Author: David Ma, AllianceDAO Translator: Shan Oppa, Golden Finance

Twenty years ago, I naively believed that the free market was the best form of market. Now, my perspective has softened, which may be wisdom or simply age.

I will not praise the free market, because this has dominated the mainstream of social economy for the past 50 years. So, now let me talk about its disadvantages...

The free market touches every corner and promotes optimization on a global scale. Adjustments to high levels of specialization are taking place around the world. But now I understand that this kind of optimization can leave local economies stagnant, overinvested, and turned into depressed places when the market winds change. Prosperous economies are completely squeezed by the pursuit of short-term global optimality.

Examples abound: the rise and fall of mining towns, Venezuela's overinvestment in the oil industry in mid-2010, which was hit hard when oil prices fell, and even in the United States, The inability of Detroit's auto industry and Rust Belt manufacturing to remain competitive in the global economy has plunged the local economy into a deep recession.

In the crypto world, the Axie Infinity game has enabled a large population of the Philippines to start earning income from the global speculative mania. Fortunately, this example ended up pretty good. The mania did not last long and produced no structural changes to the local economy.

But I don’t think it matters what the “proper” free market is, I’m just interviewing founders. The truth is, cryptocurrencies currently have the freest market in history.

Cryptocurrency capital flows are simply a market fundamentalist’s dream. This is the pinnacle of globalization in financial markets, with capital flowing freely, like water to the smallest cracks that offer the highest returns.

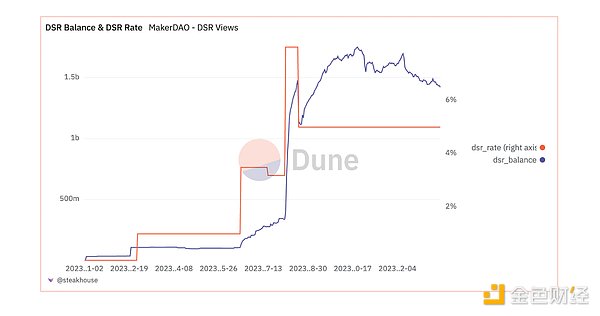

Treasuries vs. Maker's sDAI's 8% Yield

At the bottom of the bear market (not so Low), the on-chain yield is compressed to less than 5%, which is lower than the yield on short-term treasury bills. As a result, the overall stablecoin market value has slowly shrunk.

Maker has always used DAI-backed collateral to earn off-chain yields - what our industry calls RWA (real assets). Maker has quietly turned itself into the largest RWA provider in defi. I still don't know how this works legally.

My best guess is that sDAI has no actual requirements for the revenue generated by Maker. Maker simply controls DAI’s borrowing and lending rates to stabilize DAI’s anchor to the U.S. dollar. Collateral, on the other hand, is used to purchase Treasury bills. As it happens, DAI’s 5% savings rate is very close to the Treasury bill rate.

p>

In fact, Maker decided to increase the yield on sDAI to 8% as a promotion, which lasted for about two weeks. Their TVL immediately soared 5x, a large part of which came from Justin Sun, the “coin leader” who never misses an opportunity for free money.

The promotion was undoubtedly a success as money continued to flow in even after interest rates returned to normal levels (5%). Maker has quickly established itself as the most liquid place to park stablecoins on the chain. Liquidity is sticky, and all it took was $1 million in “advertising.”

At the same time, newer T-Bill RWA projects like Ondo Finance and Mountain Protocol, although their product structures are clearer, are still making every effort to increase TVL. Million dollar effort. They will be discussed further later.

Cannibalizing Lido's market share

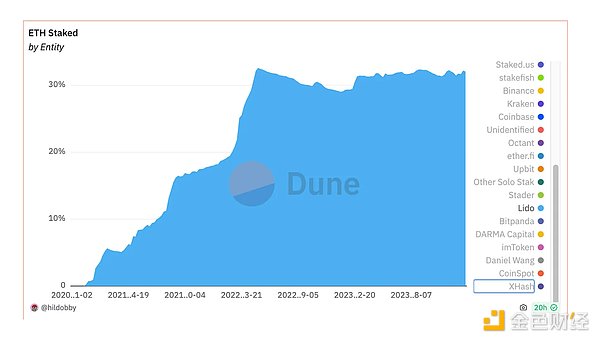

Lido has been discussed for some time in 2023 Dominance in liquid staking Ethereum, and whether they should self-limit for decentralization purposes.

Early attempts to challenge Lido were mostly the same: points programs, DeFi integrations, KOL campaigns, and promises to implement distributed validator technology (DVT). The market has not reacted to any of these moves. The bull market is far away, the return on investment is uncertain, and the point rewards are worthless. Participants are risk-averse and content with the status quo.

Diva (the first integrated DVT) and Swell are both launching Enzyme pools around Q3 2023 to incentivize early participation. Neither pool achieved the target results they shared publicly. As of today, their combined amount is about 25,000 ETH, which is much lower than Lido’s 9.3 million ETH.

Second-level native yield track: Blast and imitators

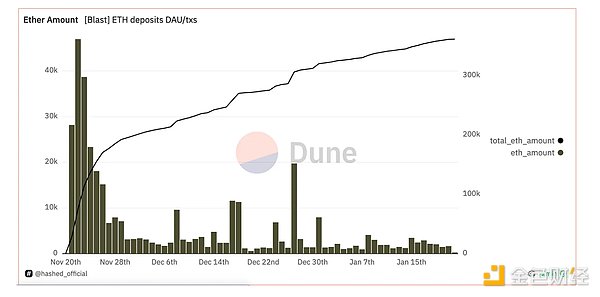

With Blur The second season airdrop ended, and PacmanBlur did not stop and announced Blast secondary native staking benefits in November 2023. A large number of cryptocurrency KOLs immediately retweeted and announced their angel investment in Blast.

Despite having no product other than a multi-signature wallet that receives and stakes committed ETH, their marketing campaign attracted 185,000 ETH in one week, It has now climbed to 360,000 pieces. Nearly 5% of Lido TVL is locked until May 2024 in anticipation of a lucrative airdrop.

p>

Until recently, staking ETH was primarily a first-level feature. Popular secondary solutions like Optimism and Arbitrum use native ETH as the gas token, and they do not allow users to put contract-locked ETH at risk in any form of staking. The only staked ETH that exists on the second level is the bridged wstETH, which is a non-rebasing version of Lido's staked ETH. Even then, its liquidity is negligible.

So it's just a matter of time before the market gets what it wants: earnings and capital efficiency, not scalability. Scalability is the underlying narrative, but revenue is what drives the market.

Of course, this is only a tongue-in-cheek statement. It's unclear how Blast can attract such a high TVL when other projects haven't. Reasons that come to mind include: seizing on the early days of a bull market, getting CT influencers on their investment list, Paradigm's name recognition, owning a well-known brand and project (Blur), or maybe a referral play.

Imitators

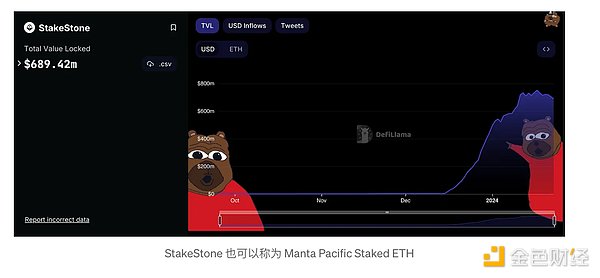

After every successful event, imitators are sure to appear in the cryptocurrency space . The key is to move quickly and surpass the original in some ways. Manta L2 and Mantle L2 (very confusingly named) emerged less than a month after Blast and announced their own secondary native revenue plans.

Manta pays depositors roughly 7% of the staking returns on the large amount of capital they raised at the peak of the 2021 bull market (while finding product market fit) twice. Additionally, the fact that the ETH they stake, trading under the ticker $mETH, is perfect for meme fodder is also a plus.

Manta, on the other hand, pieced together a DeFi ecosystem in record time and copied Blast’s referral point game, even including NFT cards and boxes .

This resulted in over 450,000 ETH being pledged, not including other bridging assets.

Just as Blast partners with Lido and Maker as its revenue providers, Mantle and Manta each work with their respective protocols. Mantle partners with Ondo Finance (Treasury Bills). Manta partners with Mountain Protocol (Treasuries) and StakeStone (LSTs).

These partnerships demonstrate their support for smaller protocols. Mountain Protocol’s TVL grew 10x after partnering with Manta, while Stakestone grew rapidly from scratch.

p>

Manta's hasty release

Some people privately call Manta's approach a "hodgepodge of ready-made solutions." It's a high-leverage bet trying to ride the narrative bandwagon. They were the first airdrop and the first project to have a slightly usable product on Celestia.

This was an impressive display of agility, but there were inevitably some holes, mismatches, and some promised airdrops but missed by Manta " " group.

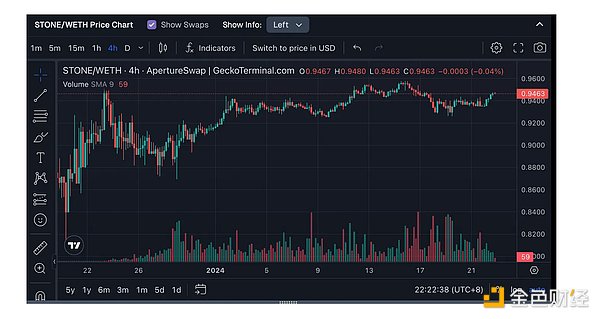

In the middle of the release of Manta Pacific, they decided to lock two income-generating assets for 69 days in exchange for Manta airdrop points (the event is called New Paradigm) to allow users Commitment to Level 2.

p>

Since only STONE (a pledged ETH) and wUSDM are locked on the secondary level, while most assets can be freely withdrawn, this means that the locked assets will face liquidity Sexual discount.

In fact, almost immediately, STONE was trading at a discount to ETH, as airdrop farmers sold STONE for ETH, then bridged it out, and then bridged it back.

p>

This farming is in vain because, judging from the complaints I’ve collected on Twitter, the airdrops are nowhere near as generous as farmers expect. Most of the airdrops went to influencers who were able to get people to use the referral code.

The rise of EigenLayer

In contrast to revenue-focused secondary solutions, EigenLayer’s narrative has been one of slow but constant rising tide. Since Eigenlayer opened up deposits, its self-imposed deposit limit has filled up instantly every time it has been raised.

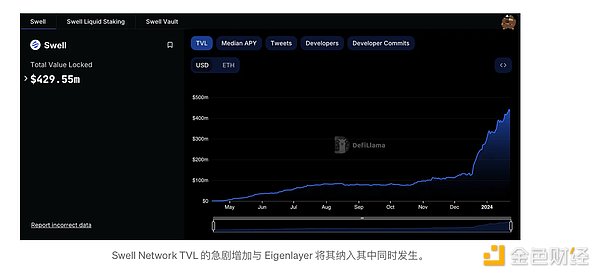

Initially limited to three LSTs (stETH, cbETH, and rETH), then Eigenlayer opened up new LSTs. This is where Swell Network finally breaks through. They were able to get on the new LST list, and the demand for farming EigenLayer was so great that it pushed its TVL onto the new LST.

This is actually proof that Swell has been working hard. They've been building partnerships with everyone, including not just Eigenlayer, but Enzyme, Pendle, Penpie, Sommelier, Maverick, Aura, and more. Not all initiatives will be catalytic, but at the same time you don’t know what will give you the 10x growth you need.

p>

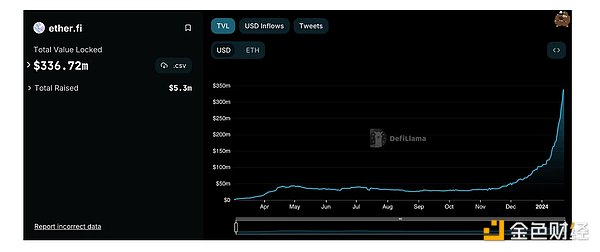

When EigenLayer's limitations on LST were reached, attention turned to the unrestricted native restaking option. Native restaking protocols like Ether.fi open the door for anyone who wants to earn EigenLayer points. This is a brilliant strategy.

p>

Today, EigenLayer's TVL exceeds 750,000 ETH, of which only 112,000 are from Lido.

Is Lido still the king?

While all these new developments are eating into Lido’s share, Lido’s share of staked ETH remains stable at around 31%. However, cracks are forming as more and more of the staked ETH within it is now controlled by entities like Blast and Mantle, which can switch providers or stake in-house.

p>

Over the past few months, I believe Lido's dominance in the LST market is not unshakable. Non-Lido providers are gaining trust and liquidity every day in an effort to grab market share. L2 and restaking change the landscape.

There are also some new protocols that are beginning to gather the long-tail staking market that is still illiquid. Sanctum on Solana and Tenderize on Polygon and The Graph are building a marketplace to provide liquidity to all individual stakers who today have no choice but to wait for the unstaking period to end. This makes sense because most of the staking risk disappears once the asset enters the unstaking queue. I expect they will move to Ethereum soon to capture a larger market share.

Some takeaways

Changes in TVL largely reflect the location of large revenue opportunities , and profit opportunities are related to overall market sentiment. However, it is these moments of opportunity where users are most willing to try new projects, which opens the window for the landscape to change.

The work behind the scenes is mostly invisible. Market feedback happens slowly, then suddenly, and is very noisy. Try to focus but also embrace narrative. Build partnerships, this is ultimately a cooperative game.

JinseFinance

JinseFinance

JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance Clement

Clement Bitcoinist

Bitcoinist Bitcoinist

Bitcoinist Cointelegraph

Cointelegraph