Source: Lawyer Jin Jianzhi

On January 3, 2024, the Shanghai Taxation Bureau of the State Administration of Taxation issued a document on the public account Shanghai Taxation "Common Misunderstandings about Personal Income Tax Business Income and Classified Income", which pointed out that individuals pass Online buying and selling of virtual currencies requires personal income tax.

This article caused an uproar among friends in the circle, both worried If your income will be reduced due to paying taxes in the future, you will be more worried about the tax bureau conducting tax audits on your previous income.

Maybe Mankiw’s friends don’t need to be too nervous.

01 This is just a tweet to increase knowledge

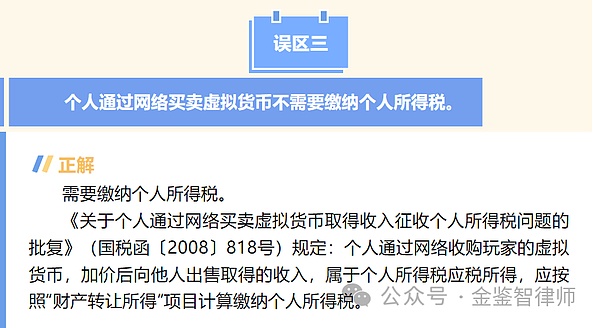

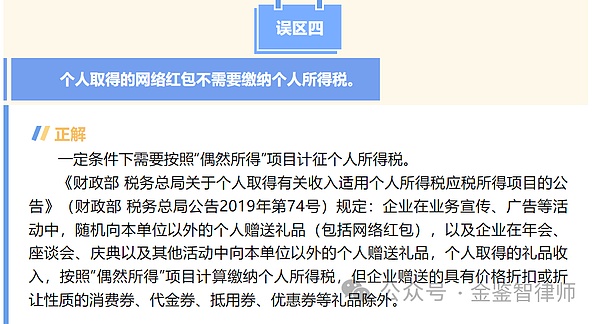

This article from Shanghai Taxation is just an ordinary popular science tweet in their regular "Increase Knowledge" column. The purpose is to help citizens increase their tax knowledge, including unconventional and bizarre tax knowledge. Immediately following the issue of individuals needing to pay personal income tax when buying and selling virtual currencies online is "Individuals need to pay personal income tax when receiving online red envelopes." The strange question about whether you have to pay personal income tax when receiving online red envelopes makes the question about whether you have to pay personal income tax when buying and selling virtual currencies seem weird. People have to wonder, is the virtual currency mentioned by Shanghai Taxation the virtual currency that friends in the industry understand, or is it a game currency such as QQ coins?

But what is clear is that this article from Shanghai Taxation is not an official document. Maybe the editor read Lawyer Mankiw Jin's article on October 17, 2023 "Do Chinese citizens need to pay taxes when trading virtual currencies?" 》 or editing ideas generated by videos.

02 ;Do you need to pay taxes for currency speculation?

Getting back to the subject, regardless of whether Shanghai Taxation issued the document unintentionally or intentionally, and regardless of the policy direction, from the perspective of laws and regulations , does the state have the legitimacy and legality to levy taxes on the income from currency speculation? some.

Whether it is the "Notice on Preventing Bitcoin Risks" (Yinfa [2013] No. 289) (hereinafter referred to as "Circular No. 289"), the People's Bank of China and other five ministries and commissions, the People's Bank of China, etc. The "Announcement on Preventing Token Issuance Financing Risks" (hereinafter referred to as the "94 Announcement") issued by seven ministries and commissions on September 4, 2017, is also the "About Further Measures" issued by the People's Bank of China and other ten ministries and commissions on September 24, 2021. "Notice on Preventing and Handling the Risks of Speculation in Virtual Currency Transactions" (hereinafter referred to as the "924 Notice"), Although the state denies the legal currency attributes of virtual currencies, it does not deny the property or commodity attributes of virtual currencies. Since virtual currency has property attributes, my country’s existing tax laws can tax virtual currency transactions.

According to my country's current tax laws, the income generated from the transfer of virtual currencies such as Bitcoin may involve the payment of personal income tax.

According to the "Individual Income Tax Law of the People's Republic of China" and "Implementation Regulations of the Individual Income Tax Law of the People's Republic of China", income from property transfer is subject to personal income tax. In addition, according to the currently effective "Reply of the State Administration of Taxation on the Collection of Personal Income Tax on Income Obtained by Individuals from Online Trading of Virtual Currencies" (Guo Shui Han [2008] No. 818), individuals purchase virtual currencies from players online and sell them to others at a markup. The income obtained is taxable income for personal income tax, and personal income tax should be calculated and paid according to the "income from property transfer" item.

Although game currency is very different from the virtual currency referred to in this article, they are currently the same in terms of legal characterization. Therefore, personal income from trading virtual currencies can be taxed according to the National Tax Letter [2008] No. 818.

03 Can the tax audit be conducted indefinitely?

An issue that Mankiw’s friends are also concerned about is, what should the tax bureau do if they turn over old scores and require tax on previous gains from virtual currency transactions? Can the Inland Revenue Department pursue tax payments indefinitely? Can't.

The tax law stipulates the recovery period. The reason for setting the tax recovery period is, on the one hand, to urge the tax authorities to exercise their powers in a timely manner and implement the principle of administrative efficiency; on the other hand, it is to give taxpayers a reasonable expectation, which is a reflection of tax certainty, thereby ensuring the stability of the legal order. However, in the case of tax evasion, tax resistance, and tax fraud, the tax authorities can recover the tax indefinitely. In the scenario of virtual currency transactions, under the current circumstances, attorney Mankiw King believes that there is no tax evasion, tax resistance, or tax fraud. Becausethe current legal evaluation of virtual currency transactions in judicial practice is ambiguous or even negative. Taxpayers have no definite expectations about whether to pay taxes, so there is no subjective intention to steal, resist, or cheat taxes. , the reason for non-payment of taxes can only be attributed to the tax authorities.

According to Article 52, Paragraph 1 of the "Tax Collection Administration Law of the People's Republic of China (2015 Amendment)", "due to the responsibility of the tax authorities, taxpayers and withholding agents fail to pay Or if the tax is underpaid, the tax authorities may require the taxpayer or withholding agent to pay back the tax within three years, but no late payment fees may be imposed." And Article 83 of the "Implementing Rules of the Tax Collection and Administration Law of the People's Republic of China (2016 Revision)" "The time limit for back payment and recovery of taxes and late payment fees shall be determined by the taxpayer and the withholding agent. The calculation shall be calculated from the date of payment.” If tax is not paid or underpaid due to the responsibility of the tax authority,the tax authority shall promptly conduct a tax audit within 3 years from the date of expiration of the tax payment period. Otherwise, the taxpayer has the right to refuse tax audit on the grounds that the collection period has expired.

04 Mankiw King’s lawyer’s advice

Policies may changeevery day ,but compliance should be used to respond to changes. Paying taxes is an honorable thing, but for taxpayers, they only pay the taxes they should pay. All in all, Mankiw’s friends remember three points:

From a tax law perspective, the country has The income from currency speculation has the legitimacy and legality of tax collection.

If tax is not paid or underpaid due to the responsibility of the tax authorities, the tax authorities have a recovery period of only 3 years.

It is never wrong to plan ahead and conduct reasonable tax planning.

JinseFinance

JinseFinance