Source: Gryphsis Academy

Abstract

NEOPIN selected for Abu Dhabi Investment Office’s Innovation Program , and is cooperating with local government agencies to develop the DeFi regulatory framework. It is a very rare DeFi service provider that has obtained regulatory permission. It actively embraces regulation to ensure that long-term development is not restricted.

NEOPIN is the only DeFi protocol that supports both Klaytn and Finschia networks, and is an obvious benefit from the merger of Klaytn and Finschia. Or, it may become a DeFi example of the "blockchain merger" concept in the future.

Through comparable analysis valuation, we expect $NPT to The price of the coin will reach $3.10 to $8.39 USD by the end of the first quarter of 2025, which has great upside potential compared to its current token price.

Backed by giants and operated in compliance DeFi, and benefiting from the historic event of the merger of two major public chains, NEOPIN has a good chance of winning the trust of more communities in the future wave of blockchain mergers; as a highly inclusive DeFi protocol, NEOPIN will introduce real-world assets Efforts on the chain are also more likely to be recognized by users, and there is a chance to win the loyalty of the majority of web2 and web3 users.

1. Project Introduction

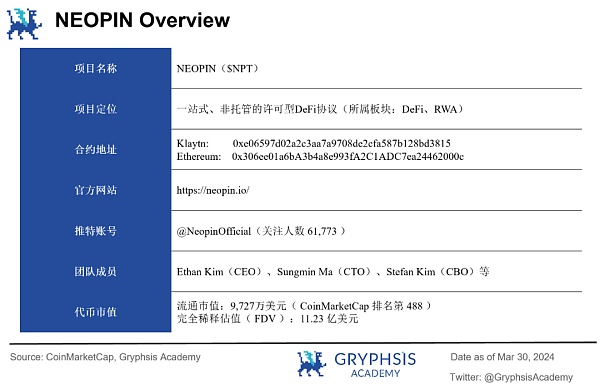

NEOPIN was founded in 2021. It introduces itself as a "one-stop, non-custodial license A protocol for the safe use of cryptocurrencies under a regulatory framework, and with the advantages of both CeFi and DeFi. Based on a stable security protocol and a regulated environment, NEOPIN aims to build a bridge between traditional finance and DeFi protocols for users."

NEOPIN’s parent company is Neowiz, a well-known Korean game company (the FPS game "Crossfire" that was once popular in Asia was published globally by this company). NEOPIN has been selected for the innovation program of the Abu Dhabi Investment Office (ADIO), which operates the United Arab Emirates’ sovereign wealth fund, attracting direct and indirect investments. NEOPIN is working with the UAE government to develop a DeFi regulatory framework and expand services based on this framework globally.

NEOPIN official website introduces its team members from Binance, Samsung, Neowiz, Coupang and other well-known companies in the web2 and web3 fields. Through LinkedIn, we can see that NEOPIN currently has no less than 30 employees. The main team members are all from South Korea, which is a considerable talent scale among web3 start-ups.

2. Business model and products

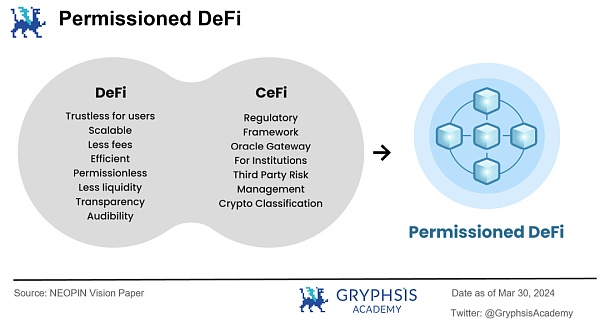

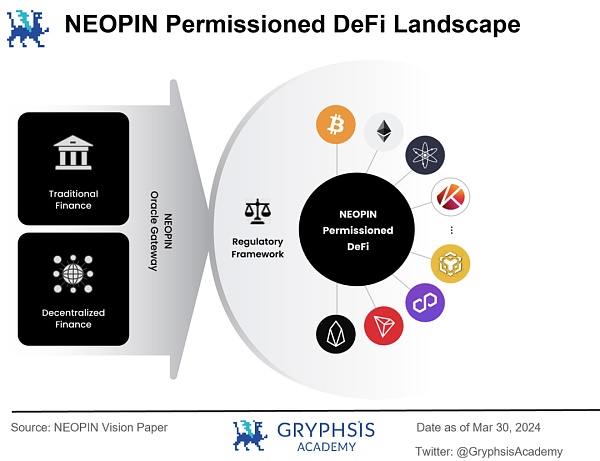

NEOPIN believes that CeFi, represented by centralized exchanges, has caused many problems due to factors such as unclear customer fund management and ethical issues. , resulting in many victims. DeFi also faces a series of risks including oracle risks and protocol flaws, which have caused huge disasters. Therefore, NEOPIN proposes a new concept of “permission-based DeFi”.

Permission-based DeFi protocol established by NEOPIN , is committed to providing a stable, secure, and compliant platform while maintaining high transparency, innovation, and flexibility.

In terms of regulatory compliance, NEOPIN has become the first DeFi protocol to work with the UAE’s Abu Dhabi Global Market (ADGM) to develop and integrate a regulatory framework.

In terms of the functions of the DeFi protocol itself, the NEOPIN ecosystem also connects various encrypted financial services such as P2E, S2E, M2E, and NFT. Both users and liquidity providers can obtain the ecological token $NPT. beneficial.

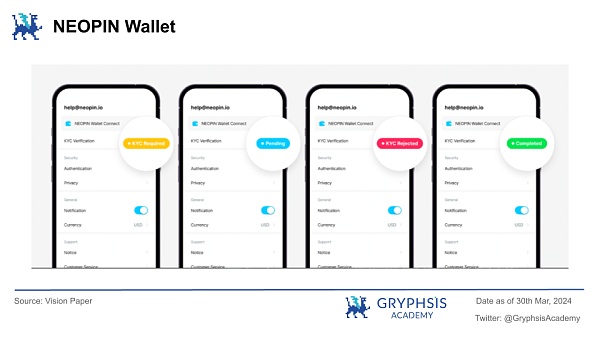

With the product updates of NEOPIN , the non-custodial wallet NEOPIN Wallet, which is crucial in its ecosystem, is hard not to attract our attention.

First of all, it is not just a simple cryptocurrency wallet, it represents a comprehensive blockchain ecosystem. This is reflected in the fact that it provides users with a seamless experience from basic wallet functions to advanced financial services. Its ecosystem design allows users to explore DeFi, NFT, and other innovative blockchain-based products and services, going beyond traditional asset management.

More importantly, the design of NEOPIN App focuses on user experience. Its intuitive interface and simple operation process make managing crypto assets extremely simple, even for cryptocurrency novices.

NEOPIN's compliance is also fully reflected in its wallet application. After creating or importing the wallet, you need to pass a simple KYC authentication. Its good KYC authentication process simplifies the user's identity verification process. With simple steps and clear guidance, users can quickly complete certification and enjoy a wider range of services and features.

3. Project Highlights

What is the difference between NEOPIN and other DeFi protocols on the market? Why is NEOPIN likely to create extremely high user loyalty? We believe that NEOPIN’s outstanding highlights include at least the following three points:

3.1NEOPIN is the first DeFi protocol to benefit from the concept of “blockchain merger”

To understand For this, you need to understand the following background information first:

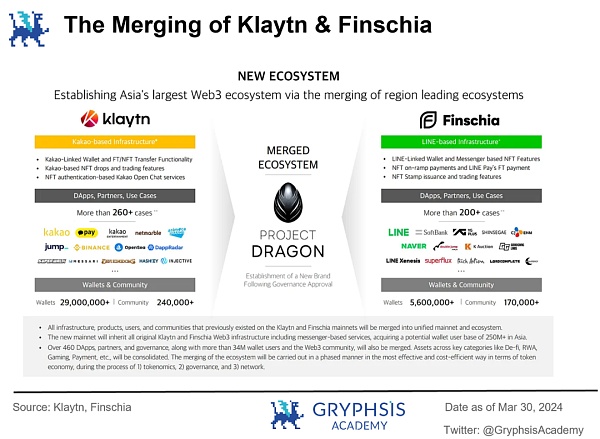

On February 15 this year, the Klaytn public chain and the Finschia public chain agreed to merge to build Asia's largest Web3 ecosystem Project Dragon, covering more than 2.5 100 million Asia Wallet users.

Both Klaytn and Finschia’s backgrounds are very Powerful: Klaytn is a public chain developed by Ground X, a subsidiary of Korean Internet giant Kakao.

Kakao Talk is the most popular instant messaging tool among Koreans (equivalent to South Korea’s WeChat); Finschia is a public chain developed by Line Tech Plus, a subsidiary of the Japanese Internet giant Line. Line Messenger is the most popular instant messaging tool among Japanese people (equivalent to WeChat in Japan).

The merger of the public chains of the Korean version of WeChat and the Japanese version of WeChat is likely to become a landmark event in the blockchain industry, triggering an upsurge of "blockchain mergers" in the future.

You must know that in the world of Web3, blockchain "forks" are very common, while blockchain "mergers" are extremely rare. Taking the opportunity of the hard fork of BCH and BSV in 2017-2018, the blockchain industry once set off a "fork wave". Many project parties forcibly created "community conflicts" and created a large number of forked coins (such as Bitcoin Coin Gold BTG, Bitcoin Diamond BCD, etc.). But it turns out that these forked coins basically can only go silent.

In contrast, blockchain "mergers" are rarely proposed or implemented. But in fact, a very obvious truth is: blind division will only make the blockchain world become more and more fragmented, with all parties working on their own, and project parties reinventing the wheel on different public chains, issuing various Such tokens make the already small web3 world assets extremely fragmented.

The concept of blockchain merger is different: the merger of public chains means the condensation of community will and the establishment of a higher-level consensus. In addition, from the perspective of the traditional financial industry, "bifurcation" is equivalent to "spin-off and listing", and "merger" is equivalent to "mergers and acquisitions", but in traditional financial markets, the frequency of the latter occurring far exceeds that of the former. Most spin-offs and listings can only bring temporary hype, while mergers and acquisitions are an important means for companies to become bigger and stronger.

Therefore, we firmly believe that the large number of blockchain "forks" that have appeared are just episodes in the development process of the web3 world. In the long run, the blockchain "merger" represents the progress of the web3 world. and the future.

So, what does this merger have to do with NEOPIN?

—— Because NEOPIN is the only DeFi protocol and governance committee member to support both Klaytn and Finschia networks.

In order to assist in this historic blockchain merger, NEOPIN has done a lot of prior work (for example, NEOPIN launched the first cross-chain bridge between Klaytn and Finschia, supporting Two-way cross-chain between Klaytn and Finschia).

In such a complex and huge merger project, users using the protocols on the chain or holding assets on the chain are bound to encounter many unprecedented problems, and NEOPIN, as the only The DeFi protocol that supports both Klaytn and Finschia networks has attracted market attention for every move it makes, and the launch of each new feature is expected to become an important example of how DeFi protocols respond to blockchain mergers.

If NEOPIN performs well in this merger, then in more blockchain mergers in the future, NEOPIN, as the first DeFi protocol to take advantage of it, will definitely have the opportunity to play a greater role. .

3.2NEOPIN actively embraces regulation and is the first protocol to propose "permission-based DeFi"

In recent years, with the development of the encryption market With the continuous expansion, regulatory agencies in various countries have increased their investigation and supervision of projects in the web3 field. It is a general trend that more and more projects are brought under the regulatory framework. Insufficient transparency, vulnerability to hacker attacks, and compliance risks are important issues that limit the long-term development of DeFi projects.

NEOPIN, as the first protocol to propose "permission-based DeFi", chooses to proactively embrace regulation, which is a very courageous and long-term move.

Proactively choosing to cooperate with regulatory agencies in the early stages of the project will help build a cryptocurrency usage platform that not only complies with the regulatory framework but can fully utilize the advantages of DeFi and CeFi. It cooperates with the UAE government to develop the DeFi regulatory framework and Expanding services based on this framework globally will also put itself in a favorable competitive position, while latecomers may have to choose to accept the same regulatory framework and cannot pose a threat to pioneers like NEOPIN.

Before using the NEOPIN service, users need to undergo KYC verification. This step also avoids illegal funds from flowing into the DeFi protocol and causing unnecessary trouble to users.

Web3 was not born to create a The ultimate goal of a lawless place is to promote innovation in traditional fields in another way. For long-term development, DeFi protocols, which involve large capital flows and high risks, must be integrated into the existing regulatory framework. Therefore, for a DeFi project, only by achieving compliant development can it lay the foundation for long-term and healthy development.

We believe that taking the initiative to accept supervision in the early stage of the project and operating in compliance with the law will be more conducive to the project's survival in the future when supervision becomes stricter. A good reputation can also help the project attract more people who are new to web3. new users, and attracting a large number of new users who have not yet been exposed to web3 is a necessary condition for the entire industry to grow.

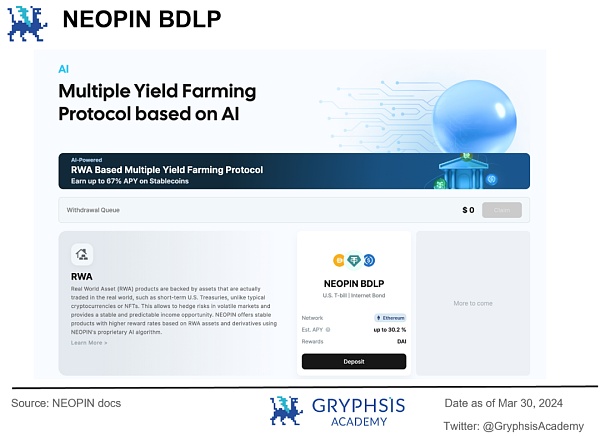

3.3 NEOPIN enters the RWA field, and the compliance framework will help it happen

On March 28 this year, NEOPIN officially announced the launch of RWA-based DeFi products, entering the RWA market.

The RWA (Real World Assets) market is an important link between the on-chain world and the off-chain world. In recent years, TVL in the RWA field has grown several times every year, making it a golden track with highly deterministic growth.

BCG and other top global institutions predict that the RWA market will develop into a huge market worth trillions or even more than ten trillion US dollars in the next few years. ONDO Finance, which is also compliant and engaged in RWA business, has seen its governance token $ONDO grow by more than 300% in the past 3 months.

NEOPIN BDLP launched by NEOPIN is a multiple-income liquidity mining protocol based on RWA. Users can recharge DAI, USDT or USDC, while NEOPIN uses sDAI and USDe to provide users with generous income (currently annualized The yield is between 13%-30%).

In order to provide each user with the best asset management ratio, NEOPIN has even developed a proprietary AI algorithm to help users decide how to allocate different assets through their own preferences and on-chain data. ratio to efficiently invest in complex DeFi derivatives.

In this process, NEOPIN simplifies the investment process, allowing users to easily explore and invest in various DeFi without having to jump to browse multiple protocols, lowering the user threshold.

Future, compliant RWA Products will be the link between the web2 world and the web3 world. Only a compliant RWA platform can enable more web3 beginners to have access to high-quality real-world assets. Currently, pioneers in the RWA field have the opportunity to establish first-mover advantages on both the product and user sides and win in future competition.

4. Token Economy

4.1 Token Issuance

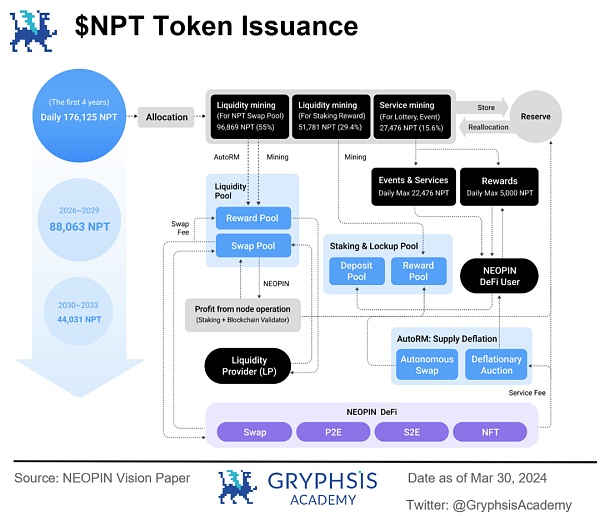

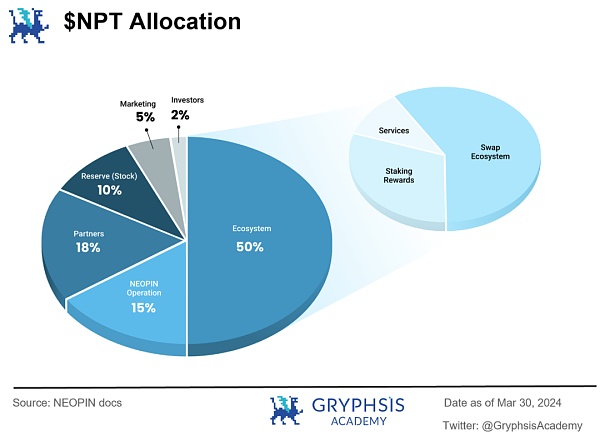

NEOPIN’s ecological token $NPT has a total issuance of 1 billion and is currently in circulation There are approximately 86.64 million coins in the supply chain, and the circulation rate is less than 10%. The allocation ratio of $NPT is as follows:

Ecosystem (50%): including liquidity pool (29.75%), staking rewards (13.23%), service rewards (7.02%)

Partners (18%): Used to establish new partnerships and develop new services

Team operations (15%): Incentivize the project team and conduct research based on the understanding of the ecosystem Contributions are allocated to individuals

Treasury (10%): develop the ecosystem outside of the designed allocation

Marketing (5%): Promote marketing and increase the number of ecological participants

Investors (2%): Allocate to early investors

Exact token unlock times will vary depending on the type of allocation.

4.2 Token Utility

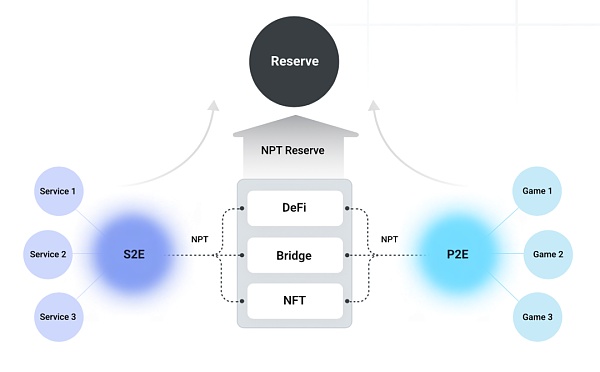

NPT token plays a core role in the NEOPIN ecosystem, connecting various crypto financial services, including P2E (Play to Earn), S2E (Stake to Earn), M2E (Move to Earn) and NFT (Non-Fungible Token), through these services, users and liquidity providers can benefit from NPT.

The NPT economic system aims to reward users based on their contributions to the NEOPIN ecosystem. By establishing a sustainable token economic system and allocating most of the rewards to users, NEOPIN is committed to creating a user-centered centered ecosystem.

The specific functions of $NPT are as follows:

Liquidity provision and transaction fee rewards: users can transfer virtual assets or NPT Deposit into the liquidity pool and generate exchange transaction fees on NEOPIN, thus contributing to the growth of the NEOPIN ecosystem and the increase in the value of NPT.

Staking and locking rewards: NPT provides staking and locking products, and the rewards are proportional to the amount delegated to the staking products, aiming to reward users based on their contribution to the ecosystem.

Liquidity mining: Provide liquidity mining rewards, based on the interest rate of the liquidity pool and the fees generated by swap transactions, to incentivize liquidity providers.

Event and service participation rewards: By participating in events that promote NEOPIN services, users can receive rewards to promote active use of the ecosystem.

Automatic repurchase and supply deflation (AutoRM): The NPT economic system adopts automatic repurchase and supply deflation strategies to support the value of NPT through market repurchase of NPT and profit repurchase. Stability and sustainable development of ecosystems.

Ecosystem service support: supports cross-chain Swap, NFT market, P2E, S2E and other services. Through this circular structure, users are encouraged to participate and collected through diversified services. Rewards to help maintain the stability of the ecosystem.

Source: Vision Paper

NPT’s token economic system is designed to encourage users Participate voluntarily and have the reward rate adjusted based on their contribution to the ecosystem. Through a stable NPT cycle and reward mechanism, NEOPIN aims to maintain the stability of the ecosystem and the stability of the liquidity pool, while expanding the use scenarios of NPT through measures such as supporting multi-chain products, expanding X2E services, and creating initial liquidity pools, Ensure long-term sustainability of ecosystems.

5. Project valuation

Comparable analysis is a commonly used valuation method, which is performed by comparing with similar companies in the same industry. Valuation. The underlying assumption is that similar businesses should have similar valuation multiples. When conducting a comparability analysis, it is critical to select businesses that are as similar as possible in terms of industry, business model, risk profile and market dynamics.

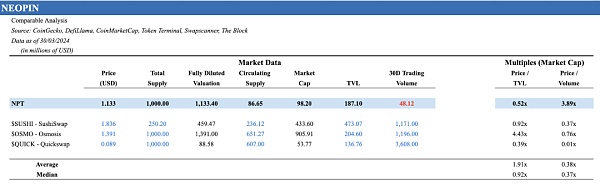

By ensuring that these aspects are comparable, the influence of external factors is reduced, allowing us to focus on the intrinsic value drivers of the companies being analyzed. Taking into account NEOPIN's business diversity and the development prospects of leading public chain projects, we conducted a comparable valuation analysis with four projects whose main businesses are DEX, Staking, Bridge and RWA.

When conducting comparable analysis valuations of our projects, we particularly noticed a gap of more than ten times between the fully diluted valuation (FDV) of the project and the current market capitalization (Market Cap).

This significant difference may lead to unavoidable biases when using FDV for valuation. Therefore, in our valuation model we choose to use current market capitalization rather than FDV for our analysis. At the same time, taking into account the importance of FDV data, we only predict the price of $NPT tokens at the end of 2024 based on existing data and under certain scenarios.

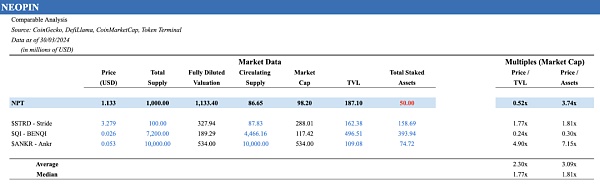

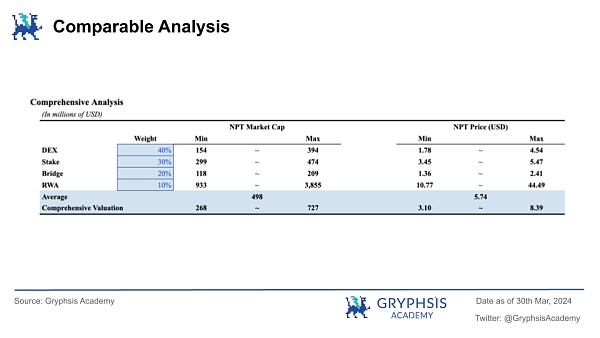

Finally, we will summarize the valuation results of NEOPIN's four businesses: DEX, Staking, Bridge and RWA, and evaluate the entire project according to the proportional weights of 40%, 30%, 20% and 10% respectively. Make a valuation.

5.1 Comparable analysis method valuation

5.1.1 DEX

In the DEX project, we selected SushiSwap, Osmosis and QuickSwap for comparison. After analysis, and finally combining three different assumptions, the valuation range of NEOPIN is as follows:

By conducting comparable analysis and valuation of NEOPIN and the above DEX projects, we believe that the NPT token price will reach $1.78 to $4.54 USD by the end of 2024.

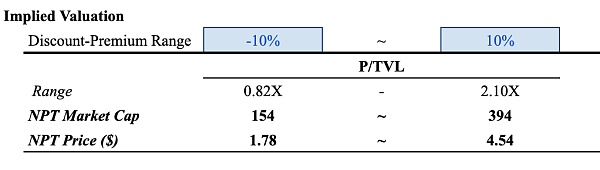

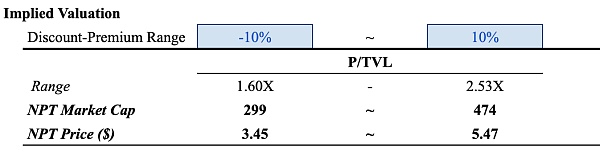

5.1.2 Staking

In the Staking project, we selected Stride, BENQI and Ankr respectively for comparable analysis. Finally, combining three different assumptions, the valuation range of NEOPIN is as follows:

By comparing NEOPIN with the above Staking projects Analyzing the valuation, we believe that the NPT token price will reach $3.45 to $5.47 USD by the end of 2024.

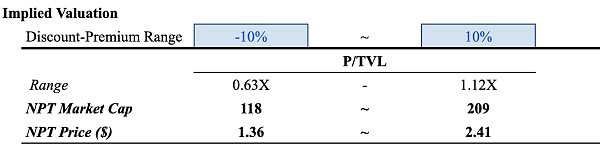

5.1.3 Bridge

In the Bridge project, we selected Synapse, Across and Connext Network respectively for comparable analysis, and finally combined three different assumptions. The valuation range of NEOPIN is as follows:

By conducting a comparable analysis and valuation of NEOPIN and the above Bridge project, we believe that the NPT token price will reach $1.36 to $2.41 USD by the end of 2024.

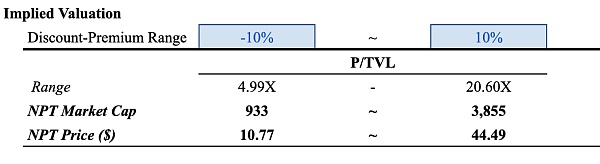

5.1.4 RWA

In the RWA project, we selected Synthetix, Ondo Finance and Ribbon Finance respectively to conduct comparable analysis, and finally combined three different assumptions to analyze NEOPIN The valuation range is as follows:

Pass Conducting comparable analysis and valuation between NEOPIN and the above RWA projects, we believe that the NPT token price will reach $10.77 to $44.49 USD by the end of 2024.

5.2 Valuation results

The following are the final valuation results. The valuation details can be understood in detail through the valuation model.

The picture above shows the project based on Defi Based on the assumption of circulating market capitalization and total lock-up value TVL, project valuation and token price, combined with the valuation results of DEX, Stake, Bridge and RWA, we proceed according to the weights of 40%, 30%, 20% and 10% respectively. The final valuation results are that at the end of 2024, NEOPIN's Market Cap will be in the range of $268 million to $727 million, and the price range of $NPT will be $3.10 to $8.39 USD.

6. Summary

In summary, the main highlights of NEOPIN include:

The project is backed by the Korean gaming giant Neowiz. The team has a strong background and a considerable scale, which shows that the project side has a strong willingness to actively build.

NEOPIN is the first DeFi protocol to benefit from the concept of "blockchain merger". If it can play an important role in the merger of Klaytn and Finschia, then the future of blockchain In the wave of mergers, NEOPIN has a good chance of gaining the trust of more communities.

NEOPIN proactively embraces regulation and is the first protocol to propose "permission-based DeFi". As a highly inclusive DeFi protocol built under a compliance framework, the project is optimistic about its long-term development.

NEOPIN has entered the RWA field under the compliance framework. Its efforts to introduce real-world assets onto the chain are more easily recognized by web2 and web3 users, and it has a good chance of becoming web2 An important bridge between the world and the web3 world.

Through comparable analysis and valuation, we expect the price of the $NPT token to reach $3.10 to $8.39 USD by the end of 2024, a significant increase compared to its current token price potential.

Therefore, we can fully open our imagination:

As a user If web3 users of multiple public chains can use the same DeFi protocol to seamlessly connect and transition between multiple public chains in the future wave of blockchain mergers; or as a former web2 user, if In the process of trying to purchase various RWA assets using protocols in the web3 world, I found that I could use the same company's webpage or APP (and not worry about legal compliance issues). So one can imagine how loyal users will be to this protocol.

JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance Edmund

Edmund Bernice

Bernice Cheng Yuan

Cheng Yuan JinseFinance

JinseFinance Bitcoinist

Bitcoinist Cointelegraph

Cointelegraph