On July 18, 2024, the Hong Kong Monetary Authority (HKMA) released the list of participants in the stablecoin regulatory sandbox. JD.com, Yuanbi, and Standard Chartered became the first batch of participating companies. Once the list was announced, it immediately triggered a high level of discussion in the market; on July 28, Hong Kong virtual bank Tianxing Bank, a joint venture between Xiaomi Group and AMTD Group, also announced on its official website that it had reached a stablecoin issuer sandbox cooperation with JD.com Coinlink Technology (Hong Kong) Co., Ltd. (JINGDONG Coinlink), a subsidiary of JD.com Group, which triggered the market's infinite imagination.

As a traditional Internet giant, JD.com entered the stablecoin track, known as the "crown of the crypto industry". The strategic considerations, demonstration effects, and far-reaching impact on the development of Hong Kong's Web3 are worth in-depth analysis. More importantly, the Hong Kong Monetary Authority's consultation document on stablecoin regulatory legislation released in July comprehensively provided the market with a "Hong Kong solution" that is both prudent and inclusive of innovation. From the entry of giants to the acceleration of legislation, whether the stablecoin based in Hong Kong can go global, the regulatory dynamics reflected behind the legislative proposals, and the winning formula of stablecoins supported by giants, this article analyzes them one by one.

1. Cause: Traditional Internet giants enter Web3, the first-mover in the era of going global

1. JD.com's strategic considerations: make up for the shortcomings of payment, the disruptive advantages of stablecoins in cross-border payments

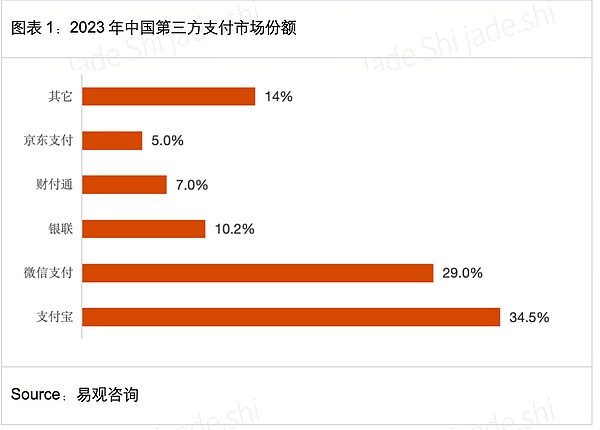

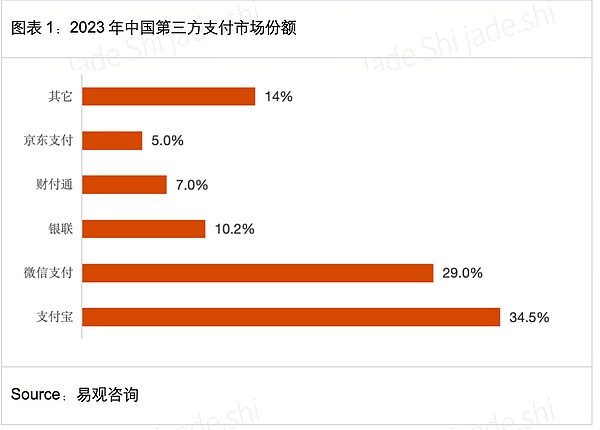

According to public information, as early as 2014, when JD.com went public in the United States, a media reporter interviewed Liu Qiangdong and asked "whether he had made any mistakes". Liu Qiangdong replied at the time: The biggest mistake I made in JD.com's business was not starting payment earlier. Today, the prophecy has come true. The loss of its first-mover advantage in payment has left JD.com with no spare energy to compete with Alibaba and Tencent in third-party payment. According to data from consulting firm Analysys, the market share of JD.com Payment will be more than five times that of WeChat and Alipay in 2023.

Being late in payment may have given JD.com a full warning. JD.com's subsequent strategic layout in technology is very forward-looking to avoid missing major opportunities. JD.com can be seen in almost every Internet outlet.

Looking back at the history of payment, we can clearly see the strategic considerations behind JD.com's announcement of entering the stablecoin market. As a payment tool that has been proven by the market, stablecoins have disruptive advantages over traditional payments, especially the amazing profit prospects and broad space of the stablecoin business itself are undoubtedly very attractive. Needless to say, with the performance of domestic Internet e-commerce giants under pressure and each of them taking "going overseas" as the second growth curve of business growth, JD.com will not let itself fall into the dilemma of falling behind in payment again, nor is it willing to miss the upcoming "golden age" of Web3.

2. The era of going overseas: It is the right time to combine cross-border overseas and web3 payment to seize the first mover

Behind JD.com's entry into stablecoins, a more important era background is the collective overseas expansion of Chinese e-commerce giants. Especially after the epidemic, the competition for going overseas has become increasingly fierce, among which cross-border payment is the top priority. However, the efficiency dilemma of cross-border payment and geopolitical risks have always plagued these giants going overseas.

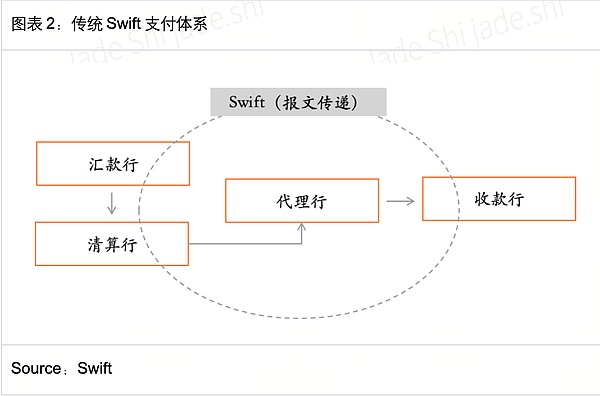

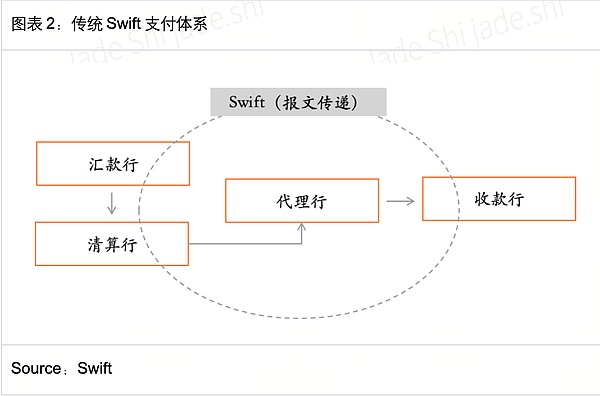

Take the traditional Swift system as an example. At the beginning of its establishment, it was a top-down construction method. Now, the system is bloated and huge. A cross-border transfer process involves not only the remittance bank and the receiving bank, but also the communication, messages, and capital flow between multiple organizations such as the clearing bank, the agent bank, and Swift. In particular, in recent years, the agent banks in the global Swift system have been continuously reduced, further improving the timeliness and cost of cross-border settlement. What is more worrying is that due to the frequent geopolitical risks, the SWIFT organization faces fragile cooperative relationships. Once it is removed from the SWIFT system or subject to financial sanctions, it means that it is basically impossible to establish contact with banks outside the country.

The US dollar stablecoin represented by USDT and USDC is not only the cornerstone of the entire Web3 industry, but also the payment tool most likely to subvert traditional payments. Compared with traditional payments, the transfer payment of stablecoins on the blockchain is sufficient to achieve the function of payment and settlement without any intermediate links.

According to statistics from the Bank for International Settlements (BIS), the use of stablecoins and other cryptocurrencies for cross-border payments can increase time efficiency by more than 100 times, and reduce transfer costs by more than 10 times. In terms of timeliness and cost alone, stablecoin payments are a disruptive impact on traditional payments.

In the specific scenario of cross-border overseas expansion, the use of Web3 payments has incomparable advantages in terms of efficiency and cost. In this field, Tencent and Alibaba have rapidly expanded their territory overseas based on their advantages accumulated in China. The two companies have obtained payment licenses in Malaysia, Singapore, the United States, etc., and have landed in dozens of countries and regions around the world.

It is unknown whether JD.com can achieve a curve overtaking overseas by entering Web3 payments through stablecoins, but once successfully implemented, it will quickly narrow the gap with other giants in payment, and it also proves that, at least in the field of payment, the first-mover advantage is very important.

3. Big companies' actions: From Hong Kong to the world, the tentacles reaching out to Web3 are secretly extended

Jingdong is not a novice in the blockchain. The company involved in this event: Jingdong Coinlink Technology (Hong Kong) Co., Ltd. (JINGDONG Coinlink) was established in March this year, but it is not a new establishment in essence. Instead, it is the original Jingdong asset management company in Hong Kong that changed its name. It also has licenses No. 1, 4, and 9 issued by the Hong Kong SFC, and has hired Liu Peng, a veteran in the payment industry, to take the helm. At least it shows that Jingdong is not "suddenly motivated" or just chasing fashion in this matter. In fact, Jingdong has a long history of layout in the blockchain. Around 2016, when the momentum of the domestic alliance chain was hot, Jingdong participated strongly and built Zhizhen Chain with UnionPay. At the same time, in the NFT craze, it was similar to other big companies and released the NFT platform Lingxi. Although it gradually faded out under the influence of tightened supervision, Jingdong is no stranger to technology and understanding of blockchain.

Correspondingly, although other major companies have also gradually withdrawn from tracks such as NFT, they have not completely given up Web3 overseas, and various investments are being secretly extended. An important influencing factor here is the compliance process in Hong Kong, Singapore and other places.

Tencent announced in 2021 that its Tencent Cloud was prohibited from engaging in matters related to virtual currency. In 2023, after the supervision of Hong Kong, Singapore, Dubai and other places gradually became clear, Tencent officially restarted its support plan for the global Web3 industry at the Web3 Summit held in Singapore. At the same time, its first four heavyweight partners, Ankr, Avalanche, Scroll and Sui, were also made public. All four projects are well-known projects in the encryption industry; in 2023 and 2024, it invested in Lens Protocol and Chainbase respectively. The latter is not only a participating investor, but also the lead investor.

ByteDance announced a partnership with Sui in April 2024, launching its first foray into blockchain projects, intending to enter Web3 through games and socialfi ecology. Of course, TikTok, owned by ByteDance, also launched an NFT series during the NFT boom.

Another Internet giant, Alibaba, has a deeper involvement in Web3, and the timing of its involvement is consistent with Tencent. Both will fully enter Web3 in 2023. According to an incomplete inventory, Alibaba has established cooperation with NEAR, Aptos, Avalanche, BNB Chain, etc. Cai Chongxin, the current helmsman and one of the founders of Alibaba, is a staunch supporter of Web3. The family's Blue Pool Capital has invested in well-known Web3 projects such as FTX, Polygon, and Animoca in the early days.

If we look at the timeline, the key time for big companies to go from NFT silence to reopening Web3 investment is in the second half of 2022 and 2023. The subtle thing is that Hong Kong issued the "Policy Declaration on the Development of Virtual Assets in Hong Kong" in October 2022. The determination of the Hong Kong government reflected behind the declaration, and the trend of regulatory compliance may be an important basis for these big companies to participate in succession. Until this time, JD.com directly participated in the Web3 project.

Second, stablecoin regulation: from regulatory sandbox to legislative proposals, policies are inclusive and prudent

1. Regulatory sandbox: The regulatory thinking is cautious and pragmatic, but participation does not mean permission, and the intention is to be the first

The operation of the sandbox has overall specifications, and participation does not mean permission, but the timing of first-mover is important. The Hong Kong Monetary Authority’s Fintech Regulatory Sandbox was launched as early as 2016. Its main purpose is to allow participating companies to test new financial products in a relatively relaxed regulatory environment without having to fully comply with the existing regulatory system. As of the latest disclosure time, the Hong Kong Monetary Authority has a total of 336 sandbox operation projects. In terms of the specific operation of the sandbox, there are no detailed regulations and standards, but there are generally the following characteristics:

a. Allow participating sandbox institutions to launch relevant financial technology products or services

b. Participating test institutions do not need to meet all regulatory requirements during the sandbox period

c. Participating test institutions should not use the "regulatory" sandbox to circumvent certain applicable regulatory provisions

At the end of the sandbox evaluation stage, the HKMA has no clear standards, and the overall supervision is relatively flexible. In the end, the HKMA will decide whether to pass the sandbox test and whether to allow it to be promoted to the entire market based on the test results and various factors.

The regulatory sandbox for stablecoins was officially launched on March 12 this year. According to the requirements of the regulatory sandbox, all participants need to provide the HKMA with detailed business feasibility plans and "sandbox" plans. The core considerations are the real intention and reasonable plan for issuing stablecoins, the sandbox plan, and reasonable expectations that meet regulatory requirements.

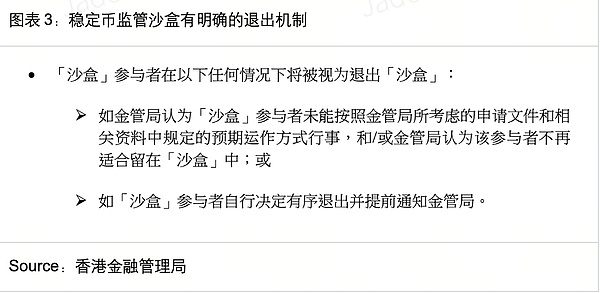

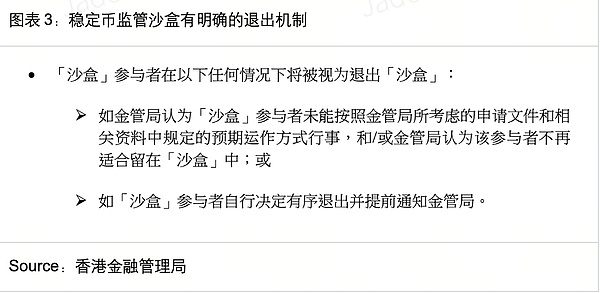

It is worth further clarifying that participating in the regulatory sandbox does not mean being approved for formal issuance, nor does it mean obtaining a stablecoin license. In March of this year, the regulatory sandbox document disclosed by the HKMA clearly stated that the sandbox has an exit mechanism.

The above document also means that for the three participants, they can withdraw at any time or be forced to withdraw because they do not meet the requirements of the HKMA. At the same time, in the overall operating principles of the regulatory sandbox, if the subsequent stablecoin regulatory sandbox fails, the stablecoin cannot be launched to the market.

If any of JD.com, Yuanbi, Standard Chartered & Anfu & HKT passes the sandbox test, although it still needs to apply for a license from the regulatory authorities, the probability of obtaining a license is much greater than that of non-participants. This is undoubtedly an important reason for JD.com and the other two participants to participate in the stablecoin sandbox test.

The three companies have their own strengths, but they all have traditional backgrounds, and the Hong Kong government's regulatory thinking is cautious and pragmatic. The participants in the list announced by the Hong Kong Monetary Authority this time have two characteristics:

a. All have traditional financial backgrounds. This may not be entirely a coincidence. After all, traditional finance has rich experience in risk control, regulatory communication, and consumer protection, and the financial strength behind it is quite strong, which can ensure that there is enough capacity to meet various requirements during the testing period, which is enough to show the HKMA's cautious and high threshold requirements for the issuance of stablecoins.

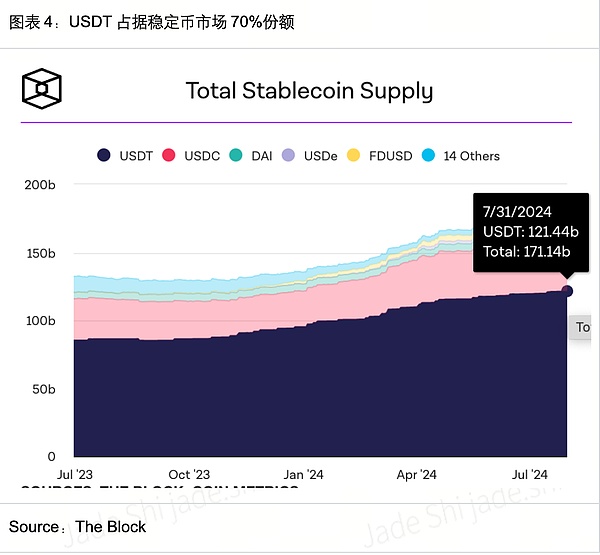

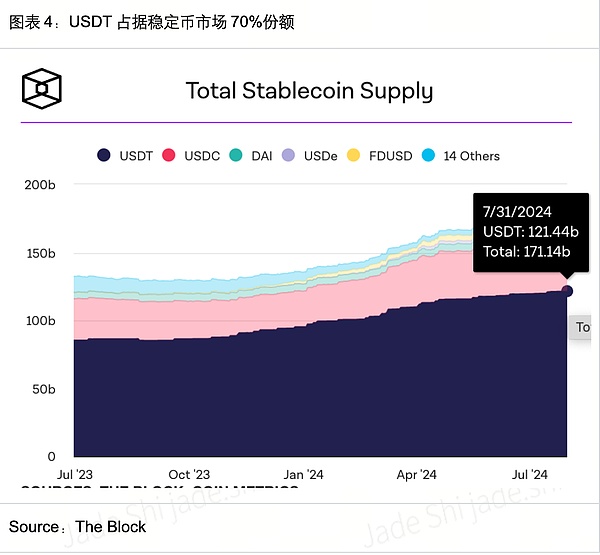

b. The three institutions have their own resource endowments, but there are clear scenarios behind them. The current stablecoin market is an oligopolistic market, with stablecoins pegged to the US dollar accounting for more than 99% of the market share, of which Tether accounts for more than 70% of the US dollar stablecoin market.

If a stablecoin that is not pegged to the US dollar is launched, whether it can make a breakthrough in market share, in addition to the need for appropriate supervision, it is more important to find scenarios and use cases for Hong Kong dollar stablecoins. It is particularly important to expand market share through scenario-based applications. The huge cross-border e-commerce trade behind JD.com is an important scenario for stablecoins as a payment tool; Yuanbi Technology itself has wallets, Defi and other businesses, and is rich in experience in the Web3 field. It can use the Hong Kong dollar stablecoin as an important bridge tool from We2 to Web3 to expand its share; traditional banks represented by Standard Chartered Bank can further explore the role of stablecoins as core tools in the financial payment market.

The signal that can be clearly read from the above two points is that the Hong Kong government is cautious in the issuance of stablecoins as a whole. The list of participants has been carefully selected and has clear scenario support, which also shows that the Hong Kong government is very pragmatic in supervision.

2. Draft of Hong Kong Stablecoin Legislation: Prudent and Inclusive Regulatory Thinking

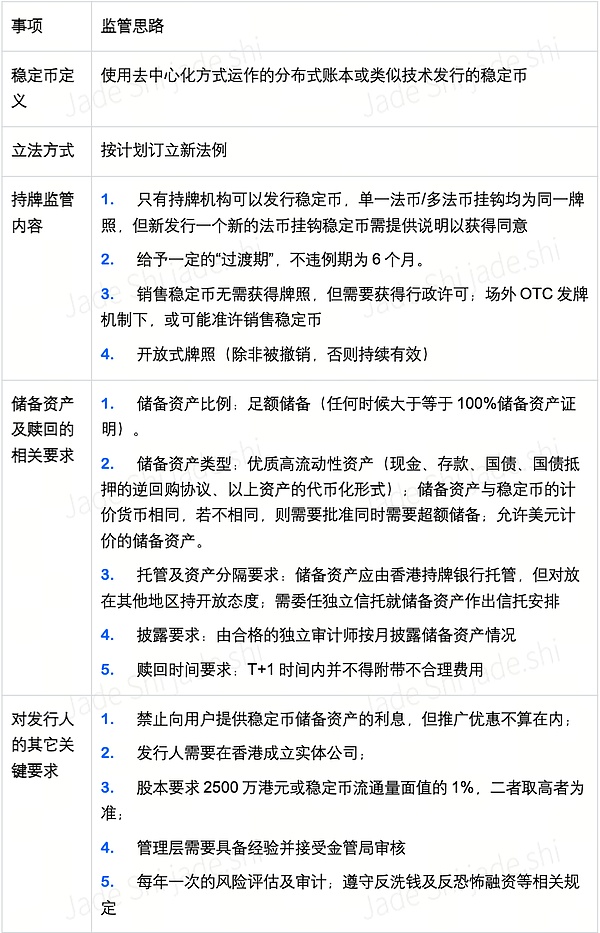

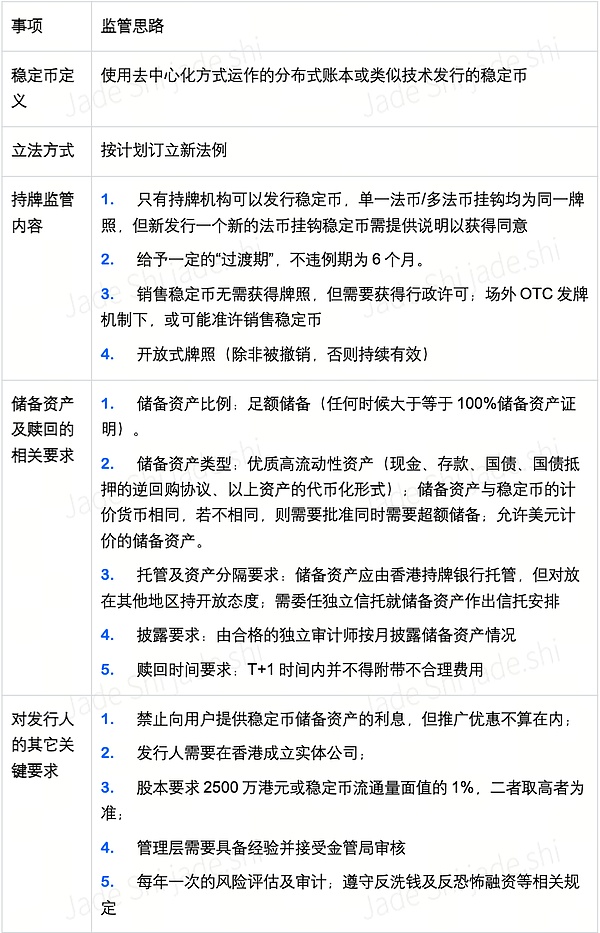

In addition to the sandbox announced by the HKMA in July, it also announced the "Legislative Proposal for the Regulatory System of Stablecoin Issuers in Hong Kong (Consultation Summary)". This document is a summary and response to the consultation document on the stablecoin regulatory system officially released to the public in December 2023 and the response opinions, which can give us a glimpse of the Hong Kong government's regulatory thinking on the issuance of stablecoins.

The document elaborates on the Hong Kong government's legislative approach, regulatory framework, custody, sales, etc. of stablecoins and responds one by one.

For stablecoins, the most important key is undoubtedly the security and liquidity of the reserve assets linked to the stablecoins, which is the core interest of users. Combining the last consultation draft and this document, it can be clearly seen that the Hong Kong government’s response to the reserve assets is very detailed, and some of its positions are very firm, highlighting its attitude towards protecting consumer rights; on the other hand, it has also made some adjustments and innovations to the content, such as reducing the issuer’s equity requirement from the original 2% of the stablecoin circulation to 1%.

The more significant display of the Hong Kong government's innovation is reflected in the fact that it allows RWA assets such as government bonds to be tokenized as reserve assets, and allows assets denominated in US dollars to be used as reserve assets for Hong Kong dollar stablecoins. This has no precedent in the stablecoins that have been issued globally before, which also deeply reflects the Hong Kong government's support for the real-world assets represented by RWA on the chain and its innovative tolerance.

III. Impact and Outlook: Based in Hong Kong, Facing the World, Cooperation Wins

1. Impact: Demonstration effect of giants leaving the field, but compliance acceleration is more critical

Traditional giants represented by JD.com can trigger huge discussions in the Web3 field. Behind this, there is an expectation that the native encryption world will become mainstream, and there is also an overall trend of accelerated integration of Web2 and Web3. From Hong Kong to the world, it is the same. For example, the traditional payment giant Paypal will issue stablecoins in August 2023, and the total market value has exceeded US$600 million in one year; Visa not only cooperates with exchanges to launch stored-value cards, but is also cooperating with Solana to provide USDC stablecoin settlement.

Especially since this year, Bitcoin spot ETF and Ethereum spot ETF have been listed in the United States and Hong Kong respectively. The compliance of the crypto world has officially become the mainstream paradigm. With the support of compliance, there are more and more cases of traditional institutions embracing virtual currencies. JD.com is not the first, and it will not be the last.

In recent years, due to regulatory reasons in mainland China, large companies have mainly waited and watched the crypto ecosystem, and occasionally entered the market with small-scale overseas investments. JD.com's personal trial of the stablecoin business has undoubtedly set a good example for large companies that are waiting and watching, especially considering that Liu Qiangdong, the actual helmsman of JD.com, has always been known for his unique strategic vision in the industry, and his leading role is even stronger. On one side is the increasingly compliant and booming early crypto world, and on the other side is the extremely cruel and involuted traditional Internet ecosystem; entering the crypto ecosystem may become a must for large companies, and this trend will only get stronger.

2. Prospect: Exploring the Hong Kong dollar stablecoin scenario and building an ecosystem in cooperation is the key to success

For the first participants such as JD.com, Yuanbi and Standard Chartered, even if the fiat currency assets denominated in US dollars are used as reserves, how the Hong Kong dollar stablecoin can expand the market in the oligopolistic US dollar stablecoin is still a major problem, especially since the Hong Kong government is also promoting the digital Hong Kong dollar and does not allow the Hong Kong dollar stablecoin to pay interest. This also further distinguishes the application of the digital Hong Kong dollar and the stablecoin. The former serves as the most basic credit currency tool with the status of legal currency, which can be adopted in offline retail scenarios, while the Hong Kong dollar stablecoin serves as a value measurement tool for crypto assets and a cross-border payment tool.

From the perspective of blockchain technology, issuing stablecoins does not involve high-barrier technologies. The blockchain technologies used by the currently circulating fiat-asset-collateralized stablecoins are similar and there is no obvious difference, but in terms of adoption rate, there is a clear gap. For fiat-collateralized stablecoins alone, the most core elements are compliance foundation and scenario application support. Taking USDT, USDC and FDUSD as examples, all three are fiat-collateralized stablecoins. USDT firmly occupies the first position in the market thanks to strong user inertia, but the rise of USDC and FDUSD benefits from compliance and scenario support respectively. If we analyze historical data, we can find that whenever USDT encounters a compliance trust crisis, the market value of USDC can always be upgraded; FDUSD benefits from the strong support and drainage of Binance, and its scale soars rapidly.

From various real successful cases, we can see that the success of Hong Kong dollar stablecoins in the future is inseparable from the carrying of large-traffic application scenarios, and it is far from enough to rely solely on JD.com or the other two participants. From the user experience process, it is necessary to open up the full compliance channel of legal currency-stable currency-cryptocurrency-stable currency-legal currency to provide a basis for large-scale adoption.

The cooperation between HashKey Exchange, the largest licensed exchange in Hong Kong, and Kun is a typical example. It solves the problem of compliant transactions between users' legal currency and cryptocurrency, but this is only the first step. In this ecosystem, the cooperation of licensed stable currency issuers, compliant exchanges, licensed OTC, RWA asset issuance, and custodian banks is required to strengthen the entire ecosystem. Taking the above picture as an example, the issuer of the Hong Kong dollar stablecoin must not only solve the first step of converting fiat currency to stablecoin, but also establish cooperation with licensed banks, compliant exchanges (such as Hashkey, OSL), crypto asset management institutions, licensed OTC (licensing mechanism to be introduced), third-party payment institutions, etc., so that the use case of the Hong Kong dollar stablecoin is not limited to payment, but also allows users to enjoy a series of benefits such as crypto asset management and investment, so as to build a complete user crypto journey, which can not only solve the real payment problem, but also help users enjoy the dividends of the overall growth of the crypto industry, so as to expand the user's adoption rate and stickiness and realize the real breakthrough of the Hong Kong dollar stablecoin.

JinseFinance

JinseFinance