Author: Stanley, Kernel Ventures

Compiled by: JIN, Techub News

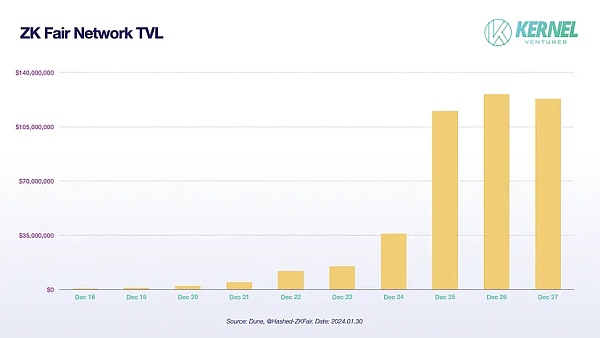

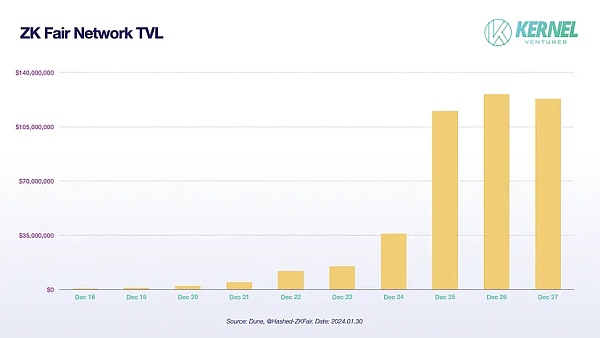

In just a few days, ZKFair The total value locked (TVL) has reached $120 million and is currently stable at $80 million, making it one of the fastest growing rollups. This ⌜Three Wus⌟ public chain with no financing, no market makers, and no institutional support has achieved such rapid growth. This article will take stock of the development of ZKFair and conduct a fundamental analysis of the current momentum of the Rollup market.

1. Summary background

Introduction

Rollup is one of the layer 2 (L2) solutions that moves the calculation and storage of transactions from the Ethereum mainnet (L1) to (L2) for processing and compression. The compressed data is then transmitted back to the Ethereum mainnet to improve Ethereum's performance. The emergence of Rollup has significantly reduced L2's gas costs compared to the main network, thereby saving gas consumption, faster transactions per second (TPS), and smoother transaction interactions. Some mainstream Rollup chains that have been launched include Arbitrum, Optimism, Base, as well as ZK Rollup solutions such as Starknet and zkSync that are widely used in the market.

Data overview

Rollup Chain data comparison

It is obvious from the data that OP and ARB still dominate the Rollup chain. However new entrants like Manta and ZkFair have accumulated considerable total value locked (TVL) in a short period of time. Still, it may take some time for them to catch up to OP and ARB in terms of number of agreements. The protocols for mainstream Rollups are mature and their infrastructure is complete. At the same time, emerging blockchains still have room for development in terms of protocol expansion and infrastructure enhancement.

2. Summary analysis

We will introduce some recently popular Rollup chains by category, and Mature Rollup chain.

Mature Rollup chain

Arbitrum is an Ethereum L2 expansion solution based on Optimistic Rollup created by Offchain Labs plan. While settlements for Arbitrum still take place on the Ethereum mainnet, execution and contract storage occur off-chain, with only necessary transaction data being submitted to Ethereum. As a result, Arbitrum’s gas fees are significantly lower compared to mainnet.

Optimism is built based on Optimistic Rollup, using a single-round interactive fraud proof mechanism to ensure that the data synchronized to L1 is valid.

Polygon zkEVM is an Ethereum L2 scaling solution built on ZK Rollup. This zkEVM extension leverages ZK proofs to reduce transaction costs and increase throughput while maintaining the security of Ethereum L1.

Emerging Rollup chain

ZkFair, as a Rollup, has several key features:

Rollup token ZKF is 100% allocated to the community. 75% of the tokens are distributed in four phases, with distribution completed within 48 hours to participants participating in gas consumption activities. Essentially, participants participate in the primary market sale of tokens by paying gas fees to the official sequencer. The corresponding primary market financing valuation is only US$4 million.

ZkFair TVL growth trend

ZKFair’s TVL is growing rapidly in the short term Growth, in part due to its decentralized nature. According to community insights, it was able to be listed on mainstream exchanges such as Bitget, Kucoin and Gate because the community and users actively established relationships with the exchanges. Subsequently, the official team was invited to carry out technical integration, all initiated by the community. On-chain projects like Izumi Finance also follow a community-driven approach, led by the community and supported by the project team, demonstrating strong community cohesion.

According to Lumoz, the development team behind ZkFair (formerly Opside), they plan to launch Rollup chains with different themes in the future. This includes Rollup chains based on current hot topics such as Bitcoin, as well as Rollup chains focusing on social aspects and financial derivatives. The upcoming chain will likely be launched in collaboration with the project team, similar to the current trend of L3 concepts where each Dapp has its own chain. According to the team, these upcoming chains will also adopt the Fair model, which distributes a portion of the original tokens to participants on the chain.

Blast is an L2 network based on Optimistic Rollups and is compatible with Ethereum. In just 6 days, the on-chain (TVL) has exceeded US$500 million and is approaching US$600 million. The surge doubled the price of the BLUR token.

Blast grew out of founder Pacman’s observation that more than $1 billion in Blur’s bid pool was essentially dormant, generating no returns. This situation is prevalent in applications on almost every chain, suggesting that these funds are subject to passive depreciation due to inflation. Specifically, when a user deposits funds into Blast, the corresponding ETH locked on the L1 network will be used for local network staking. ETH staking rewards earned are then automatically returned to users on the Blast platform. Essentially, if a user holds 1 ETH in their Blast account, it may automatically increase in value over time.

Manta Network, as a representative of modular ZK applications, has established a new paradigm for the L2 smart contract platform by utilizing modular blockchain and zkEVM. It aims to build a modular ecosystem for the next generation of decentralized applications (DApps). Currently, Manta Network offers two networks.

The focus here is Manta Pacific, a modular L2 ecosystem built on Ethereum. It solves the availability problem through modular infrastructure design, achieving seamless integration of modular data availability (DA) and zkEVM. Since becoming the first Celestia platform to be integrated on Ethereum L2, Manta Pacific has helped users save over $750,000 in gas fees.

Metis has been running for over two years, but the recent launch of its decentralized sequencer has brought it into the spotlight again. Metis is an L2 solution built on the Ethereum blockchain. It is the first to innovate by using a decentralized sequence pool (PoS Sequencer Pool) and a hybrid technology of Optimistic Rollup (OP) and Zero-Knowledge Rollup (ZK) to enhance network security, sustainability and decentralization .

In the design of Metis, the initial sequence nodes are created by whitelist users and passed through the parallel staking mechanism. Users can become new sequence nodes by staking the native token METIS, enabling network participants to supervise sequence nodes. This adds transparency and credibility to the entire system.

3. Technology stack analysis

Polygon CDK

Polygon Chain Development Kit (CDK) is a modular open source software toolkit designed for blockchain developers to launch new L2 chains on Ethereum.

Polygon CDK leverages zero-knowledge proofs to compress transactions and enhance scalability. It prioritizes modularity and promotes flexible design for specific application chains. This allows developers to select virtual machines, sequencer types, gas tokens, and data availability solutions based on specific needs. Its features include:

Polygon CDK allows developers to customize L2 chains according to specific requirements to meet the unique needs of various applications.

Chains built using the CDK will have a dedicated Data Availability Committee (DAC) to ensure reliable off-chain data access.

Celestia DA

Celestia works by decoupling the blockchain into three layers: the data layer , consensus layer and execution layer, creating the concept of modular blockchain. In traditional monolithic blockchains, these three layers are typically handled by a single network. Celestia focuses on the data layer and consensus layer, allowing L2 delegation to the data availability layer (DA) to reduce transaction gas fees. For example, Manta Pacific has adopted Celestia as its data availability layer, and according to Manta Pacific’s official statement, the cost was reduced by 99.81% after migrating DA from Ethereum to Celestia.

For specific technical details, please refer to Kernel Ventures' previous article: Exploring Data Availability - Related to Historical Data Layer Design (mentioned articles may provide detailed information ).

OP vs. ARB

Optimism is not the only existing Rollup solution. Arbitrum also offers a similar solution and is the closest alternative to Optimism in terms of features and popularity. Arbitrum allows developers to run unmodified EVM contracts and Ethereum transactions on the L2 protocol while still enjoying the security of the Ethereum L1 network. In these respects, it provides very similar functionality to Optimism.

The main difference between Optimism and Arbitrum is the type of fraud proof they use, Optimism uses a single round of fraud proof, while Arbitrum uses multiple rounds of fraud proof. Optimism's single-round fraud proof relies on L1 to perform all L2 transactions, ensuring fraud proof verification is instant.

Since its launch, Arbitrum has consistently shown better performance than Optimism in every L2 data. But this trend began to gradually change after Optimism began to promote the OP stack. The OP stack is an open source L2 technology stack, which means that other projects wishing to run L2 can use it for free to quickly deploy their own L2, thus greatly reducing development and testing costs. L2 projects adopting the OP stack can achieve security and efficiency due to the technical consistency of the architecture. After the OP stack was launched, it was initially adopted by Coinbase. With the demonstration effect of Coinbase, the OP stack has been adopted by more projects, including Binance’s opBNB, NFT project Zora, etc.

4. Looking to the future

Fair start

The current fair launch model in the Inscription vertical has been widely recognized, allowing retail investors to directly acquire original tokens. This is why inscriptions remain popular today. ZkFair follows the essence of ⌜Fair Start⌟. In the future, more chains may adopt this model, leading to rapid growth of TVL.

Rollup absorbs L1 market share

From a user experience perspective, Rollup and L1 There isn't much substantive difference. Efficient transactions and low gas generally attract users because most users make decisions based on experience rather than technical details. Some fast-growing Rollup networks provide excellent user experience and fast transaction speeds, providing generous incentives for users and developers. With ZkFair’s precedent, future chains may continue to adopt this approach, further absorbing L1’s market share.

Clear plan and healthy ecosystem

In the narrative of the current Rollup wave, Projects like ZkFair and Blast provide significant incentives to help build a healthier ecosystem. This reduces a lot of unnecessary TVL and pointless activities. For example, zkSync has been running for years without token distribution. Although it has a high TVL due to large amounts of funding and continued participation from technology enthusiasts, there are few new projects running on the chain, especially those with new narratives and themes.

Public goods

In the latest Rollup wave, many chains have introduced Gas fee sharing the concept of. Taking ZkFair as an example, 75% of gas fees are distributed to all ZKF token stakers, while 25% is distributed to dApp deployers. Blast also distributes gas fees to Dapp deployers. This allows many developers to go beyond project revenue and ecosystem fund grants and use gas revenue to develop more free public goods.

Decentralized serializer

Cost collection on L2 and cost payment on L1 Both are executed by the L2 sequencer. Profits also go to the sequencer. Currently, both OP and ARB sequencers are operated by their respective official entities, with profits going into the official treasury.

The mechanism of the decentralized serializer is likely to operate on the basis of proof of stake (POS). In this system, the decentralized sequencer requires L2’s native token, such as ARB or OP, as collateral. If they fail to meet their obligations, collateral may be slashed. Ordinary users can choose to stake themselves as a sequencer, or they can use a staking service similar to Lido. In the latter case, users provide staked tokens and professional decentralized serializer operators perform the serialization and upload services. Stakers receive a significant portion of the sequencer’s L2 fees and MEV rewards (in Lido’s mechanism, this is 90%). This model aims to make Rollup more transparent, decentralized and trustworthy.

Disruptive business model

Almost all L2 solutions start from the ⌜sublease⌟ model Profit from it. Subletting here means leasing the property directly from the landlord and then subletting it to other tenants. Likewise, in the blockchain world, the L2 chain generates revenue by charging gas fees to users (tenants) and subsequently paying fees to L1. In theory, economies of scale are crucial and as long as a sufficient number of users adopt L2, the cost of paying :L1 will not change significantly (unless the transaction volume is huge, as is the case with OP and ARB). Therefore, if a chain cannot achieve expected transaction volume within a certain period, it may be in a state of long-term losses. This is why chains like the aforementioned zkSync prefer to proactively attract and engage users; with large amounts of TVL, they don’t worry about a lack of user transactions.

However, this business model is not sustainable in the long run. While the focus is on chains with good financing conditions like zkSync, for smaller chains, relying solely on actively attracting and retaining users may not be as effective. Therefore, as mentioned earlier, the rise of ⌜grassroots⌟ projects such as ZkFair provides valuable lessons for other chains. In the process of pursuing TVL, the long-term sustainability of TVL must be considered, rather than blindly pursuing the acquisition of TVL.

5. Summary

The article first introduces that ZkFair has achieved 120 million in a short period of time USD TVL and use this as a focus to explore the prospects of Rollup. It covers established players like Arbitrum and Optimism, as well as new entrants like ZkFair, Blast, Manta, and Metis.

On the technical side, an in-depth look at Polygon CDK's modular toolkit and Celestia DA's modular concepts. It compares the differences between Optimism and Arbitrum, highlighting the possibility of a decentralized orderer adopting a POS mechanism aimed at making Rollup more transparent and decentralized.

In the future outlook section, the article highlights the broad appeal of the fair launch model and the potential for Rollup to absorb L1 market share. It noted that the difference in user experience between Rollup and L1 is minimal, with efficient transactions and low gas attracting users. Emphasizing the importance of public goods and the concept of fee sharing introduced by the chain in the latest rollup wave. The article concludes by pointing out that it is important not only to obtain TVL, but also to focus on its long-term sustainability.

Essentially, this new wave of Rollup is characterized by new projects with tokens, modular design, generous incentives, accelerated Initial business and token price fluctuations.

JinseFinance

JinseFinance