Author: TrustlessLabs Source: X, @TrustlessLabs

Last July, Kain Warwick, founder of Synthetix, announced the launch of a new decentralized perpetual exchange (later changed to "comprehensive DeFi platform") Infinex. What does Infinex do? What innovations does it have? What opportunities do users have to participate?

Bottleneck of crypto market development: How to break through the user threshold?

In the current blockchain and cryptocurrency market, decentralized technology has spawned many powerful new products. However, the user coverage of these products is limited to a small number of people who have a deeper understanding and more experience in the industry. The main reason for this is that users need to master a lot of new knowledge, such as wallets, cross-chain bridges, and miner fees, which undoubtedly sets a high threshold for ordinary users.

At present, centralized exchanges, as a "temporary" solution, provide convenience for users who want to get in touch with but have not yet learned how to use cryptocurrencies. However, centralized exchanges have a significant drawback: they cannot fully leverage the powerful network effects of decentralized ecosystems and open networks. The products that centralized entities can provide are always only a subset of the products available on the chain. Permissionless protocols can enable new types of meme coins, lending pools, derivatives, etc. to be put into use faster than any centralized server, and this effect continues to grow as the network grows.

Infinex: DAPP Breakthrough

Currently, poor user experience is a key obstacle to the vision of large-scale application of blockchain technology. Although current decentralized products and services are powerful, they have a high barrier to entry, resulting in a huge gap between users and products. Many are reluctant to cross this gap, but Infinex, a comprehensive DeFi platform founded by Synthetix founder Kain Warwick, is committed to unifying decentralized ecosystems and applications under a single user experience layer designed for users familiar with Web2.

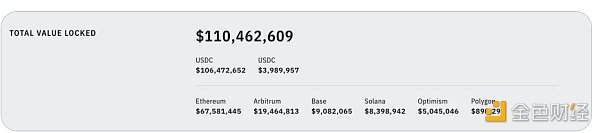

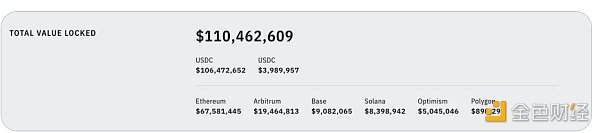

Current data

On May 13, Infinex officially opened the account creation and deposit channels, and announced that it would distribute 377 million governance points GP to all deposit users in the next 30 days. Currently, the total locked value of Infinex in Ethereum, Arbitrum, Base, Solana, Optimism, Polygon and other networks has exceeded 110 million US dollars.

Main Innovations and Breakthroughs

Infinex's innovations and breakthroughs are mainly reflected in the following aspects:

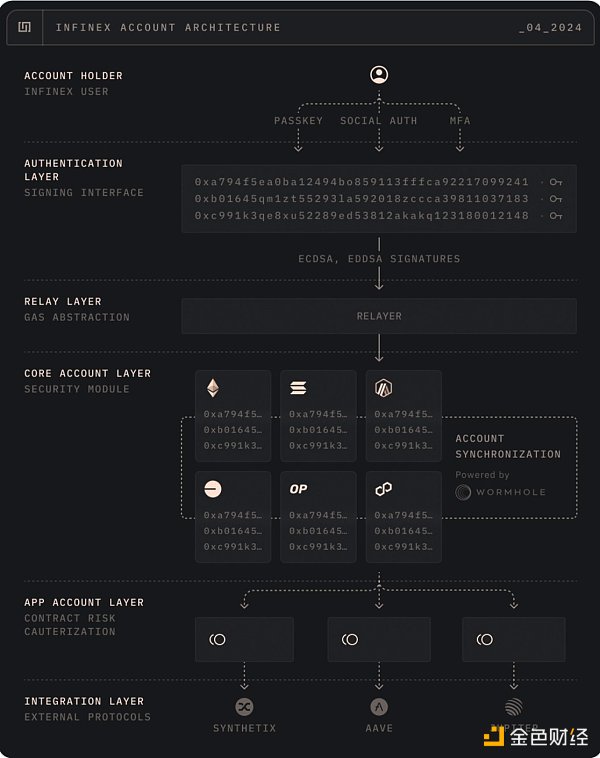

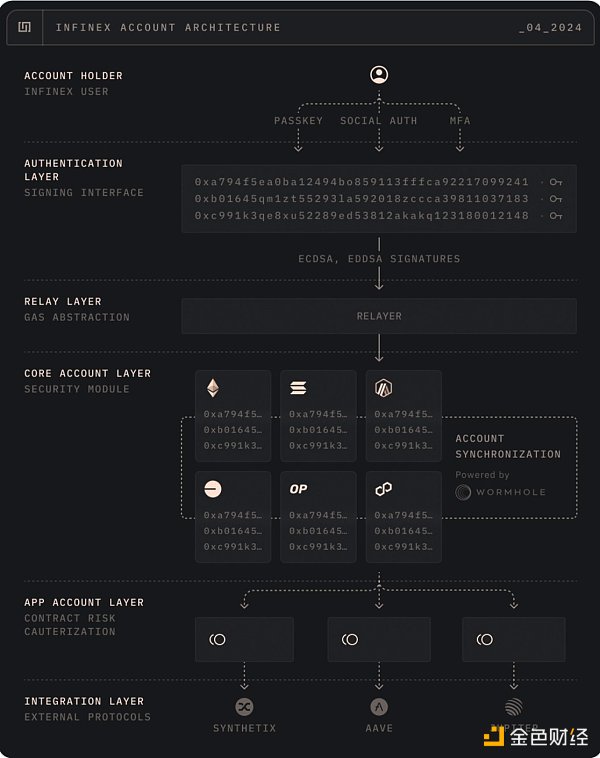

1. Improve user experience Infinex was launched to improve user experience by simplifying user operations. Infinex adopts the referral link and transaction fee rebate mechanism commonly used by centralized exchanges, and generates a public-private key pair for each user, which is stored in the browser and automatically signed when trading. These improvements make it more convenient for users to operate without the need for cumbersome on-chain operations, thereby lowering the entry threshold. For example, Infinex generates a unique deposit address for each user, and users can use USDT, USDC or sUSD to deposit, and the funds are transparent and traceable, ensuring security.

2. Enhance liquidity and market attractiveness Infinex plans to provide more efficient perpetual contract trading services by integrating with Synthetix Perps V3. Infinex not only supports a variety of collateral, but also improves capital efficiency and reduces the risk of liquidity providers by using stablecoins such as USDC. For example, using USDC as collateral can enable liquidity providers to earn an annualized return of 13.6% at a collateralization rate of 110%, while SNX can only earn an annualized return of 3% at a collateralization rate of 500%.

3. Cross-chain expansion

Infinex supports multi-chain operations, and users can trade on multiple chains such as Ethereum, Optimism, and Base. This will expand the user base and bring more trading volume and revenue.

4. Enhance market competitiveness

Infinex was launched to compete directly with centralized exchanges. By providing a user experience similar to that of centralized exchanges, Infinex hopes to attract more users to switch from CEX to DEX. In addition, Infinex's seamless experience layer design further bridges the experience gap between CeFi and DeFi and promotes the popularity of DeFi. For example, the highlights of the features included in Infinex include logging in with username and password, multi-factor authentication, and cross-chain deposits, which make users feel like they are using a centralized trading platform, but the backend is supported by decentralized and permissionless liquidity.

Analysis of Infinex governance mechanism: What are GP and Patron NFT?

As a typical decentralized application, Infinex has built a community-centric governance framework. In this framework, governance points (GP) and Patron NFT play a key role in ensuring the transparency of the protocol, the effectiveness of the incentive mechanism, and the fairness of fund management.

· What is GP (Governance Points)?

GP is a governance point used to reward and incentivize community members in the Infinex ecosystem. Community members can obtain GP through a variety of ways, such as participating in GP Farming, being active on community platforms such as Discord and Twitter, participating in governance conference calls, holding designated NFTs (must register an Infinex account and deposit at least 50USDC into the account), and submitting and passing proposals. GP plays the following roles in the Infinex governance framework:

1. Participation in governance: GP holders have the right to participate in Infinex's governance voting, including the approval and execution of various proposals. This mechanism ensures that community members have a say in the future development of the protocol.

2. Redemption rewards: GP can be used to redeem Patron NFTs, which not only enhances the holder's status and influence in the community, but also obtains certain rewards and recognition.

3. Community incentives: By allocating GP to reward members who actively participate in community activities, Infinex encourages more users to participate and contribute, and promotes the healthy development of the ecosystem.

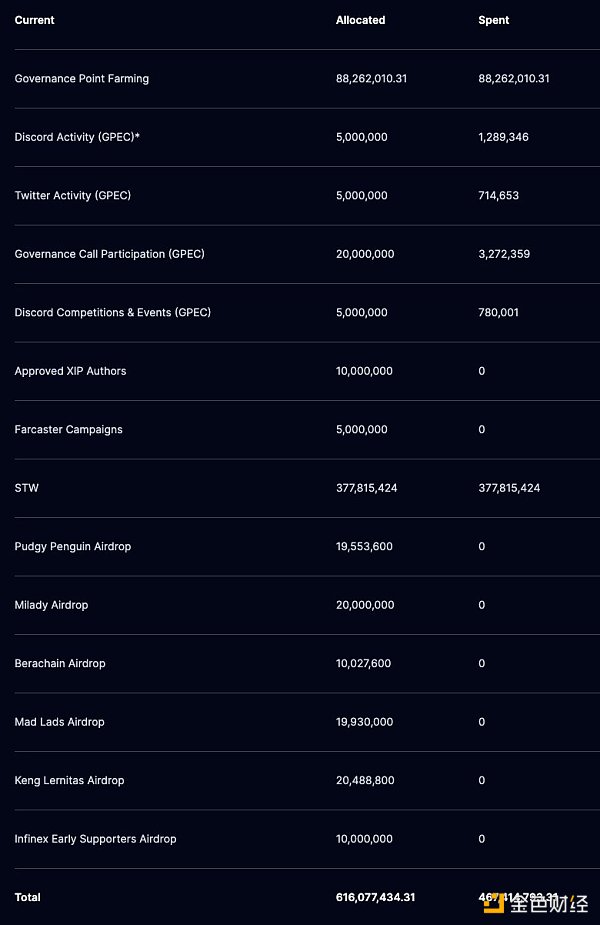

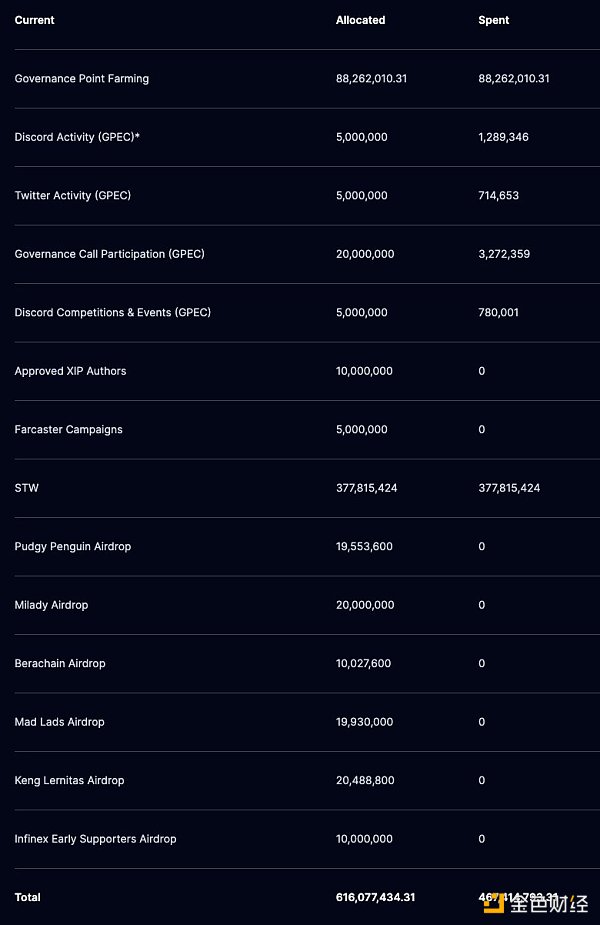

GP current distribution

GP expected future distribution

What is Patron NFT?

Patron NFT is a non-fungible token that represents contributor status in Infinex. Each Patron NFT can be obtained by burning 200,000 GP, and the minting fees will be allocated to the Infinex Treasury to pay for operating expenses, growth and market incentives, and contributor alignment. This design is intended to recognize members who have made significant contributions to the Infinex ecosystem. The role of Patron NFT in the Infinex governance framework includes:

1. Symbolize Contributor Status: Users holding Patron NFTs are regarded as sponsors of Infinex, and this recognition helps to enhance their reputation and influence in the community.

2. Participation Incentive Program: Patron NFT can be used as an incentive to reward members who make non-financial contributions to the Infinex protocol, further promoting active participation in the community.

3. Participation in governance: Although Patron NFT itself does not confer direct governance rights, its holders have a high reputation in the community, and this influence can indirectly affect community decision-making and governance.

Through GP and Patron NFT, Infinex has built a decentralized, transparent and effective governance framework to encourage community members to actively participate and contribute to the development of the ecosystem.

New opportunities for airdrops? ——Infinex "Speedrun the Waitlist"

Infinex launched the Whitelist Race (Speedrun the Waitlist) at 00:00 UTC on May 13. Here is an outline of the event:

1. Create an account and deposit:

Starting at 00:00 UTC on May 13, anyone can create an Infinex account and deposit USDC.

2. Governance Points (GP):

· During the 30-day "Speedrun the Waitlist" event, stakers will receive 377 million GP, a portion of the Patron NFT supply, and priority access to future integrations.

· Infinex officially promised that the total supply of GP is limited to 600 million (changed to 630 million in the subsequent XIP-26 proposal), and it will not become a "points scam."

· GP is mainly used to govern Infinex, and the Infinex Committee has allocated 3,000 Patron NFTs to GP holders, and every 200,000 GP can be exchanged for one NFT.

3. Event details:

· The event starts at 00:00 UTC on May 14 (24 hours after the account is opened for deposits).

· Deposits will be locked during the event.

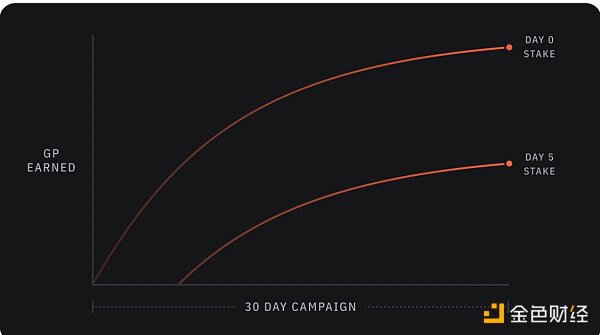

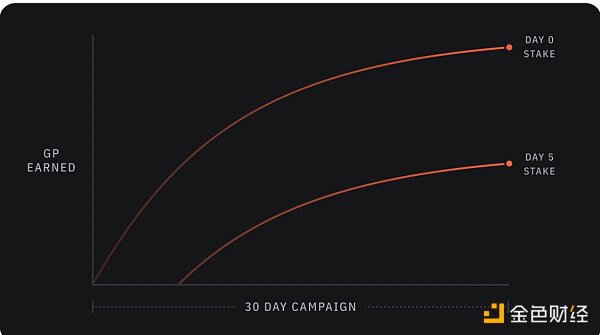

· Early deposits will receive more GP.

· 377 million GP will be linearly distributed to pledgers in proportion to the total TVL (total locked value).

So, can GP bring potential benefits to retail investors?

First of all, GP is an important review standard for the "entry ticket" to the official version of Infinex. According to official disclosure, Infinex has received more than 200,000 whitelist applications for access qualifications after its official release, so it is necessary to use the GP points system to screen and decide which users can be the first to obtain experience qualifications when Infinex releases the first integrated function.

Secondly, will Infinex follow the example of various popular Points-Fi projects in the current market and launch GP-related points exchange or airdrop rewards?

It should be noted that Infinex mentioned in an article published in September 2023 that "Infinex's interests will be aligned with Synthetix, so Infinex will not launch its own tokens", and "a large part of the governance rights will be allocated to Synthetix stakers".

However, in Infinex's community governance, the proposal XIP-19 submitted in February 2024 involving the allocation of more GPs to SNX stakers was rejected, which may to some extent reflect the direction adjustment of the Infinex community.

In addition, Infinex's current development and radiation scope have broken through the early positioning of "Synthetix's new front-end application to optimize user experience", and are growing stronger in the broader Web3 multi-chain ecosystem outside Synthetix.

It is worth thinking about that in Infinex's governance framework, it can be seen that GP is the core part of its incentives. So, if Infinex does not issue tokens, how can the points be implemented as real economic returns in the hands of users?

Currently, Infinex is constantly improving and updating the supply and distribution of GP. At the same time, it also continues to stimulate users' imagination and expectations of GP by opening up more channels and carrying out more abundant points incentive activities. But - save GP, then what?

Whether it turns to launch its own governance tokens or undertake the expectations of GP for users through other economic incentives, Infinex has to submit a more complete and reasonable answer to users. Therefore, the actual value and potential of GP need to be further verified.

Conclusion

The launch of Infinex aims to solve the bottlenecks of various decentralized applications in the current crypto market by improving user experience, enhancing liquidity and market attractiveness, achieving cross-chain expansion, and enhancing market competitiveness. Infinex has demonstrated its innovation and breakthrough by simplifying user operations, introducing multiple collateral and stablecoins, supporting multi-chain operations, and providing a user experience similar to that of centralized exchanges.

However, the success of Infinex also needs to verify the effectiveness of its governance mechanism and incentives, especially the actual economic returns of governance points (GP) and Patron NFT. Although the GP points system provides users with the opportunity to participate in governance and obtain rewards, its actual value and potential still need further observation and verification. Whether Infinex can submit a complete and reasonable answer to users will determine its long-term competitiveness and development prospects in the field of decentralized finance.

Weatherly

Weatherly