Author: The DeFi Investor, Translated by Shaw Jinse Finance

One thing I've learned repeatedly in the cryptocurrency world is to never give up on a trend.

Currently, the Perpetual Contract Decentralized Exchange (Perp DEX) is the hottest topic on crypto social media.

Everyone who participated in the Hyperliquid, Aster, and Avantis airdrops will tell you that they made far more money than they expected.

This makes me think that there's still a lot of money to be made from Perp DEX. If you've been following me for a while, you know that I'm bullish on Lighter.

In this post, I want to show the exact strategy I use to earn perpetual contract returns on Perp DEX, the protocols I primarily participate in, and why I chose them. Even if you're not a perpetual contract trader, you can easily apply this. Lighter and Longer-Lasting - My Focus on Perp DEX Before diving into my actual strategy, I want to talk about why I chose to focus on this specific revenue stream: "Lighter and Longer-Lasting." The truth is, 99% of airdrops today aren't worth your time. Therefore, choosing the right airdrop project is crucial. Before writing this article, I spent quite a bit of time researching the entire Perp DEX space. I tried to find projects that reminded me of Hyperliquid's early days. Speaking of Lighter, there are a few things that make me confident about it: First-mover advantage - Lighter was the first Perp DEX to introduce zero trading fees for retail traders, a move that has proven so successful that other DEXes are now following suit. Why is this important? Because projects that bring something new to the market typically have higher valuations. Higher valuations equal higher airdrop value. Now, some (myself included) question the sustainability of zero fees, as any product needs revenue to survive. Lighter founder Vladimir Novakovski clarified that Lighter will still generate revenue by charging fees solely to market makers. This is similar to the model of Robinhood, which also charges no fees for retail investors and is nonetheless one of the most successful companies in the world. Points become increasingly scarce over time - a fixed number of 250,000 points are distributed to Lighter users each week. This is similar to what Hyperliquid is doing, and I think it's a very good thing because it means Lighter points will become increasingly difficult to earn as the protocol grows, rewarding early adopters who use it early. A strong community—this is exactly why I'm so bullish on the airdrop. I've seen dozens of posts about Lighter, each with hundreds of likes. The reason HYPE has a fully diluted valuation (FDV) of $47 billion (as of this writing) isn't just because Hyperliquid built a great product. Dozens of great products have failed. The difference is that Hyperliquiquit has a strong community that's constantly promoting it. In cryptocurrency, attention is crucial. Given the active community surrounding the Lighter token, I expect its FDV to be high once it launches.

Next, the airdrop project that I have a second firm belief in is Extended. I only recently discovered this, but after some research, I think it's definitely worth getting involved. Extended isn't very popular, but it's growing very quickly. Here are the main reasons I chose Extended: Confirmed 30% Token Airdrop — The team announced plans to airdrop 30% of its token supply to early adopters (the TGE is scheduled for the first half of 2026). Extended issues approximately 1 million to 1.1 million points per week, regardless of total trading volume. This means that as Extended's trading volume grows, points will only become more scarce and harder to obtain, just like Lighter.

Excellent User Experience – In terms of user experience, my experience with Extended has been fantastic. While it's not drastically different from other Perp DEXs, I love the attention to detail. For example, I found the realized profit and loss page very useful.

Strong Team – Extended was founded by former Revolut team members. Ambitious Roadmap - One of the most intriguing features the team plans to release is unified cross-asset collateral. This will allow for opening positions using any asset as collateral, including yield-generating assets like wstETH. That being said, if I had to choose only one PerpDEX airdrop to participate in, I'd probably choose Lighter, as its success is practically guaranteed at this point. Lighter is currently the fastest-growing tokenless PerpDEX with a very strong community and all the ingredients for a large-scale airdrop. Extended is still at a disadvantage, but its team is incredibly solid, the app's user experience is excellent, and they've committed to providing up to 30% of the tokens allocated for this airdrop. I decided to participate in both airdrops because my strategy also requires using both exchanges. To be clear, this article represents my personal opinions only, and I do not receive any compensation from any of the DEXs mentioned. I am only sharing my own yield farming experience using my own capital. Now let's take a deeper look at how I secured these airdrops: Funding Rate Arbitrage: How and Why Let's first explain some basic concepts. Funding is a mechanism present on every PerpDEX. It is a regular payment between traders holding short and long positions.

If too many people short an asset at the same time, the funding rate will become negative, and traders with short positions will pay fees to traders with long positions;

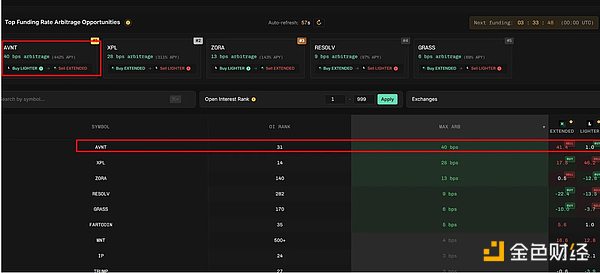

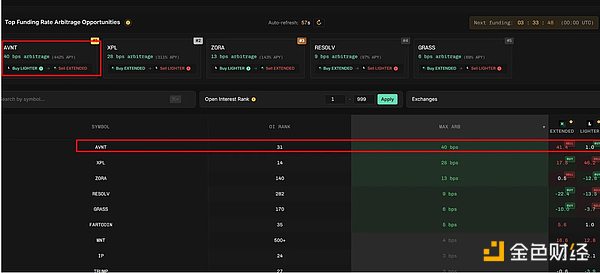

If too many people go long an asset at the same time, the funding rate will become positive, and traders with long positions will pay fees to traders with short positions. Funding rates exist to keep perpetual futures contract prices aligned with spot prices. Funding rates vary for each asset across different exchanges. On PerpDEXes like Lighter and Extended, funding rates are paid/received hourly. This presents some very interesting opportunities. Funding rate arbitrage is essentially a delta-neutral strategy that allows you to profit from differences in funding rates between exchanges by opening long and short contracts for the same asset on different exchanges. I performed this arbitrage trade to profit from funding rates while also generating significant trading volume on the exchange to qualify for the Perp DEX airdrop. It might sound a bit complicated at first, but you'll find it's actually quite simple. To arbitrage funding rates, here's what I did: Go to loris.tools → Click on "Exchanges" and select only Lighter and Extended. Click on "MAX ARB" to sort the displayed arbitrage opportunities by funding rate differential (the larger the differential, the higher the return). Then, go to Lighter and Extended, respectively, and go long and short on the assets with arbitrage opportunities you saw on loris.tools on both exchanges. That's it. After that, monitor your leveraged contracts on both exchanges from time to time to ensure you don't get liquidated.

When the funding rate differential disappears for more than 3-4 hours, close the position and move on to the next arbitrage trade.

Here's a case in point:

In the Loris Tools chart above, you can see that the best funding rate arbitrage opportunity available between Extended and Lighter is the AVNT trading pair. The platform even tells you exactly what to do: Sell (short) AVNT on Extended and buy (long) AVNT on Lighter. All you have to do is follow these instructions. Afterward, when the pip value (displayed under "MAX ARB" on Loris Tools) for your chosen arbitrage opportunity (in this example, the AVNT trading pair) drops below 3 pips within 3-4 hours, close your position and move on to your next trade. Don't expect to make a fortune with this strategy. However, the profits from the funding rate should certainly cover the trading fees and slippage you pay, and still leave you with some profit.

This is by far the best way to earn Perp DEX airdrops.

Things to Keep in Mind

First, here are some general tips to help you maximize your points:

Keep all trades open for at least 10 minutes - if you can keep them open for several hours, you'll likely earn more points. Trading volume is the most important, but trade duration is also important. Don't short and long the same asset simultaneously on the same exchange—you might be flagged as a "bot account" and stop receiving airdrops, even if you use different accounts (my recommendation is to use two different exchanges for funding rate arbitrage. I use Lighter and Extended). Avoid trading the BTC/ETH pair—even though it's the most liquid, trading less liquid altcoins like KAITO, ENA, JUP, and BERA on platforms like Lighter can earn you 2x to 3x more points on average. The advantage of funding rate arbitrage is that it doesn't require directional market exposure to a particular asset. Even the worst trader can profit from it because you're essentially opening a delta-neutral futures position. However, this strategy still carries the risk of liquidation. If you're arbitrage-adjusted funding rates on a volatile asset, you could easily be forced to close your position, potentially losing part of your principal. I have four suggestions to minimize this risk: Check your trading positions at least twice a day to ensure they're not getting liquidated—if your position is close to the liquidation price, partially or fully close it or add more margin. Don't use too much leverage - as a general rule, make sure the liquidation price of your short position is at least 2x higher than your entry price when you open a new position. For example, if you're shorting ENA at $0.70 on one exchange, first make sure the liquidation price is above $1.40 (you should be able to see it on every exchange) Avoid trading volatile tokens. Meme coin is a good example. I generally avoid using these token pairs for funding rate arbitrage because their high volatility also carries a higher risk of liquidation. Always use stop-loss and take-profit. I primarily use stop-loss on short positions, as they are generally more likely to be liquidated. Stop-losses are very useful, especially during periods of high market volatility.

For example, if I short ENA at $0.70 and my liquidation price is $1.40, I would set my stop-loss at $1.35 to avoid liquidation (the stop-loss needs to be slightly below the liquidation price).

Then on another exchange, I would go long ENA to arbitrage the funding rate and achieve a delta-neutral position, and I would set a take-profit order at $1.35.

By doing this, you can avoid liquidation 95% of the time.

I have another tip for you.

When you arbitrage funding rates, the biggest cost you pay is not the trading fee (which is zero on Lighter), but the spread. The spread is the difference between the highest price a buyer is willing to pay (the bid price) and the lowest price a seller is willing to accept (the ask price). For major assets like BTC, the spread is negligible. But for more volatile altcoins, this ratio can sometimes range from 0.03% to 0.15% and impact the profitability of funding rate arbitrage strategies. How can I minimize the spread I pay (which acts like a hidden fee)? By using limit orders. For example, if you want to arbitrage the funding rate of an asset between Lighter and Extended, you can do the following: Place a limit order on Extended at the midpoint between the bid and ask prices for a short or long position; Once the limit order is filled, immediately place a market order on Lighter.

This way, you'll be able to arbitrage funding rates with lower fees.

Other Perps DEXes Where You Can Participate in Yield Farming

As I said, the main airdrops I'm participating in are Lighter and Extended.

But if you want more opportunities, I've found some other interesting Perp DEXes.

If you're interested, I'll write a full overview comparing them in the coming weeks.

Pacifica — a self-funded Perp DEX founded by FTX COO and founder of Nftperp (currently in invite-only phase);

Paradex — a zero-fee decentralized exchange with deep liquidity, over 250 markets, and privacy, backed by Paradigm and Jump Capital;

EdgeX — the second-largest tokenless Perp DEX by volume and one of the most profitable DeFi protocols. You can trade on your computer and phone using EdgeX’s mobile app;

Based — A popular trading platform built on Hyperliquid, powered by Ethena, Hashed, Delphi Digital, and Spartan Group.

JinseFinance

JinseFinance