In the past 24 hours, many new hot currencies and topics have appeared in the market, and they may be the next opportunity to make money

Summary

Yesterday, BTC slightly corrected after breaking through the $70,000 pressure level for the third time in a month. BTC spot ETF has had net inflows for four consecutive days. As the halving approaches, Bitcoin and its ecological projects show signs of breaking upward. ENA doubled its price within a week after TGE and became the most profitable stablecoin project last week. USDe's circulating market value also reached $2 billion, ranking fourth in the stablecoin market value. Among them:

The sectors with strong wealth-creating effect are: Bitcoin ecology (BRC20, ARC20, BTC Layer2, etc.), Ethena (ENA), nakamoto upgrade related tokens (STX, T);

Users' hot search tokens & topics are: Pixels, Harvest Finance, Matr1x;

Potential airdrop opportunities are: Morph, TimeSwap;

Data statistics time: April 8, 2024 4:00 (UTC+0)

1. Market environment

After a brief correction, the spot gold price rose again, breaking the historical high to reach US$2,353/ounce. BTC slightly corrected after breaking through the $70,000 pressure level for the third time in a month. BTC Spot ETF had a net inflow for four consecutive days from April 2 to April 5, and market sentiment began to improve.

The ETH/BTC exchange rate weakened, falling 13% in the past month. In the past 24 hours, the gas on the ETH chain dropped to around 10gwei, and the activity on the ETH main network decreased significantly. In the Layer2 network, except for the recent obvious increase in TVL of Base, the TVL of Starknet, Optimism, and Arbitrum fell by 10%, 9%, and 5% respectively in the past week.

II. Wealth-making sector

1) Sector changes: Bitcoin ecosystem (BRC20, ARC20, BTC Layer2, etc.)

Main reasons:

(1) Bitcoin halving is approaching, and Bitcoin ecosystem projects are most likely to attract market attention. A large number of Bitcoin asset issuance protocols and expansion protocols will prepare to release important announcements before and after the halving;

(2) Atomicals Protocol's ARC20 token split solution Beta version enters the testing phase;

Increase: In the past 24 hours, ATOMARC rose 24% and MUBI rose 26%; in the past week, CKB rose 37%, and other top assets such as BRC20 and ARC20 also rose significantly.

Factors affecting the future market:

The situation and effect of Bitcoin ecosystem innovation before and after the Bitcoin halving, and the actions of the main funds during this period will directly affect the trend of the entire sector. At present, the asset liquidity of the ARC20 sector is weak, which is conducive to capital pulling. The market value of ATOMARC and QUARK is not high. It is worth paying attention to the changes in the sector and investing in it at the right time.

2) Sector changes: Ethena (ENA)

Main reasons:

(1) Ethena's protocol fee reached 8.3 million US dollars in the past week, ranking first in the stablecoin protocol, far exceeding the second-ranked MakerDAO. USDe's circulating market value has also rapidly reached the level of 2 billion US dollars.

(2) Ethena has been very popular in social media and among industry KOLs. Some people compared Ethena with Luna to highlight the risks of the project, while others pointed out the difference between the project and Luna and praised it for proactively disclosing its own potential risks. Amid discussions and disagreements, Ethena's social media exposure continued to rise.

Rise: ENA continued to rise from an opening price of about $0.6 after the TGE a few days ago. The current price has reached $1.2, doubling in a week.

Factors affecting the market outlook:

USDe circulation growth: USDe's current market value is 2 billion US dollars, and it has come to the fourth place in the stable currency market value. If USDe's circulation market value can approach or even exceed the third-ranked DAI, then ENA's currency price imagination space will be greatly opened.

Ethena's expected rate of return and the strength of external cooperation projects: The second season of the Ethena campaign has been launched. Ethena has cooperated with a large number of well-known projects such as Zircuit to add more benefits to USDe's pledge. If Ethena can continue to carry out such expansion and allow users holding USDe to get more excess returns given by the outside, the project will be able to develop faster.

3) The sectors that need to be focused on in the future: Nakamoto upgrade-related tokens (STX, T)

Main reason: The Stacks Nakamoto upgrade will be launched between April 15 and 29, and the bootstrap contract required for the Nakamoto upgrade is ready. The Stacks Nakamoto upgrade is to upgrade the BTC cross-chain bridge to threshold signet, and Threshold Network and its $tBTC are threshold signet cross-chain BTC bridge solutions that have been running for 5 years.

Specific currency list: STX (Stacks), T (Threshold Network)

III. User hot searches

1) Popular Dapp

Pixels: Pixels is a social casual Web3 game based on the Ronin network, with an open world game environment for exploration, farming and creation. According to DappRadar data statistics, Pixels UAW has reached 740,000, with a large user scale. A major feature of Pixels is that it combines the player earning (play-to-earn, P2E) function and farmland NFTs, aiming to provide a comprehensive gaming environment through PIXEL tokens, closely combining currency use and gameplay, and is widely loved by players.

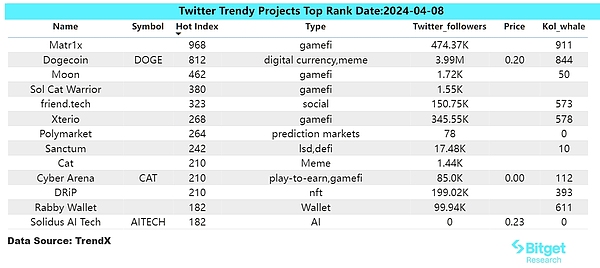

2) Twitter

Matr1x

Matr1x is a global Web3 entertainment platform that combines multiple episodes of games. The platform's first game, Matr1x Fire, is a mobile shooting game set in the metaverse, the first of its kind in the Web3 gaming industry.

The cryptocurrency gaming track has rebounded collectively recently. The price of Matr1x token FIRE has performed well. The main factors affecting the price of Matr1x's token FIRE include its unique position in the gaming and Web3 entertainment sector, the success and adoption of its flagship game Matr1x Fire, and the overall growth and engagement of its platform.

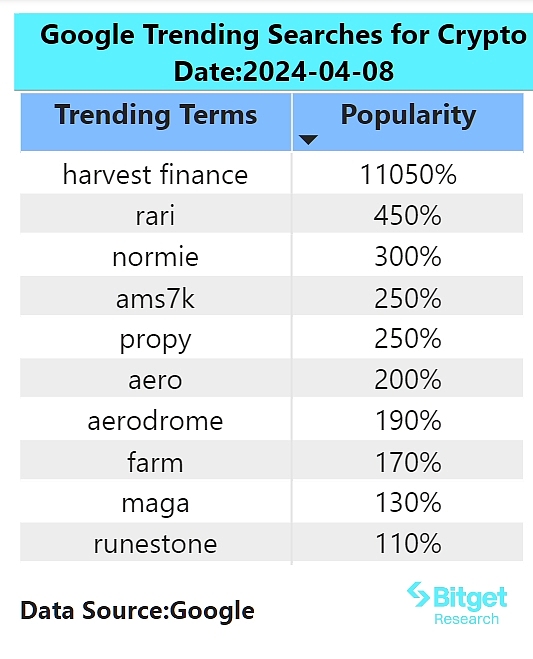

3) Google Search & Region

Globally:

Harvest Finance

Harvest finance is a multi-chain DeFi income viewing dashboard project. The project is very convenient for users to check their LP, Yield Farming and other situations deployed on multiple chains, and it is convenient for users to quickly claim profits.

The highest increase in the price of the token of this project yesterday was about 160%, and finally reached 100%. The token is currently listed on Coinbase, Kraken and Binance. Due to the increase in the price of the token, there are many hot searches on social media. However, the project party has not announced any breakthrough functions or special cooperation information. It is not clear why the token has risen for the time being. Investors can continue to observe.

From the perspective of hot searches in various regions:

(1) Southeast Asia has a strong interest in AI and MEME topics:

Southeast Asian users have significantly increased their attention to MEME tokens and AI tokens. MEME coins such as PEPE, WEN, SHIBA INU, etc. have appeared in a large range of searches by Southeast Asian users. MEME is simple and cute, and is widely loved by Southeast Asian users. In terms of AI, FET, WLD, ARKM, etc. all appear at the top of the search. Since AI tokens are officially affected by the industry iteration and upgrade, they have a high volatility and retail investor participation.

(2) Europe and CIS regions pay more attention to mainstream coins:

The tokens that users in Europe and CIS regions mainly pay attention to are SOL, FTM, TRON, etc. The recent mainstream market has returned to a high level after adjustment. Retail investors generally pay attention to mainstream coins, which shows that retail investors are optimistic about the future market of mainstream coins and believe that there may be a breakthrough market, so they generally bet on it. Similarly, the recent popularity of Solana chain has driven other public chains to imitate it. Under the premise that users are more willing to participate in the public chain ecosystem, users' demand for the public chain tokens has also increased accordingly.

Fourth, potential airdrop opportunities

Morph

Morph is a consumer-level blockchain that meets users' daily blockchain needs through zkEVM and responsive technology. Morph aims to provide one-stop development tools and solutions for project founders. Morph is built on three key technologies: decentralized sequencer, Optimistic zkEVM integration, and modular design.

Morph announced the completion of a $19 million seed round of financing, led by Dragonfly Capital and participated by Pantera Capital and others.

Participation method: Log in to the Morph official website and add the test network RPC into the wallet software, collect test ETH at the official faucet, cross-chain the test ETH to the Morph test network, and participate in the Morph test network on-chain project.

TimeSwap

Timeswap is a liquidation-free lending protocol that uses its own style of AMM model and design for lending. Users can borrow tokens into the pool to earn fixed income, borrow tokens or leverage without liquidation risk.

DeFi lending protocol Timeswap completed its seed round of financing, led by Multicoin Capital, with participation from Mechanism Capital and Defiance Capital. The amount of financing has not been announced.

How to participate: Log in to the Timeswap official website, select the LP pool with TIME subsidies, and form the corresponding LP to add deployment to participate in the TIME token pre-mining.

Original link: https://www.bitget.com/zh-CN/research/articles/12560603807882

Edmund

Edmund

Edmund

Edmund Edmund

Edmund Joy

Joy Hui Xin

Hui Xin Huang Bo

Huang Bo JinseFinance

JinseFinance Beincrypto

Beincrypto decrypt

decrypt Coindesk

Coindesk Cointelegraph

Cointelegraph