Geopolitics has just been suspended, and Trump and Musk have started a war of words in everyone's wallets, and the market has been turbulent. But even so, it is difficult to cover up the edge of the tokenization of US stocks. In the past week, with the high-profile entry of Robinhood and xStocks, the tokenization of US stocks has been like a spring breeze, making the market feel relaxed and happy. For a time, institutions regarded it as a magic weapon for growth, retail investors said it was a new code for wealth, and the media was competing to praise and spread it. The slogan of reshaping the market has been launched, and the tokenization of US stocks has become the new political correctness of encryption.

But obviously, political correctness cannot be established by a slogan, and the integration of coins and stocks is far from as simple as imagined.

The past and present of US stock tokenization

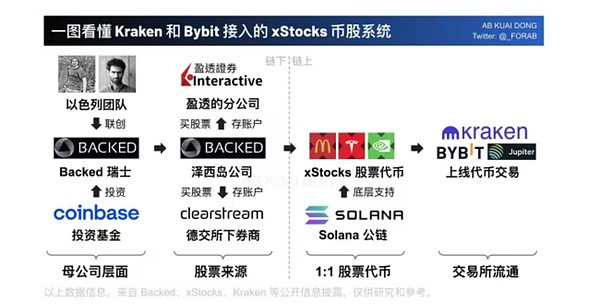

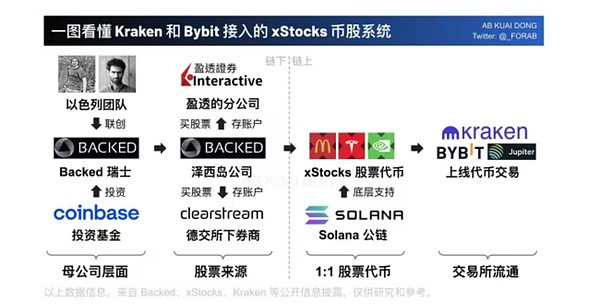

The beginning of this round of US stock tokenization began with Kraken, but the explosion originated from Robinhood. On May 22 this year, Kraken announced on the X platform that the crypto exchange will cooperate with Baked to launch xStocks on Solana to provide tokenized trading of US listed stocks. On June 30, xStocks was officially launched, realizing the tokenization of 60 US stocks. Bybit also participated in it, stating that its spot platform will gradually launch xStocks tokenized US stocks and ETF products.

On the same day, Robinhood also announced that it would allow EU customers to trade US stocks and ETFs on the blockchain and launch the "Robinhood Stock Token". It is reported that this type of token presents popular company stocks in the form of cryptocurrency, trading is commission-free, and holders can receive dividends in its application. Customers can trade stock tokens representing more than 200 companies, 24 hours a day, 5 days a week. These stocks were originally issued on Arbitrum and will be migrated to the company's own Layer2 chain.

One is a global leading exchange, and the other is a rising stock market rookie in recent years. This news instantly ignited the market. Affected by this, Robinhood's stock price hit a record high, with a single-day increase of more than 10%. The volume of voices surrounding the mechanism, investment discussion, and practical significance of tokenization is increasing day by day. The tokenization of US stocks has become an incremental track recognized by the market.

It seems to be a hit, but in fact, the tokenization of US stocks is no longer a new thing, and Mirror Protocol is a typical representative of it. As early as December 4, 2020, Mirror Protocol, the originator of the tokenization of U.S. stocks, was launched. The founder of this platform is also very familiar to the market. He is the CEO of Terraform Labs, Do Kwon, who is currently in prison.

The platform relies on on-chain synthetic assets to track U.S. stock prices, and ultimately maps out a new asset, mAssets, which is an asset formed by simulating real stock prices through oracles and smart contracts. In other words, asset holders do not actually own U.S. stocks, but buy tokens that track certain stock prices. At that time, mAssets could not only be traded freely on decentralized exchanges, but also serve as collateral to earn interest. It not only maintained the anonymity of on-chain finance, enjoyed the high liquidity on the chain, but also had the growth of U.S. stocks. It can be said to be a win-win situation.

Everyone is familiar with the subsequent plot. Terra collapsed, leaving a lot of criticism in the market. Mirror Protocol unexpectedly fell into a downturn. Coupled with the subsequent SEC securities investigation, it eventually disappeared from the public's view.

Five years later, the tokenization of US stocks has come again, and this time, it seems different. In addition to the obvious regulatory benefits, the current tokenization of US stocks is also different from Mirror in terms of mechanism. Compared with Mirror, which does not require the endorsement of underlying assets and simply focuses on the price fluctuation model, today's tokenization must not only be in compliance, but also requires the actual holding of corresponding securities.

Take xStocks as an example. Its actual issuer is the Swiss parent company Backed Assets. The company buys stocks in the US stock market through the channel of IBKR Prime under Interactive Brokers and transfers them to the segregated account of Clearstream, a depository affiliated with the German Stock Exchange. After purchasing stocks, the issuer will trigger the Solana on-chain contract to realize the corresponding token issuance and mint tokens at a 1:1 ratio based on the number of stocks purchased. The exchanges that cooperate with it can then list such tokens and contracts, and redemption also follows similar operations, ultimately building a closed loop of the token life cycle of minting-issuance-trading-destruction.

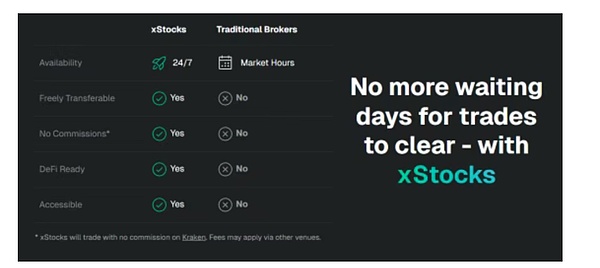

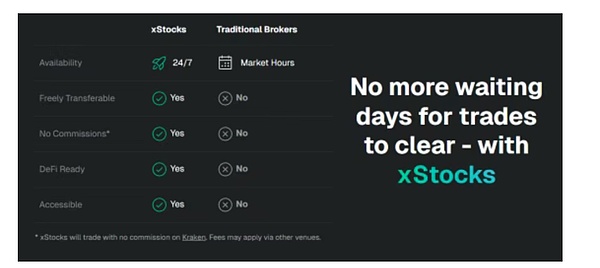

Robinhood's mechanism is similar, except that the issuer has been changed to Robinhood Europe, the underlying assets are managed by a US compliant institution, and the on-chain contract is built based on a self-built chain. The biggest difference is that Robinhood's coin stocks are restricted to the European APP, and the coins cannot be withdrawn to the chain after purchase, while Kraken and Bybit can support token on-chain contracts. However, both xStocks and Robinhood Europe must follow the EU MiFID II framework, which means mandatory KYC/AML and only allowed to conduct business in compliant regions. At present, xStocks can only be used by non-US users, while Robinhood is only for EU customers. Neither of them has voting rights, but both have dividends. xStocks supports dividends through token airdrops and other methods, while Robinhood automatically reflects them in token holdings.

Overall, limited by the regulatory attributes of the subject, Robinhood, which started in the traditional world, is more stringent in compliance. Not only is it more particular about details such as custody and trading, but it is also more inclined to self-development and take the initiative at the infrastructure level. Therefore, the target group is more mainstream people who are accustomed to traditional stock market operations. Kraken and Bybit's xStocks are more crypto-native and more open. The promotion model focuses more on ecological network effects, supports native on-chain transactions and DeFi protocols in the currency circle, has a lower investment threshold, and is more attractive to retail investors.

Although the mechanisms are not completely consistent, the moves of the two are still far-reaching. From a positive perspective, this is an effective attempt to tokenize stocks under the background of compliance. By introducing the traditional stock market into the on-chain world, it successfully opened a window of traditional finance in the crypto field, which not only marks the acceleration of the mainstream process in the crypto field, but also greatly reduces the threshold of asset investment. It helps the crypto market to expand trading channels globally from the perspective of asset equality and further promotes the growth of scale. As a typical demonstration, stock tokenization will also greatly promote the growth of tokenized products, and a new era of securitization and monetization is expected to come. It is worth noting that DeFi has also ushered in new opportunities. In the current context of the absence of high-quality assets, the tokenization of US stocks has continued the narrative space of Defi as a strong supplement. For the traditional stock market, the original stock trading model is expected to be reshaped, the trading time is greatly extended, and the liquidity is more active under 7/24 hours. This move has opened up a new liquidity window for some stocks in the new trading time, which has a very positive impact on improving the utilization rate of funds and the transaction matching rate.

But everything has two sides, and the strong invasion of US stocks has also had a huge impact on the current market structure. With the development of US stock tokenization, especially the subsequent launch of tokenized perpetual contracts, the currency-stock coupling is likely to return the liquidity of native encryption to the on-chain stock market, and the liquidity acting on other non-utility tokens will be siphoned, which means that the development of altcoins will face greater challenges. In other words, if there is already a "US stock value token" investment that can be quantified and anchored to a certain extent, investors can enjoy the dual benefits of stock growth and Defi, then the recognition of "air tokens" with a single nature will inevitably plummet.

US stock tokenization, many challenges

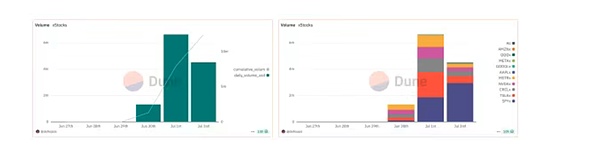

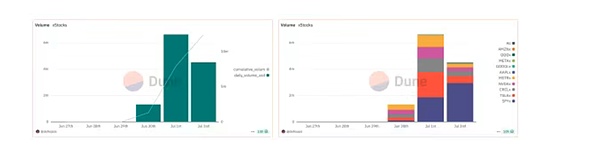

Of course, from the current point of view, this worry is still premature. Although the slogan is loud, the actual liquidity of stock tokenization is not satisfactory. According to Dune data, since its launch on June 30, xStocks' total transaction volume has only been about 12.49 million US dollars, and the number of users is only more than 10,000. From the perspective of market depth, only SPYx's 24-hour trading volume can be stabilized at more than one million US dollars, which is enough to show that stock tokenization still has a long way to go.

The weakness of liquidity is caused by many factors. The first is user limitations. Under the existing compliance terms, the most purchasing power American users are excluded, which greatly affects liquidity. In fact, if it is not compliant with the US market, the significance of stock tokenization will be greatly reduced, especially in the context of the vast majority of the underlying assets being US stocks.

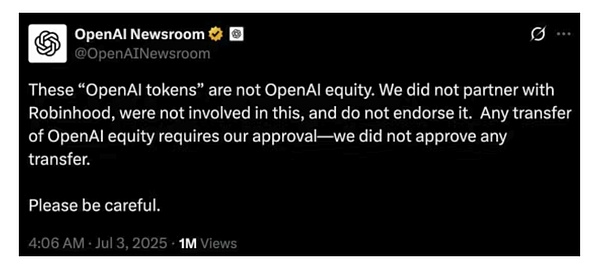

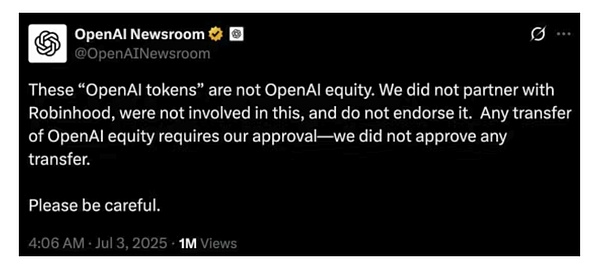

Just today, in response to Robinhood's promotion of giving away OpenAI tokens worth 5 euros, OpenAI issued a statement in response, stating that these 'OpenAI tokens' are not OpenAI's equity, we have not cooperated with Robinhood, we are not involved in it, and we do not support it", emphasizing that "any transfer of OpenAI equity requires our approval - we have not approved any transfer."

This actually reflects the nature of tokenized stocks. Although the issuer will purchase the corresponding securities as the underlying assets, and the user has successfully mapped the physical securities through such tokens, the user does not have the ownership of the stock, and the physical delivery is also difficult. The reason is that the existence of such tokenized stocks is actually another level of regulatory arbitrage. On the basis that the derivatives and tokenization rules have not yet been perfected, the issuer wraps the so-called "stock coin" assets in the shell of derivatives to attract users. In-depth analysis shows that users only buy "tokens" issued by securities companies, not stocks in the true sense. This is why most tokenized stocks have no voting rights. Furthermore, the token price is completely provided by the oracle. The current market does not have depth, and delays or even decoupling are possible when there is a large fluctuation. If it is not handled properly, it is very likely to stage another runaway drama. It is worth noting that on Robinhood's official website, tokenized stocks have received a risk rating of 7, and the highest risk of this rating is also 7.

In addition to man-made disasters, there are also limitations in the mechanism. At present, the on-chain tokenized stocks on xStocks have a transaction fee of up to 0.50% + and an annual fee of 0.25 % management fee (currently waived), is not friendly to market makers. Dragonfly partner Rob Hadick said that market makers face high transaction costs and compliance risks. "At this stage, most platforms rely on SPV to purchase equivalent real stocks in the market as collateral, but most of them can only buy them during the opening hours of the U.S. stock market. This means that all after-hours/weekend transactions require market makers to bear the price risk themselves. However, such price fluctuations are difficult or almost impossible to hedge in traditional finance. Even for redemption, market makers have to bear a handling fee of up to 25 basis points, which is quite expensive. At the same time, any DeFi protocol or market maker that accidentally provides such token trading services to U.S. users will face compliance risks far higher than other crypto assets. This means that weekend/after-hours trading is basically not suitable for professional traders, price fluctuations are highly coupled with the official opening price, and such products are not easy to use for most users. ”

Although there are still shortcomings in compliance and mechanism, the potential of the stock tokenization market has been seen by the market. After Robinhood and Kraken, Coinbase, Jupitar, Gemini, Ondo, INX Digital and many other institutions are eager to try. Faced with this market that may easily reach hundreds of billions of dollars, any company with a little ambition will not let it go. The competition for technical routes is also ongoing. There are rumors in the market that Arbitrum has spent a lot of resources to obtain the cooperation of Robinhood. After all, a small step in stock tokenization may be the beginning of the TradFi market.

Ending

How far can stock tokenization go? No one knows. But in the clamor of the audience singing praises, both the people in the currency circle and the stock market can only jump on the train of the times with their eyes closed.

Weatherly

Weatherly