Author: TokenInsight Research, Translator: Shaw, Jinse Finance

In the ever-evolving digital asset space, a common point of contention is whether Circle's USDC (widely regarded as a model of regulated and transparent stablecoins) will eventually surpass Tether (USDT). While USDC is undoubtedly the preferred choice for institutions and the regulated "on-chain" economy, it is too early to assert that it will surpass Tether.

Tether's dominance is due to its strong network effects and a decade-long first-mover advantage. Since its launch in 2014, USDT has become the "reserve currency" of the cryptocurrency market. It is the primary liquid trading pair on global exchanges and a functional unit of account for traders. However, its real advantage lies in its widespread adoption in emerging markets.

USDT and USDC Trading Volume on Centralized Exchanges

Source: Dune Dashboard

In Southeast Asia, Africa, the Middle East, and Latin America, a large number of users now use USDT for peer-to-peer transfers, remittances, merchant payments, and simple dollar savings.

In regions such as Southeast Asia, Africa, the Middle East, and Latin America, a large number of users now use USDT for peer-to-peer transfers, remittances, merchant payments, and simple dollar savings.

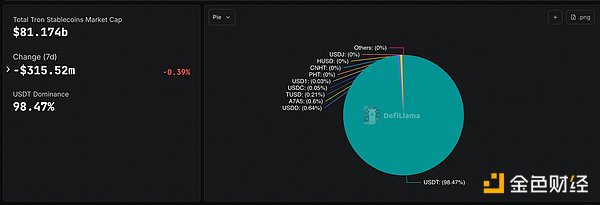

USDT supply in different supply chains

Total market capitalization of TRON stablecoins (USDT accounts for 98.47%)

Source: Defillama

Conclusion

USDT has established a firm foothold in the global dollar system's retail and capital control environment, especially in regions where banks, foreign exchange markets, or stable local currency channels are limited. Even as USDC continues to expand its share in the regulated on-chain economy, this demand-based existing user base is unlikely to be shaken in the next 3-5 years. On the capital side, Tether's outstanding profitability and potential tokenization plans highlight the enormous value accumulated in the reserve layer. In the blockchain arena, the economic viability of its next-generation USDT native chains (such as Plasma and Stable) depends on its ability to attract and retain funds flowing out of existing channels like Tron or Ethereum.

Anais

Anais