With the recent surge in established virtual currencies such as Bitcoin and Ethereum, most old friends believe that the long-awaited "Spring of Crypto Assets" and "Super Bull Market" "It has arrived, and we can’t wait to invest a lot of money in the crypto asset market to look for opportunities to get rich. At the same time, Sister Sa noticed that due to the huge aura of the explosion of Bitcoin Big Brother, the entire currency circle has followed suit, and the price has begun to rise more or less.

This is originally a good thing for those who have been paying attention to crypto assets for a long time, but there are always crises lurking under the opportunities, and some criminals have begun to use them again. The eyes are on the wallets of investors in the currency circle, and the methods of committing crimes are becoming more and more brutal and rapid. On February 23, 2024, BitForex, a crypto exchange that publicly claimed to be headquartered in Hong Kong, withdrew US$57 million from its online crypto asset wallet at lightning speed, and then ran away with the bucket, creating Hong Kong A new record for the “first run” in the crypto asset circle in 2024.

How did BitForex cheat and escape?

Friends in the currency circle may be unfamiliar with the name BitForex, but in fact BitForex is the former "Binfu.com" The exchange has just changed its skin. For the Sajie team, which has been paying attention to and researching crypto-asset crimes for a long time, BitForex can be regarded as an "old acquaintance". Even before BitForex ran away, the team often used this exchange as a typical case to explain the classic cases of crypto-asset crimes. Specific criminal methods such as "false liquidity traps" and "wash transactions".

Since around 2019, BitForex has transformed its own exchange through frequent multi-account self-buying and self-selling, multi-platform cross-trading, and internal and external circulation of funds. liquidity is falsely raised. But in September 2023, it even began to call itself "one of the world's leading cryptocurrency exchanges by market capitalization, with a daily trading volume of approximately US$2.6 billion."

But in fact, BitForex’s entire exchange-level transaction data is shockingly fake. According to the crime research report data of Chainalysis, a well-known third-party crypto asset crime platform, as early as BitForex’s real transaction data in 2019 is only about one-eighth percent of its publicly disclosed data. But even after its astonishing 8,000% fraud rate was revealed, due to the lack of strong regulatory measures, BitForex was still able to continue to attract a large number of retail investors by frequently listing a variety of small coins and using water to make markets.

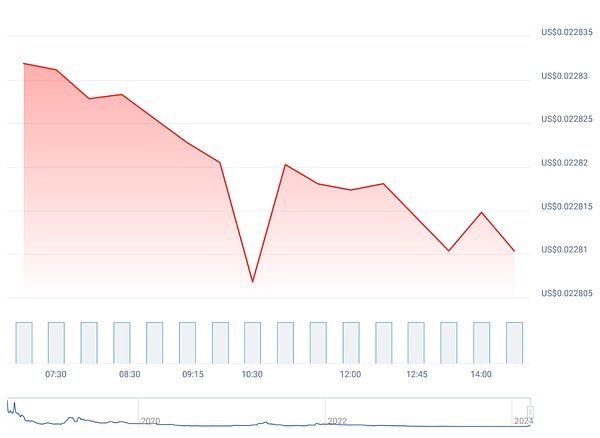

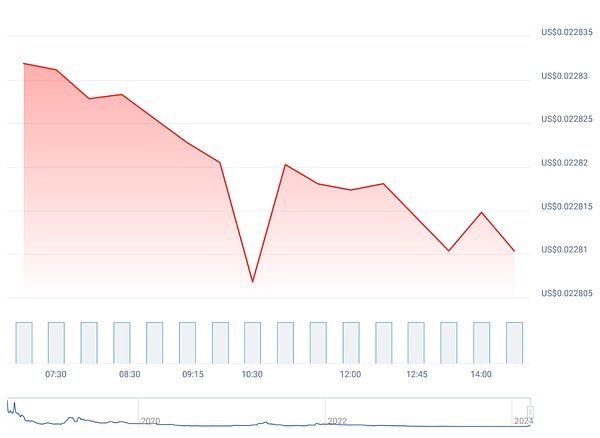

When pulling the transaction data of the exchange, Sister Sa’s team also noticed that the platform actually had obvious signs before running away: it was running away. In the past two days, BitForex's trading data began to fall off a cliff. The trading data on February 22 almost fell out of a "right angle" on the chart. The entire trading data was extremely abnormal, like a patient who had been taking medicine for a long time to survive suddenly. Same as extubation.

(picture from third-party data company)

Small-scale like this After the exchange's turnover plummeted, it was no surprise that it ran away with a bucket, but what everyone didn't expect was that this company ran away so fast. On February 23, 2024, BitForex closed its website after directly withdrawing US$57 million from its online crypto asset wallet, and the customer service staff of the crypto community deleted its account and disappeared. To be precise, a total of $56.5 million was lost from BitForex wallets, according to ZachXBT’s report. This includes $54 million in TRB, $1 million in ETH, and $250,000 in USDC.

How can ordinary retail investors keep a close eye on the bull market?

1.Stay away from the Pheasant Exchange

Stay away from the 18th Line Pheasant Exchange! The Sajie team has said this sentence a hundred and eighty times on countless occasions and in countless legal popularization articles, and has been tirelessly working to spread this iron rule to all places related to the education of crypto asset investors. .

I believe that for all rational and smart partners, there is no need to repeat the reasons and reasons for staying away from the Pheasant Exchange. However, as a professional criminal team, Sister Sa’s team The defense team, on the basis of summarizing the experience in handling cases, would like to remind everyone: no matter how advanced the deception is, it will be discovered, and no matter how low-level the deception is, some people will be fooled. When smart people deceive the Pheasant Exchange, they are overconfident in their own investment level and deceived by short-term gains, thus ignoring the essence of the scam. In other words, staying away from the pheasant exchange means staying away from the misunderstanding of superstitious "short-term, flat and fast" speculation and inappropriate greed.

2. Learn to use third-party data tools to identify falsehoods and truth

For investors, it is very important to use third-party data tools reasonably and correctly. Reasonable reference to various data can effectively help investors identify abnormal behaviors of the platform and possible absorption transactions, such as in In the BitForex case, if investors use third-party tools to verify standardized transaction data from February 22 to 24, 2024 (statistics that add the actual traffic of the platform network as a parameter to the algorithm to identify whether the platform has market manipulation behavior ), we can find that the actual trading volume of BitForex is extremely high. Its actual trading volume is only about ten million US dollars, which is far less than the public US$2 billion.

In addition, Dune Analytics and Chainalysis are also commonly used on-chain data monitoring and analysis tools by the Sajie team. The virtual asset reports regularly released by multiple platforms are not only data sources It is extensive and has a certain degree of real objectivity and can be used as an investment reference.

3. Focus on exchange personnel changes

For For crypto-asset trading platforms that lack effective supervision, investors need to pay special attention to whether the platform has undergone major personnel changes, shareholder changes, etc. in the near future. According to the case-handling experience of Sajie’s team, large-scale or significantly abnormal personnel changes on crypto-asset platforms often This means that the platform may have "changed ownership" or changed its normal business strategy in preparation for running away, or it may want to achieve liquidation in disguise.

Judging from the BitForex case, ZachXBT’s preliminary investigation results show that in January 2024, Jason Luo, the apparent CEO of BitForex, suddenly resigned. as "a new leadership team will join BitForex to drive the exchange to greater heights." At present, apart from Jason Luo's resume fraud, the Sajie team has not found a causal relationship between his resignation and BitForex's withdrawal of funds, but it still reminds everyone to pay close attention to such information.

Mainland residents have been deceived, how can they safeguard their rights in Hong Kong?

As far as the BitForex case is concerned, on March 4, 2024, the Hong Kong Securities and Futures Commission (referred to as the "Hong Kong Securities Regulatory Commission") "Will") has issued an announcement regarding suspected fraudulent transactions by cryptocurrency exchange BitForex: Although BitForex is headquartered in Hong Kong, it does not possess the license required by the country's digital asset operator regulatory framework. From this point of view, Hong Kong's judicial authorities have jurisdiction over this fraud case. Therefore, if mainland residents suffer huge losses due to BitForex fraud, they need to consider safeguarding their legitimate rights through the Hong Kong judicial system.

Sister Sa's team has previously explained to partners that the design of the recovery and restoration system for criminal cases in Hong Kong is very different from that in mainland China. In short, mainland China’s Criminal Law, Criminal Procedure Law and other laws, judicial interpretations and administrative regulations require judicial organs to have the ex officio responsibility to recover illicit money and recover losses for victims in the process of handling economic criminal cases. , parties involved in criminal cases in mainland China can supervise the work of judicial organs in recovering stolen goods and damages, but they are not allowed to directly participate in related work. The jurisdiction of Hong Kong's judicial organs in handling economic criminal cases is limited to handling the criminal case itself, that is, ascertaining the facts of the criminal offense and convicting and punishing it in accordance with the law. It does not have the responsibility to trace and recover the victim's funds. , even if the seized criminal suspect's property may be stolen money or stolen goods, it cannot be directly returned to the victim without legal procedures. Therefore, an important way for victims to recover stolen goods and recover losses is to file a separate civil lawsuit against the criminal suspect in a court with jurisdiction in Hong Kong.

Take BitForex as an example. Mainland residents can currently report to the Hong Kong police or the Joint Financial Intelligence Unit of the Hong Kong Government (Joint Financial Intelligence Unit) by phone, online, or in person in Hong Kong. JFIU) and other institutions reported and accused BitForex of committing fraud crimes, provided relevant account information, and clearly requested the police to freeze the suspect's relevant bank accounts and crypto asset accounts. In addition, if the amount of losses suffered is large and the relevant accounts have not been frozen by the police, and there is a risk of funds being transferred, you can entrust a lawyer to apply for an emergency freezing order from the Hong Kong court to freeze the accounts involved.

Of course, if they want to protect their legitimate rights and interests, the victims of the BitForex case still need to invest money to entrust a lawyer to recover the defrauded funds. Judging from the causes of action of this type of litigation (similar to the causes of action in mainland China), the main optional causes of action are: (1) Fraud; (2) Unjust Enrichment; (3) Legal construction Trust or constructive trust (Constructive or Resulting Trust), etc. There is no doubt that the BitForex case is highly likely to constitute fraud, and the plaintiff has been able to provide corresponding evidence to effectively prove that BitForex committed fraud.

In addition, if a victim in the mainland wants to file a civil lawsuit against BitForex, some evidence may not be available on his own, such as the suspect's bank account, account holder information, Information and documents such as bank transfer statements and crypto asset wallet details. In practice, this part of the evidence is generally provided by the Hong Kong police or the banks or crypto-asset platforms involved in the case. If the aforementioned institutions do not provide relevant evidence, relevant information and documents can be obtained through lawyers applying to the court for a disclosure order.

JinseFinance

JinseFinance