From Solidity to Move: A quick overview of Movement M1, M2 and related ecosystems

Movement raised $38 million, and the zkMove-based Ethereum Rollup M2 will be launched later this year.

JinseFinance

JinseFinance

LSD as Ether An important part of the POS mechanism network represented by Fangfang, it has played a strong positive role in lowering the network pledge threshold, improving network security, maintaining currency prices, stimulating asset liquidity and other derivatives of the Defi ecosystem.

In order to vigorously develop On the liquidity staking track, Metis has officially issued numerous ecological incentive plans such as MetisLSB, which gives the LSD protocol an annual mining yield of 20%, far exceeding Ethereum and other networks which only have 4.25%.

Emerging protocols such as ENKI and Artemis have launched community proposals. Their token economics and upcoming ecological activities will serve as important standards for early airdrops and deserve attention.

1) Lower the high threshold for traditional staking

LSD’s full name is Liquid Staking Derivatives, which is liquid staking derivatives . Since the Ethereum Paris upgrade shifted the POW of the public chain to the POS mechanism, nodes on the chain need to pledge a certain number of tokens to participate in the network and obtain block rewards and pledge incentives. However, for ordinary users, participating in public chain pledges It's not easy.

Generally speaking, the amount required for public chains is high. For example, Ethereum nodes require 32 $ETH to start, which leads to a higher threshold for participation; the pledge time is long , for retail investors, capital lock-in will lead to low efficiency; staking requires some technical & hardware requirements, which is not user-friendly.

Ethereum Shanghai Shapella upgrade has enabled pledge withdrawals, which has since opened the curtain of LSDfi. LSD not only opens new token income channels for ordinary users and unlocks the liquidity of pledged assets, but also derives a variety of LSDfi, Restaking and other protocols based on this, promoting the rapid growth and widespread participation of the Defi ecosystem.

Metis, as Layer 2, innovatively introduced the POS mechanism into the sequencer pool, creating a demand for $METIS staking. The security of the network consensus maintained by node staking is transferred to the decentralization of the sequencer, and the development of LSD is also the most important step on the road to achieving decentralization.

Metis, an Ethereum second-layer network that truly focuses on achieving "decentralization", is the first to focus on decentralized sorting The server will feed gray income such as MEV back to the community, thus becoming a transparent and user-friendly network. We detail Metis’ decentralized technology in this article, the most important of which is its node-staking decentralized ranker pool.

Metis becomes a sorter pool by introducing multiple sorters. Any sorter that enters through staking has the right to see the contents of the transaction pool and has the right to process transactions. , making a single sorter unable to be maliciously manipulated;Nodes must pledge the network token $METIS to participate in the network. To become a sorter node, you need to pledge at least 20,000 $METIS (worth approximately US$2.4 million). However, once the sequencer participates in transaction block generation, it can simultaneously obtain the Gas income from processing transactions and additional $METIS pledge incentives;It will be randomly broadcast as a Proposer based on the node pledge share.

In addition, becoming a Metis sorter can not only enjoy network and staking benefits, the EDF plan officially launched by Metis will allocate 3M from the 4.6M $METIS Used to achieve decentralization of the sorter. It is enough to show that Metis officially attaches great importance to the decentralized sorter, but ordinary users who want to participate have to face a pledge threshold of up to 2.4 million US dollars, which is prohibitive.

LSD provides such a channel so that users can participate in staking with a small amount of investment, which greatly lowers the threshold for participation.

2) Enhance network security and maintain currency prices

Why open staking to the community? For public chains with POS mechanisms, the security of the network depends largely on the degree of decentralization of node pledges.

If the pledged assets are concentrated in the hands of a few nodes, then they have enough power to control the network, leading to centralization risks. Conversely, if the network has many and dispersed staking participants, a single node will have less influence on the network, which increases the cost of any potential malicious behavior because more nodes will need to be controlled to attack the network.

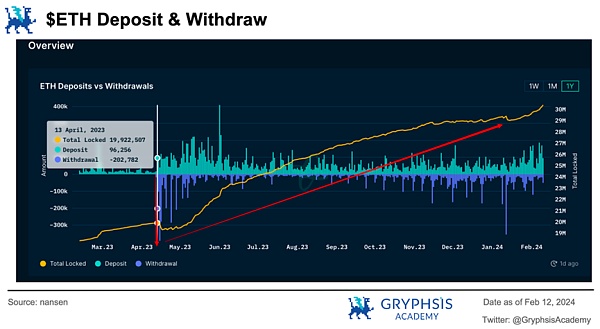

Although there was a large short-term retracement of $ETH staking after the Ethereum Shanghai upgrade, in the long term, the total amount of ETH locked has achieved considerable growth of. Users move the withdrawn funds to the LSD protocol, allowing them to enjoy asset liquidity and flexibility while pledging. It also achieves an increase in the Ethereum pledge rate, maintains network consensus, and thereby improves the security and stability of the network.

It can be seen that the launch of LSD makes Ethereum's network pledge open to more retail investors, and the Ethereum network becomes more secure as more and more tokens participate in pledge; at the same time, pledge reduces the market liquidity of $ETH and controls the supply. to maintain/increase token value.

3) Improve capital efficiency & promote Defi ecology

LSD, as an important part of Ethereum, has a current TVL of 37.96B, accounting for 35% of the total TVL of Ethereum. Head protocols such as Lido and Rocketpool provide high-standard and multi-functional liquidity staking, driving the development of other segmented tracks such as LSDFi, Re-Staking, and DVT.

The complete liquidity staking ecosystem makes $ETH assets easier to split and trade, stimulating new ways of playing in the DeFi ecosystem. For example, users can further use the tokens obtained through staking in scenarios such as lending, market making, and farming, which greatly improves the efficiency of the originally locked capital.

LSD attracts more users and capital into the DeFi ecosystem by providing liquidity and innovative financial products, thereby stimulating economic growth throughout the ecosystem.

It can be seen that the development of LSD is crucial to the network of POS mechanism. It is an important step in maintaining network consensus and promoting the circulation of ecological capital, and Metis It also provides a rich and complete incentive plan to stimulate the liquidity staking track of this ecology.

Metis launched the LSB plan (Liquid Staking Blitz), focusing on helping Metis become the first Rollup with a decentralized serializer and share the serializer revenue with the community.

The official extracted 3M’s $METIS from the 4.6 million Ecological Development Fund (MetisEDF) to accelerate the deployment and development of the LSD protocol. The selected protocol will have the right to pair with the Sequencer node and provide 20% of the MRR (Mining Reward Rate) mining incentive in the first year.

As mentioned above, becoming a sequencer of Metis, once participating in transaction block production, you can get both the Gas income from processing transactions and additional $METIS staking incentives. The tokens obtained by the LSD protocol for the community also have the right to be paired with the sequencer node as a separate individual to obtain a 20% mining reward rate.

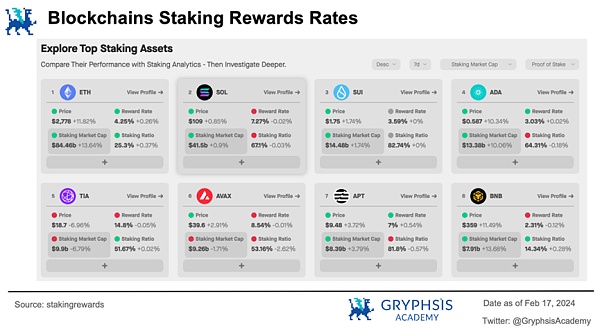

Compared with the pledge incentive rate of other POS mechanism networks, Ethereum has only 4.25%, Solana has 7.25%, and Celestia has 14.8%. If it is only for Ethereum From the perspective of the ecosystem, except for the recently popular API3, only Metis has the highest reward rate, and the others are all below 10%.

Metis LSB provides income incentives for LSD products by integrating sequencer mining and ecological funds, amplifying the income from liquidity staking, not only attracting more users to participate in the realization of decentralization, but also for staking-related derivative products including re- The expansion of subdivided tracks such as staking enables network expansion while activating asset circulation.

On December 6, Metis provided an incentive plan worth $5M, #MetisJourney, to the Defi category to incentivize and attract more related Dapps deployments.

On December 18, Metis launched the #MetisEDF (Ecosystem Development Fund) plan, allocating 4.6M of $METIS (worth $5.5 billion) of ecological funds to The implementation of decentralized Sequencer, Grants for Dapps, Dapp Building mining incentives, liquidity incentives and other ecological development activities, etc.

It is clarified that 3M will be allocated from EDF for sequencer mining to ensure the functionality and decentralization of the network; the remaining 1.6M of $METIS will be used for Attract more LSD protocol deployments, including ecological development such as lending, stablecoins, and CDPs.

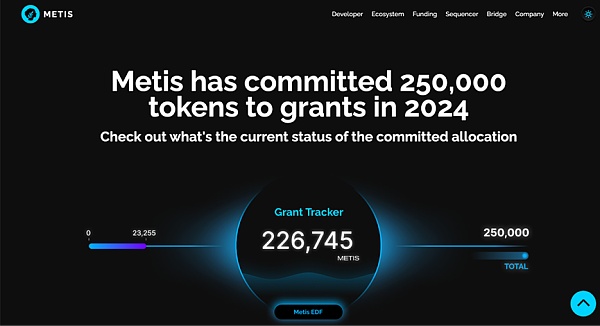

On February 16, it was determined that 250,000 $METIS would be drawn from EDF as the Grant Pool for 2024, and 23K has been claimed so far.

Source: https://www.metis.io/grants

As of now, Metis has provided billions of dollars as an incentive plan, providing new power to combine new assets, products and platforms, providing strong support for the decentralized development of the network and asset liquidity.

The community proposal voting for the LSD protocol has been opened. Combined with the LSB plan, we can expect to participate in these elected protocols and enjoy high mining rewards. Mining income, so what exactly are it?

ENKI is the first LSD project deployed on Metis, aiming to simplify the process of participating in Metis Sequencer Node Staking. It allows users to earn rewards without the technical complexity of running a Sequencer node themselves. Think of ENKI as a bridge, connecting ordinary users to the Metis Sequencer Node and reaping multiple benefits.

The following is its workflow:

Step 1: Convert to $eMETIS. Users will convert the $METIS they hold into $eMETIS in Enki (through Minter).

Step 2: Stake $eMETIS and receive $seMETIS as a proof of active participation in the income acquisition process.

Step 3: Yield accumulation, the $seMETIS held will accumulate income over time, reflecting the performance of the Metis Sequencer Node ecosystem.

Step 4: Get rewards, which will be distributed every 7 days. 70% of the $eMETIS income will be converted into $seMETIS and released immediately. The remaining 30% has entered the vesting stage. For this part of the income, users need to pledge $ENKI to be able to use it within one year. Unlocked.

Step 5: To receive rewards, you can convert $seMETIS into $eMETIS in ENKI, and then go to secondary markets such as Netswap to convert $eMETIS into $METIS.

Users can participate in staking even if they hold a smaller amount of $METIS, excluding It eliminates the technical knowledge required by users and the need for a large number of initial settings, providing more users with the opportunity to participate in staking and obtain benefits.

1) Distribution mechanism

The native token of the ENKI protocol is $ENKI. The expected total supply is 10M. Holding $ ENKI tokens can not only participate in lock-in, but also gain potential governance rights and other benefits within the ecosystem.

$ENKI initial distribution plan is as follows:

Market, partners and Early Community Supporters:10% of the total amount, which is 1M $ENKI.

Protocol liquidity support: Accounting for 10% of the total, which is 1M $ENKI, according to the market Demand and agreement income are added in batches.

Future mining incentives and some market activities: Accounting for 80% of the total, i.e. 8M $ ENKI, gradually released through various forms.

ENKI team itself does not hold any token allocation shares, does not raise funds, and all stages of token release are Fair Launch way.

2) Dual-token model

$esMETIS:Represents the pledged $eMetis, allowing users to effectively mortgage ; Proof of $eMetis, and at the same time earn more tokens with staking income, and at the same time have liquidity and can interact with other Defi ecosystems.

3) Value capture

Governance Rights: Holders are an important part of the decentralized governance model, and most $ENKI tokens will serve as mining incentives, and holders can vote to influence incentive content, fee structures, protocol upgrades, and the development of the entire ecosystem.

Unlocking rights: As mentioned above, the 30% mining incentive of the ENKI protocol requires users to lock $ ENKI can be unlocked within 365 days.

$ENKI tokens are critical to the locking process, and staking $ENKI is part of what $esMETIS holders earn Requirements for $eMetis Rewards. This locking mechanism, combined with the $ENKI token, encourages users to continue to participate and invest in the ecosystem, successfully tying incentives to the long-term development of ENKI.

1) Community Test Season 2

ENKI is currently deployed on Metis Sepolia Testnet and participates in Metis decentralized sorting The second phase of server community testing.

On January 16, Metis officially launched Community Testing on the Sepolia test network to test the POS Sequencer pool by exploring various Dapps, and users will also receive corresponding Testing Points rewards. Each Dapp corresponds to a different point pool, and each operation also has a different point ratio. Participants can obtain testnet $METIS through network leadership to participate and earn points at zero cost.

In Season 1, participating ecological projects include Hummus Exchange, League.Tech, Tethys Finance, Midas Games, Netswap; in this Season 2, only Contains ENKI.

Source: https://decentralize.metis.io/#szn2

Receive by For the test coin $METIS, you can Mint&Stake on the ENKI website to get points. You can also receive $ENKI test coins for staking and get rewards.

2) Fantasy Genesis Project

Source: Medium

The official launched the ENKI Fantasy Genesis plan on February 8, and will release 10% (1M) of $ENKI tokens in stages in advance as an incentive.

The entire activity will be divided into two stages:

The first stage- Early market activities and test network (Pre-launch)

Community participation and Trivia Task: Allocate 25,000 $ENKI (0.25% of the total).

Participate in testnet activities: allocate 25,000 $ENKI (0.25% of the total).

Testnet Bug Bounty and Marketing Cooperation: 100,000 $ENKI allocated (1% of the total).

Ecological partner airdrop: 100,000 $ENKI (1% of the total amount) is allocated to reward the ecological partner community in Metis Loyal customers.

All users who participate in the above activities will be eligible to mint an early supporter on the Metis mainnet after the end of the first phase. NFT, this NFT will be used as a voucher for receiving airdrops later.

The second phase - after deployment to the Metis main network (Post-launch)

Metis staking airdrop: 200,000 $ENKI (accounting for 2% of the total amount) is allocated. For users who pledge Metis in the ENKI protocol, according to the pledge Proportional airdrop.

Invite staking activity: 400,000 $ENKI allocated (4% of the total).

Users holding $eMetis or $seMetis are eligible to participate in this event, they will be able to mint a special inviter NFT and receive a unique invitation code . Users who stake through this invitation code will add airdrop points to the inviter's NFT, provided that each invitee contributes at least 0.1 $METIS to the staking pool to help the inviter increase points.

The points calculation rule is as follows: Points = 100 * total number of invitees + 200 * total pledge amount of the invitees. After the event, the airdrop tokens will be distributed according to the proportion of airdrop points. The inviter's NFT will also be used as a voucher to receive the airdrop

ENKI Liquidity Incentive: 150,000 $ENKI allocated (accounting for 1.5% of the total amount) ).

ENKI is the most important step for Metis to realize a decentralized sorter, lowering the staking threshold to reach ordinary users& ; Benefit individual investors so that the entire community can participate in network construction and enjoy benefits.

Artemis Finance is a liquidity staking protocol designed specifically for the Metis decentralized sorter pool. Users can stake on Artemis Stake their $METIS tokens and obtain the liquid token $artMETIS, automatically accumulate profits and use $artMETIS to interact on the Metis chain.

1) Distribution mechanism

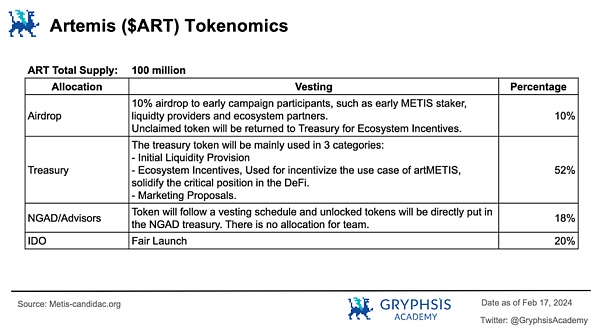

The native token of the Artemis protocol is $ART, with a total supply of 100M. The initial distribution plan is as follows :

Airdrop (10%, 10M): Early activity Participants such as $METIS pledgers, liquidity providers, and ecological partners, etc.

Treasury (52%, 52M):Treasury funds are mainly used for initial liquidity provision, $artMETIS usage incentives; marketing partnership proposals and more.

NGDAO/Advisor (18%, 18M): Locked into the DAO, the team itself cannot Hold shares.

IDO(20%, 20M):Sold in the form of Fair Launch.

2) Value Capture

Artemis allocates 10% of tokens to early participation Players such as $METIS pledgers can obtain multiple benefits from $METIS pledges, similar to the role of a golden shovel. They can enjoy the incentives of other ecological projects and further stimulate the motivation of staking. In addition, another part of the share is used to expand the use cases of $artMETIS, which can expand the utility and application scenarios of the asset.

The benefits that can be enjoyed as a holder of $ART have not been disclosed yet.

Artemis expects to announce a series of activities, including working with DeFi projects, liquidity providers and yield optimization platforms to increase liquidity and expand the use cases of $artMETIS:

Launch $artMETIS/$METIS pool on DEXes and provide liquidity mining incentives;

Place $ artMETIS is listed as a qualified collateral for the loan agreement;

Aims to attract more people to participate in $METIS staking while allowing users to Use $artMETIS in the diverse DeFi ecosystem and earn profits. Artemis, like ENKI, offers $METIS holders a streamlined opportunity to participate in a decentralized sequencer and earn profits.

We can foresee the positive cycle brought about by Metis' vigorous development of the LSD protocol: the LSD protocol lowers the pledge threshold and allows ordinary users to enjoy multiple benefits, motivating more users to participate in staking; the pledge rate of $METIS increases, promoting the decentralization of the network The MEV revenue of traditional Layer 2 is shared with the community, reducing user costs and maintaining user benefits; forming unique network characteristics to attract more users to participate in the network.

And $METIS is a consumption token for using the network. The increase in network usage will bring more consumer demand, causing the token to rise; while LSD is a consumption token. The fastest and high-yield investment income method for token holders, more users will participate; rich user traffic stimulates more derivative tracks such as LSDfi, Re-Staking, etc., allowing assets to gain income and enjoy liquidity at the same time , thereby activating the gameplay of the entire Defi ecosystem.

Reference materials

[1]https:// medium.com/@ENKIProtocol/understanding-enki-an-essential-faq-before-testnet-launch-57ab3f2e6a22

[2]https://pro. nansen.ai/eth2-deposit-contract

[3]https://medium.com/@GryphsisAcademy/diving-into-lsd-the-growth- potential-and-strategic-opportunities-bcea5c10cdc6

Movement raised $38 million, and the zkMove-based Ethereum Rollup M2 will be launched later this year.

JinseFinance

JinseFinanceWasabi raised $3 million in its latest seed round led by Electric Capital.

WenJun

WenJunMorph is an innovative project dedicated to applying blockchain technology to everyday life. Its mission is to make blockchain technology decentralized, fair, and accessible to everyone.

JinseFinance

JinseFinanceMeme, NFT, cryptocurrency, Meme coin vs elite coin: a cultural revolution in the crypto world Golden Finance, at present, Meme coin may be the best honest alternative.

JinseFinance

JinseFinanceDive into the world of Dogwifhat, the Solana-based meme coin making waves in the crypto market with its Bybit listing and significant price surge. Explore its potential and charm in our latest blog.

Miyuki

MiyukiExplore the captivating world of DigiToads (TOADS), a hybrid DeFi meme coin on the Ethereum blockchain. Beyond memes, DigiToads offers a play-to-earn gaming platform where users breed, train, and battle NFT toads for TOADS tokens. Staking TOADS and NFTs further enhances earnings, and a commitment to environmental sustainability sets DigiToads apart in the meme coin landscape.

Huang Bo

Huang BoMetaverse is still very much important as the days of the internet are taking a new shape with the migration of different projects into Web3.

Nulltx

NulltxDeFi protocol Temple DAO lost over $2.3 million to a hack and confirmed by blockchain analytical firm Peckshield.

Others

OthersDoes M&M’s need the Bored Ape Yacht Club? Or is it the other way around? Is this partnership cool or ...

Bitcoinist

Bitcoinist Nulltx

Nulltx