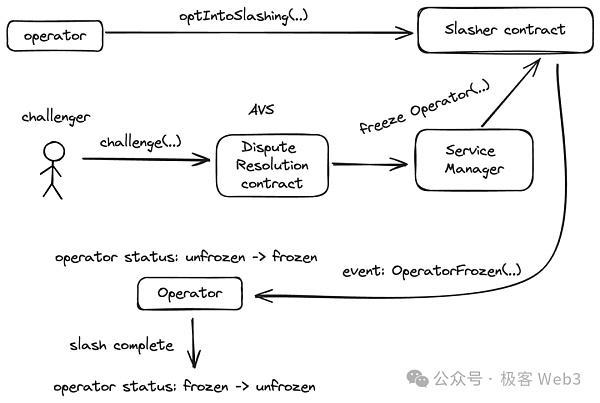

1. AVS:When the Operator accepts the AVS operation commission, it must also accept the slashing trigger conditions and slashing standards proposed by AVS. Two important contract components should be emphasized here: the dispute resolution contract and the Slasher contract.

The Dispute resolution contract is established to resolve the dispute of the challenger; the Slasher contract will freeze the Operator and perform slashing operations after the challenge window period ends.

2. Challenger:Anyone who joins the Eigenlayer platform can become a challenger. If it believes that the behavior of an Operator has triggered the slashing conditions, it will start a fraud proof process similar to OP.

3. Staker: The slashing of the Operator will also cause the corresponding Staker to suffer losses.

The execution process of slashing the Operator is as follows:

1) The challenger calls the challenge function in the Dispute Resolution contract established by AVS to initiate a challenge;

2) If the challenge is successful, the DisputeResolution contract will call the freezeOperator function of the ServiceManager, causing the Slasher Contract to trigger the OperatorFrozen event, changing the state of the specified Operator from unfrozen to frozen, and then enter the slashing process. If the challenge fails, the Challenger will be punished to prevent malicious challenges to the Operator.

3) After the slashing process is over, the Operator's state will be reset to unfrozen and continue to operate.

During the execution of the slashing operation, the Operator's state is always frozen in an "inactive state". In this state, the Operator cannot manage the funds pledged by the staker, and the stakers who choose to pledge funds to this Operator cannot withdraw funds. This is like a person who must be punished for his crime and cannot be allowed to go unpunished. Only when the current punishment or conflict is resolved and the Operator is not frozen by the Slasher can new interactions be carried out.

Eigenlayer's contracts all follow the above freezing principles. When the staker pledges funds to the operator, the state of the Operator will be checked through the isFrozen() function; when the staker initiates a request to redeem the deposit, the isFrozen function of the Slasher contract will still be used to check the state of the Operator. This is Eigenlayer's full protection of the security of AVS and the interests of Stakers.

Finally, it should be noted that AVS does not unconditionally obtain the security of Ethereum in Eigenlayer. Although the process of obtaining security on Eigenlayer is much simpler than building AVS by itself, how to attract Operators on Eigenlayer to provide services and attract more stakers to provide assets for their own POS systems is still a problem, which may require hard work on APY.

There is no doubt that Restaking is one of the hottest narratives in the current Ethereum ecosystem, and Ethereum occupies half of Web3. In addition, various Restaking projects have already gathered extremely high TVL, which has a significant impact on the crypto market and may last for the entire cycle. We can analyze it from both micro and macro perspectives.

We must recognize that the impact of Restaking on various roles in the Ethereum ecosystem is not single, and it brings both benefits and risks. The benefits can be divided into the following points: (1) Restaking has indeed enhanced the underlying security of downstream projects in the Ethereum ecosystem, which is beneficial to the latter's long-term construction and development; (2) Restaking has liberated the liquidity of ETH and LST, making the economic circulation of the ETH ecosystem smoother and more prosperous; (3) The high yield of Restaking attracts the staking of ETH and LST, reducing the active circulation volume, which is beneficial to the token price; (4) The high yield of Restaking has also attracted more funds to enter the Ethereum ecosystem.

At the same time, Restaking

also brings huge risks:

(1) In Restaking, an IOU (financial claim) is used as collateral in multiple projects. If there is no proper coordination mechanism between these projects, the value of the IOU may be over-inflated, thereby causing credit risk. For example, if multiple projects simultaneously demand the redemption of the same IOU, then this IOU cannot meet the redemption requirements of all projects. In this case, if one of the projects has problems, it may trigger a chain reaction and affect the economic security of other projects.

(2) A considerable portion of LST liquidity is locked. If the price of LST fluctuates more than ETH, and the staking users cannot withdraw LST in time, they may suffer economic losses. At the same time, the security of AVS also comes from TVL. The high volatility of LST prices will also pose a risk to the security of AVS.

(3) The pledged funds of the Restaking project are ultimately stored in the smart contract, and the amount is very large, which leads to excessive concentration of funds. If the contract is attacked, huge losses will occur.

Microeconomic risks can be mitigated by adjusting parameters, changing rules, etc., but due to space limitations, we will not elaborate on them here.

First of all, it should be emphasized that the essence of Restaking is a kind of multiple leverage. The crypto market is very obviously affected by cycles. If you want to understand the macro impact of Restaking on the crypto field, you must first understand the relationship between leverage and cycles. Restaking adds two layers of leverage to the ETH ecosystem, as mentioned above:

First layer: LSD doubles the value of the staked ETH assets and their derivatives.

Second layer:Restaking is not all ETH, but also LST and LP Token. LST and LP Token are both voucher tokens, not real ETH. That is to say, the LRT generated by Restaking is an asset based on leverage, which is equivalent to the second layer of leverage.

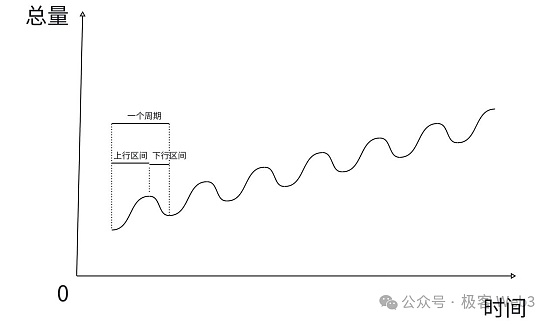

So is leverage beneficial or harmful to an economic system? First of all, the conclusion: leverage must be discussed in the cycle. In the upward range, leverage will accelerate development; in the downward range, leverage will accelerate the collapse.

The development of social economy is as shown in the above figure. If it rises for a long time, it will fall, and if it falls for a long time, it will rise. One rise and one fall is a cycle. The total economic volume will spiral upward in this cycle. The bottom of each cycle will be higher than the previous one, and the overall total volume will also increase. The current cycle of the crypto market is very obvious. It is in the four-year halving period of Bitcoin. In the first 2-3 years after the halving, there is a high probability of a bull market, and in the next 1-2 years, it is often in a bear market.

However, although the Bitcoin halving cycle is roughly the same as the bull-bear cycle of the crypto economy, the former is not the root cause of the latter. What really causes the bull-bear cycle of the crypto economy is the accumulation and rupture of leverage in this market. The Bitcoin halving is just an inducement for funds to flow into the crypto market and leverage to appear.

What is the process of the accumulation and rupture of leverage leading to the replacement of the crypto market cycle? If everyone knows that leverage will definitely break, why do we need to add leverage when it is going up? In fact, the underlying laws of the crypto market and the traditional economy are the same. We might as well look for laws from the development of the real economy. In the development of the modern economic system, leverage will definitely appear and must appear.

The essential reason is that in the upward range, the development of social productivity has led to too fast material accumulation, and if the over-abundant products want to circulate in the economic system, there must be enough currency. Money can be issued, but it cannot be issued arbitrarily and unlimitedly, otherwise the economic order will collapse. But if the amount of money is difficult to meet the circulation required after the material surplus, it is easy to cause economic growth to stagnate. What should we do at this time?

Since it cannot be issued unlimitedly, the utilization rate of unit funds in the economic system must be improved. The role of leverage is to improve the utilization rate of unit funds. Here is an example: assuming that $1 million can buy a house, $100,000 can buy a car, and the house can be mortgaged for loans, and the mortgage rate is 60%, that is, the mortgage house can borrow $600,000. If you have $1 million, without leverage and without borrowing, you can only choose to buy 1 house or 10 cars; if there is leverage and borrowing is allowed, you can buy 1 house and 6 cars. In this way, can your $1 million be spent as $1.6 million? From the perspective of the entire economic system, if there is no leverage, there is only so much money in circulation, everyone's consumption capacity is curbed, market demand cannot grow rapidly, and the supply side will naturally not have too high profits, so productivity will not develop so fast or even regress; with leverage, the problems of money supply and consumption capacity are quickly solved. So, in the upward range, leverage will accelerate the development of the entire economy. Some people will say, isn't this a bubble? It's okay. In the upward range, a large amount of off-site funds and commodities will flow into the market, and there is no risk of the bubble bursting at this time. This is similar to when we use contracts to go long, when the price of the currency rises in the bull market, there is often no risk of liquidation. What about the downward range? The funds in the economic system are constantly absorbed by leverage, and there will be a day when they will be exhausted, and then it will enter a downward range. In the downward range, prices will fall, so the mortgaged house will not be worth $1 million, and your mortgaged property will be liquidated. From the perspective of the entire economic system, everyone's assets are facing liquidation, and the capital circulation that originally relied on leverage suddenly shrinks, and the economic system will decline rapidly. Let's still use the contract as an example. If you don't open a contract and only play spot, the price of the currency will fall in a bear market, and the assets will only shrink; and if the contract is opened and the position is blown up, it is not just the shrinkage of assets, but it will go directly to zero. Therefore, in the downward range, leverage will definitely collapse faster than without leverage.

From a macro perspective, even if it will eventually break, the emergence of leverage is inevitable; secondly, leverage is not entirely good or bad, it depends on which cycle it is in. Back to the macro impact of Restaking, the leverage in the ETH ecosystem plays a very important role in leveraging the bull-bear cycle, and its appearance is inevitable. In each cycle, leverage will definitely appear in the market in some form. The so-called DeFi Summer in the last cycle was essentially the second pool mining of LP Token, which greatly contributed to the bull market in 2021. The catalyst for this round of bull market may become Restaking. Although the mechanisms seem different, the economic essence is exactly the same. Both are leverages that appear to digest the large amount of funds pouring into the market and meet the demand for currency circulation.

According to the above explanation of the interaction between leverage and cycle, Restaking, a multi-layer leverage, may cause this round of bull market to rise faster and reach a higher top, and it will also cause the bear market in this cycle to fall more violently, with a wider chain reaction and a greater impact.

Restaking is a secondary derivative of the PoS mechanism. Technically, Eigenlayer uses the value of restaking to maintain the economic security of AVS, and uses the mechanism of pledge and confiscation to achieve "borrowing and repaying, and borrowing again is not difficult". The window period for redeeming pledged funds not only leaves enough time to check the reliability of Operator's behavior, but also avoids the collapse of the market and system caused by the withdrawal of a large amount of funds in a short period of time;

As for the impact on the market, it is necessary to analyze from both macro and micro perspectives: From a micro perspective, while Restaking provides liquidity and returns to the Ethereum ecosystem, it also brings some risks, which can be mitigated by adjusting parameters, changing rules, etc.; From a macro perspective, Restaking is essentially a multi-layer leverage, which exacerbates the overall economic evolution of cryptocurrencies within the cycle, creates a large bubble, and makes the upward and downward movement of cryptocurrencies more rapid and intense, and is very likely to become an important reason for the leverage rupture of this cycle and the transition to a bear market, and this macroeconomic impact conforms to the underlying economic laws and cannot be changed, but can only be followed.

We need to clarify the impact of Restaking on the entire crypto space, and take advantage of the dividends it brings in the upward range, and be prepared for leverage rupture and market decline in the downward cycle.

Custody risk, slashing risk, and liquidity risk are the main concerns in the BTC LST landscape.

JinseFinance

JinseFinanceBabylon's LST is unlikely to be an Alpha, and it is also difficult to replicate the hype of Eigen LST.

JinseFinance

JinseFinanceLRT is in a pre-Bull period of silence.

JinseFinance

JinseFinanceStakeStone, a leader in Omnichain liquidity, offers a decentralized Liquid Staking Token (LST) protocol, aiming to revolutionize staking with innovative solutions.

Brian

BrianStakeStone uses STONE (interest-bearing ETH token) to bring native staking income and liquidity to the Layer2 network. This article attempts to comprehensively understand the fundamentals of the StakeStone project through 12 questions.

JinseFinance

JinseFinanceThere has been a lot of discussion recently around EigenLayer's re-staking and LRT. Users are placing bets around the protocol's potential airdrop expectations, and re-staking has become the hottest narrative in the Ethereum ecosystem. This article will briefly discuss some of the author’s thoughts and opinions on LRT.

JinseFinance

JinseFinanceCrypto researcher Ignas started from the potential of the LRT track and made a panoramic analysis of the "LRT war" carried out by the re-pledge protocol from the perspectives of points mechanism, revenue method, token economics, etc., and finally gave his own strategy manual.

JinseFinance

JinseFinanceLST, LRT, pledge, and re-pledge, these concepts can easily confuse people.

JinseFinance

JinseFinanceTIA has exceeded $20B, and the airdrop expectations for ETH's enhanced version of TIA - Eigenlayer have also been very high. The LRT track based on Eigen can achieve double points.

JinseFinance

JinseFinanceThe addresses mainly run by active human traders have notched more than 147,000 addresses for the first time since November.

Cointelegraph

Cointelegraph