Source: Stacks

At 0:00 on December 18, 2024, Beijing time, sBTC was officially launched on the BTC L2 Stacks mainnet.

Stacks is the leading Bitcoin L2. The launch of the sBTC mainnet will introduce 2 trillion BTC liquidity into the chain ecosystem, which is expected to completely revitalize BTCFi.

Introduction to sBTC

What is sBTC?

sBTC is an asset on the Bitcoin second-layer network Stacks that is 1:1 pegged to Bitcoin. It will enable developers to create fruitful application scenarios for Bitcoin, opening the door to areas such as Bitcoin decentralized finance (DeFi), non-fungible tokens (NFTs), etc.

Unlocking Bitcoin liquidity is a key narrative, especially considering that Ethereum, although its market capitalization is less than 25% of Bitcoin, has a much higher total locked value (TVL) in the DeFi ecosystem.

sBTC aims to unlock more than $2 trillion worth of Bitcoin liquidity through Stacks for use by DeFi and decentralized applications (dApps), paving the way for a thriving Bitcoin-driven economy.

sBTC is operated by many signers, including institutional giants such as BitGo, Asymmetric, Ankr, etc., making it the most decentralized second-layer network BTC. In addition, transactions on the L2 network are guaranteed by 100% of the Bitcoin security budget, making Bitcoin transactions on the L2 network as irreversible as on the L1 network.

How does sBTC work?

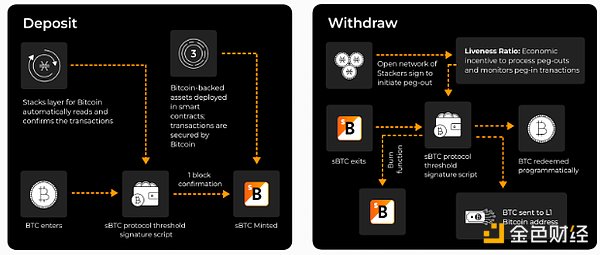

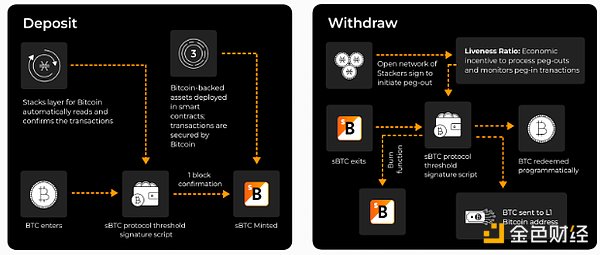

The user flow starts with a Bitcoin mainnet transaction, where BTC is deposited in a multi-signature protocol monitored by a decentralized group of Stacks signers.

Once BTC is deposited, sBTC is minted on Stacks, enabling users to interact with DeFi decentralized applications.

Thanks to this design, users can participate in Bitcoin DeFi without even knowing they are on Stacks. For example, the Zest protocol will support Bitcoin mainnet deposits and automatically convert them to sBTC. With the possibility of sBTC becoming a gas token for handling fees on Stacks in the future, the user experience will be further improved.

Will sBTC be capped?

Will sBTC be capped?

A 1,000 BTC deposit cap will be implemented at this stage to allow for controlled testing. This will scale as ongoing security measures continue to harden the protocol.

In the early stages, only deposits will be enabled, and withdrawals will be temporarily unavailable.

Will sBTC be profitable?

Imagine earning Bitcoin earnings just by holding BTC. No staking, no points, no complexity — just get Bitcoin rewards into your wallet. Early adopters of sBTC will receive a 5% annualized yield (APY) when they connect their wallet to https://bitcoinismore.org/ (launched at 11am EST on December 17, 00:00 BST on December 18).

This is now possible through the sBTC rewards program. Early adopters can receive Bitcoin rewards - issued in the form of sBTC - for simply holding sBTC.

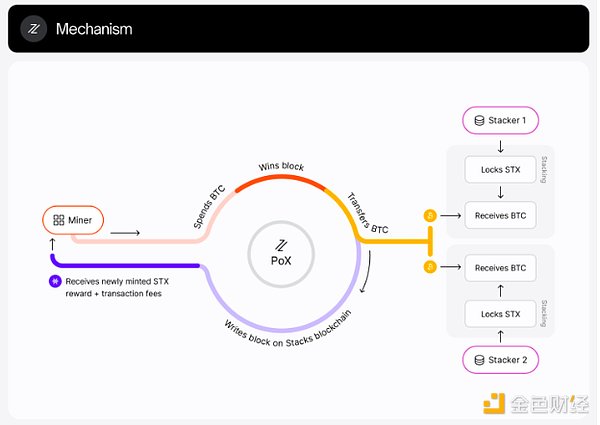

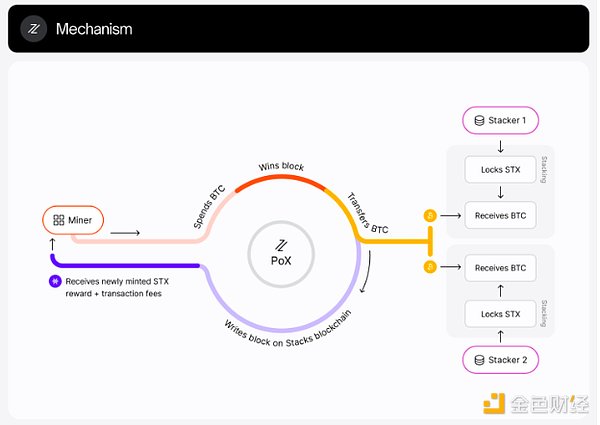

The sBTC rewards program is supported by a group of participants who "Stacking" STX (Stacks' native token).

When STX Stacking is performed, participants receive Bitcoin through the Stacks consensus mechanism. To enable the sBTC rewards program, these participants contribute the corresponding Proof of Transfer Bitcoin rewards to the sBTC rewards pool.

BTC from the reward pool is directly deposited into a smart contract that converts Bitcoin into sBTC and distributes rewards to sBTC holders in proportion. The protocol takes a snapshot of the sBTC held by users every day, and rewards are distributed every two weeks (the length of a PoX cycle).

The current estimated annualized Bitcoin reward is 5%, which is distributed every two weeks.

What are the key features of sBTC?

DeFi Use Cases of sBTC: Additional Income

Where can sBTC be used?

Multiple DeFi protocols will support sBTC, allowing users to earn more than 5% additional income just by holding sBTC:

1.Bitflow DEX:

Liquidity Pool: Users can deposit sBTC into Bitflow’s liquidity pool to facilitate transactions and earn a share of transaction fees.

Yield Farming: Liquidity providers can stake their LP tokens in a yield farming program to earn additional rewards, which usually come from trading activities or platform incentives.

Early deployment of sBTC is expected to earn an additional annualized yield of 10-30%.

Bitflow Runes AMM:

Bitflow has launched a Stacks second-layer network rune automatic market maker, and you can bring runes to the second-layer network for a better user experience.

2. Zest—— Lending Market

sBTC will be included in the Zest protocol lending market on day one.

The Zest protocol will launch a yield-enhancing campaign on its lending market from day one, offering up to 10% Bitcoin yield on sBTC supply.

Zest will also unlock more DeFi strategies involving sBTC, such as:

Deposit sBTC to earn up to 10% annualized Bitcoin yield

Borrow USDh stablecoins with Bitcoin (or other stablecoins and convert them to USDh)

Stake USDh on Hermetica to earn up to 25% annualized stablecoin yield, USDh is a Bitcoin-backed yield-type stablecoin on Stacks with a yield of 25%.

Reminder: Hermetica's DeFi protocol provides USDh, the first Bitcoin-backed, yield-bearing stablecoin. Its yield is sustainably generated through perpetual contract funding rate payments on centralized exchanges and is distributed daily.

stSTXbtc is a new liquidity staking token that users can use in Stacks' DeFi. By holding this token, users will receive up to 10% of staking rewards paid in sBTC directly in their wallets.

3. Velar, DEX

Liquidity provision: Users can supply sBTC to Velar's liquidity pool, facilitate transactions and earn a share of the transaction fees generated by the platform.

Yield farming: By participating in the yield farming program, users can stake LP tokens earned from providing sBTC liquidity to earn additional rewards in the form of Velar native tokens or other incentives.

Staking: If Velar launches a sBTC staking option, users can stake their sBTC is locked in a staking contract to earn rewards, such as additional tokens or a percentage of earnings, by supporting network operations.

Velar will have its own incentive program that allows you to earn its native token called VELAR by deploying sBTC in a pool on its decentralized exchange.

4.Arkadiko——USDA Stablecoin

Through a governance vote, Arkadiko will allow sBTC to be used as collateral within its protocol, enabling users to borrow USDA or other assets with their Bitcoin holdings.

5. ALEX DEX

Users can deposit sBTC into ALEX's liquidity pool and pair it with another asset, such as STX or a stablecoin. Doing so can promote transactions on the platform and earn a share of the transaction fees generated by the pool.

ALEX will provide additional income in the form of its native token ALEX through the "Surge Campaign". This means that in addition to the 5% annualized rate of return of the sBTC reward program, you will also be able to earn income by joining the sBTC pool, as well as receive additional ALEX token rewards.

6. Granite (not yet launched) - Lending protocol

Borrowers can obtain stablecoin loans by pledging their Bitcoin, while liquidity providers earn income by providing stablecoins to the protocol.

Borrowing: Users can borrow stablecoins using sBTC as collateral, which can then be used in various DeFi strategies to earn income.

Liquidation participation: Users can act as liquidators and repay part of the undercollateralized loans in exchange for collateral and rewards, thereby earning income through the liquidation process.

Granite currently has a waitlist, allowing early access to those who sign up in advance. Eventually, a points system will bring additional benefits, and users who sign up in advance will have a significant advantage.

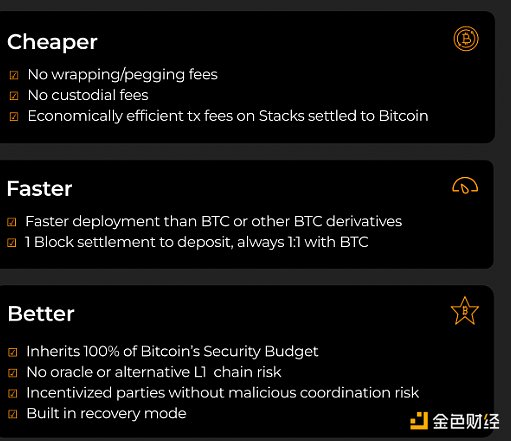

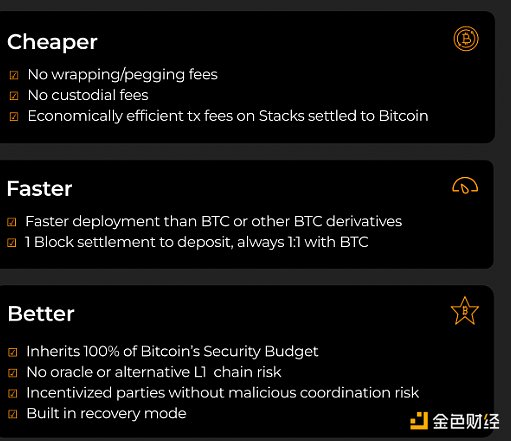

How is sBTC different from other Bitcoin assets (such as wBTC, cbBTC, ecc, etc.)?

These Bitcoin assets usually require sending Bitcoin to an intermediary, or rely on a trusted alliance of signers or small multi-signature mechanisms.

sBTC will initially rely on 15 signers, including enterprise-level institutions such as BlockDaemon, Figment, Luganodes, and Kiln, to handle peg-ins and peg-outs. Over time, this responsibility will be transferred to all Stacks signers, allowing anyone to participate in securing and decentralizing the network. BitGo, Aptos Foundation, and others are also expected to join the action.

In addition, thanks to the design of Stacks, sBTC will benefit from 100% Bitcoin finality, which means that transactions on the Stacks layer will be as irreversible as Bitcoin transactions.

Reminder: Signers are responsible for verifying and approving each block produced; anyone can become a signer as long as they accumulate enough STX to become an independent signer - this is similar to the concept of a validator.

sBTC Supplementary Information

1) Other materials of sBTC:

-sBTC website:https://www.stacks.co/sbtc

-sBTC documentation:https://docs.stacks.co/concepts/sbtc

-sBTC presentation:https://www.stacks.co/sbtc-deck

2) Nakamoto upgrade information:

- Nakamoto upgrade website:https://www.nakamoto.run/

- Documentation: https://docs.stacks.co/nakamoto-upgrade/nakamoto-upgrade-start-here

The Nakamoto Upgrade is critical because it brings the following results:

Fast blocks: Fast blocks bring a Solana-like experience to trading and Bitcoin DeFi interactions, greatly improving the overall user experience of interacting with the Stacks layer 2 network.

The Stacks DeFi ecosystem has grown tremendously this year, and it now takes only seconds to apply DeFi strategies, making it easy for new users to onboard and retain them.

Prior to the Satoshi hard fork, Stacks blocks settled in lockstep with Bitcoin blocks (10 minutes on average), making the chain slow and inefficient for DeFi activities. This limitation is no longer in place. Instead, Stacks blocks now take only seconds to generate, with performance continuing to improve. All while still leveraging Bitcoin’s security after Bitcoin blocks settle.

100% Bitcoin Finality:With the Satoshi upgrade, transactions occurring on the Stacks layer 2 network can leverage 100% of Bitcoin’s security budget, meaning that Stacks transactions become as irreversible as Bitcoin transactions once a subsequent Bitcoin block settles.

Instead of a single Stacks block being tied to a single Bitcoin block, Bitcoin blocks are now tied to a miner’s term, during which they can mine multiple Stacks blocks that settle in seconds.

There are currently 50 signatories, including enterprise-level institutions such as BitGo, Aptos, Luganodes, Kiln, etc., responsible for verifying and approving each block produced during the miner's tenure.

The fast block time combined with Bitcoin finality makes Stacks the most secure and scalable Bitcoin second-layer network, running through a decentralized network of signers, which will allow the decentralized transfer of Bitcoin to the second-layer network in the future through the upcoming sBTC upgrade.

3) Stacks analysis platform:

-Signal 21: https://signal21.io/

-DefiLlama: https://defillama.com/chain/Stacks

-Stacks Browser: https://explorer.hiro.so/

Anais

Anais